By Danish Lim, Investment Analyst, Phillip Nova

Spot Gold prices jumped to a fresh all-time high on 17 July, up as high as 2,482.42. COMEX gold futures contract for August delivery rose as high as 2,487.50, before falling for 4 consecutive days on profit-taking activity and a stronger USD. The contract then recovered to around 2416.70 as of SGT 13:49 on 24 July.

The Dollar, and consequently, US Treasury yields, have a negative correlation with Gold as a stronger Dollar makes USD-denominated Gold investments more expensive for holders of foreign currencies. Higher Treasury yields also diminishes the appeal of non-interest bearing Gold. As seen below, weakness in Gold futures prices over 18 July to 22 July coincided with a stronger Dollar Index (DXY).

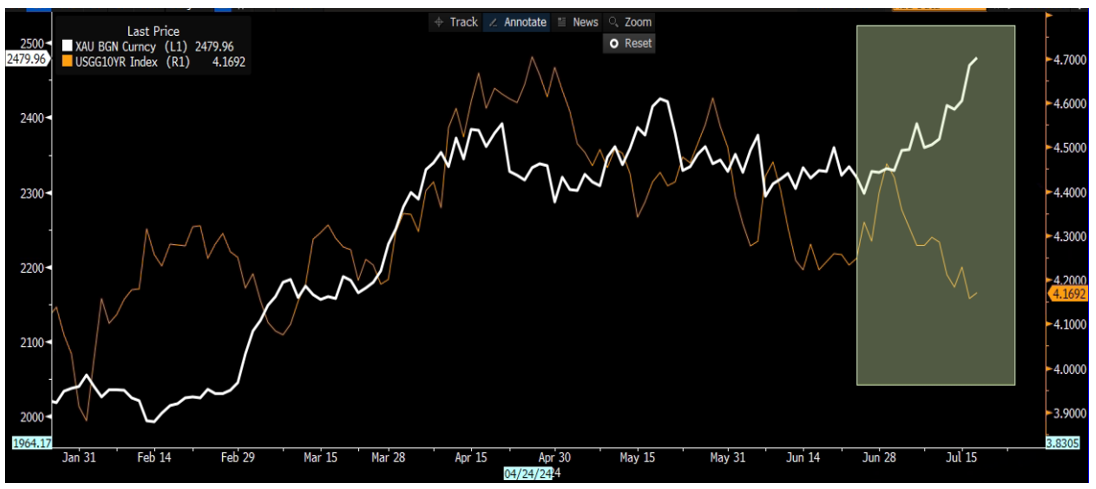

The inverse relationship between 10-year Treasury yields and Gold can be seen below.

Gold Drivers

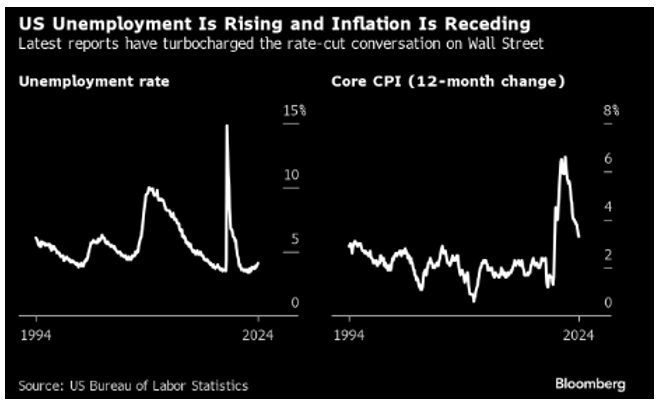

Much of the rally in Gold was driven by mounting hopes of a Fed rate cut in September following soft inflation readings and rising unemployment figures (as seen below). Other drivers include central-bank gold buying, despite China having paused its accumulation in recent months. Safe haven appetite amid geopolitical uncertainty could also serve as tailwind. Gold’s historically low correlations with most asset classes could be another factor driving inflows.

Rate cuts as a boost

During periods of falling yields, Gold’s appeal as a non-yielding asset improves when compared to other interest-yielding assets like bonds and money market instruments. Thus, Gold prices tend to react positively when yields fall as the opportunity cost of holding cost (giving up higher yields on interest-bearing instruments) is reduced.

