Trading Products

Stocks

Click here to view the Stocks FAQ.

Fractional Trading & Amount-based Order FAQs

A fractional share is a portion of a whole share. For example, holding 1.5 shares means you own one full share and half a share—this 0.5 portion is considered a fractional share.

An amount-based order allows you to specify the total dollar amount you wish to trade instead of entering the number of shares. This is useful when you prefer to invest a fixed amount—such as USD 50—without having to calculate the exact share quantity.

For securities that do not support fractional share trading, the entered amount is used to calculate and submit the maximum whole-share quantity.

Only Day Market and Day Limit orders are supported. Sell orders are not permitted for amount-based orders.

Securities that support fractional share trading

Market Orders

- The amount entered is submitted directly as an amount-based order.

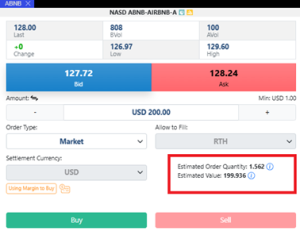

Market Order Example

- Company AAA is eligible for fractional share trading

- You place an amount-based order of USD 200 using a Market order to buy.

- The executed amount may return as USD 199.936, depending on the fill quantity and execution price.

In the Order Ticket, you will be informed of the Estimated Order Quantity and its Estimated Value.

Limit Orders

- Nova converts the entered amount into an estimated share quantity, rounded down to three decimal places, and submits the order using this calculated quantity at the specified limit price.

- You will be prompted that order submissions are based on the Estimated Order Quantity

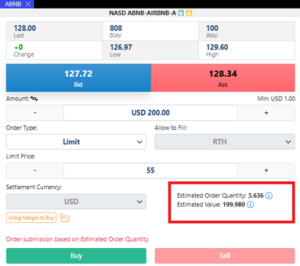

Limit Order Example

- Company AAA is eligible for fractional share trading

- You place an amount-based order of USD 200 with a Limit Price of USD 55 to buy.

- Nova calculates an order quantity of 3.636 shares (USD 200 ÷ USD 55).

- This quantity will be submitted at the limit price, resulting in an executed amount of up to USD 199.98 (3.636 × USD 55), but never more than USD 200.

In the Order Ticket, you will be informed of the Estimated Order Quantity and its Estimated Value.

Securities that do not support fractional share trading

For these securities, the amount-based order field functions as a calculation aid. Nova converts the entered amount into the maximum whole-share quantity based on the applicable price and submits the order using this calculated quantity.

Market Orders

- Nova calculates the order quantity using the entered amount divided by the prevailing market price.

- The quantity is rounded down to the nearest whole share.

- The Estimated Order Value shown on Nova is based on the calculated quantity × prevailing market price.

- You will be prompted that order submissions are based on the Estimated Order Quantity

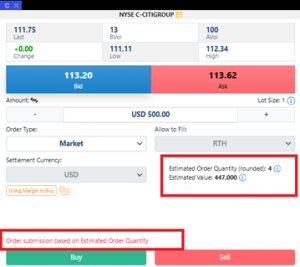

Market Order Example

- Company XYZ is not eligible for fractional share trading. The Last Traded Price is USD 40.

- You place an amount-based order of USD 100 as a Market Order to buy

- Nova calculates and sends an order for 2 shares (USD 100 ÷ USD 40) to be purchased at the market

- The executed amount may differ from the estimated value depending on the final execution price.

In the Order Ticket, you will be informed of the Estimated Order Quantity and its Estimated Value

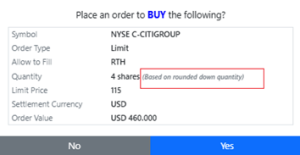

In the Order Confirmation Box, you will be reminded that the quantity is to be submitted is based on a rounded down quantity.

Limit Orders

- Nova calculates the order quantity based on the entered amount divided by the Limit Price.

- The quantity is then rounded down to the nearest whole share.

- The resulting Actual Order Value is the calculated quantity × Limit Price.

- You will be prompted that order submissions are based on the Actual (rounded down) Order Quantity

Limit Order Example

- Company XYZ is not eligible for fractional share trading

- You place an amount-based order of USD 100 with a Limit Price of USD 30.

- Nova calculates and sends an order for 3 shares (USD 100 ÷ USD 30) to be purchased at USD 30

- The order submitted is 3 shares, with an executed amount of up to USD 90.

In the Order Ticket, you will be informed of the Actual (rounded) Order Quantity and its Estimated Value.

In the Order Confirmation Box, you will be reminded that the quantity is to be submitted is based on a rounded down quantity.

You are advised to always review the derived share quantity before submitting the order.

How NOVA Determines the Prevailing Market Price

US securities:

- Uses the Last Traded Price from the Regular Trading Session.

- If unavailable, the Closing Price is used.

Non-US securities:

- Uses the Last Traded Price.

- If unavailable, the Closing Price is used.

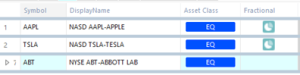

- Nova Web/Desktop: Look for the “Fractional” column in the Watchlist or on the Order Ticket. A pie symbol indicates eligibility.

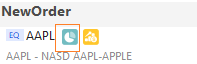

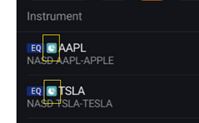

- Mobile app: The pie symbol appears next to the symbol code in the Watchlist and on the Order Ticket

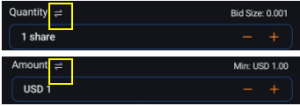

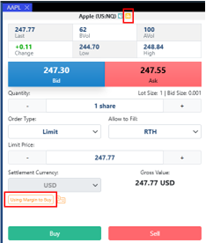

Amount-based orders can only be placed via the Order Ticket. Clicking the toggle icon will switch order placement in “Quantity” to “Amount”. Click the same button again to revert to order placement in “Quantity”.

- Nova Web/Desktop:

- Mobile app:

Fractional share trading and amount-based orders are currently supported only for U.S. exchanges, including NYSE, Nasdaq, and AMEX.

However, not all securities listed on these exchanges are eligible. Only securities that support fractional share trading can be executed as true amount-based orders.

Fractional share orders are routed to a separate execution venue. When you place an order that includes both whole and fractional shares, your order is submitted as a single order but may be executed in parts—whole share(s) and fractional shares separately—potentially at different prices.

You must opt in and agree to our Fractional Shares Trading Terms and Conditions.

You can opt in via:

- Nova Web/Desktop: Settings > Trade > Slide “On” for Opt-in to Fractional Shares Trading

- Order Ticket: “Opt-in to Fractional Shares” (visible only for eligible securities) > Click “Agree” on Fractional Shares Trading Terms and Conditions

Orders with fractional shares are only supported during regular trading hours.

Trading fractional shares involves risks similar to trading whole shares, including market volatility and security-specific risks. However, fractional shares may also be subject to limited liquidity and execution constraints.

For full details, please refer to our Fractional Shares Trading Disclosure Statement.

Yes, if a stock pays dividends, you will receive a pro-rated dividend based on the fractional amount you hold.

Shareholder rights and/or participation in stock splits, mergers, or other mandatory corporate actions is subjected to the discretion of the Company and/or issuer.

No, fractional shares do not carry voting rights.

No, fractional shares cannot be transferred in or out of your account.

Commission for amount-based orders are based on quantity executed.

Please refer to our website here for the latest commission structure and applicable fees.

Shares Margin Trading FAQs

Phillip Nova’s Shares Margin Trading allows you to maximise your purchasing power by financing the purchase of marginable securities held in your trading account. Marginable securities refer to stocks and ETFs accepted by Phillip Nova as having collateral value for financing purposes.

A haircut is applied to these securities as a risk buffer. The discounted (net) value is then added to your buying power. All financing is subject to the prevailing haircut, security eligibility, and account‑level financing limits determined by Phillip Nova.

By using margin, you potentially get to:

- Amplify your investment capacity

- Take larger positions with the potential for higher returns.

- Generate positive carry

- Earn dividends or coupons that exceed the cost of financing.

- Access multi-currency financing

- Borrow in the traded currency to create a natural hedge against currency risk.

By using margin, you assume additional risks, including but not limited to:

- Leverage amplifies losses

- While you can invest more, losses are magnified in the same way as gains. You may lose more than your initial capital.

- Market Volatility and Gap Risk

- Sharp overnight movements or market gaps can cause losses that exceed your available margin before you have a chance to respond.

- Margin Calls and Forced Liquidation

- If the value of your marginable securities falls, you may be required to top up your margin at short notice. Phillip Nova can liquidate your positions without prior notice to meet margin requirements, and you remain liable for any shortfall.

