By Danish Lim, Investment Analyst, Phillip Nova

The Nikkei 225 Index plunged -12.40% on 5 August, its steepest single-day decline since 1987. Investors fled equities as a stronger yen hammered export stocks, tighter monetary policy led to unwinding of carry trades, and fears of a US recession led to risk-off sentiment.

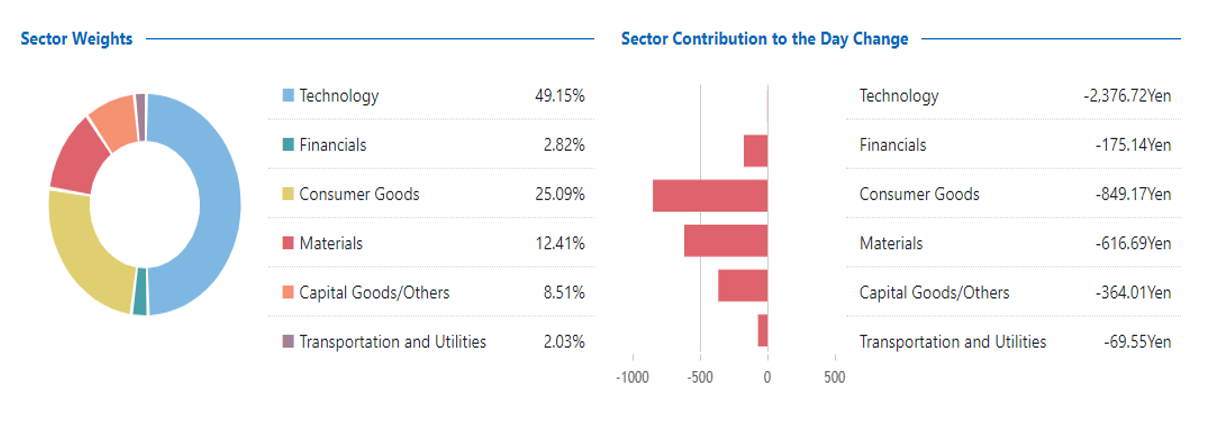

While the decline was broad, Tech was particularly hard hit, with stalwarts like Softbank Group (-18.66%) and Tokyo Electron (-18.48%) down by nearly 20%. This is important as Tech has roughly a 49% weightage in the Nikkei 225 index, meaning a decline in Tech has an outsized effect on the index. Even banks and insurers that were expected to benefit from the rise in rates were not spared from the rout as government yields slumped.

Source: https://indexes.nikkei.co.jp/en/nkave/archives/summary?dt=08052024&idx=nk225

Nevertheless, the index rebounded on 6 August, and was up by 9.57% as of 10:06 SGT. The SGX Nikkei 225 Index Futures contract was up 10.6% as of 10:20 SGT. We attribute this rebound to strong US Services data that provided comfort economic growth could hold, easing recession fears.

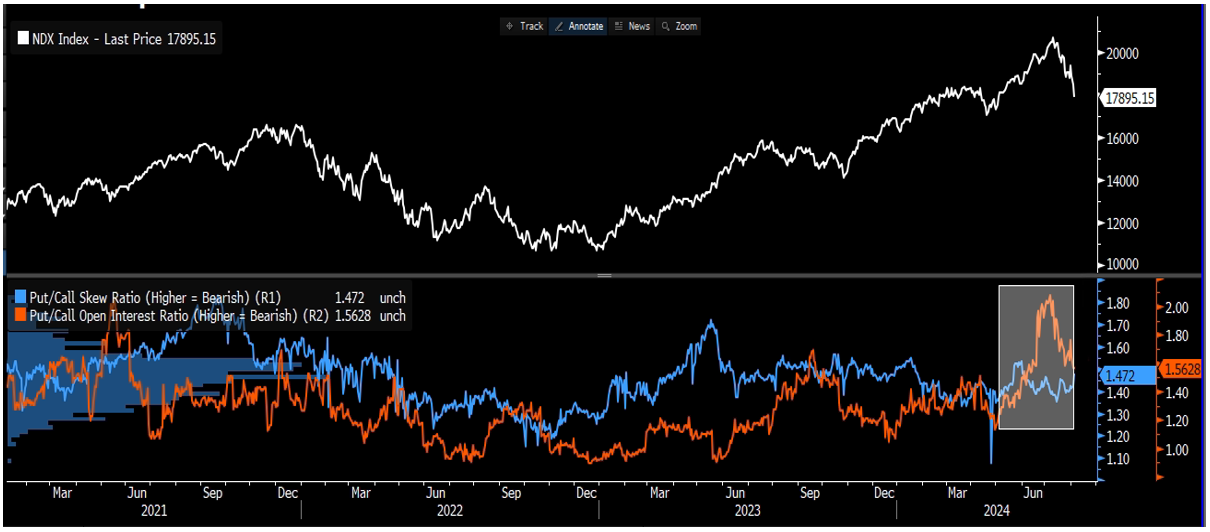

The wild swings in prices suggest that volatility could remain elevated for the time being. With implied volatility seen below at record highs.

For most of the year, 3 core tenets drove equity markets to new all-time highs:

- US economy is resilient and is headed for a soft landing

- AI momentum is unstoppable and will quickly generate massive profits

- BOJ’s policy normalization will not be hawkish enough to really matter, Yen will stay weak

Observations over the past several weeks have poured cold water over each of these tenets.

Firstly, the July jobs report highlighted that markets may have underestimated US recession risks as unemployment rate rose and job growth (NFP) was well below forecast. A flight to quality saw a rush into short-dated treasuries, driving the 2-year treasury yield below those on 10-year bonds for the first time in over 2 years. This phenomenon, knows as a yield curve dis-inversion, has occurred just before the past 4 recessions.

