By Eric Lee, Sales Director, Phillip Nova

Every Friday, the Commodity Futures Trading Commission (CFTC) will publish the Commitment of Traders (COT) report. The report lists the aggregate holdings of different trading participants in the U.S. futures markets. This is a treasure trove of data as it allows traders to study market trends, in particular where the “smart money” was placing their “bets”.

The COT report classifies traders into these main categories: Commercials, Large Speculators, and Small Speculators. Commercials are corporations that are mainly hedgers. Starbucks, for example, is likely categorised under Commercials in the Coffee futures market. Their main objective is to achieve price stability and the reduction of risk. Starbucks buys the commodity as raw material for their business end-product, so they are therefore likely to buy in a falling market and sell in a rising market, thus creating long-term support and resistance to the prices.

Large Speculators are traders who trade in sizes of more than 100 lots. They could be individual traders, hedge fund managers, or part of a financial institution. As a group, Large Speculators mostly trade into the direction of the trend. Those who do not fall within the Commercials or Large Speculators categories are classified as Small Speculators.

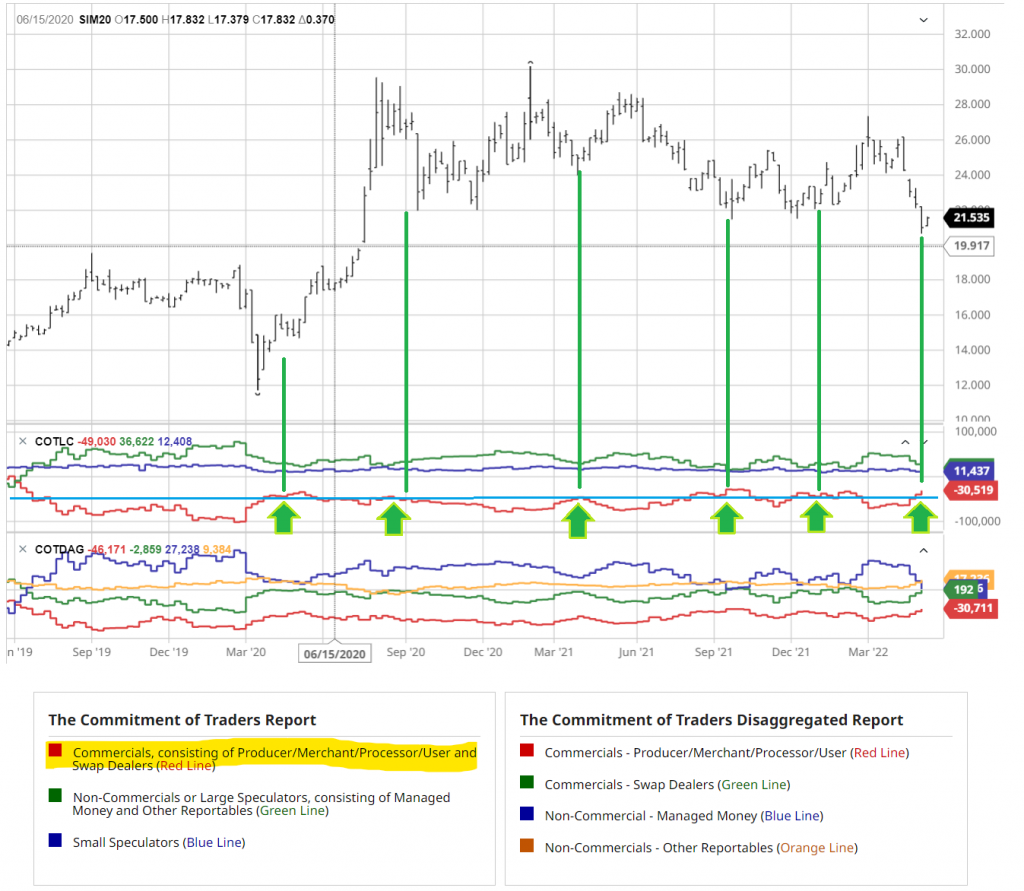

Source: https://www.barchart.com/futures/commitment-of-traders/interactive-charts/SI*0

The chart above is a COT chart plotted along the weekly chart of CBOT Silver futures. The red line indicates the weekly aggregate positions of Commercial traders. We can see that since 2020, whenever the Commercials indicator reaches the blue horizontal line, Silver tends to bottom-out as indicated by the green arrow and vertical line pointing to the reversal in trend and price of Silver appreciates over the next 2-3 months afterwards. Currently, we are seeing a similar set up as the Commercial indicator had indicated.

