By Danish Lim, Investment Analyst, Phillip Nova

There are 2 ways to gain exposure to Japan’s equity market via futures contracts – via the SGX Nikkei 225 Index Futures or the SGX FTSE Blossom Japan Index Futures for ESG-conscious investors.

The Nikkei 225 Index is perhaps the most well-known blue-chip equity index in Japan. Born in 1950 and boasting a line-up of 225 major companies listed on the Tokyo Stock Exchange, it serves as a key barometer of the performance of the Japanese stock market.

It is a price-weighted index, meaning higher priced stocks carry greater weight. Technology (~50%) is by far the largest sector. The top 3 holdings include Fast Retailing (owner of Uniqlo), Tokyo Electron, and Softbank Group.

Nikkei 225 Index Futures are offered on 3 exchanges- Singapore Exchange (SGX), Osaka Exchange (OSE), and the Chicago Mercantile Exchange (CME). Below is a brief comparison of their offerings:

Singapore Exchange (SGX):

- Contract size: ¥500 multiplied by the index futures price

- Tick size: 5 index points or ¥2,500 per contract

- Tick size (USD): 5 index points or US$25

- Liquid market available for trading during onshore Japan holidays

- Currency Option: USD or JPY

- Mutual Offset System with CME enables round-the-clock trading

Mutual Offset System (MOS): CME and SGX have a special arrangement that allows traders of yen- and USD-based Nikkei 225 contracts to take positions at either exchange and clear them at the other on the same trading day. This provides flexibility and convenience for traders operating in different time zones.

Chicago Mercantile Exchange (CME):

- Contract size: ¥500 multiplied by the index futures price

- Tick size: 5 index points, or ¥2,500 per contract

- Tick size (USD): 5 index points or US$25 per contract

- Currency Option: USD or JPY

Osaka Exchange (OSE):

- Contract size: is larger, ¥1,000 multiplied by the index

- Tick Size: 10 index points or ¥10,000 per contract

- Currency Option: JPY only

While the Nikkei 225 is a solid investment choice, it’s worth noting that the SGX FTSE Blossom Japan Index Futures contract could be an equally compelling, yet often overlooked, alternative.

FTSE Blossom Japan Index Futures

Inaugurated in 2017, the FTSE Blossom Japan Index is a sustainability-focused equity index which tracks the performance of Japanese companies with strong environmental, social, and governance (ESG) practices.

It is constructed by selecting companies from the FTSE Japan All Cap Index with good ESG scores. The FTSE Blossom Japan Index is free-float market cap weighted and follows its parent Index (FTSE Japan All Cap Index).

As of 28 June 2024, Industrials (26.57%) and Consumer Discretionary (21.16%) are the largest sectors; followed by Financials (13.39%) and Tech (11.55%). The top 3 holdings are Toyota Motor, Sony Corp, and Hitachi. A single constituent’s weight in the index is capped at 15%.

What is the inclusion methodology?

Source: FTSE

- Each company in the FTSE Japan All Cap Index universe is given an overall ESG score ranging from 0 to 5, with 5 being the highest score.

- Those with an overall ESG score of 3.3 or above are eligible for inclusion to the FTSE Blossom Japan Index.

- Those with an overall ESG score <2.9 or having one or more ESG themes assessed as high exposure with a corresponding score of zero are at risk of deletion from the index.

- Constituents below the exclusion threshold during an index review have a 1-year grace period, it will be deleted at the index review one year later if the eligibility criterias are still not met. Index users will be informed of the list of constituents that are at risk of deletion by a client notification.

- Companies involved in “controversial” business areas need to meet a higher requirement for inclusion or are excluded entirely. E.g. Nuclear weapons, Tobacco.

- The index has 351 Japanese securities as of 16 July 2024. Index governance is overseen by the FTSE Russell ESG Advisory Committee, which includes investment professionals experienced in ESG factors.

What are the available products?

