The US Dollar Index which gauges the greenback’s strength against a basket of major currencies dipped to 103.2, a level not seen since end of August. Among the factors weighing on the Dollar include market expectations that the Federal Reserve has hit the end of its interest rates hiking cycle, as investors start to assess the possibility of rate cuts. The shift in market sentiment came amid softening economic and inflation figures in the US. Read on to learn how major currency pairs may move in the near term.

USDJPY

The USDJPY fell steeply after breaking down from a rising wedge that had formed since September. A temporary rebound to retest 148.5 (R1) resistance zone is probable, before the pair heads lower to test the technical breakdown target around 144.7 (S3).

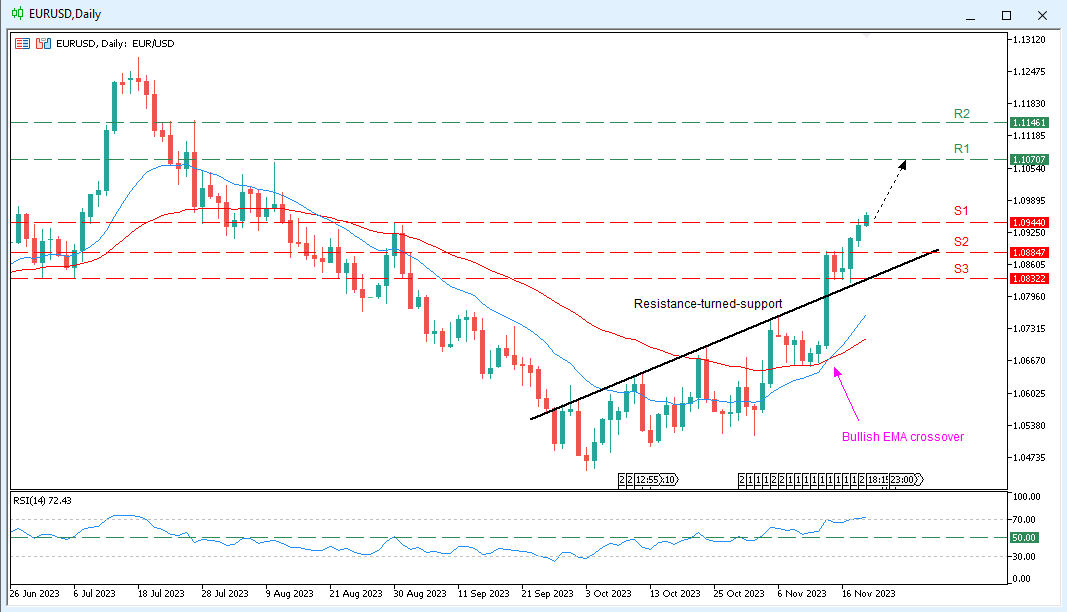

EURUSD

The EURUSD marches to the highest level since August with a strong bullish momentum. A bullish cross between 20 and 50 EMA hints at further upside beyond 1.10 resistance zone.

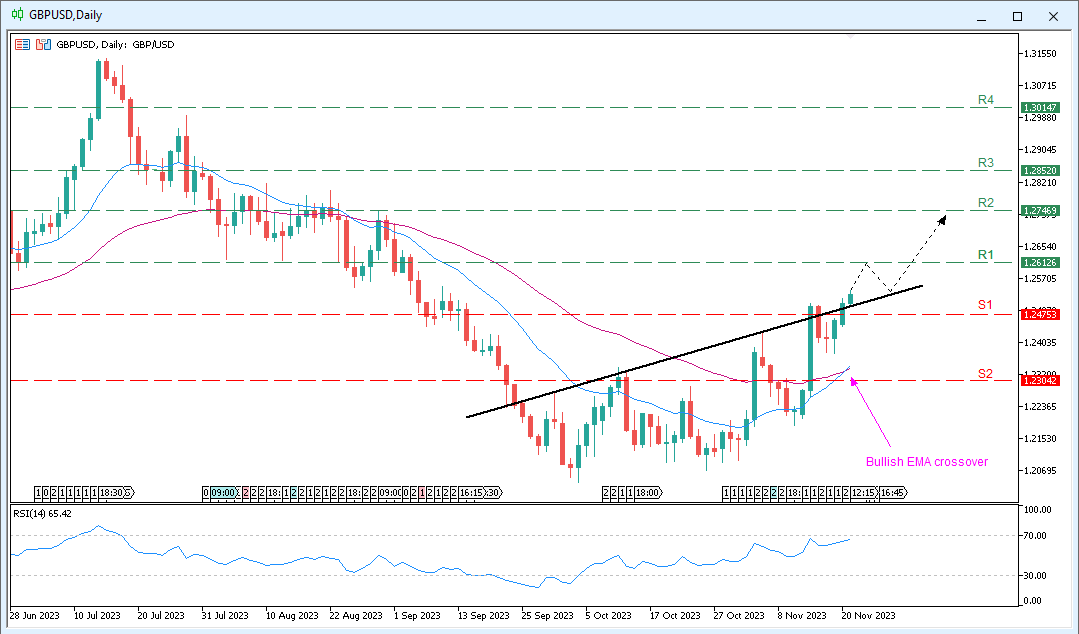

GBPUSD

GBPUSD broke out from a triple bottom pattern to the upside. Potential resistance around 1.26 (R1), but technical setup on daily chart suggests imminent rise to the 1.27 (R2) zone. Bullish EMA cross supports the bullish projection.

USDCNH

USD depreciated sharply against the Chinese yuan to 7.13, marking a 3.20% decline from its early September peak at 7.36. The pair is deeply oversold and we eye a rebound to 7.19 (R1) before continuation of downtrend.

For more market views on Forex, please sign up for our upcoming webinars here.

Trade Forex on Phillip MetaTrader 5 (MT5).

Trade Forex at zero commission on Phillip MetaTrader 5, a dynamic platform that offers low spreads. Integrated with Acuity’s Signal Centre and Trading Central Indicators, and available on mobile and desktop app, you will never miss a trading opportunity with Phillip MT5.

Download Trading Central’s Market Buzz for updates on more topics.

What’s more? Phillip MT5 is now supported on Mac OS! To install, simply download the file below and complete a simple installation process.