By Eric Lee, Sales Director, Phillip Nova

Company Background

Tencent is arguably the most influential internet firm in China as one can hardly go by a day without using its products. Tencent is the world’s largest video game vendor and owns the world’s top-grossing mobile game–Honor of Kings. Tencent also runs China’s largest social media super app–WeChat. The app is now part of the fabric of life for Chinese people who use it to chat, shop, watch videos, play games, order food and taxis, and more. Equally as impressive as its own portfolio, Tencent is also among the world’s largest venture capital and investment corporations. The firm is now one of the largest shareholders in leading tech companies like Meituan, JD, DiDi, Snap, PDD, Kuaishou, Epic Games, and more.

Since China ditched its zero-Covid policy and cited its pro-economy stance, Tencent’s share price had almost doubled from its low of $190 in November 2022 to high of $415 in January this year. Its share price had since corrected into a Bullish Flag formation and had just broken out today after it had reported a surprise profit growth, lifted by digital-ad recovery. Management had declared 2022 final dividend of HK$2.40 per share vs HK$1.60 per share in 2021. Since 2010, Tencent had increased its dividend payout by 24x.

Based on Bullish Flag projection, the target price for Tencent can be set at HK$520 and HK$330. It can be used as cut-loss level should its share price fail to appreciate but fall below it.

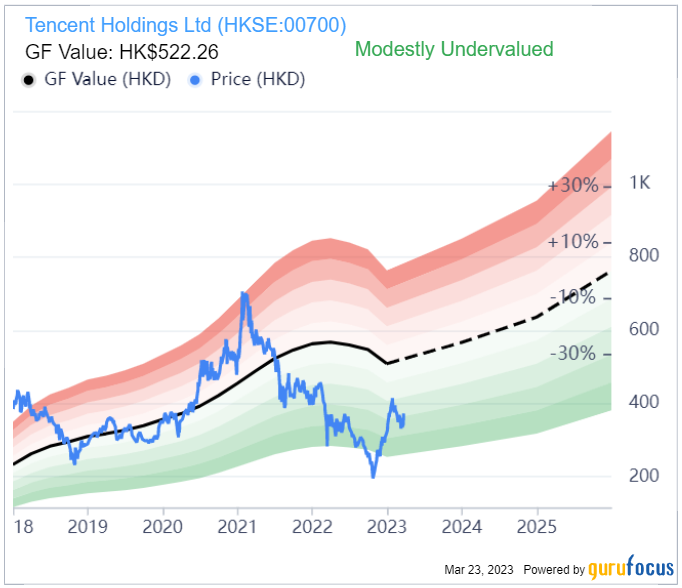

Valuation

GuruFocus set its valuation for Tencent at HK$520. Currently, its share price is trading at 30% discount to this valuation.

Analysts’ Projection

There are some warning signs that investors should watch out for.

- Efficiency had fallen as Tencent is growing its assets at a higher rate than its revenue growth over the past 5 years

- Operating Margin and its Return-On-Invested-Capital had fallen because of the above

- Its growth rate had fallen from the 5-Year average of 30% to down by 1%.

No doubt, its slow-down in business is macro-driven, mainly due to China’s zero-Covid and tech crack down policies. Hopefully, with the change in government’s policy, Tencent can return its businesses back to growth-focus.

In fact, as the table indicated, analysts had projected for Tencent to grow its revenue by 50% and to double its Earnings Per Share by FY2025.

Potential Catalyst

Tide looks to be turning for China’s tech giants when its recently reported in January that China’s Cyberspace Administration had purchased “Golden Shares” in Alibaba (9988) and its rumoured to have plans to do the same for Tencent (0700) as well.

“Golden Shares” are shares that grant special voting rights and in this case, give the Chinese regulators a board seat in the tech giants. To the Western economies, this may seem like a negative to have government poking around their businesses. But in China context, this is good news as it aligned the interest of the Chinese government with the companies. Especially for Tencent, which require the regulators to grant them the licenses necessary for its businesses.