SGX-listed futures are likely the most liquid tradeable products. There are also 2 ETFs (Daiwa ETF FTSE Blossom Japan Index (1654) and the One ETF ESG (1498)) that are linked to the index but they are only listed on the Tokyo Stock Exchange (TSE).

Key Information to Know

- The FTSE Blossom Japan Index is reviewed semi-annually in June and December.

- Changes arising from the reviews of the FTSE Blossom Japan Index will be implemented after the close of business on the third Friday (i.e. effective Monday) of June and December.

- A constituent will be removed from the FTSE Blossom Japan Index if it is also removed from the parent FTSE Japan All Cap Index

Key Highlights of the FTSE Blossom Japan Index

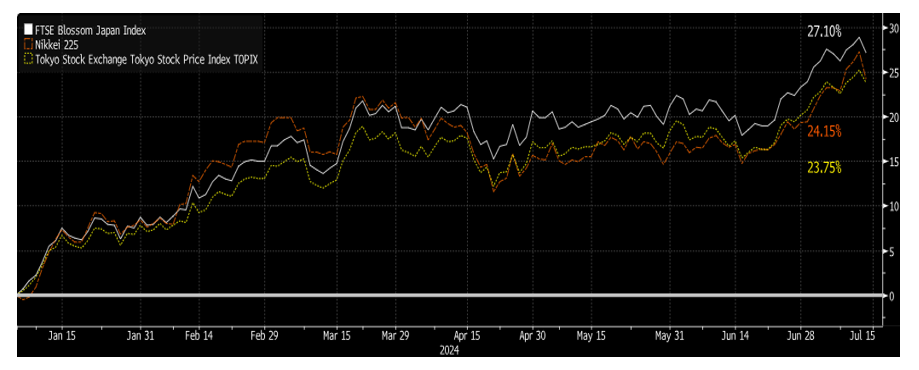

1) The FTSE Blossom Japan Index has outperformed the Nikkei 225 and TOPIX on a YTD basis.

2) The FTSE Blossom Japan Index is highly correlated (93.6%) with the Nikkei 225 over the past 10 years. Allowing for easy integration into investment portfolios.

3) Top 10 Gainers and Underperformers YTD in the FTSE Blossom Japan Index

Why Sustainable Investments in Japan? Why Now?

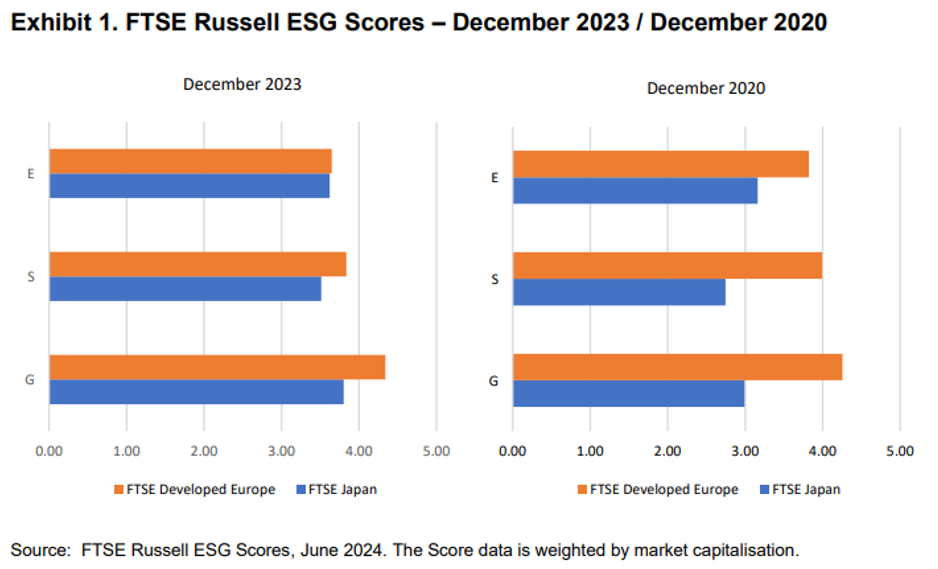

As seen below, data from FTSE Russell shows that the ESG scores of Japanese companies have been gradually improving since 2020, finally catching up with European companies.

