By Danish Lim, Senior Investment Analyst, Phillip Nova

With the reopening of the onshore Chinese markets this week on Tuesday, 8 October 2024, investors were no doubt looking to see whether the bullish momentum seen in the last two weeks will continue. The CSI300 gained as much as 25% in the past 2 weeks, fuelled by optimism surrounding aggressive stimulus measures announced by the PBOC.

With the re-opening of the onshore markets, Chinese stocks gained as much as 10% before retracing during the closely watched briefing by China’s National Development and Reform Commission (NDRC) – the nation’s top economic planner. With prices jumping as much as 10% at the open, traders were expecting more stimulus measures to be announced during the briefing but were left disappointed at the lack of fresh stimulus measures. Hong Kong stocks slumped as much as 10%, while onshore Chinese shares pared gains to close the morning session just 4.8% higher.

NDRC Chairman Zheng Shanjie mostly recapped earlier policies and showed a general lack of urgency which underwhelmed investors. He also shared that the government would contribute 200 billion yuan for investment projects this year; and reiterated his confidence that the country will be able to achieve its social and economic goals for the year.

Moving forward, direction will likely depend on the size and strength of further policy follow-ups. This comes amid other risks including the upcoming US elections and rising tensions in the Middle East, with many likely opting to take profit from the recent rally.

Divergent movement in the Futures market

With prices seen in the overbought region, the SGX FTSE China A50 Index Futures fell as much as 10% at 10:29am in the morning of Tuesday, 8 October 2024. The HKEX Hang Seng Index showed a similar movement trailing closely behind in terms of the percentage fall. Typically, the movement of the futures market will follow the cash market, but a divergence was seen this morning. Prices could potentially align within the day or in the coming days.

Technical Analysis

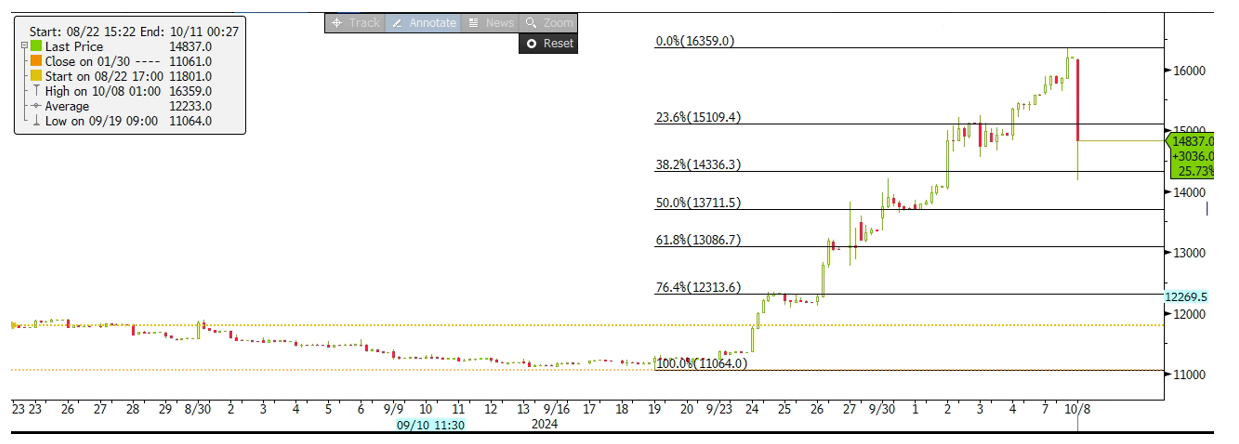

- Near term resistance at around 15,100 to 15,109

- Support at around 14,330 to 14,336

We prefer to remain patient and observe how stimulus measures play out. There will be more opportunities for officials to roll out additional stimulus measures later in the year, including a potential December Politburo Meeting.

Without additional stimulus measures, we see the SGX FTSE China A50 Index Futures contract potentially trading between the 38.2% retracement level around 14,330 to 14,336 and the 23.6% retracement level around 15,100 to 15,109. A break above resistance could see the contract heading towards 16,350 to 16,359.

Get Started now

Don’t miss out on the potential opportunities. Gain access to the following China and Hong Kong market related products on Phillip Nova 2.0:

Futures

- SGX FTSE China A50 Index Futures

- HKEX Hang Seng Index Futures

Stocks

- China A (SZSH)

- Hong Kong (HKEX)

Gain exposure to the China and Hong Kong markets, click here to try a demo now!

Ready to get started? Open an account here.

Trade Stocks, ETFs, Forex & Futures on Phillip Nova

Features of trading on Phillip Nova

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, China, Hong Kong, Malaysia and US markets.

- Over 90 Technical Indicators

View live charts and trade with ease with over 90 technical indicators available in the Phillip Nova platform

- Trade Multiple Assets on Phillip Nova

You can trade Stocks, ETFs, Forex and Futures on a single ledger with Phillip Nova