By Eric Lee, Sales Director, Phillip Nova

The world had mostly opened up and through its annual report, we can see that Comfort Delgro’s financials had improved and its gradually building its balance sheet with more cash and lower debt. Yet, its share price remained depressed and trading at 60% to pre-CoVid level.

Unlike its competitors, Grab and Gojek, in Singapore. Comfort Delgro is profit making, while the other 2 are still burning cash at a high rate. In current high interest rates environment, the loss-making companies would have pay a higher cost to take on more debt or to raise fund from the market via private or public placement. In comparison, investing in Comfort Delgro will be a much attractive proposition.

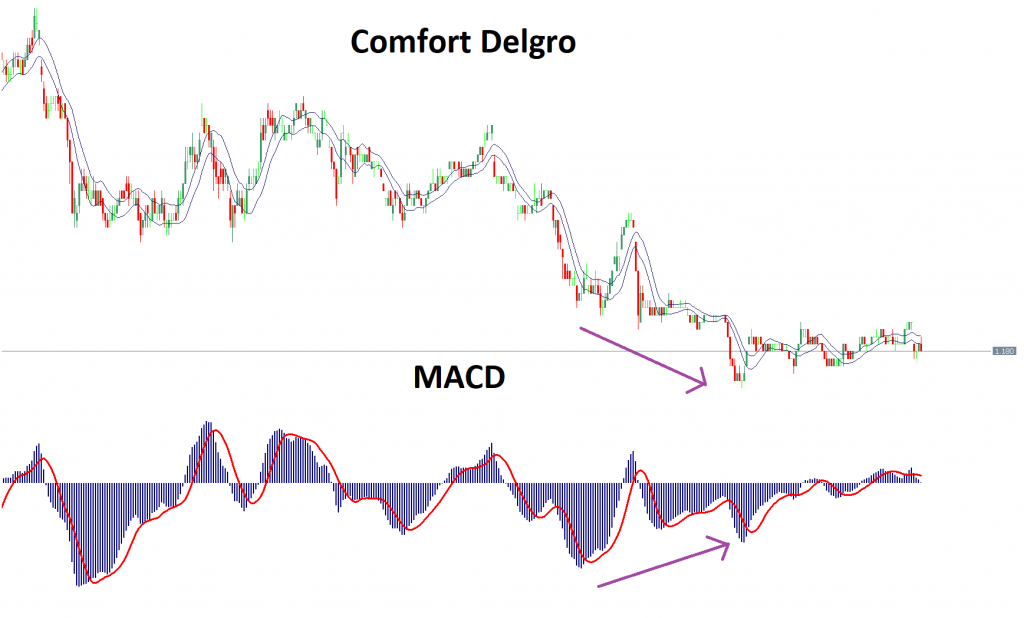

Recent price action of Comfort Delgro suggested some signs of market accumulation. Trade analysis had also shown institutional buying interest the past week. Based on various analysts’ projection and technical analysis, the next resistance levels traders can look out for are $1.40 and $1.55. Support is at $1.10.