- Carry trades can reverse

- If dividend yields fall or financing costs rise, a once-profitable carry may turn negative.

- Interest Rates Risk

- Financing costs (interest rates) are variable and can rise unexpectedly, eroding potential returns or turning profits into losses.

- Liquidity Risk

- In times of market stress or low trading volumes, it may be difficult to sell your securities quickly without substantial price impact, especially during forced liquidations.

- FX risk

- Foreign-currency movements can impact both your returns and financing cost, as changes in exchange rates impact the value of your holdings and borrowings.

- Regulatory and Haircut Adjustments

- Phillip Nova may change the eligibility or haircut of marginable securities at any time. A sudden increase in haircut could cause an instant margin shortfall, triggering margin calls or liquidations.

- Concentration Risk

- Holding a few securities as marginable assets can lead to significant exposure if those securities experience sharp declines.

Illustrations of how leverage increases your investment capacity, potentially leading to higher returns.

Scenario 1 – Trading with Cash:

- You have S$10,000 cash in your trading account.

- You purchase 10,000 shares at S$1, totalling S$10,000 (10,000 shares x S$1).

- Your entire cash is used, so your buying power is reduced to S$0.

- The share price rises to S$1.25, and you sell your 10,000 shares for S$12,500

(10,000 shares x S$1.25).- Gross profit less commission = S$2,500(S$12,500 shares proceeds – S$10,000 initial purchase cost)

Scenario 2 – Trading with Margin:

- You have S$10,000 cash in your trading account.

- You use margin to buy 20,000 shares at S$1, totalling S$20,000 (20,000 shares x S$1).

- This will result in a loan of S$10,000

(S$10,000 initial deposit – S$20,000 shares purchased).- With a 30% collateral haircut, that leaves a net collateral value of S$14,000

(70% of S$20,000 collateral value)- This leaves a remaining cash balance of S$4,000 (S$10,000 initial deposit – S$20,000 shares purchased + S$14,000 of net collateral value).

This becomes your available buying power.

- After 7 days, the share price rises to S$1.25, making your holdings worth S$25,000 (20,000 shares x S$1.25).

- Net collateral value increases to S$17,500 (70% of S$25,000).

- Buying power increases to S$7,500.

(-S$10,000 loan + S$17,500 of net collateral value).- You sell your shares for S$25,000.

- Financing charges = S$9.59(S$10,000 loan x 5% p.a. x 7/365 days)

- Gross profit less commission = S$ 4,990.41(S$25,000 shares proceeds – S$20,000 initial purchase cost – S$9.59 financing charges).

Illustrations of how leverage increases your exposure to losses, potentially resulting in losses greater than your initial capital.

Scenario 3 – Trading with Cash:

- You have S$10,000 cash in your trading account.

- You purchase 10,000 shares at S$1, totalling S$10,000 (10,000 shares x S$1).

- Your entire cash is used, so your buying power is reduced to S$0.

- The share price falls to S$0.75, and you sell your 10,000 shares for S$7,500

(10,000 shares x S$0.75).- Gross loss less commission = S$2,500(S$7,500 shares proceeds – S$10,000 initial purchase cost)

Scenario 4 – Trading with Margin:

You have S$10,000 cash in your trading account.

You use margin to buy 20,000 shares at S$1, totalling S$20,000 (20,000 shares x S$1).

- This will result in a loan of S$10,000

(S$10,000 initial deposit – S$20,000 shares purchased). - With a 30% collateral haircut, that leaves a net collateral value of S$14,000

(70% of S$20,000 collateral value) - This leaves a remaining cash balance of S$4,000 (S$10,000 initial deposit – S$20,000 shares purchased + S$14,000 of net collateral value).

This becomes your available buying power.

- This will result in a loan of S$10,000

After 7 days, the share price falls to S$0.75, making your holdings worth S$15,000 (20,000 shares x S$0.75).

- Collateral haircut reduces to S$4,500 (30% of S$15,000).

- Net collateral value reduces to S$10,500 (70% of S$15,000).

- Buying power reduces to S$500.

(-S$10,000 loan + S$10,500 of net collateral value).

The next day you sell your shares for S$15,000.

Financing charges = S$10.96(S$10,000 loan x 5% p.a. x 8/365 days)

Gross loss less commission = S$5,010.96(S$15,000 shares proceeds – S$20,000 initial purchase cost + S$10.96 financing charges)

Phillip Nova applies several controls to promote prudent financing and risk management. These include application of collateral haircuts, security price caps (SPC), single‑security limits (SSL), and an account‑level maximum loan value (MLV). All parameters are subject to periodic review and may be adjusted at Phillip Nova’s discretion.

- Collateral Haircut – A discount applied to the market value of a security used as collateral. This helps ensure a safety buffer against market fluctuations, supporting responsible risk management.

- For example, if a stock is worth S$100 and has a 30% collateral haircut, only S$70 of its value will be counted as collateral.

- Security Price Cap (SPC) – A cap on the collateral valuation of each margin‑eligible security. This prevents artificially inflated or volatile market prices from overstating the collateral value and helps manage downside risk.

- For example, if a stock is trading at S$40 and has historically traded between S$10 and S$50, a price cap of S$80 may be applied.

- Single Security Limit (SSL) – A maximum collateral exposure per security to manage concentration risk.

- For example, if a Single Security Limit (SSL) of S$50,000 is applied to a stock, and you hold S$100,000 worth of it, only S$50,000 will be counted towards your collateral value.

- Maximum Loan Value (MLV) – A limit on the total financing extended to your account.

- For example, if your account has S$100,000 cash and the stock has a 50% collateral haircut, you would typically be able to purchase S$200,000 worth of the stock — borrowing S$100,000 from Phillip Nova. However, if a MLV of S$50,000 is applied, the maximum stock purchase would be limited to S$150,000.

| Not Opted In to Shares Margin Trading (Trading in Fully Paid-Up Securities) | Opted In to Shares Margin Trading |

Is Shares Margin Trading permitted? | No | Yes |

Can I purchase securities of value greater than my Equity Balance? | No | Yes |

Is multi-asset trading available? | Yes, if other trading pre-requisites are met. | Yes, if other trading pre-requisites are met. |

Am I subject to margin calls and forced liquidations if I only trade securities? | You may receive margin calls arising from commission or other trading fees. Phillip Nova may also liquidate your fully paid-up securities to cover any outstanding deficit that arises in your account. | You may receive margin calls arising from a reduction in collateral value, or from commission and other trading fees. Phillip Nova’s Low Equity Policy applies, and forced liquidation may occur when account equity falls to 20 % of total margin. Fully paid-up securities may also be liquidated to cover any outstanding deficit in your account. |

You may apply for a Shares Margin Trading account as long as you are above 21 years of age.

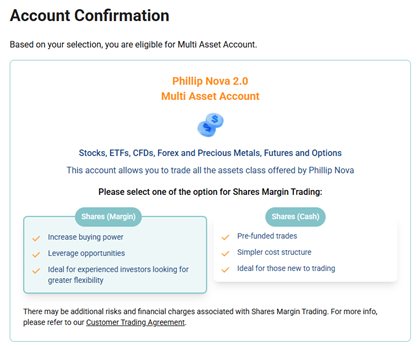

If you are a new client to Phillip Nova, select Phillip Nova 2.0 Multi Asset Account as you begin your investment journey. When you get to the Account Confirmation page, select Shares (Margin) as your account type.

If you have an existing Nova trading account, you may opt-in for Shares Margin Trading on the Client Portal. If you have an existing MT5 trading account with Phillip Nova, you will need to apply for a Nova trading account for Shares Margin Trading.

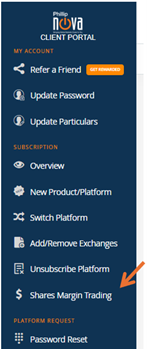

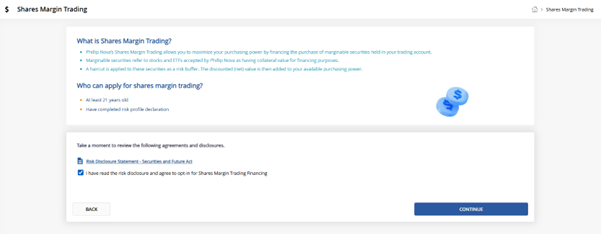

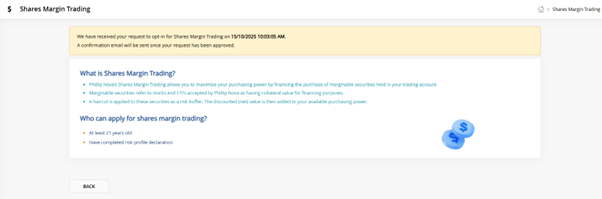

If you have an existing Nova trading account, follow these steps to opt-in for Shares Margin Trading on Client Portal:

First, click on Shares Margin Trading in the right panel under Subscription.

