Our Seamless Online Account Opening Process

Account opening with Phillip Nova is fast, secure and only takes minutes. The process is entirely online through the integration of a modern AI-powered identity verification tool. Experience it now.

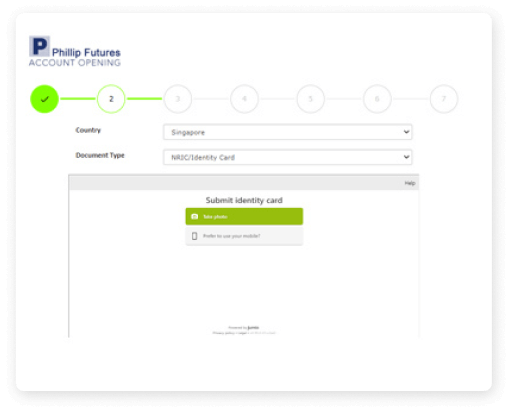

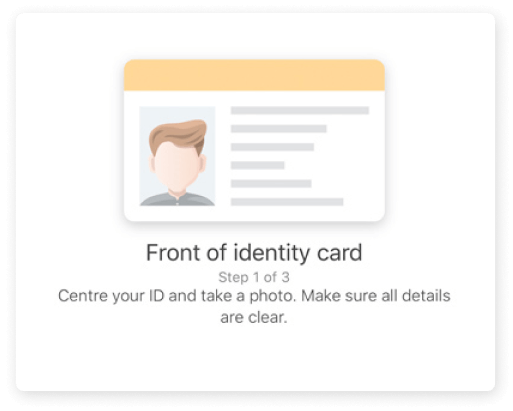

Get Your ID Document Ready

ID Proof Check

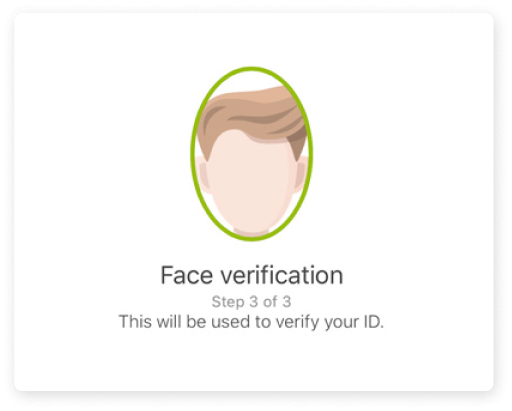

Similarity and Liveness Check

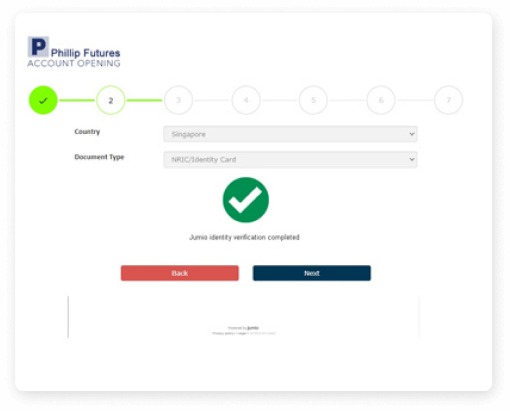

Identify Verification is Complete

Trading Platforms Offered by Phillp Nova

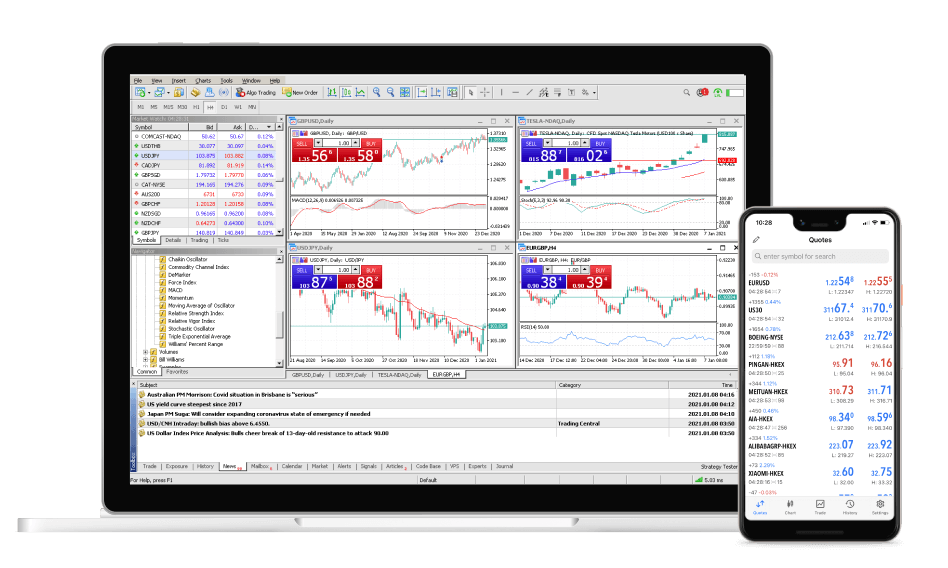

Philip MetaTrader 5

Phillip MT5 comes with an auto trading function, advanced charting and technical indicators for trading Forex and CFD (indices, oil, & shares). Phillip MetaTrader 5 is available in desktop, mobile and web (MAC OS friendly).

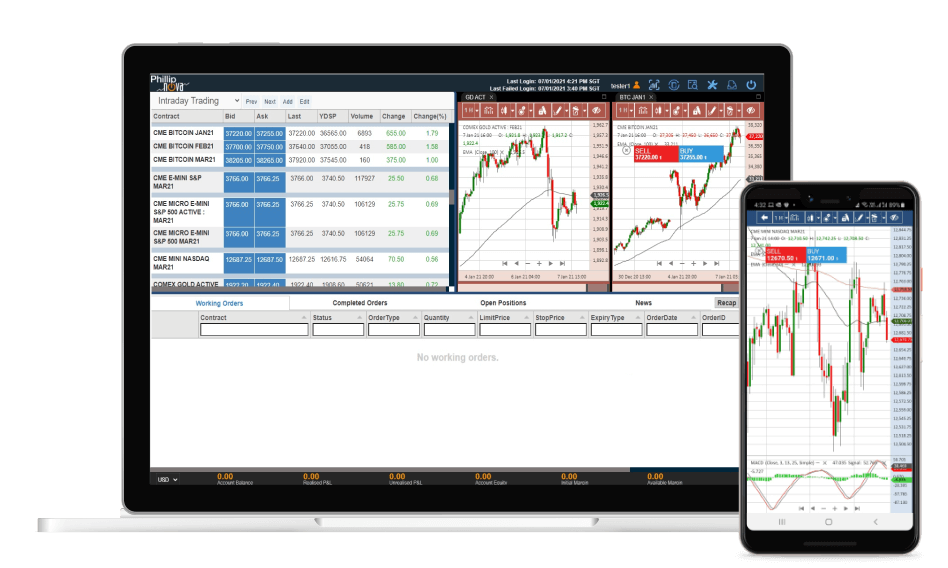

Phillip Nova

Phillip Nova is a powerful, intuitive platform that enables effective trading of Stocks, Forex and Futures from your desktop browser, tablet or mobile phone.

FAQ on Account Opening

We’re licensed and regulated by Monetary Authority of Singapore (MAS). For more information, click here.

Your money will be held in a customer pooled account basis with a licensed bank, separate from money belonging to us. Your money cannot be used to meet our obligations in the unlikely event that Phillip Nova Pte Ltd goes into liquidation.

Clients can choose to open a Multi-Asset account, a Forex and CFD account or both.

No, opening an account is absolutely free.

You may open an account with a minimum deposit of USD $500 (or equivalent).

We currently only accept bank/wire transfers. Do email the receipt/proof of transfer to nova_finance@phillip.com.sg and we will reply to your email with a confirmation once the funds have been sighted.

Both Phillip MT5 and Phillip Nova platforms come at no charge.

- Phillip MT5 enables zero commission trading of Spot Forex/Bullion/CFD trades.

- Phillip Nova enables effective trading of Stocks, Forex and Futures. Commission rates for each trade vary from SGD1.50 to SGD12 depending on the product traded.

No, you’re only allowed one trading account on Phillip MT5 and/or Phillip Nova.

Phillip MT5 is used for trading CFD, Spot Forex and Spot Bullion.

Phillip Nova is for trading Stocks, Futures, and Commodities.

This is for documentation purposes only.

This is to prevent identity theft and to ensure that you have personally submitted your application and to ensure that the details provided in the submission have not been used/ submitted by another party.

- Government issued NRIC/Passport

- Proof of mailing address (if address is different from your NRIC/residence Address

* Phillip Nova does not send any physical letters, all communication with customer will be via email.

- Common Reporting Standard (CRS) is a new information gathering and reporting standard implemented by participating countries globally.