AI momentum was halted in recent weeks amid a rotation out of Tech due to fears of an “AI Bubble”. Markets grew concerned about the vast expenditures needed to build the infrastructure necessary for AI workloads. Put/Call Open Interest Ratio on the Nasdaq surged, as investors piled into bearish puts on the Nasdaq. Amazon and Intel both plunged after disappointing results. The Magnificent 7 saw a plunge of -11.30% since the start of July.

The BOJ also hiked rates for the 2nd time this year in a surprise move, leading to a surge in the yen which led to an unwinding of carry trades. A carry trade typically involves borrowing at the lower-yielding yen and investing in higher-yielding US assets. Carry returns have seen a decline as interest rate differentials narrow. As carry trades get liquidated, traders will have to buy back yen to repay loans taken to fund the carry trade, traders may also sell off assets, including stocks, to cover their positions.

Furthermore, previously a key driver of the market’s rally, foreign investors sold a net 1.56 trillion yen ($10.5b) of Japanese stocks and index futures for the week ended July 26.

Looking Ahead

Volatility is likely to remain elevated due to the unwinding of carry trades and US recession fears which we believe are in the process of being priced-in. “Bad news will be bad news” going forward as markets assess whether the US is headed for a recession.

We believe there are 2 ways to trade the Nikkei 225 in view of the current backdrop moving forward:

1) Long Nikkei 225 Index Futures on Dips

Data this morning showed an increase in real wages for the first time in 27 months. This could have contributed to the rebound in Japanese equities as traders saw hope that a virtuous wage-price cycle could emerge to support consumer spending and sentiment. Japanese households have also poured 7.5 trillion yen ($52b) of funds into new tax-free investment accounts called NISA during 1H 2024, according to Japan Securities Dealers Association.

Should costs ease and wages continue to grow, we expect domestic demand recovery to be the next key growth catalyst for Japanese equities.

However, over the coming months, until recession fears recede and USD/JPY stabilizes, Japanese equity momentum could be limited due to a re-pricing of recession risks and the unwinding of carry trades.

2) Use options to position for elevated volatility (Straddle, Strangle)

With volatility likely to remain elevated, especially with the upcoming US elections, unwinding of carry trades, and fears of a US recession, we favour a long straddle/strangle option strategy.

The 2 strategies have no directional bias (“directionally agnostic”), and payoffs depend on the magnitude/size of a move, not its direction. The ideal outcome is for either the put or call to increase in value far enough to offset the premiums paid. Thus, these strategies are generally view to be market-neutral and bullish on volatility.

Long Straddle

Features include:

- Upside: Potentially unlimited regardless of underlying price direction, as long as the move is strong enough.

- Downside: Max loss is limited to when the share price on expiration date is trading at the strike price of the options bought. At this price, both options expire worthless, and the options trader’s loss is limited to the premiums paid

- Market-Neutral: Straddles are used typically when an option trader expects the underlying securities to experience significant volatility in the near term.

Strategy Execution:

Simultaneously buying a put and a call of the same underlying, strike price and expiration date.

- Buy 1 ATM Call

- Buy 1 ATM Put

Example: Using SGX Nikkei 225 Options, Prices are hypothetical for ease of understanding

- Current Nikkei 225 Index price: S= $20

- Long 1 ATM Call @ Strike = $20

- Long 1 ATM Put @ Strike = $20

- Cash outlay = Call premium ($5) + Put premium ($5)= $10

Payoff at Expiration

- If Nikkei 225 > $20; rises to $40: Call option is in-the-money and put option expires worthless.

- Profit = $40 – $20 – $10= $10

(Potentially unlimited upside, depending on magnitude of underlying price move) - If Nikkei 225 < $20; drops to $5: Put option is in-the-money and call option expires worthless.

- Profit = $20 – $5 – $10= $5

- If Nikkei 225 remains unchanged at $20: Both call and put options expire worthless,

- Loss = -$10 (premiums paid)

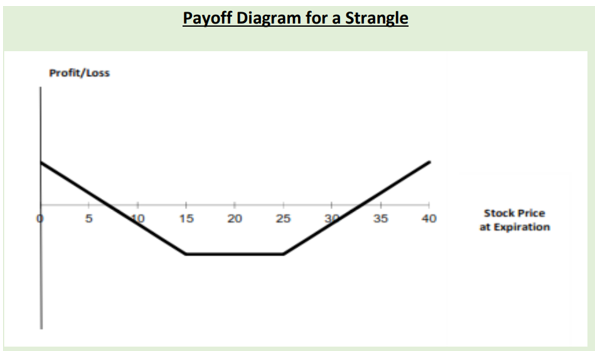

Strangle

A Strangle is similar to a Straddle strategy, except it:

- Buy 1 OTM Call (Higher Strike price)

- Buy 1 OTM Put (Lower Strike price)

- Upside: Potentially unlimited, depending on the magnitude of underlying move, either upwards or downwards.

- Downside: Max loss occurs when the underlying trades between the strike prices of both options. In the table above, max loss occurs when the underlying trades between $15 and $25.

Trade Now & Fly to Japan Promotion

Win tickets to Japan when you trade SGX Nikkei 225 Index Futures, at only 50 cents, with Phillip Nova. Click here to learn more now.

Trade Stocks, ETFs, Forex & Futures on Phillip Nova

Features of trading on Phillip Nova

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, China, Hong Kong, Malaysia and US markets.

- Over 90 Technical Indicators

View live charts and trade with ease with over 90 technical indicators available in the Phillip Nova platform

- Trade Multiple Assets on Phillip Nova

You can trade Stocks, ETFs, Forex and Futures on a single ledger with Phillip Nova