Next, read and acknowledge the Risk Disclosure Statement and select Continue.

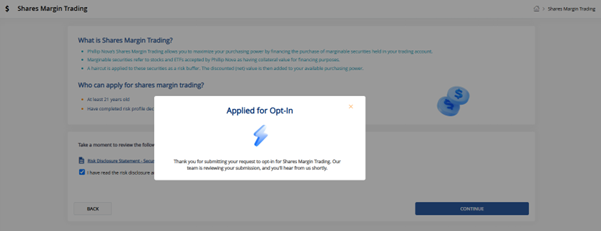

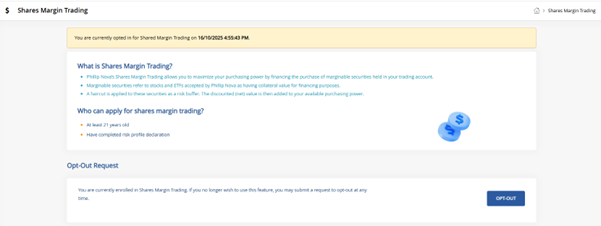

When your request meets the criteria for immediate approval, it will be approved on the immediately. You will see a banner displaying the time and date of your opt-in, and an email confirmation will be sent to you.

If your request doesn’t qualify for immediate approval, it will be reviewed internally. The banner will show that your request is under review, and you will receive an email confirming this status.

After the review, if your request is approved, you will see a banner displaying the time and date of your opt-in, and an email confirmation will be sent to you.

If your request is not approved after review, the banner will show no status, and you will receive an email notification of the decline

Margin-eligible securities can be identified with these icons on the Watchlist and the Order Ticket:

Alternatively, you may refer to the list of margin-eligible securities available here.

No, there is no need for an additional pledge of marginable securities to Phillip Nova.

Once your account is approved for Shares Margin Trading, any marginable securities in your trading account held under Phillip Nova’s custody will automatically be recognised as collateral to support additional share purchases.

Yes, you can. The value of your marginable securities will be converted into the traded currency at prevailing foreign exchange rates to determine your purchasing power.

However, if you buy securities in a currency you do not hold, it will create a currency deficit. To avoid interest charges, ensure you have sufficient equity balance in that currency.

You may refer to our prevailing financing rates published here.

No, Phillip Nova does not charge any account or platform fees for the use of Phillip Nova’s margin facility.

Financing charges will apply only if your account shows a shortfall — that is, when the sum of your Equity Balance and Initial Margin is less than zero. Charges are computed on the deficit amount in each respective currency.

You are deemed to have taken up financing when your Equity Balance is less than zero in any currency. Such a negative balance may arise when your securities purchases exceed your available Ledger Balance, or from realised or floating losses in derivative trading, commission, or other related trading fees and financing charges. Interest charges are computed based on any negative sum arising from your Equity Balance, less your Initial Margin, accrued daily on all negative balances until repaid.

Here are some scenarios to illustrate:

| Scenario | Equity Balance (SGD) | Initial Margin Requirement (SGD) | Interest Chargeable Amount | Explanation |

|---|---|---|---|---|

| 1 | 1,000 | 2,000 | 1,000 | You have a shortfall of SGD 1,000. Interest is charged on this amount. |

| 2 | –2,000 | 0 | 2,000 | Your equity is negative, meaning you owe SGD 2,000. Interest is charged on this amount. |

| 3 | 2,000 | 1,000 | None | No shortfall. No interest is charged. |

| 4 | 1,000 | 1,000 | None | Equity fully covers the margin requirement. No interest is charged. |

Yes, our Low Equity and Weekend Risk Policies are standardized across account types. Please find the our Margin Trading FAQs here.

Our Margin Call, Low Equity and Weekend Risk policies are standardised across account types. Please find our Margin Trading FAQs here.

Please find our Margin Trading FAQs here.

While transferring securities into Phillip Nova will increase your collateral base, it is generally not practical because our standard margin call policy typically requires settlement within 2 days.

We recommend that you refer to our Margin Trading FAQs here for more information on the available methods of fulfilling margin calls.

No, we do not facilitate trading with CPFIS-OA/ SRS. Phillip Nova will still act as custodian of assets for your securities purchased through us.

Corporate actions may affect the collateral value of your shareholdings. Phillip Nova will adjust financing eligibility, haircuts, and collateral values in accordance with its internal policies and the characteristics of each event.

If a corporate action has a significant adverse impact on the value of your holdings or overall portfolio health, your account may become exposed to a margin call or, in severe cases, low-equity liquidation.

The table below illustrates how certain types of corporate actions can affect a stock’s price and, consequently, the value of your portfolio. Actual results may vary from the examples shown.

Risk Level | Corporate Action | Possible Impact on Shares Margin Trading | Theoretical Impact on Stock Price | Why It’s Risky for Shares Margin Trading |

Very High | Delisting | Collateral value removed entirely | Signals reduced liquidity; often falls sharply before delisting | Sharp value loss may result in margin calls or forced liquidation of portfolio |

Very High | Trading Suspension | Collateral value may be removed entirely | Price frozen; risk of steep drop if trading resumes. | No ability to sell; removing collateral value may result in margin calls or forced liquidation of portfolio |

High | Merger & Acquisition (Target Firm) | Collateral value can fluctuate significantly throughout the deal period, and if the transaction falls through, the share price may collapse. Collateral value declines if acquiring shares are ineligible as collateral | Price usually rises on announcement and moves towards offer price; price may remain volatile during deal period. | During periods of high volatility, collateral haircuts may increase. Volatility can trigger margin calls and share value losses may result in the forced liquidation of your portfolio. Financing availability may also decline suddenly if new shares from the merger or acquisition are not eligible as collateral, which can in turn result in margin calls or forced liquidation. |

High | Merger & Acquisition (Acquirer Firm) | Collateral value usually falls on announcement. | Price often falls on announcement due to dilution and deal risks | Lower collateral values can trigger margin calls, and continued volatility or further declines may lead to margin calls or forced liquidation of positions. |

High | Rights Issue (Renounceable or Non-renounceable) | Price drops to the TERP on ex-date, reducing collateral value. Exercising rights requires cash outflow. Rights are not margin-eligible until converted to paid-up shares. | On the ex-rights date, the share price may drop to the TERP | May cause steep collateral value drop which could result in margin calls; if severe, it may result in forced liquidation of the portfolio. |

Medium | Special Dividend (Cash) | Collateral value falls on ex-date, while cash is credited only on or after pay date, resulting in a temporary gap in financing coverage. | Drops by dividend amount; special dividends may be significantly larger than regular dividend. | Dividend are not credited on ex-date. The drop in collateral value reduces buying power and may trigger margin calls; if severe, it may result in forced liquidation of the portfolio. |

Medium | Special Dividend (Shares) | Collateral value falls on ex-date and collateral value ex-div will depend on the eligibility of new share. New shares issued under a different counter may be ineligible as collateral or credited only after the pay date, causing a temporary gap in financing coverage. | Parent share price drops proportionally. | Loss of eligibility for spin-off shares can reduce financing. The drop in collateral value reduces buying power and may trigger margin calls; if severe, it may result in forced liquidation of the portfolio. |

Medium | Capital Reduction | Collateral value falls on ex-date, while cash is credited only on or after pay date, resulting in a temporary gap in financing coverage. | Price drops may exceed the capital returned, particularly when the reduction is tied to restructuring or adverse financial conditions. | Capital returns are not credited on ex-date. The drop in collateral value reduces buying power and may trigger margin calls; if severe, it may result in forced liquidation of the portfolio. |

Low | Stock Dividend / Bonus Issue | Collateral value falls on ex-date, while new shares are credited only on or after pay date, resulting in a temporary gap in financing coverage. | Price drops proportionally; total value unchanged. | Minimal risk if the counter remains margin-eligible. The drop in collateral value reduces buying power and may trigger margin calls; if severe, it may result in forced liquidation of the portfolio. |

Low | Share Split / Reverse Split | Collateral value unchanged; only quantity and price adjust. | Price changes proportionally to split ratio. | Minimal risk if counter remains eligible. |