Geopolitical risk and US elections could boost gold

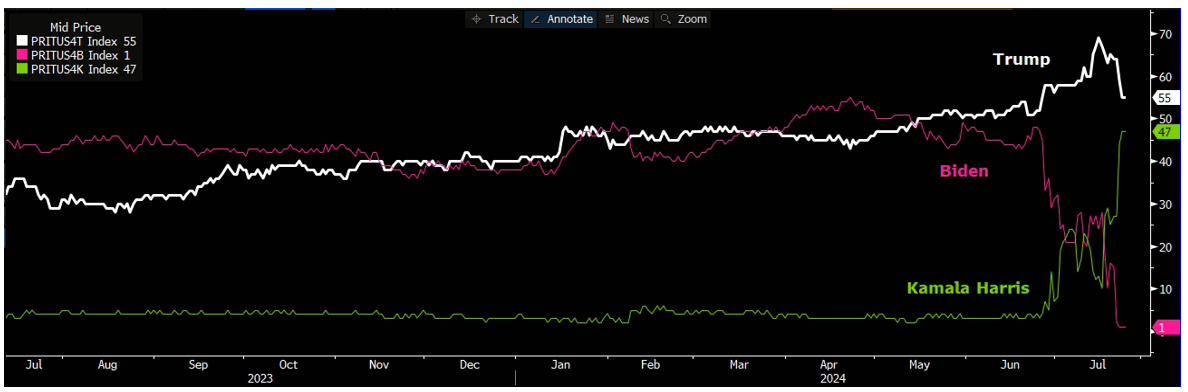

Gold may still see some upside without rate cuts during times of uncertainty thanks to its historical status as a safe haven asset. President Biden relinquishing his re-election bid and choosing to back VP Kamala Harris as presidential nominee added a jolt of political uncertainty. We attribute the recent recover in gold prices to back above 2,400 to this added political risk premium.

Updated odds for the 2024 US elections can be seen below. We believe that a tighter race will be beneficial for Gold prices.

However, we highlight the risks of a “Trump trade”- where higher trade tariffs, increased US-China tensions, and looser fiscal policy under a Trump election victory could spur a rise in treasury yields. This will be a headwind for non-interest bearing Gold. Nevertheless, both Trump and running mate JD Vance have expressed a desire for a weaker Dollar to make exports more competitive and boost local manufacturing.

Gold as an attractive portfolio diversifier: Correlation with other asset classes.

Technical Outlook

In the current macro environment, we see central bank buying to continue, political uncertainty, and Fed rate cuts in view. Trump’s potential import tariffs and desire for a weaker dollar could spur even more interest in Gold. We believe there is room for more upside.

The contract appears to be trading within a tight range of the 38.2% and 23.6% extension level between 2,400 and 2,460. Key immediate resistance lies at the extension level of 2,460 – 2,464.

The 50.0% extension level around $2,520 is the next immediate target. If this level is breached, and we continue to see more favourable US CPI prints, we expect prices to head further north towards the year-end to a range of 2,575 – 2,644.

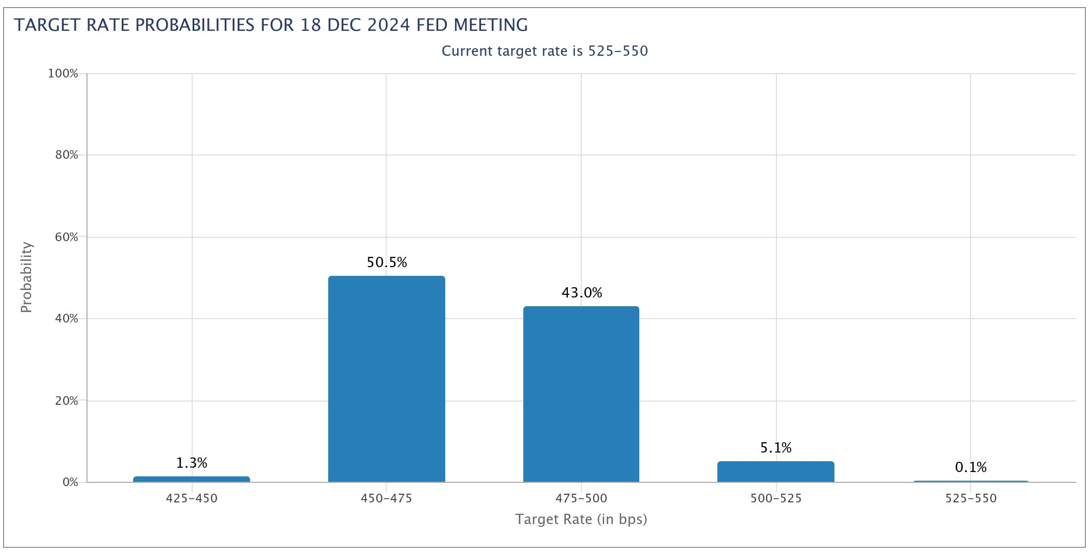

Markets are currently pricing in 75 bps worth of rate cuts or 3 rate cuts by December at 50.5% probability (CME FedWatch Tool). Fed chair Jerome Powell said on July 15 that recent inflation readings “add somewhat to confidence” that the pace of price increases is returning to the 2% target target in a sustainable fashion, suggesting that rate cuts may not be far off.

Looking forward, lower interest rates should strengthen the profitability of gold investments and support a case for gold to break out higher because of a lower opportunity cost of holding gold.

Flash Deal Promotion – August 2024

Trade COMEX Gold Futures and Options at only 50 cents*. Learn more now!

Trade Stocks, ETFs, Forex & Futures on Phillip Nova

Features of trading on Phillip Nova

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, China, Hong Kong, Malaysia and US markets.

- Over 90 Technical Indicators

View live charts and trade with ease with over 90 technical indicators available in the Phillip Nova platform

- Trade Multiple Assets on Phillip Nova

You can trade Stocks, ETFs, Forex and Futures on a single ledger with Phillip Nova