By Danish Lim, Senior Investment Analyst for Phillip Nova

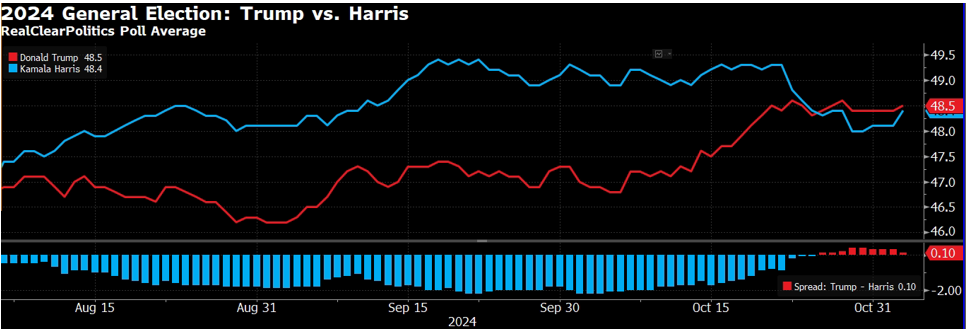

In what seems like a coin-toss election, Donald Trump and Kamala Harris are blitzing through swing states to make their final pitches to voters in the campaign’s final days, with polls signalling no clear winner. Latest polls have them tied at around 49% each. Another poll showed Harris with a 47%-44% lead in Iowa.

It should be noted that results may not be finalised on election night, as some states including Washington DC do not begin counting ballots until polls close and some states will tally votes more quickly than others. In 2020, the results were announced four days after the election; while in 2016, Hillary Clinton conceded to Donald Trump just the morning after the election. A delayed election result could raise volatility across asset classes.

Additionally, right off the heels of election day will be the November FOMC meeting on 8 Nov at 03:00 SGT, where the Fed is expected to cut rates by 25bps.

Insights:

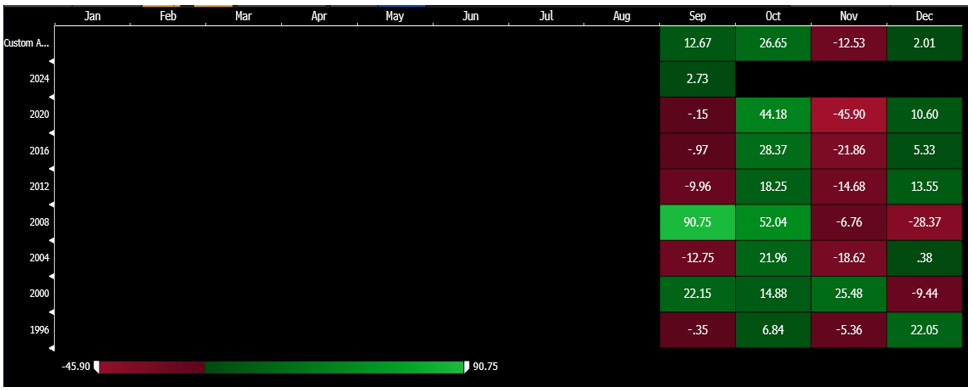

- Volatility tends to rise prior to Elections

The most predictable outcome would be more volatility. Across the past 7 elections, the VIX typically sees an increase of about 26.65% in October, the month before the elections, before declining on average about -12.53% in November as volatility subsides post-election, as seen in the seasonality chart below.

- Election Impact on the S&P 500

Reviewing S&P 500 performance going back to 1992 as seen below, we see that the S&P 500 averages a 2.45% decline a month before the election, while eking out a 0.35% and 0.83% gain in November and December respectively, post-election.

Overall, the S&P 500 saw an average gain of 1.15% in election years since 1992. Election years have generally been good for the US stock market, with the S&P 500 having risen in almost every election year since 1992, the exceptions being 2000 and 2008, which were marred by economic recessions.

Thus, unless the economic backdrop sees an abrupt change, we remain constructive on US equities post-election.

Trump Victory:

- Trump proposed to lower the corporate tax rate to 15% from 21%.

- 10%-20% across the board tariff, and 60% on Chinese-made goods. Could have inflationary impact.