Low | Cash Dividend | Collateral value falls on ex-date, while cash is credited only on or after pay date, resulting in a temporary gap in financing coverage. | Price drops by dividend amount, usually by a small amount. | Minimal risk unless yield is unusually high. |

*TERP = Theoretical Ex-Rights Price

Metric | Description |

Cash B/F | Cash brought forward |

Adjustments | Fund deposited or withdrawn |

Net Comm/GST | Net commission paid, with GST if applicable |

Realised P/L | Realized profit or loss for Futures, Options and OTCD trades |

Option Premium | Option premium paid or received |

Stock Purchases | Total value of securities bought |

Stock Proceeds | Settled stock proceeds |

Cash C/F | Cash carried forward |

Forward Value | Forward dated realized profit or loss for Futures, Options and OTCD trades |

Unrealised P/L | Floating profit or loss from open positions in Futures, Options and OTCD positions |

Equity Balance | Equity Balance represents the total value of your account after accounting for all settled and unrealised activities. |

Collateral BG/Cash | Cash equivalent collateral, including Bank Guarantees |

Collateral Eligible Securities (Net) | Eligible collateral that counts toward Margin Excess and Available Equity for Securities |

Collateral Marginable Securities (Net) | Eligible collateral that counts toward Available Equity for Securities |

Outstanding Stock Proceeds | Value of stocks sold that have not been settled |

Margin Stock Credit | Purchased value of stocks that count toward Margin Excess / Deficit |

Initial Margin | Initial margin arising from open positions in Futures, Options, and OTCD |

Main. Margin | Maintenance margin arising from open positions in Futures, Options, and OTCD |

Excess Control Curr | Value of excess controlled currencies. This amount will be deducted from Margin Excess / Deficit, Available Equity for Securities and Allowable Withdrawal. |

Margin Excess / Deficit | Excess funds to support trading of Futures, Options and OTCD. A negative value indicates a shortfall.

Margin calls are based on this value, but the daily Margin Excess / Deficit value does not directly equal the margin call amount for that day. Margin calls are determined on a cumulative basis. |

Available Equity for Securities | Excess funds to support trading of Securities |

Allowable Withdrawal | Available funds that can be withdrawn. This excludes outstanding stock proceeds and excess controlled currencies |

Net Option Value | Combined mark-to-market value of all open option positions |

Stocks Market Value | Total market value of all your securities holdings, based on the closing prices of each security. |

Cryptocurrency

As opposed to traditional fiat currencies, cryptocurrencies are a form of digital currency secured by cryptography, allowing individuals to transmit them in a virtual setting, anytime and anywhere. Cryptocurrencies are decentralized with no overarching regulatory body.

The Bitcoin, launched in 2009, was the first cryptocurrency. Other examples of cryptocurrencies are Ethereum, Litecoin, Ripple and etc.

A blockchain is a database that functions as a decentralized virtual ledger, existing on a network of many computers. Data is arranged chronologically in blocks and each block’s metadata contains information linking it to the previous one. As such, once data has been stored, any modifications or deletions will be almost impossible.

No, you do not need to set up a virtual wallet.

All cryptocurrency trades made are CFDs. Hence, you will not own the underlying physical cryptocurrency. Transactions are Over-the-counter (OTC) with Phillip Nova as the counterparty.

You will be able to go both long and short on Bitcoin and Ethereum. However, you will only be able to go long on Ripple and Litecoin. Sell side orders for Ripple and Litecoin are accepted for liquidation only.

As the underlying cryptocurrencies are highly volatile and come with high-risk, Phillip Nova reserves the right to limit your ability to go long or short.

There are a number of risks involved in trading CFDs. Customers are advised to understand the nature and risks involved in margin and CFD trading before trading. The section below highlights the risks trading into CFDs on cryptocurrency. You may refer to our website here, detailing the risks in trading CFDs in general.

The price of our cryptocurrency CFDs are made available to us by the exchanges and liquidity providers who we trade with. Please note that Phillip Nova reserves the right, in its sole and absolute discretion to suspend trading in accordance to our Terms and Conditions and/or Customer Trading Agreement.

- Lack of legislative protection by MAS

Cryptocurrencies are not legal tender and are not issued by any government nor backed by any asset or issuer. Cryptocurrencies are currently not subjected to any regulatory requirements or supervisory oversight by the Monetary Authority of Singapore (MAS). Hence, the safeguards afforded under MAS’ regulatory framework will not apply to consumers dealing with unregulated products, such as CFDs on Cryptocurrencies.

- Extreme volatility

Cryptocurrencies have little or no intrinsic value, making them hard to value and extremely volatile. Being highly speculative, investing in cryptocurrencies entails high risks as prices are prone to sharp, sudden swings as a result of unanticipated events or changes in market sentiments primarily due to the lack of price transparency.

- Liquidity risks and price slippages

Cryptocurrencies is a relatively new asset class and regulations, or a lack thereof, may have an impact on liquidity which in turn may result in unwanted price slippages. This is exacerbated in times of market volatility. Possible failure of cryptocurrency exchanges may also increase illiquidity.

- Cybersecurity risks

Being a virtual, decentralized currency with no overarching regulatory body, cryptocurrency intermediaries are vulnerable to security breaches and market manipulations. Technical glitches on cryptocurrency intermediaries may happen as well. Such scenarios may cause disruption to trading and may cause substantial volatility in prices.

- Hard forks

A hard fork changes the software, making it not backward compatible. Blocks running the new software will not be recognized and work with users running the older software, essentially splitting a single cryptocurrency into two. Hard forks may cause substantial volatility in prices.

Phillip Nova will endeavour to inform you of any hard forks but it is ultimately your responsibility to be aware of them.

A fork is when software is modified or updated creating a divergence in the cryptocurrency’s blockchain. When software is updated to be backward compatible, it is called a soft fork. The updated software can still work and interact with older versions.

A hard fork on the other hand, fundamentally changes the software, making it not backward compatible. Blocks running the new software will not be recognized and work with users running the older software, essentially splitting a single cryptocurrency into two.

In the event of a hard fork of a cryptocurrency, we will generally follow the blockchain that has majority consensus of users and apply it to the basis for its price. Phillip Nova reserves the right to determine the cryptocurrency unit which has the majority consensus behind it.

If the hard fork results in a viable second cryptocurrency, we reserve the right to create an equivalent position on your account or make a cash adjustment to represent this value. This is done at our discretion and we will have no obligation to not do so.

If, within a reasonable time frame, the second cryptocurrency does not become tradable, we may void positions that was previously created at zero value on your account.

Hard forks may cause substantial volatility in prices and Phillip Nova reserves the right, in its sole and absolute discretion to suspend trading in accordance to our Terms and Conditions and/or Customer Trading Agreement.

It is important for customers to know the inherent risks and characteristics of Bitcoin Futures. As with any investment product, customers are responsible for their own risk management.

- Bitcoin is a relatively new product and is known to be volatile. As much as 30% of price movement has been recorded within a trading day.

- Bitcoin cash trades 24 hours including weekends. However, its Futures contracts listed in CME and ICE SG have specific trading hours. This may result in wide price gap that could potentially be as high as 25% or beyond.

- Liquidity is also an inherent risk for Bitcoin Futures. Near month Bid/Offer spreads had been recorded to be as wide as 120 points, and up to 1000 points for the far month expiry. This may transcend into very high cost, especially for customers trading the CME Bitcoin Futures contract, which is 5 times bigger than the ICE SG contract.

- Please note that there will be no call in trading support for Bitcoin contracts. Customers would need to manage the possible risks and choose to trade during active hours.

Do note that the Initial margin (IM), which is based on CME or ICE SG daily settlement price, may experience huge fluctuations daily.

CFD

There are no commission charges for trading CFDs. However, at the end of each trading day, open positions in your account will be subjected to a ‘holding cost’. The holding cost can be positive or negative depending on the direction of your position and the applicable holding rate. The applicable holding rate differs across various underlying assets, and is a function of:

- Overnight financing charge (Based on benchmark rates)

- Cost of Carry adjustments

- Dividends adjustments

- Mark ups

- Hard-to-borrow cost

Formula for overnight financing charge across CFDs = nights held x (Previous Day Closing Price of instrument* x Trade Size x (Relevant benchmark rate** +/- 3%) / 360

*Previous Day Closing Price is taken from Bloomberg

**Relevant benchmark rate is determined by the currency in which the underlying instrument is denominated in

Note: The formula uses a 365-day divisor for Singapore, Hong Kong, Japan, & UK markets. For other markets, a 360-day divisor is used in the formula.

