By Danish Lim, Senior Investment Analyst for Phillip Nova

It’s about 6pm on 6 November 2024 in Singapore and we see Trump having attained 267 Electoral College votes. He just needs three more to clinch victory. Despite putting on a good fight, Kamala Harris is currently trailing him with just 224 Electoral College votes. It looks like a foregone conclusion that Donald Trump will return as the 47th President of The United States of America.

The key to Trump’s reappointment would be the victory achieved in key battleground states of Pennsylvania, Georgia and North Carolina. Congratulatory messages for Trump have already begun pouring in from foreign leaders including Australia, France, Ukraine, the United Kingdom, Israel and Australia.

Market Reaction

As the votes in the various states were being tallied, the markets started to react according to a probable Trump return.

- The S&P 500 jumped 1.8% and the Russell 2000 has since gained a whopping 6%.

- The USD has rose to the highest level since July. Bitcoin rose 6.85% to hit a new all-time high of $75,000. Dogecoin’s surge exceeded 20%.

- The Nikkei 225 also gained 2.25%, while the Yen weakened wit the USDJPY nearing 154.

- COMEX Copper is down alongside most metals like Silver, Platinum, and Palladium. SGX Iron Ore down over 2%.

- Hang Seng slumps by -2.7% while CSI 300 is down by -0.45%.

A Recap on Sectors and Stocks That Could Benefit

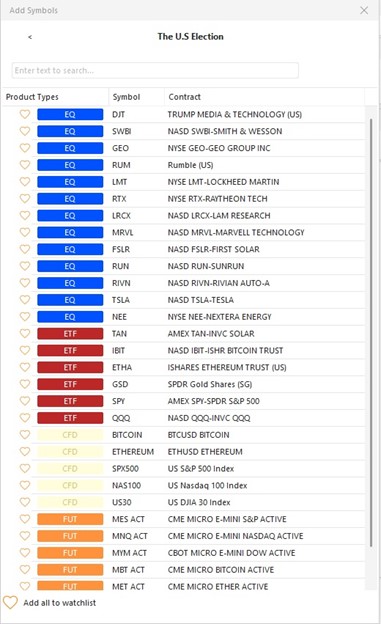

- Sector ETFs: Financials & Energy under Trump, even Bitcoin/Ethereum-related ETFs due to Trump’s pro-crypto stance

- Oil Stocks: Exxon Mobil, Halliburton, Devon Energy, EQT, and Chevron

- Healthcare: another heavily regulated sector that may face easier regulation under Trump, Health insurers like UnitedHealth, Humana, and CVS Health.

- Banks: Bank of America, Goldman, Citigroup, Wells Fargo, and JPmorgan.

- Stocks like Trump Media & Technology Group, Gunmaker Smith & Wesson, prison operator GEO Group, and Conservative video-sharing platform Rumble Inc are expected to benefit from a possible Trump second term.

- Defence companies like Lockheed Martin and Raytheon Technologies may also benefit if Donald Trump is re-elected.

- Small Caps thanks to lower tax rates and Trump’s protectionist policies.

- Crypto stocks and ETFs: Coinbase Global Inc, Marathon Digital, Riot Platforms

Sectors and Stocks That Could Face Headwinds by Trump’s Policies

- On the downside, Chinese equities and semiconductors with exposure to China (Marvell, Lam Research, KLA) could see headwinds from a Trump victory due to the potential for additional tariffs on Chinese-made goods and export restrictions.

- Other companies exposed to China include Air Products and Chemicals Inc, Celanese Corp, Agilent Technologies, and Jabil Inc

- Renewable energy: Invesco Solar ETF, stocks like Nextera, Rivian, and First Solar could fall under Trump

- Tariff-sensitive stocks: Lululemon, Gap, and Ulta Beauty could slump if Trump gets elected, with Nike sourcing a chunk of their footwear from China, and Lululemon from Vietnam

- EVs: Trump’s claim that he will reverse Biden’s EV policy means EVs like Rivian and Lucid may be under pressure. But Tesla is in a unique position to benefit from both parties, given Musk’s vocal support for Trump

- EV charging network operators: ChargePoint, Beam Global, and Blink Charging

Prepare for Election-Driven Opportunities with Phillip Nova 2.0

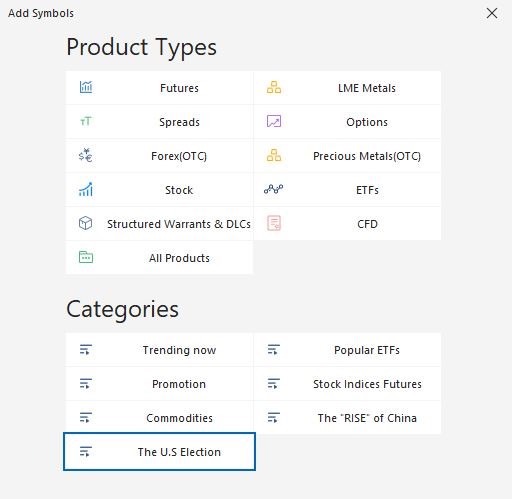

We’ve done the heavy lifting for you. With our new “US Election” category, Phillip Nova 2.0 provides a carefully curated list of products across different asset classes likely to be impacted by the election. Whether you’re interested in energy, financials, tech, or renewable sectors, this feature enables you to identify trading opportunities that align with potential political outcomes. To access the new curated category, head to your Watchlist>+Add>click on the “US Election” category.

Phillip Nova 2.0 gives you the tools to stay ahead of election-driven market shifts and make informed trading decisions with ease.

Trade US Stocks, ETFs, Futures & Options now

Trade US stocks, ETFs, Futures & Options on Phillip Nova 2.0 now! Click here to open an account now. Try a demo here.

Trade Stocks, ETFs, Forex & Futures on Phillip Nova

Features of trading on Phillip Nova

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, China, Hong Kong, Malaysia and US markets.

- Over 90 Technical Indicators

View live charts and trade with ease with over 90 technical indicators available in the Phillip Nova platform

- Trade Multiple Assets on Phillip Nova

You can trade Stocks, ETFs, Forex and Futures on a single ledger with Phillip Nova