Nevertheless, there appears to be further room for improvement in the “S” and “G” pillars.

Latest Trends in Sustainable Investing

- Japan Principles for Responsible Investment (PRI)

Launched in 2006, the PRI is based on the premise that ESG factors have implications on investment performance, and offers a framework for incorporating ESG into the investment and ownership decisions.

At the annual “PRI in Person 2023” event, PM Kishida announced that at least 7 Japan public pensions with JPY 90T (US$ 600B) in AUM will sign the PRI.

The World’s largest pension fund, Japan’s Government Pension Investment Fund (GPIF) has been a signatory of the PRI since 2015 and is consistently promoting ESG investment.

The FTSE Blossom Japan Index has been selected by GPIF as a core ESG benchmark. GPIF has roughly JPY 2.1T (~US$ 14B) of assets tracking the Blossom family of indices as of March 2024.

- Nippon Individual Savings Account (NISA)

Effective from January 2024, the NISA was enhanced to allow for inclusion of ESG indices for the first time. This includes ETFs linked to the FTSE Blossom Japan Index. Sustainable ESG investments is expected to broaden out to involve individual investors following the enhancement. Inflow of funds to NISA has been strong, supported by Japanese equities hitting new record highs.

FTSE Blossom Japan Index vs Nikkei225 Index

Style Tilts:

From a style perspective, the Blossom index appears to be more tilted towards the Value, Low Vol, and Dividend Yield factors compared to the Nikkei 225 index. But it is less tilted towards the Quality, Growth, and Idiosyncratic return factors.

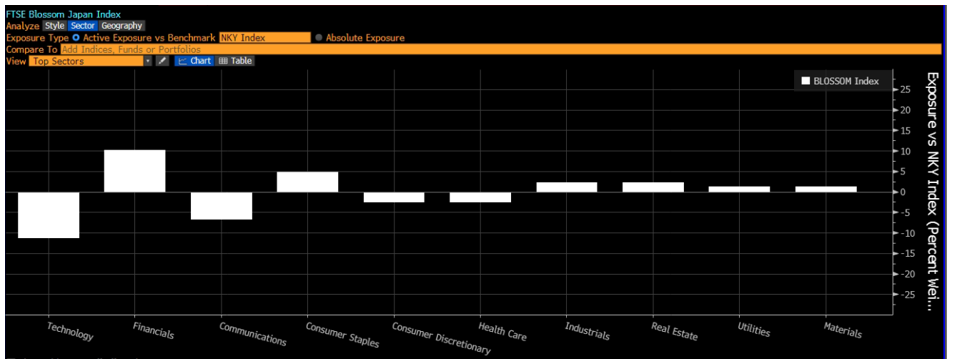

Sector Tilts:

From a sector perspective, the FTSE Blossom Japan Index appears to be more heavily weighted towards value-oriented sectors like Financials and Consumer Staples. However, it is less tech-oriented compared to the Nikkei 225 index.