Currency | Reference Rate |

| USD | SOFR Index |

| EUR | ESTRON Index |

| GBP | SONIA Index |

| HKD | One month Hong Kong Interbank Index |

| SGD | SORA Index |

| AUD | Australia RBA Cash Rate Target Index |

| CHF | SF0001M Index |

| JPY | MUTKCALM Index |

Example of a Financing Cost

As illustrated below, your net profit can increase when you trade CFD at zero commission.

Trader A buys DBS Shares CFD with Phillip Nova (that has a spread included in the prices, but does not charge any commissions). Trader B also buys DBS shares CFD at the same time from a conventional CFD provider. Both sold it an hour later. The table below shows how Trader A was able to save $10 more by trading CFDs on zero commission with Phillip Nova. View the table below to learn more:

| DBS Bid Price | DBS Ask Price | |

| Initial Price | $25.00 | $25.01 |

| Final Price (One hour later) | $26.00 | $26.01 |

| Trader A | Trader B | |

| Phillip Nova Zero commission CFD trading | Conventional CFD with commissions | |

| Buy Price | $25.03 | $25.01 |

| Sell Price | $25.98 | $26.00 |

| Shares Size | 500.00 | 500.00 |

| Buy Commission | $- | $15.00 |

| Sell Commission | $- | $15.00 |

| Client Total Cost for the trade | $20.00 (Cost from spread) | $30.00 |

| Client Net Profit | $475.00 | $465.00 |

Should you have any other query on zero commission CFD trading, you may contact the Client Service team at 6538 0500 or email to nova@phillip.com.sg.

CFDs allow you to speculate on the market movements of its underlying asset, without actually owning or taking physical delivery of the underlying asset. CFDs can also be used to hedge a portfolio’s value.

Benefits of trading CFDs include:

- Flexibility to Short

- Leverage

- No Expiry Date of Spot CFD Contracts*

- Transparent Pricing

- Ease of Trading

*Please refer to our full contract specifications here.

There are a number of risks involved in trading CFDs. Customers are advised to understand the nature and risks involved in margin and CFD trading before trading.

Some of the risks include:

Leverage Risk

As CFDs are traded on margin, gains and losses can be amplified. A relatively small market movement will have a proportionately larger impact on your equity balance. If the market moves against your position or if margin levels are increased, you may be called upon to pay additional funds on short notice in order to maintain your position (also known as a margin call*).

Liquidity Risk and Risk of trading suspension

CFDs are traded on an over‐the‐counter (OTC) basis, which are subject to the availability of buy and sell prices and volume. CFD traders may experience insufficient depth of market liquidity and a wide bid-offer spread when the underlying markets are experiencing volatility, off peak trading or are closed. As such, Phillip Nova does not offer CFD trading when the exchange for the underlying market is closed. As slippages can be expected when liquidity is thin, working orders may not be filled at the exact specified price. Hence, it is important that customers seek clarification and gain understanding on the nature of contracts they intend to trade.

Additionally, there may be instances where CFD trading is temporarily suspended for reasons such as,

- Severe market volatility in the underlying market where spreads are unfavourable

- Underlying market hits the limit up, or limit down, bands and trading is suspended

- Trading halts on the underlying, as announced by the associated exchange

- Negative pricing experienced on the underlying asset

Even when trading is suspended on the MT5 trading platform, liquidation may still happen to customer’s CFD positions should the Equity Balance fall below the stipulated force‐selling margin level (also known as the Close Out Level).

Additional Risks

Due to pricing errors from market makers, CFDs are subjected to having a stale price traded off the current fair values. In a “price discrepancy” situation, Phillip Nova reserves the right to amend the executed price in CFD to the price deemed to be fair by liquidity providers.

Market volatility

Financial markets may fluctuate rapidly and the prices of our products will reflect this. Gapping is a risk that arises as a result of market volatility. Gapping occurs when the prices of our products suddenly shift from one price to another, as a consequence of market volatility. You may not be able to place an order or the platform may not be able to execute an order between the two price levels. This could result in stop orders being executed at unfavourable prices, either higher or lower than what you may have anticipated, depending on the direction of your trade. Customers can limit the risk and impact of market volatility by applying an order boundary (i.e. stop-limit orders).

Risk of Shares Recall

To enable the customer to take a short position in Shares CFD, there may be a need to borrow the shares of the underlying to conduct a short hedge. Lenders of the shares have the right to recall anytime. In the event of a recall, the shares may have to be returned at short notice and the CFD provider might no longer be able to maintain the short hedge. This may result in the Phillip Nova force closing your short Share CFD positions immediately or at a short notice. In addition, where working short Share CFD orders have been accepted, Phillip Nova will be entitled to disregard or cancel those orders without liability as a result of such action.

Regulatory changes prohibiting short selling and share borrowing in specific shares or in the entire underlying market may also result in the broker force closing customers’ short positions in CFD.

Counterparty Risk

CFD is an over-the-counter (OTC) leveraged product traded on an off-exchange basis. However, CFD trading is regulated by the Monetary Authority of Singapore (MAS), and is maintained in high integrity in accordance to MAS regulations. The firm with which customers conduct their transactions (which may be Phillip Nova, or another firm, if Phillip Nova acts as your broker to effect a transaction with such firm) may be acting as counterparty to the transaction.

Please refer to the Risk Disclosure Statement on our website and our Product Information Sheet for more details on the risks involved in trading CFDs.

Note: *Please note that margin call is not applicable to MT5. MT5 will auto liquidate the positions when equity balance falls below the stipulated force-selling margin level (also known as the Close-out Level)

You will need to meet the Customer Knowledge Assessment (CKA) requirements and acknowledge the Risk Fact Sheet (RFS).

If you are an existing customer, but have not acknowledged the RFS, please click here.

You can trade Indices, Commodities, Cryptocurrencies, Shares and ETF CFD on the Phillip MetaTrader 5. For the full list of contracts available, please click here.

You can trade Indices, Shares and Cryptocurrencies CFD on Phillip Nova 2.0.

Our CFD bid-ask prices are derived from prices of the reference instrument quoted in the underlying exchange, market or liquidity provider. Therefore, the CFD prices will only be available if the underlying exchange or market is open or if there is sufficient liquidity.

Spreads may vary across different CFDs and across trading hours.

Please see the examples below to understand how profit and loss of a CFD contract is calculated.

Profit and Loss (Commodity)

Assuming that you bought 1 CFD (contract size of 100 barrels) of UKOIL at USD70 per barrel, and

A) Sold 1 UKOIL CFD at USD73 subsequently. You will gain a profit of USD300. This can be calculated as (USD73 – USD70) x 100 barrels = USD300;

B) Sold 1 UKOIL CFD at USD65 subsequently. You will incur a loss of USD500. This can be calculated as (USD65 – USD70) x 100 barrels = -USD500.

Profit and Loss (Indices)

Assuming that you sold 1 CFD (contract size of 1 index share) of US30 at USD25,000, and

A) Bought 1 US30 CFD at USD24,000 subsequently. You will gain a profit of USD1,000. This can be calculated as (USD25,000 – USD24,000) x 1 CFD = USD1,000;

B) Bought 1 US30 CFD at USD25,100. You will incur a loss of USD100. This can be calculated as (USD25,000 – USD25,100) x 1 CFD = -USD100.

Profit and Loss (Shares)

Assuming that you bought 1 CFD (contract size of 1000 shares) of DBS-SGX at SGD19.16, and

A) Sold 1 DBS-SGX CFD at SGD20.55 subsequently. You will gain a profit of SGD1390. This can be calculated as (SGD20.55 – SGD19.16) x 1000 shares = SGD1390;

B) Sold 1 DBS-SGX CFD at SGD18.17 subsequently. You will incur a loss of SGD990. This can be calculated as (SGD18.17 – SGD19.16) x 1000 shares = -SGD990;

C) In the worst case scenario, the price of DBS-SGX CFD falls to zero and the underlying stock is delisted. You will incur a loss of the full contract value of SGD19,160. This can be calculated as (SGD19.16 – SGD0) x 1000 shares = -SGD19,160. You may also be liable for additional charges, costs and fees incurred.

Please refer to our CFD Product Information Sheet for more details.

CFD margins will be based on a percentage of the previous day settlement price.

For more details, please refer to our full contract specifications here.

There will not be partial fills on your orders for Spot CFDs. All limit orders for Spot CFDs are Fill or Kill (FoK).

In the event of severe market volatility, regulated central exchanges (for e.g. CME Group, SGX, etc.) may sometimes suspend trading on one side of the underlying market. These are called Limit Up or Limit Down, depending on the direction that the market has moved. These limits can also be referred to as Circuit Breakers. Both a Limit Up and a Limit Down are used to prevent certain assets reaching excessively high volatility levels.

