By Eric Lee, Sales Director, Phillip Nova

Imagine trying to boost a car’s speed by pressing the gas pedal, but the brakes are firmly on too. That’s kind of what had been happening in China’s stock market until last Tuesday, 24th September 2024.

Rate Cuts: The Gas Pedal

A bit of exciting news hit the market recently—China is slashing interest rates and cutting the banks’ reserve ratio to try to inject some life into its economy. In simpler terms, they’re making it easier and cheaper for businesses and people to borrow money. Historically, this move would have sent the stock market flying. But since 2021, these moves hadn’t work so well. Why? Because of one major roadblock: the real estate sector.

China’s real estate market has been wobbling like a teetering Jenga tower. One of the biggest culprits? Evergrande, a colossal real estate developer, defaulted on its debt, causing a ripple effect throughout the economy. The stock market, especially the China A50, has become more closely tied to property prices than ever before. So, until the real estate sector gets its act together, those rate cuts might not have the same punch.

New Policies: More Pedal, But Brakes Still On

Wait, there’s more! On 24th September, China introduced a laundry list of policies to further boost its economy. Here are the key points:

- Reduced reserve requirements for banks

- Cut mortgage interest rates

- Lowered down-payments for second home buyers

- Encouraged state-owned firms to buy unsold flats

Their goal? Kickstart the economy, and more importantly, jumpstart the stock market. But will these moves be enough to overcome the drag of the real estate market?

Copper: The Market’s Secret Weapon

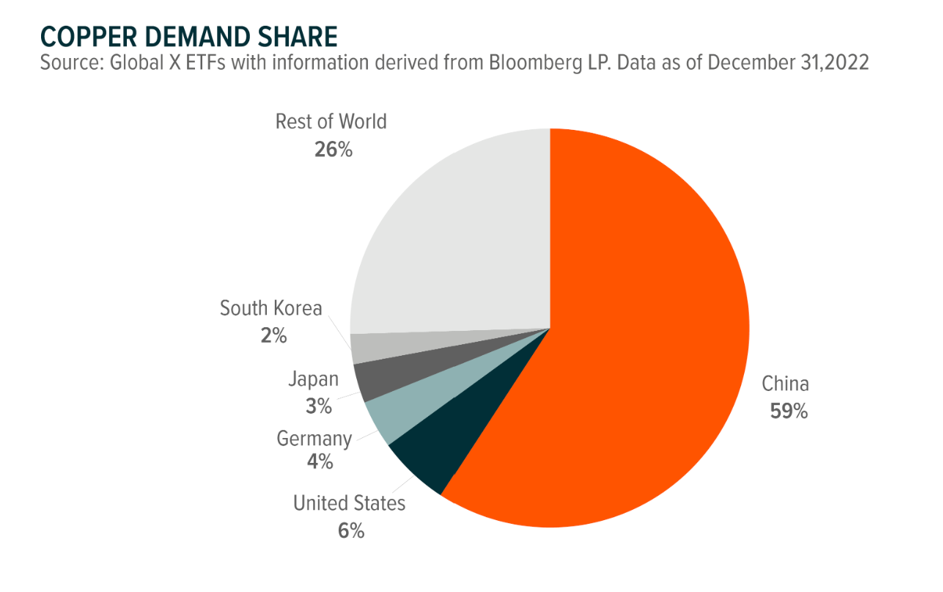

Now, if you want to go deeper than interest rates and bank policies, here’s a suggestion: keep an eye on copper. Yes, copper. It’s more than just a metal for wiring—it’s the lifeblood of construction and manufacturing. Guess what? China alone consumes 60% of the world’s copper. That’s right, 60%! No copper, no buildings, and no bustling economy.

Because of this, copper prices are often used by the investing community as a proxy for China’s economic health. If copper prices are rising, it’s a sign that China’s industrial activity is picking up—and that’s usually a good sign for the stock market too.

