Meta Platforms, previously known as Facebook, is down 34.7% YTD with the stock price at US$ 219.55 (11th Feb 22 Close). The stock saw a sharp decline of 26.4% on the 3rd of February when it released its quarterly earnings, marking the biggest single day US stock plunge and wiping out US$230 billion in market value.

What contributed to the selloff? Should investors be concerned?

Despite year-over-year revenue increasing 37% and net income increasing 35%, investors’ attention was mainly focused on current quarter’s (Q1’22) earnings guidance. In the earnings release, Meta CFO published an outlook for 2022 full year growth to be between 3% to 11%, lower than what analysts expected. In the report, Meta’s CFO mentioned increased competition, Apple’s IOS change and inflationary cost for advertisers as negative factors. The company’s monthly active users have also seemed to hit a plateau at about 2.9 billion users.

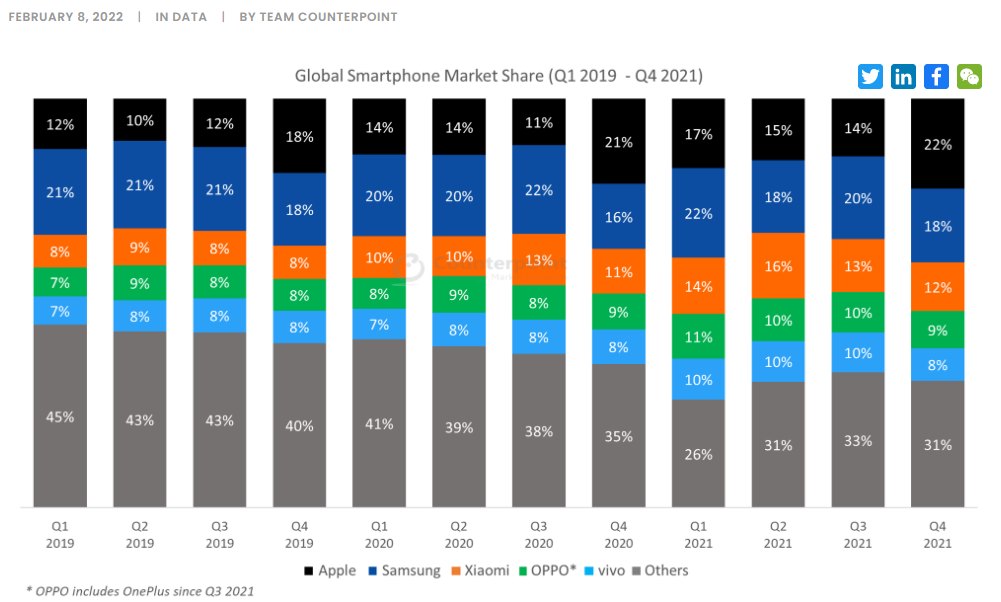

Some investors have contributed the decline of Meta mainly due to the new function known as App Tracking Transparency (ATT) launch in Apple’s latest IOS 14.5 release. The new ATT function allows consumer the ability to deny Applications from collecting data on their daily activities. What this means is that Applications such as Meta’s Facebook would no longer be able to track consumer’s activities and therefore will not be able to provide targeted marketing for advertisers. A report published by Counterpoint Research indicated that in Q421, Apple occupied 22% of the global smartphone market share followed by Samsung with 18% and Xiaomi with 12%.

A report published by Counterpoint Research indicated that in Q421, Apple occupied 22% of the global smartphone market share followed by Samsung with 18% and Xiaomi with 12%.

Apple’s 22% market share of global smartphone is sizeable and the impact of its ATT would be a great deal on applications which rely on advertising for revenue. As such, Meta’s Facebook would continue to face considerable headwind from new functions like these which could be why they are focusing more now on Web3.0 and the Metaverse.

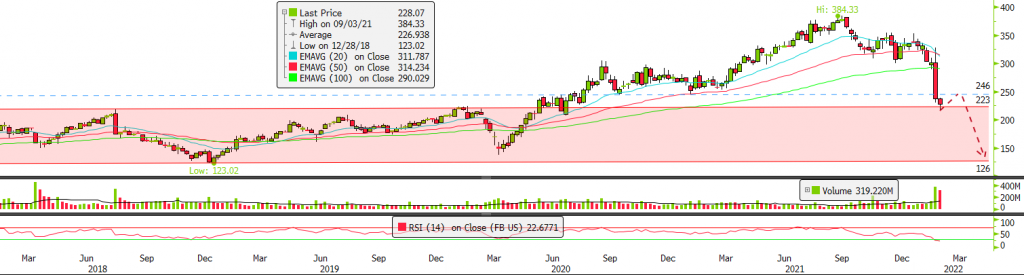

Technical Outlook

Macroeconomic events from rising inflation to hawkish US Fed’s continues to pull down technological stocks like Meta. On the technical front, investors can look out for key support levels at US$223 (weekly charts). A strong break below could see Meta trade within the range of US$126 and US$223. Those were levels last traded from 2018 to 2019. Investors can also pay more attention to the 20EMA crossing of 50EMA on the weekly chart which could potentially mark as a death cross. As the RSI 14 looks oversold, we could potentially see the stock trade higher towards its resistance around the US$246 level before coming back lower.

Investors taking a more bearish approach could short Meta (Facebook) using CFDs on Phillip MT5.

We have added 12 more CFD contracts tradable from as small as one share CFD on Phillip MT5:

- 3M Company CFD – 3M-NYSE

- Boeing Co CFD – BOEING-NYSE

- Broadcom Ltd CFD – BROADCOM-NDAQ

- Caterpillar CFD – CAT-NYSE

- IBM CFD – IBM-NYSE

- Intuitive Surgical CFD – INSURGICAL-NDAQ

- Meta Platforms CFD – FACEBOOK-NDAQ

- Paypal Holdings Inc CFD – PAYPAL-NDAQ

- Salesforce.com CFD – SALESFORCE-NYSE

- Twitter CFD – TWITTER-NYSE

- Visa CFD – VISA-NYSE

- Zoom Video Communications (A Class) CFD – ZOOMVIDEO-NDAQ

Register for a free demo trading account below!

Shares CFD is available for trading on Phillip MetaTrader 5 (MT5).

Features of trading CFD

- Trade in both the bull and the bear markets

The ability to enter a long and/or short position allows traders to take advantage of both rising and falling markets.

- Smaller barrier to entry

CFDs typically have flexible and smaller contract sizes. This means that traders will be able to enter into a CFD contract with a modest amount of capital.

- No expiration date or risk of delivery

Unlike futures which commonly have a fixed expiration date, CFDs allow traders to perpetually hold the position(s). CFDs are cash settled, no need to worry about the delivery of the underlying asset.