As trading is suspended in the underlying market, CFD for the underlying instrument will also be suspended for trading on the MT5 trading platform.

Current Limit Up/Limit Down bands

The Limit Up and Limit Down thresholds are fixed by the exchange on which the assets trade, and are set for each asset. As such they are subject to change. For more information on a particular exchange’s thresholds and the latest threshold prices, you can look directly on the exchange’s website.

Dividend adjustments are to negate the impact of the drop in an index price due to dividend pay-outs from its underlying component stocks when they go ex-dividend. All things remain equal, the price of an index price will fall by the total value of the dividend amount issued by its component stocks.

If you are holding a long position to an ex-dividend date, you will be credited the dividend adjustment. If you are holding a short position to an ex-dividend date, you will be debited the dividend adjustment.

Dividend adjustments are presented as a component of the holding costs. The amount applicable is computed, along with financing charges, into the “swap” field of the MT5 trading platform.

Please note that dividend adjustments will be subjected to the relevant tax holding rates according to the country or region in which the index is listed.

Phillip Nova reserves the right to make revisions to the dividend adjustment post ex-dividend date.

Dividends

A dividend adjustment will apply to CFD on Equities for positions held to the ex-dividend date of its underlying shares. Where applicable, this adjustment will be calculated based on the weight of the stock in the index. For single shares, local taxation rules applicable are accounted for.

Dividend adjustments are presented as a component of the aforementioned holding costs. The amount applicable is computed, along with financing charges, into the “swap” field.

Example of Dividends inclusion in Holding Rate

For example, the underlying share of DBS Group Holdings announced a final dividend of 33 cents per share. On ex-dividend date, customers holding DBS-SGX share CFD will incur a holding rate presented as follows. A positive rate indicates that customers will receive, while a negative rate indicates that customers will pay.

| Symbol | Ccy | Pricing Precision | 1 day Financing Charges for Long Position | 1 day Financing Charges for Short Position | Dividends for Long Position | Dividends for Short Position | Swap Long in Points | Swap Short in Points |

| DBS-SGX | SGD | 0.01 | -0.0017 | -0.0009 | 0.33 | -0.33 | 32.83 | -33.09 |

Assuming that you bought 1 CFD (contract size of 1000 shares) of DBS-SGX, and you held this position to the next day, which is the ex-dividend date. The holding cost for carrying this buy position will be calculated as:

- Holding Value = (Applicable swap rate in points x Pricing Precision) x Contract Size

= (32.83 x 0.01) x 1000 share = SGD $ 328.3 (receive)

Assuming that you sold 1 CFD (contract size of 1000 shares) of DBS-SGX, and you held this position to the next day, which is the ex-dividend date. The holding cost for carrying this sell position will be calculated as:

- Holding Value = (Applicable swap rate in points x Pricing Precision) x Contract Size

= (-33.09 x 0.01) x 1000 share = – SGD $ 330.9 (pay)

Dividend adjustments are denominated in the respective instrument’s settlement currencies.

Rights Issue

Trading of rights, when issued, is not facilitated. Customers, who are eligible for the rights, will not be able to sell or exercise the rights. Appropriate cash adjustments will apply when the underlying shares undergo rights issue, only for customers with long positions. To do this, rights received will automatically be subscribed on ex-right date, on condition that the rights are In-The-Money. Phillip Nova will at its sole and absolute discretion trade out the new positions from the rights subscription upon receiving the underlying shares when the market is open, or where liquidity in the market is permissible, whichever is deemed more appropriate by Phillip Nova in light of the circumstances.

The amount of cash adjustment applicable will be as follows:

- Cash adjustment amount = (Price where new positions sold – Subscription Price) x No. of shares held x US Dollar conversion rate

Customers who do not wish to be subjected to this discretionary action should liquidate their positions before ex-right date. Short positions will have to be liquidated one day before ex-right date. Customer shall indemnify Phillip Nova and Phillip Nova shall not be liable for any loss arising from or in connection with Phillip Nova’s or the Customer’s action or inaction in relation to such corporate action resolution.

Warrants

Trading of warrants, when issued, is not facilitated. Customers will not be able to sell or exercise the warrants. Appropriate cash adjustments will apply when the underlying shares undergo warrants issue (i.e. warrants rights issue or bonus warrants), only for customers with long positions. This process is similar to the rights issue procedure.

Customers who do not wish to be subjected to this discretionary action should liquidate their positions before ex-warrant date. Short positions will have to be liquidated one day before ex-warrant date. Customers shall indemnify Phillip Nova and Phillip Nova shall not be liable for any losses arising from or in connection with Phillip Nova’s or the Customer’s action or inaction in relation to such corporate action resolution.

Bonus Issue (Stock Dividend)

There will be no new CFD quantity allocated on exercise date, and no change to the original CFD position. Similar to rights issue, Phillip Nova will at its sole and absolute discretion trade out the new positions from the bonus issue upon receiving the underlying shares when the market is open, or where liquidity in the market is permissible, whichever is deemed more appropriate by Phillip Nova in light of the circumstances. Appropriate cash adjustments will apply where customers holding long positions will receive positive cash adjustments, while customers holding short positions will incur negative cash adjustments.

There is no requirement that short positions will have to be liquidated one day before exercise date. However, customers who do not wish to be subjected to this discretionary action should liquidate their positions before exercise date. Customer shall indemnify Phillip Nova and Phillip Nova shall not be liable for any losses arising from or in connection with Phillip Nova’s or the Customer’s action or inaction in relation to such corporate action resolution.

Stock Split (Reverse Stock Split)

Stock splits usually take place when the value of a company’s stock is getting too high. The share price will fall by a pre-determined percentage and holders will gain the same percentage of shares. To account for this, the current Share CFD position will be closed and re-booked at Zero P&L. All orders related to the CFD on the underlying Share will be cancelled. The settlement rate and associate margins required will also be adjusted for the stock split.

Example on Share CFD stock split

Assuming that you bought 1 CFD (contract size of 1000 shares) of DBS-SGX at $19.16. As an example, DBS Group Holdings announces a stock split of 2 for 1. You held this position to split day date. This means that, for every 1 share you hold, you will be issued 2.

The original buy position of 1 CFD on DBS-SGX at $19.16 will be closed at $19.16. The new position will be re-booked at Zero P&L, so you will now hold 2 CFD on DBS-SGX at the reduced price of $9.58. Note that the overall contract value remains the same.

Suspension

Whenever a stock suspends, Phillip Nova’s Risk committee will conduct an internal review and decide whether it is likely to trade again. If the news surrounding the company is negative, customers with open share CFD on the underlying stock will be notified that the margin requirement may be raised substantially after internal review. There will be no trading allowed for the share CFD during the suspension period. The margin requirement could remain at elevated levels until there is further news in the underlying market.

Delist

As soon as a company announces it is delisting, the stock status will first need to be reviewed by Phillip Nova’s Risk committee. For open share CFD positions on a stock that delists, the position will be closed at a level of zero. All orders related to the CFD on the underlying Share will be cancelled. Phillip Nova, on best effort basis, will seek returns to shareholders, a process which may take years. Any return found will be credited back to the customer’s account.

Other Corporate Actions not considered by Phillip Nova

Notwithstanding the foregoing, Phillip Nova reserves the right to close all open positions and working orders relating to CFDs of the underlying security before the ex-date for any corporate action not mentioned above.

In the event there is a combination of Corporate Actions (“CA-Cum All”), where it includes corporate actions other than the above mentioned, customers may not be able to enjoy the entitlement and may be required to close off all open positions before the ex-date.

Please refer to our CFD Product Information Sheet for more details on how corporate actions are handled.

Force‐liquidation Margin (FM)

Phillip Nova reserves the right to liquidate your CFD positions without prior notice when the Equity Balance falls below the stipulated force‐selling margin level (also known as the Close-out Level*). For Phillip MT5 system, you will be receiving a notification should your account be in margin deficit. You are required to reduce your position(s) or top up your funds immediately to bring your margin level back above initial margin level requirements. It is your responsibility to monitor the equity balance in your account to avoid the risk of your account meeting the Close-out Level which will result in the automatic liquidation of your position(s) at market prices.

*Close-out level on MT5 for Accredited Investors is 50%, and Non-Accredited Investor at 20%.

For more information, please refer to our CFD Product Information Sheet here.

- Within the Market Watch panel, mouse over your desired instrument and right-click

- Select ‘Specification’to view more details of the instrument.