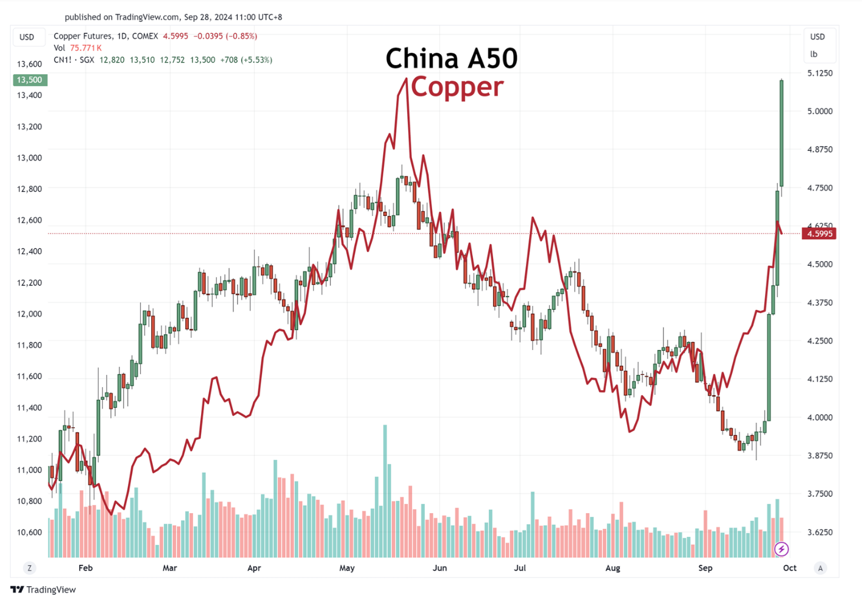

A Technical Approach: Copper and China A50

Let’s go one step further and look at how we can use copper to get an edge in the stock market. By overlaying the price of Comex Copper Futures with the SGX FTSE China A50 Index Futures, traders can apply technical analysis—like spotting trends or price divergences. When copper breaks a resistance level or shows a trend reversal, it might be time to consider a trade in the China A50.

Think of copper as the coffee fuelling the construction workers. No copper? No buildings, no economic growth. And that’s why traders keep a close eye on it—because it’s a real-time indicator of what might happen in the Chinese stock market.

Conclusion:

China’s economy is like a complex puzzle, with many moving pieces. If you want to stay ahead, don’t just focus on government policy. Keep an eye on the real estate sector and the price of copper—these are the clues that can help you anticipate what’s next for the stock/futures market. Will China’s new policies be enough to revive its struggling market? Time (and copper prices) will tell!

Both COMEX Copper Futures and SGX FTSE China A50 Index Futures are available for trading on Phillip Nova 2.0.

Try a Phillip Nova 2.0 or Phillip MT5 demo now

Upcoming Webinar By Eric Lee

Want more insights from Eric Lee, do not miss his upcoming webinar on Tuesday, 29 October 2024 on Institutional Insights: Mastering Singapore Stocks with Smart Money Strategies. In this strategy webinar, Eric will share how we can make use of the information of institutional fund flow to navigate the Singapore stock market. Don’t miss his insights, register here.

Value-Added Service from Eric Lee

My clients benefited from my services including investment advisories in unit trust and stocks, investment insights based on my personal knowledge and experiences while navigating the markets for the past 20 years.

Periodically, I will be send out market analysis to my clients, as well as alerting them of support and resistance levels for the technical indicators which I am utilising on a chart. Click on the button at the bottom if you would like to arrange for a One-to-One Coaching session to learn more about trading futures, forex, stocks and more, and how you can benefit from the services I provide.

Eric Lee is a Sales Director with Phillip Nova. With expertise in Futures, Forex, Stocks, and Unit Trust, Eric makes an all-rounded advisor. Make informed trading decisions without spending time combing through endless information as Eric readily provides clients with trade alerts and insights via WhatsApp. Over his years of experience, Eric developed systematic strategies in trading and investing. Book a complimentary coaching session below to leverage on his expertise as he imparts his knowledge to enhance your trading journey.

- Open an account now

- Free Phillip Nova Demo Account

- Free Phillip MT5 Demo Account

*T&Cs apply, contact Eric below for more information.