SGX FTSE Blossom Japan Index Futures

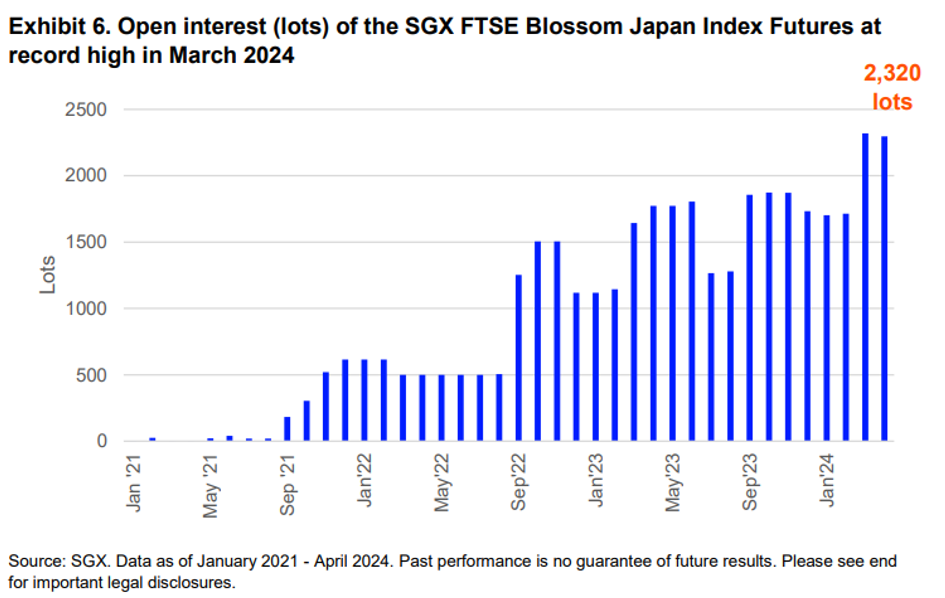

The SGX FTSE Blossom Japan Index Futures continues to lead the Japan ESG derivatives space, with month-end notional Open Interest reaching a high of US$174M and a record DAV of $11M as of March 2024.

Key Futures Contract Features

- ~22 hour trading throughout the year, except 1 Jan

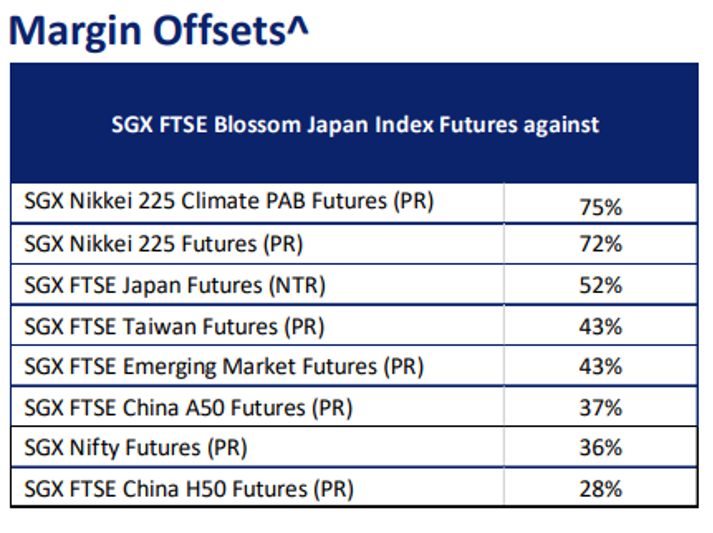

- Cross-margining with SGX’s suite of Japanese equity derivatives and other liquid products.

- Contract specifications designed similar to benchmark equity index futures for easy adoption and integration into portfolios

- CFTC approved

Conclusion:

The Nikkei 225 and the FTSE Blossom Japan Index offer unique opportunities for investors interested in the Japanese market. The Nikkei 225, a well-established blue-chip equity index, provides exposure to Japan’s major companies and is heavily influenced by the technology sector. On the other hand, ESG-conscious investors can consider the FTSE Blossom Japan Index as it focuses on companies with strong ESG practices.

Ultimately, both indices offer a unique perspective on the Japanese market and can serve as effective tools for gaining exposure to this dynamic and evolving market.

Trade Now & Fly to Japan Promotion

Win tickets to Japan when you trade SGX Nikkei 225 Index Futures, at only 50 cents, with Phillip Nova. Click here to learn more now.

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals, and Stocks with Phillip Nova 2.0

Features of trading on Phillip Nova 2.0

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, US, China, Hong Kong, Malaysia and Japan markets.

- Charting Powered by TradingView

View live charts and gain access to over 100 technical indicators

- True Multi-Asset Trading

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals and Stocks on a single ledger on Phillip Nova 2.0