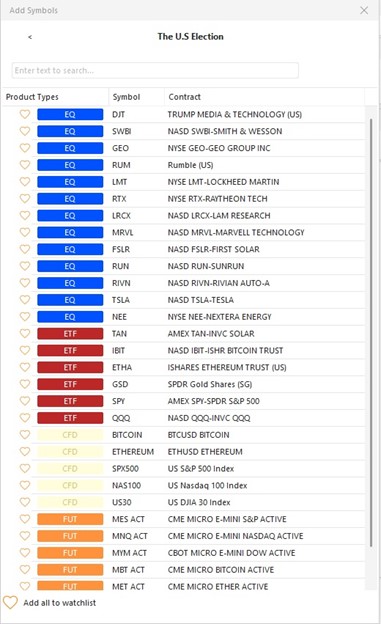

- Beneficiaries: Financials under looser regulations (Bank of America, Goldman Sachs), Oil and energy companies (Baker Hughes, Exxon Mobil, ConocoPhillips), Defence (Lockheed Martin, Northrop Grumman), Prison (Geo Group) and Gunmakers (Smith & Wesson), Crypto stocks (Coinbase, Marathon Digital, Riot Platforms). Trump Media & technology Group

- Companies with high exposure to China could face pressure if trade tensions escalate. Including Qualcomm, Marvell, Materials companies like Celanese Corp, and Industrials like Otis Worldwide Corp.

Harris Victory:

- Harris proposed for an increase in corporate tax rate to 28%, as well as higher rates for higher income earners.

- Campaign messaging suggests that Harris also will take a tough stance against China, although to a lesser extent than Trump

- Beneficiaries: Renewable energy producers like First Solar, Sunrun), EV makers (Tesla, Rivian, and Lucid), and EV-charging network operators (ChargePoint Holdings, Beam Global, Blink Charging Co). Homebuilders (DR Horton, Lennar, KB Home), Cannabis (Tilray Brands, Canopy Growth)

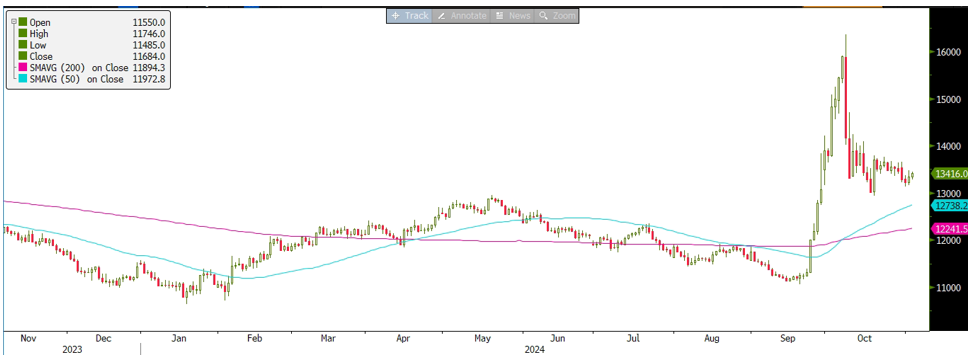

FTSE China A50 Futures:

The FTSE China A50 Futures appears to be in consolidation, amid stimulus uncertainty and a shaky economy.

When compared with the Mini H-shares Index Futures, we observe a high correlation of around 0.83 over the past 2 years. However, the A50 is typically seen as less sensitive to geopolitical tensions as A-shares generate a majority of their revenue domestically.