This could be the potential catalyst to bring back investor confidence and drive its share price higher.

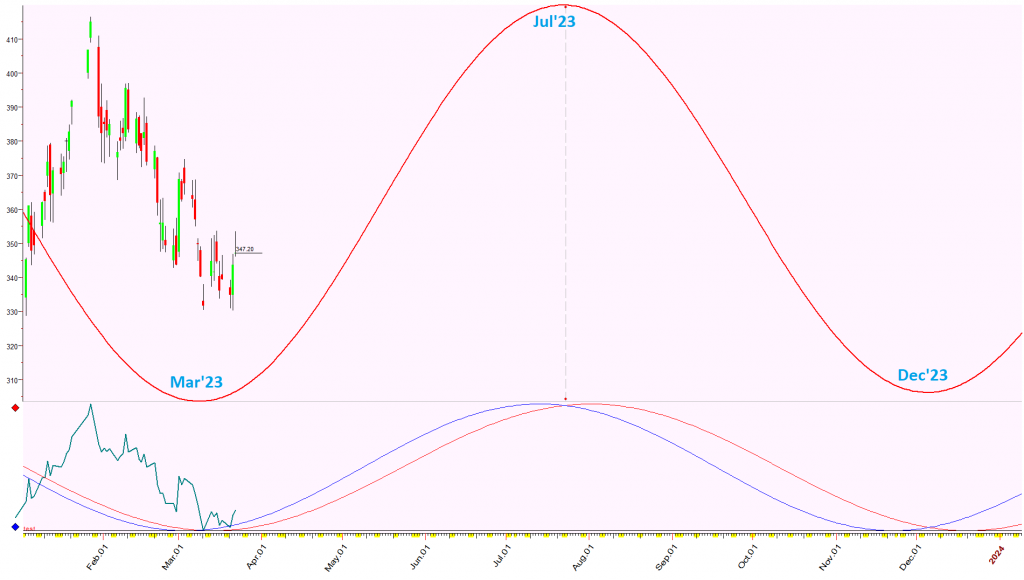

Cycle Analysis

Cycle analysis had shown that Tencent could potentially bottom in March 2023 and enter into a possible uptrend till July this year. The thing to note about cycle analysis is that it can point to us the potential peak and trough and the trend it is going on to next but it cannot inform us on the magnitude of the trend. To do that, we rely on Fundamental and Technical Analysis to set a target price and fair value for Tencent. Based on the information stated above, we can set its potential target level at around HK$500.

Tencent CFD is available for trading on the Phillip MT5 trading account. If you would like to learn how to incorporate Phillip MT5’s plugin together with other tools like Fundamental and Cyclical Analysis to improve your trading experiences, please feel free to contact me to find out more.

Value-Added Service from Eric Lee

My clients benefited from my services including investment advisories in unit trust and stocks, investment insights based on my personal knowledge and experiences navigating through the markets the past 20 years.

Where periodically, I will be sending out market analysis like this to my clients, as well as alerting them of support and resistance levels for the technical indicators which I am utilising on a chart. Click on the button at the bottom if you would like to arrange for a One-to-One Coaching session to learn more about trading futures, forex, stocks and more, and how you can benefit from the services I provide.

Eric Lee is a Sales Director with Phillip Nova. With expertise in Futures, Forex, Stocks, and Unit Trust, Eric makes an all-rounded advisor. Make informed trading decisions without spending time combing through endless information as Eric readily provides clients with trade alerts and insights via WhatsApp. Over his years of experience, Eric developed systematic strategies in trading and investing. Book a complimentary coaching session below to leverage on his expertise as he imparts his knowledge to enhance your trading journey.

- Free Phillip MT5 Demo Account

- Free Phillip Nova Demo Account

- Open an account now

*T&Cs apply, contact Eric below for more information.