Source: Phillip MetaTrader 5

On its daily chart of Spot Silver (XAG/USD) extracted from Phillip MT5, Silver had been trading within a channel, ranging between $21 to $28 since July 2020. Whenever Silver was trading near to the upper boundary of the channel and Stochastic Oscillator crossed down from Overbought region, it had offered a selling opportunity as the price of Silver tends to gyrate back down towards the lower boundary of the channel.

Similarly, when Silver was trading near to the lower boundary of the channel and Stochastic Oscillator crossed up from the Oversold region, it offered traders opportunities to buy Silver as its price tends to gyrate back above the upper boundary of the channel.

Of course, Silver is not going to stay in this channel forever. But as of now, with strong buying support from the Commercials as indicated on the COT report and with Silver bouncing up from the lower boundary of the channel formation, together with Stochastic Oscillator crossing above from Oversold level, there is a pretty good chance of Silver trending higher over the next 2-3 months.

Data source: Phillip MetaTrader 5

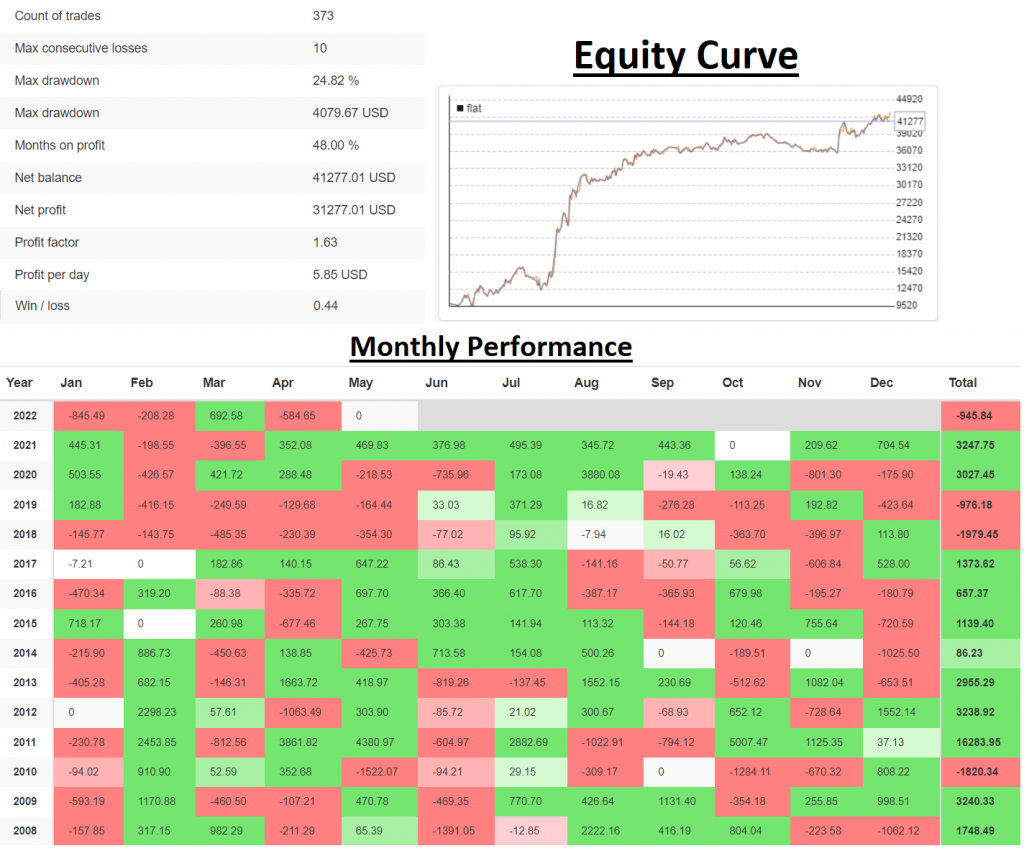

Above is a Swing Trading strategy for trading on XAG/USD, tested on the data from Phillip MT5. The rules of the strategy are provided free-of-charge to my clients. Click here open a Phillip MT5 account and I will contact you to share the trading rules of the strategy to you, as well as help you to set up your Phillip MT5 account along with the indicators template.

Eric Lee is a Sales Director with Phillip Nova. With expertise in Futures, Forex, Stocks, and Unit Trust, Eric makes an all-rounded advisor. Make informed trading decisions without spending time combing through endless information as Eric readily provides clients with trade alerts and insights via WhatsApp. Over his years of experience, Eric developed systematic strategies in trading and investing. Book a complimentary coaching session below to leverage on his expertise as he imparts his knowledge to enhance your trading journey.