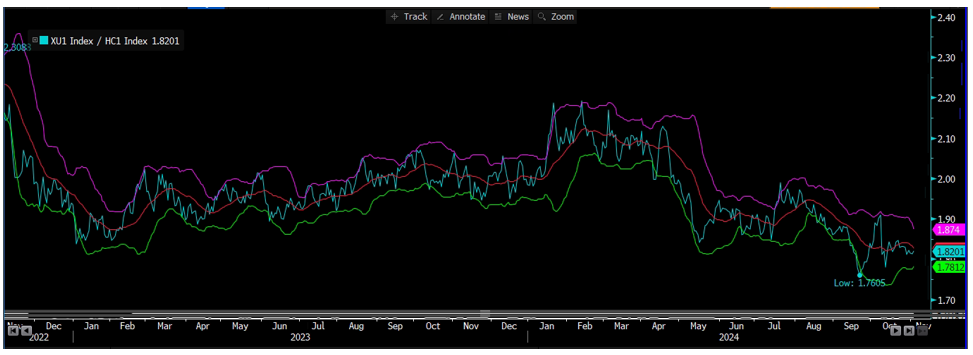

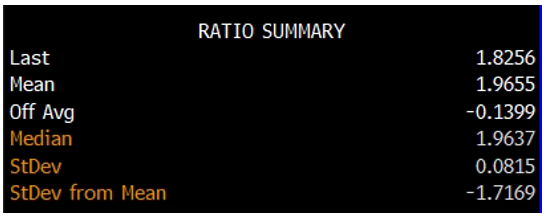

Looking at the ratio between the FTSE China A50 Futures and the Mini H-shares Index Futures, we are able to discern a mean-reverting pattern based on a Bollinger band, as seen above.

Thus, we think that election season volatility presents an opportunity for the ratio to be pushed into overbought or oversold territory temporarily before reverting to the mean. The ratio is currently -1.7 standard deviations below the mean.

Futures Playbook:

In our view, the market can perform well through year-end whether Harris or former President Trump wins the election. Fundamentals are solid and historical trends are favourable for the stock market post-election.

However, a Trump win could also result in near-term market volatility due to the inflationary impact of additional tariffs, as well as increased debt and deficit spending. On the other hand, a Harris victory could weigh on markets due to higher taxes and additional regulations

As mentioned earlier, we think that heightened volatility is likely in the near-term. Such volatility could result in short-term swings that present attractive opportunities for mean-reversion trades.

- Long CME E-mini S&P 500 Futures

We favour going long the CME E-mini S&P 500 Futures based on the historical trend of US equities gaining post-election.

- Long FTSE China A50 Futures (CN), Short Mini H-shares Index Futures (MCH)

We favour going long the FTSE China A50 Futures and shorting the Mini H-shares Index Futures. We believe the A50 is less reactionary to US election volatility as onshore A-shares are less impacted by trade tensions with the US. Thus, in the event of heightened volatility post-election, we see the Mini H-shares Index Futures seeing greater price action than the A50, which will impact the spread ratio in the near-term.

If the ratio trades 2 standard deviations below the mean, we favour going long on CN and shorting MCH, vice versa.

Prepare for Election-Driven Opportunities with Phillip Nova 2.0

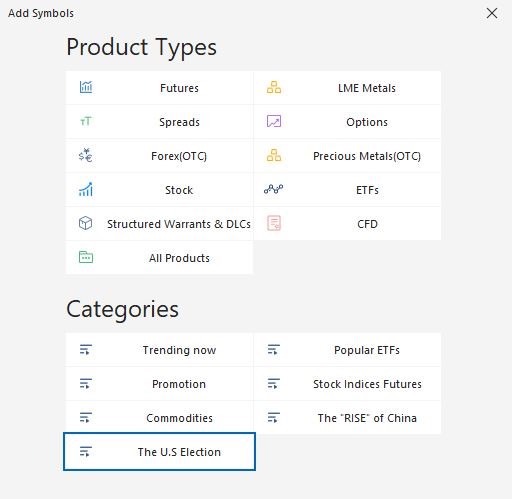

We’ve done the heavy lifting for you. With our new “US Election” category, Phillip Nova 2.0 provides a carefully curated list of products across different asset classes likely to be impacted by the election. Whether you’re interested in energy, financials, tech, or renewable sectors, this feature enables you to identify trading opportunities that align with potential political outcomes. To access the new curated category, head to your Watchlist>+Add>click on the “US Election” category.

Phillip Nova 2.0 gives you the tools to stay ahead of election-driven market shifts and make informed trading decisions with ease.

Trade US Stocks, ETFs, Futures & Options now

Trade US stocks, ETFs, Futures & Options on Phillip Nova 2.0 now! Click here to open an account now. Try a demo here.

Trade Stocks, ETFs, Forex & Futures on Phillip Nova

Features of trading on Phillip Nova

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, China, Hong Kong, Malaysia and US markets.

- Over 90 Technical Indicators

View live charts and trade with ease with over 90 technical indicators available in the Phillip Nova platform

- Trade Multiple Assets on Phillip Nova

You can trade Stocks, ETFs, Forex and Futures on a single ledger with Phillip Nova