- Under CRS, we are required to determine your TIN and tax residence. This information will be passed to Singapore’s tax authority. If your tax residence(s) is/are outside of Singapore, the information in this form may be reported, along with information relating to your accounts, to that country or countries’ national tax authority.

- This form is intended to request information consistent with local law requirements.

No, we do not withhold taxes or offer tax advice. For any tax related queries in relation to your trading, please discuss with your local tax agent.

Monetary Authority of Singapore (MAS) has introduced new requirements to provide safeguards to retail investors who wish to trade Specified Investment Products (SIPs), with effect from 1st Jan 2012. We will be assessing our customers on their relevant knowledge or experience of such SIPs before offering the products.

The Customer Knowledge Assessment (CKA) is required if you wish to trade a Specified Investment Product that is not listed on an exchange such as forex and CFD.

| Assessment Criteria | CKA (CFD) | CKA (FX) |

| Done 6 or more transactions in Leveraged Bullion/CFD/Forex/OTC Metals in the past 3 years | ✓ | ✓ |

| Obtained a Pass in ABS-SAS Learning Module on Contracts For Difference AND obtained a Pass in ABS-SAS Learning Module on Foreign Exchange Margin Trading | ✓ | ✓ |

| Have a diploma or higher qualification in relevant courses such as: | ✓ | ✓ |

| Accountancy, Economics, Actuarial Science, Finance, Business, Financial Engineering, Capital Markets, Financial Planning, Commerce, Insurance, Computational Finance | ||

| Have a professional finance-related qualification (e.g CFA, AFP, CPA/ACCA) | ✓ | ✓ |

| Have a minimum of 3 consecutive years of working experience in the past 10 years in the development of, structuring of, management of, sale of, trading or, or research and analysis of investment products or the provision of training in investment products. (Work experience in accountancy, actuarial science, treasury or financial risk management may also be considered relevant experience) | ✓ | ✓ |

Monetary Authority of Singapore (MAS) has introduced new requirements to provide safeguards to retail investors who

wish to trade Specified Investment Products (SIPs), with effect from 1st Jan 2012. We will be assessing our customers on their

relevant knowledge or experience of such SIPs before offering the products.

The Customer Account Review (CAR) is required if you wish to trade a Specified Investment Product that is listed on an exchange such as Futures.

| Customer Account Review (CAR) is required if you wish to trade Futures/Options (Exchange Listed) | |

| Assessment Criteria | CAR (Futures) |

| Done 6 or more transactions in Futures and Options (Exchange Listed) products in the past 3 years | ✓ |

| Obtained a Pass in SGX Online Education on Specified Investment Products | ✓ |

| Have a diploma or higher qualification in relevant courses such as: | ✓ |

| Accountancy, Economics, Actuarial Science, Finance, Business, Financial Engineering, Capital Markets, Financial Planning, Commerce, Insurance, Computational Finance | |

| Have a professional finance-related qualification (e.g CFA, AFP, CPA/ACCA) | ✓ |

| Have a minimum of 3 consecutive years of working experience in the past 10 years in the development of, structuring of, management of, sale of, trading or, or research and analysis of investment products or the provision of training in investment products. (Work experience in accountancy, actuarial science, treasury or financial risk management may also be considered relevant experience) | ✓ |

Our refer a friend program is aimed at rewarding our clients who invite their friends or family to trade with us. To be eligible for the USD66 bonus, your referral must meet the following criteria; the referred account has to trade at least 1 lot within 1 month from the account activation date. Your friend can include your email address in the “How did you hear of us?” section of the application form.

To find out more about the ID requirements for Directors and Shareholders, as well as the documents required from the company to open the account, please email to nova@phillip.com.sg.

Yes, we offer joint account opening. You can select Joint Account Application during account opening. A separate link will be sent to the joint applicant’s email address.

We don’t offer deposit bonuses because we believe that our funds should go into providing low-cost trading and a quality platform infrastructure.

Your daily activity statement will be made available via Client Portal or sent to your registered email address by the next working day of your trade/transaction. The activity statement will be in a password protected PDF file. The default password will be your full identity/passport number or your company registration number.

Phillip Nova only accepts deposits made from bank accounts bearing the account holder’s name. Supporting document(s) may be required to ascertain the source of funds

Our Main Office is open from Monday to Fridays, 9.00 am to 6.00 pm (except on Public Holidays). Our 24-hour Dealing Desks provides broking, execution and clearing related services to all our clients, even on Singapore Public Holidays.

- Stocks & Futures Dealing Desk (+65 6535 1155)

- CFD & Forex Dealing Desk (+65 6536 7200)