Business Description

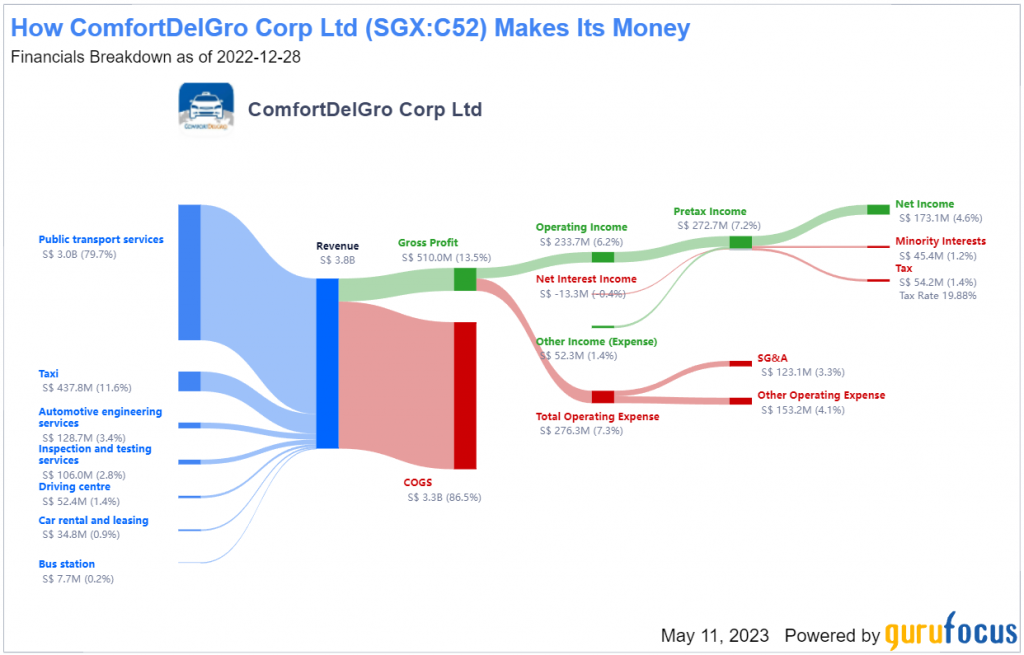

ComfortDelGro Corp Ltd is a passenger transportation company. The company organizes itself into seven segments; Public transport services offer the provision of bus and rail services to commuters traveling on public transport systems, Taxi rents out taxis operates taxi bureau services and ancillary advertisement income, Automotive engineering services offer the provision of vehicular maintenance and repair services and engineering services, Inspection and testing services offer the provision of motor vehicle inspection services, non-vehicle testing, and consultancy services, The driving center operates driving schools, Car rental and leasing comprise renting and leasing of cars, and Bus station generates income through commission income from fare collection.

Positive Factors of the growth

- Faster-than-expected recovery of its taxi business.

- Singapore taxi revenues are expected to improve, and driver earnings are expected to remain healthy as demand for taxis and private hire vehicles remains strong.

- Taxi revenues in China are expected to improve with the end of the zero-Covid policy.

- Earnings-accretive acquisition or investments.

- UK bus revenue will recover progressively to offset the higher driver cost. Re-contracting of the bus service fee is on the anniversary of each contract and is pegged to the CPI.

- Higher-than-expected passenger numbers for Singapore rails (NEL and DTL) or new bids for railway lines in overseas.

- Strong cashflow generation to support its 70% dividend payout ratio. Its Current Ratio continues to improve.

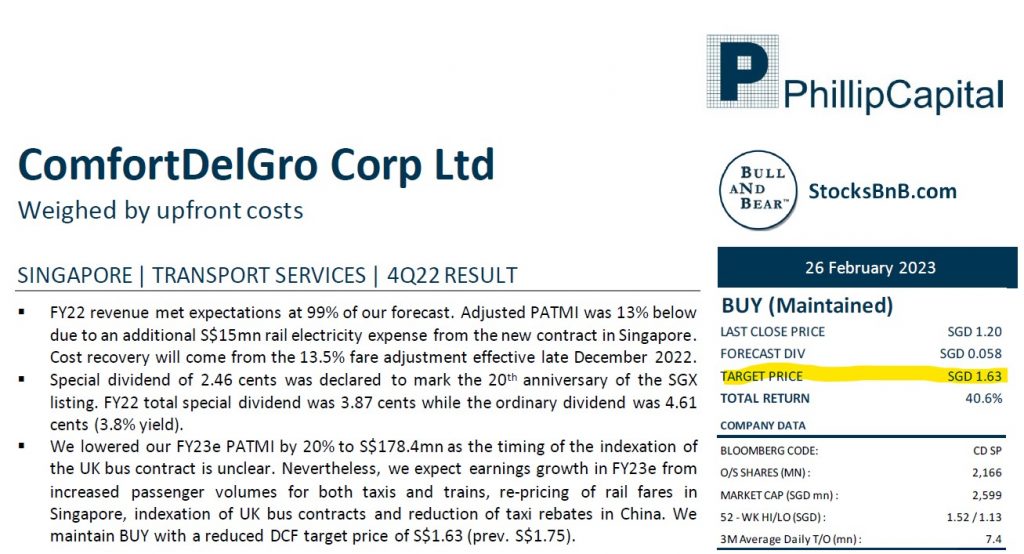

- PhillipCapital Research issued “Buy” recommendation with target price of S$1.63, representing upside potential of 36% from current price of $1.20.

Where to trade/invest in ComfortDelgro?

In Phillip Nova, ComfortDelgro contract is available for trading via

- Nova platform

- MT5 platform

You can register for trading demo account through the following links listed below to try out our platform.

Value-Added Service from Eric Lee

My clients benefited from my services including investment advisories in unit trust and stocks, investment insights based on my personal knowledge and experiences navigating through the markets the past 20 years.

Where periodically, I will be sending out market analysis like this to my clients, as well as alerting them of support and resistance levels for the technical indicators which I am utilising on a chart. Click on the button at the bottom if you would like to arrange for a One-to-One Coaching session to learn more about trading futures, forex, stocks and more, and how you can benefit from the services I provide.

Eric Lee is a Sales Director with Phillip Nova. With expertise in Futures, Forex, Stocks, and Unit Trust, Eric makes an all-rounded advisor. Make informed trading decisions without spending time combing through endless information as Eric readily provides clients with trade alerts and insights via WhatsApp. Over his years of experience, Eric developed systematic strategies in trading and investing. Book a complimentary coaching session below to leverage on his expertise as he imparts his knowledge to enhance your trading journey.

- Free Phillip MT5 Demo Account

- Free Phillip Nova Demo Account

- Open an account now

*T&Cs apply, contact Eric below for more information.