- Calculate swap for 1 standard lot of LONG or SHORT position accordingly:

– LONG: Contract Size * Tick Size * Swap Long

– SHORT: Contract Size * Tick Size * Swap Short - The calculated swap value is in the instrument currency which will then be converted to USD.

Illustration:

Trader A establishes a 2 lot (Long) DBS contract at the price of S$21.07 with the specifications shown above and wants to find out the overnight swap rate that will be credited or debited.

Overnight Swap Rate Calculation:

Contract Size * Tick Size * Swap Long

= 2000 * 0.01 * (-0.16) * 21.07

= -S$3.2 (Negative rate refers to debit/ Positive refers to credit)

You can reach our Technical Support Desk at (65) 6597 3241.

Forex

There are no commission charges for trading Forex or Precious Metals. However, at the end of each trading day, open positions in your account will be subjected to swap fee. You may receive or pay swap depending on the currency pair held and the direction of your position. The swap fee is a function of an interest rate differential between the two currency pairs.

Example of Swap Fee

You go long on 3 lots of USDJPY at 142.730 and hold the position past the trading day. The buy swap rate for USDJPY is determined to be 11.2.

Swap Fee = Buy/Sell Swap Rate * Tick Size * Contract Size

= 11.2 * 0.001 * 300,000 = 3360¥

The swap fee is displayed into the “swap” field of the MT5 trading platform in its USD equivalent amount.

For more information, please refer to our FX Product Information Sheet here.

The Foreign Exchange market, also referred to as the “Forex” or “FX” market is the largest financial market in the world with a daily average turnover of approximately US$5.3 trillion. Foreign Exchange is the simultaneous buying of one currency and selling of another. For more information, please visit our Introduction to Forex.

A Spot Forex contract involves the trading of 2 currencies for settlement within 2 business days (known as T+2). However, if the client has an open position that is held past the New York market close at 5:00pm (New York Time*). Phillip Nova will do a rollover for clients automatically and a swap is charged/earned in the process. (For more information on swap, please visit our Forex page) Thus the client will not need to worry about monitoring the contracts expiry dates. Unlike Futures contracts or equities, clients with Spot Forex open positions can hold their positions for as long as they want, provided they have sufficient margins in their accounts to finance the position(s).

The Foreign Exchange Our Spot Forex Dealing Desk is open for 24-hour trading daily, from Sundays at 5:00pm to Fridays at 5:00pm (New York Time*). Prices on our trading platforms are available and orders are matched within the abovementioned trading hours.

Any order submission, withdrawal or amendment outside trading hours will not be accepted. Good-Till-Cancel (GTC) orders that remain active over the weekend are subject to prevailing market price when trading resumes. All active orders will get done in accordance with the prices from our liquidity providers. Any prices made available outside the trading hours will not be matched.

Bullion Trading is available from Sundays at 6:00pm to Fridays at 5:00pm (New York Time). Prices on our trading platforms are available and orders are matched within the abovementioned trading hours.

Special opening hours may apply on US and UK national holidays to reflect the trading hours of the underlying futures markets.

Any order submission, withdrawal or amendment outside trading hours will not be accepted. Good-Till-Cancel (GTC) orders that remain active over the weekend are subject to prevailing market price when trading resumes. All active orders will get done in accordance with the prices from our liquidity providers. Any prices made available outside the trading hours will not be matched.

In Forex trading, there is another element known as swap, or commonly known as the interest differential between 2 currencies.

If a client is buying a currency of higher interest rate than that of the one he is selling, he will gain swap points (or earn interest), and vice versa.

For more details of the swap points for each currency pair, please contact our Forex desk at (65) 6536 7200 or Client Service Desk at (65) 6538 0500.

The standard unit or regular size for Forex transaction at Phillip Nova is 100,000 of the base currency.

New traders or those with lower risk appetites can now trade the mini or micro sized contract* which represents 10,000 and 1,000 of the base currency respectively.

*Micro contracts are available in FX365 and Phillip Metatrader 5.

With effect from 1 September 2021, an administrative fee of USD20 will apply to each Physical Delivery (PD) instruction for each Forex contract.

Should you have any query, please approach your account manager. Alternatively, please call the Client Service Desk at (65) 6538 0500 or email nova@phillip.com.sg.

Previously, Spot Forex/Bullion contracts are only closed out on a First In, First Out (FIFO) basis, as illustrated in the example below:

The investor bought 100K of EURUSD at 1.3320 on Monday. On Tuesday, he bought 100K EURUSD at 1.3310.

Within the same day on Tuesday, he sold 100K of EURUSD at 1.3312.

This trade of selling 100K EURUSD at 1.3312 will be squared off with Monday’s long EURUSD at 1.3320 based on FIFO basis. With the introduction of our Phillip MT5 platform, there is an option for hedge mode, which means an investor can buy and sell the same currency pair without squaring off the positions. So he/she is effectively holding onto 2 open positions, and can choose to close of each position individually. The same applies to multiple position held in one direction (Buy or Sell)

Commodities

Commodities trading involves undertaking an agreement to buy or sell a set amount of a commodity at a predetermined price and date. Buyers use these to avoid the risks associated with the price fluctuations of the products or raw materials while sellers try to lock in a price for their products.

For more information, please visit our Introduction to Commodities.

We offer commodity products in three main categories:

- Energy Futures contracts: Crude Oil, Brent Crude Mini Crude Oil, Natural Gas, Mini Natural Gas, Kerosene, Gasoline and Crude Palm Oil.

- Metal Futures contracts: Gold, Mini-sized Gold, Silver, Mini-sized Silver, Copper, Palladium, and Platinum.

- Agricultural Futures contracts: Corn, Soybeans, Soybean Oil, Soybean Meal, Oats, Wheat, Cotton, Orange Juice, Cocoa, Coffee, Sugar and Red Hard Winter Wheat.

Futures contracts are traded on an intra-day “First In, First Out” basis. This means that for an intra-day trade, a customer’s first position bought or sold will be the first to be liquidated.

Example: Glenn bought 2 contracts of December MSCI Singapore Index on 2 different days.

Day 1 purchase price: 306.5

Day 2 purchase price: 306.0

Before the end of the main trading session of Day 2, he proceeds to close one contract at the price of 306.3. In this scenario, Glenn will make a profit of 3 ticks (0.3) as the contract bought on Day 2 is the first contract to be closed out instead of the contract bought on Day 1.

Please refer to the relevant exchange website and search for the particular contract specifications or you can refer to the margin list from Client Portal under Trading Information.

Gold/Silver

Phillip Nova has the following Gold/ Silver products for trading:

1. Loco London Gold/Silver

2. Loco London Mini-Gold and Mini-Silver

3. Gold Crosses with EUR and JPY

4. Mini Gold Cross in SGD (100g and 10oz)

5. Gold Direct & Silver Direct Investment (GDI & SDI)

6. Gold and Silver Futures and Options (COMEX, CBOT, TOCOM)

In Spot precious metal trading, there is an element known as swap, or commonly known as rollover charge. Swaps are debited/credited when a precious metal position is held to the next day.

Spot precious metal trade involves borrowing a funding currency (e.g. USD) to pay for Gold/Silver/Platinum/Palladium, or borrowing Gold/Silver/Platinum/Palladium to pay for the funding currency. The differential between the precious metal lease rate and the funding currency interest rate that you trade in would, therefore, determine the swap.

For more details of the swap points for precious metal trading, please contact our Forex/Bullion desk at (65) 6536 7200 or Client Service team at (65) 6538 0500.

Client needs to be 21 years old and above, and is required to pass CKA E-learning.

Yes, all other leveraged products are available for you to trade on, as long as you have the sufficient required margins to initiate the trade. With the trading of other leveraged products, your account will be subject to Margin call and Low equity.

Yes, margin call needs to be fulfilled by topping up or reducing your (Futures/Spot FX/Gold and GDI/SDI) positions.

GDI & SDI are almost no leverage products which cater to long-term investors, whereas the Spot Mini Gold/Silver are leveraged products which cater to shorter-term speculators.

Investments in GDI/SDI can be done electronically via Phillip Nova or POEMS.

Yes. Please contact the Client Service Desk at (65) 6538 0500 or email to nova@phillip.com.sg for more details.

The commission is USD1. There will also be admin fee of 1% p.a. on the daily settlement price, and it will be charged on a daily basis.

Gold and Silver Direct Investment are cash settled products. However, Phillip Nova offers 1 oz Gold bar and coins for sale. For more information on Gold/Silver trading/investment, please give us a call at (65) 6538 0500 or send us an email at nova@phillip.com.sg.

GDI & SDI are almost no leverage products which cater to long-term investors, whereas the Spot Mini Gold/Silver are leveraged products which cater to shorter-term speculators.

