By Danish Lim, Senior Investment Analyst for Phillip Nova

As the 2024 US elections approach, traders and investors are paying close attention to the potential stock market movements. Historically, election years are marked by increased market volatility, with political uncertainty often creating both risks and opportunities. However, it’s important to remember that while elections can cause short-term market fluctuations, economic conditions typically have a more lasting impact.

At Phillip Nova, we’ve prepared a powerful tool to help you navigate this crucial period.

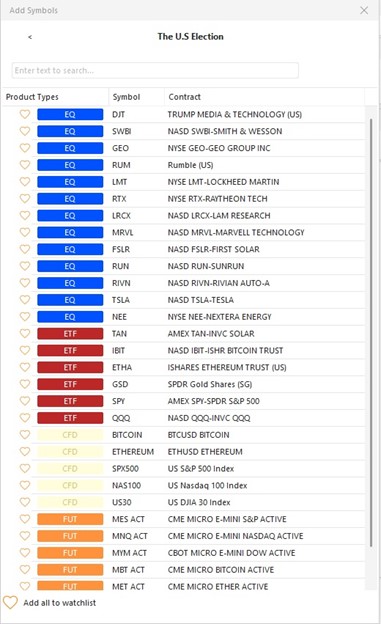

Introducing the “US Election” category in Phillip Nova 2.0! This is where you’ll find a curated list of US stocks that are likely to be impacted by the election results. This feature enables you to make informed trading decisions as political shifts take shape.

Election Implications: Key Sectors and Stocks to Watch

Our analysts have identified several sectors and companies that may see significant movement based on the election’s outcome:

Potential Trump Administration:

A second term for Donald Trump is expected to lead to lower corporate taxes, deregulation, and pro-business policies, which could benefit several industries.

Sector ETFs to Watch:

- Financials and Energy, as well as Bitcoin/Ethereum-related ETFs, are expected to rally due to Trump’s pro-crypto stance

Key Stocks to Watch:

- Trump Media & Technology Group (Ticker: DJT)

- Smith & Wesson (firearms manufacturer, Ticker: SWBI)

- GEO Group (private prison operator, Ticker: GEO)

- Rumble Inc (conservative video-sharing platform, Ticker: RUM)

- Defense Contractors: Lockheed Martin (Ticker: LMT) and Raytheon Technologies (Ticker: RTX) are likely to see gains due to anticipated increases in defense spending

On the flip side, Chinese equities and semiconductor companies with exposure to China, such as Marvell, Lam Research, and KLA, could face headwinds due to potential tariffs and export restrictions on Chinese-made goods.

Trump’s Influence on Financials & Energy:

Under Trump, we expect to see deregulation and lower corporate taxes, which would benefit both the financials and energy sectors. The energy sector may see a revival in oil drilling and other deregulated activities, potentially driving stock prices higher. Financial stocks are likely to benefit from a steeper yield curve and relaxed regulations, boosting profitability for banks.

Potential Harris Administration

If Kamala Harris takes the presidency, expect a shift toward policies favoring clean energy and electric vehicles (EVs). Renewable energy stocks and companies involved in electric vehicles are likely to perform well.

Sector ETFs to Watch:

- Renewable Energy and EVs, including the Invesco Solar ETF.

Key Stocks to Watch:

- Solar energy companies like First Solar (Ticker: FSLR) and Sunrun (Ticker: RUN)

- Rivian (electric vehicle manufacturer, Ticker: RIVN)

- Albemarle (lithium producer, benefiting from increased demand for EV batteries, Ticker: ALB)

- Healthcare stocks like Humana (Ticker: HUM) and CVS Health (Ticker: CVS) may experience pressure due to Harris’s healthcare reforms aimed at reducing drug prices

Harris and the Green Energy Revolution:

In contrast to Trump’s, a Harris administration could boost clean energy and electric vehicles, aligning with global trends toward sustainability. Stocks like First Solar, Sunrun, and Rivian are expected to perform well as government support for renewable energy industries grows. Health insurance stocks, however, may face challenges, as Harris is expected to push for healthcare reforms aimed at reducing drug prices and expanding coverage.

Prepare for Election-Driven Opportunities with Phillip Nova 2.0

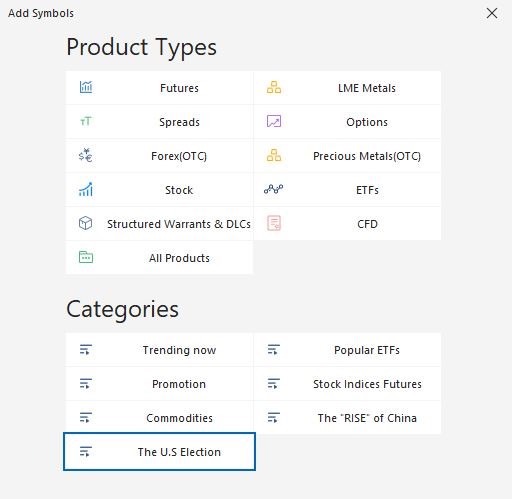

We’ve done the heavy lifting for you. With our new “US Election” category, Phillip Nova 2.0 provides a carefully curated list of US stocks that are likely to be impacted by the election. Whether you’re interested in energy, financials, tech, or renewable sectors, this feature enables you to identify trading opportunities that align with potential political outcomes. To access the new curated category, head to your Watchlist>+Add>click on the “US Election” category.

Phillip Nova 2.0 gives you the tools to stay ahead of election-driven market shifts and make informed trading decisions with ease.

Trade US Stocks, ETFs, Futures & Options now

Trade US stocks, ETFs, Futures & Options on Phillip Nova 2.0 now! Try a demo here. Click here to open an account now.

Trade Stocks, ETFs, Forex & Futures on Phillip Nova

Features of trading on Phillip Nova

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, China, Hong Kong, Malaysia and US markets.

- Over 90 Technical Indicators

View live charts and trade with ease with over 90 technical indicators available in the Phillip Nova platform

- Trade Multiple Assets on Phillip Nova

You can trade Stocks, ETFs, Forex and Futures on a single ledger with Phillip Nova