No, GDI is a cash-settled product.

1. 2017 Canadian Maple Leaf 1 oz Gold Coin with 99.99% purity level

2. Royal Canadian Mint 1 oz Gold Bar with 99.99% purity level

Note: types of gold available for purchase are subject to change

| No | Type of gold | Premium Charge |

| 1 | 2017 Canadian Maple Leaf | US$40/oz |

| 2 | Royal Canadian Mint Gold Bar | US$35/oz |

Note: premium charged is subject to change

At the moment, Phillip Nova will not be buying back the 1 Oz gold coin/bar issued.

You may contact us at 6538 0500 or email nova@phillip.com.sg so that we can facilitate your request for purchasing a 1 Oz gold coin/bar. Collection of 1 oz gold coin/bar is at Phillip Nova, located at 250 North Bridge Road, #07-01, Raffles City Tower, Singapore 179101.

Options

Trading options gives the buyer the right but not the obligation to either buy or sell a specific asset at a predetermined price on a future date.

It differs from futures trading as, the options’ purchaser has no obligation to either buy or sell for the exercise price and will do so only if it is profitable.

Options are flexible instruments because they allow you to tailor the exact exposure and risk you wish to have for an anticipated move in the options price.

Trading options allows an investor to gain leverage in a contract without committing to a trade. Furthermore, risk is limited to the option premium for the buyer of an option. (Writers of options face unlimited downside risk.) In addition, trading options allows investors to protect their positions against adverse price fluctuations when it is not desirable to alter the underlying position.

Writing an option provides one with an additional source of income arising from the premium one receives from the buyer of the option. The premium also serves as a cushion against the risk exposure one would incur.

For example, if you write a call option in anticipation of a decline in the price of an underlying, you will reduce your potential capital loss by the amount of premium you receive. However, if you expect the price of a particular underlying to rise, you may wish to write a put option and earn the premium as the put option holder will not exercise his right.

Options is both an exchange traded product and an OTC product.

Contracts traded on the Singapore Exchange Ltd (SGX) include the Eurodollar, Euroyen TIBOR, Euroyen LIBOR, 10-Year Japanese Government Bond, Mini 10-Year Japanese Government Bond, Nikkei 225 Index, Nikkei 300 Index and MSCI Taiwan Index. More information can be found on the SGX website.

All Options buyers are required to pay the premium of the Options. For Futures Style Options, a margin equivalent to the underlying futures will be charged on top of the premium.

As the seller of the Options, mostly a full margin equivalent to that of the underlying Futures contract is required for the margin. This is calculated and computed by the SGX SPAN system for Options margining.

No, because the value of the Option will depreciate with time and is worth nothing once expired.

The exercise style of an option does not prevent an investor from closing the position by engaging in a closing transaction on an exchange up to and including the last trading day for the contract. A long (purchased) option contract can be closed by one of two methods: entering into a closing sale at an options exchange, or by exercising the contract. A European exercise style option can only be exercised at expiration so the only way to close your position prior to expiration is to execute a closing trade.

Index options can have different exercise styles and trading hours. Option holders would want to be certain that they know the difference between closing an open option position by exercising the contract, and closing the position via a trade on an exchange. Even the last trading day for expiring options can vary. The contract specifications of these index products contain important trading information regarding these options.

Options will not move as much as their underlying unless they are in-the-money and/or very close to expiration. The amount an option can be expected to move given a 1-point move in the underlying futures contract is called delta. A delta of 0.5, for example, means that an option can be expected to move about fifty cents for every $1 move in the underlying contract. Delta will change with time to expiration as the option moves more in- or out-of-the-money, and will also be affected by the volatility of the underlying.

As soon as you tell your broker you would like to exercise your right to buy the futures contract you are deemed to be a contract owner. Because of the irrevocable nature of the call exercise, you will be buying the futures contract at the strike price, and you can sell those contracts immediately after giving instructions to exercise.

For options that expire on the same day as the underlying futures, at-the-money or out-of-the-money options are not allowed to be exercised on expiration day. There is no incentive for the long option holder to exercise such options since the options expire together with the underlying futures. Nevertheless, all in-the-money options will automatically be exercised on expiration day. For options that do not expire together with the underlying futures, request to exercise such options should they be at-the-money or out-of-the-money will be allowed.

Yes. Options can be sold without you owning them but this is not known as short selling. When you buy an option, you pay out money to someone and obtain the right to buy (or sell, in the case of put options) the underlying at the strike price. The seller of the option sells you this right to buy (or sell) the underlying at the strike price and in return for a premium. The seller therefore takes money in, but also takes on the obligations that go along with the contract.

Yes. You can cancel your obligation as a holder or writer of an option by effecting a closing transaction before the expiration date.

Approximately 55% of options are closed out before expiry, around 15% are exercised and around 30% expire worthless.

Non-Deliverable Forwards (NDFs)

Non-deliverable forwards (NDF) are cash-settled and are usually short-term forward contracts. The notional amount is never exchanged. Two parties agree to take opposite sides of a transaction for a set amount of money at a contracted rate. The profit or loss is calculated on the notional amount of the agreement by taking the difference between the agreed upon rate and the spot rate at the time of settlement.

NDFs are used to hedge or speculate against currencies where government regulations restrict foreign access to local currency or when there is the need to compensate for risk without a physical exchange of funds.

| Spot Forex | NDF |

| 1. Actual exchange of principal funds | 1. No actual exchange of principal funds |

| 2. Deliverable market offshore | 2. Not deliverable market offshore |

| 3. Value date is usually T+2 | 3. Value date as specified in contract |

| 4. Profits and Losses are in term currency | 4. Profits and Losses are in US Dollars |

| 5. Lower initial margins required | 5. Higher initial margins required |

Currently, we only accept call-in execution for a minimum contract size of USD250,000.

All NDFs have a fixing date and a value (settlement) date. The fixing date is the date which the difference between the prevailing spot market rate and the agreed-upon rate is calculated. The value (settlement) date is the date where the difference is paid or received in US Dollars. The fixing date is usually 2 business days before the value date.

For long positions, deduct your NDF agreed exchange rate from the NDF fixing rate at expiry, then multiply the figure by your notional amount, and divide it by the NDF fixing rate. The result will be your profit or loss in US Dollars.

For short positions, deduct the fixing rate from your NDF agreed exchange rate, then multiply the figure by your notional amount, and divide it by the NDF fixing rate. The result will be your profit or loss in US Dollars. Example: You bought 1 million USDINR NDF at 60.20, fixing date 08 Oct, value date 10 Oct. On 08 Oct, the USDINR NDF rate is fixed at 60.80. You made a profit of ((60.80-60.20) x 1,000,000)/60.80 = USD 9868.42. You will receive this amount on the value date 10 Oct.

Trading NDF is risky because spreads are usually wider during non-official trading hours. It is not as liquid as spot FX as market depth is thinner, making it more volatile. Margins will also be locked until the value date.

No, there are no deliveries for NDF positions.

No, the statement shows balances in the restricted reference currency as an indication of profits or losses in the reference currency based on the settlement rate. These are for indication and does not imply that you actually have balances in the restricted currency. Positive balances in the reference currency will be converted to US Dollars only upon fixing and that can be withdrawn after the value date.

No, you cannot use the profits made in your NDF positions before the fixing date as margins for other leverage trades. After the fixing date when the contract is settled and the profits are converted to US Dollars, the profits can then be used as margin for trading other products.

You can withdraw your profits made in your NDF position only after the value date, even if your NDF position is closed before the fixing date. Any profits realised before the fixing date can only be withdrawn after the value date.

You can close an existing NDF position before the fixing date by entering a trade of the exact contract on the opposite side.

For all open NDF positions held until expiry, the contracts will be automatically closed out at the fixing rate during fixing.

The standard tenors for NDF contracts are quoted in weeks and months. For example, 1 week, 2 weeks, 1 month, 6 months. For clients who wish to trade on odd dates, they may call in to our dealing desk and specify their desired date.

Phillip Nova Pte Ltd will amend the off market price to fair market price using reference price obtained from Bloomberg or equivalent and price source from Liquidity Providers. Cancellation of off market trades is subjected to the approval of Phillip Nova Pte Ltd.

Standard tenor of 1 week, 2 week, 3 week and 1 month NDF price published in Bloomberg or equivalent will be used as a guide to determine fair value. Concurrently, Phillip Nova will try its best efforts to check with other Liquidity Providers for fair value prices at the affected time.

Can't find what you are looking for?

Should you have any query, you may contact us at (65) 6538 0500 or

email us at nova@phillip.com.sg