By Eric Lee, Sales Director, Phillip Nova

UOL is one of Singapore’s leading public-listed property companies with total assets of S$21 billion. They have a diversified portfolio of development and investment properties, hotels and serviced suites in Asia, Oceania, Europe and North America.

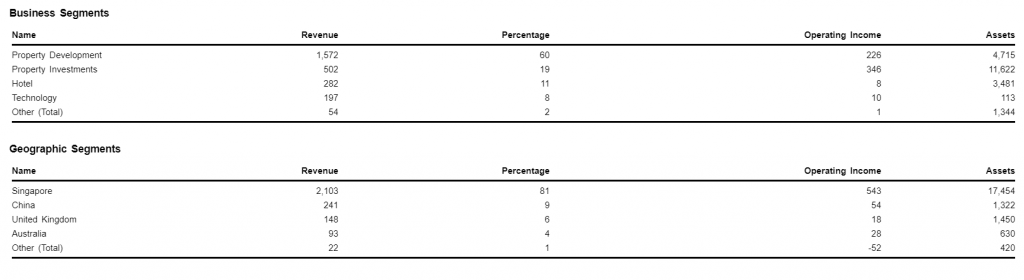

From the table below, we can see that 80% of its revenue is comes from Singapore. 60% of its operating income is derived from its Property Investment segment and the other 40% is from the Property Development segment.

From its monthly chart (on the left), UOL had demonstrated resiliency as its investment portfolio, as represented by it Book Value per share dipped briefly in 2020 but recovered quickly in 2021 and continue its growth to recently reported $12.30 per share. Since 2009, UOL management had grown its Book Value at an annualized rate of 8.3% p.a.

Since 2009, UOL trades within Price-to-Book (P/B) valuation of 0.8x to 0.5x. After recent sell-down, it is currently trading at 0.53x Price-to-Book. Based on its current Book Value of $12.30 per share. If UOL is supported by P/B ratio of 0.5x, that will set its price at $6.15 then.

Looking at its daily chart (on the right), we can see that the lower boundary of the symmetrical triangle it has been in since 2018 is sitting at $6.30. Over the past 5 years, whenever the stock was trading near to the lower boundary of the triangle and RSI (Relative Strength Index) crossing back up from the Oversold level, UOL’s share price rebounded back up towards the upper boundary of the triangle formation.

A stock price growth value is the function of its growth rate and price multiple expansion. For the case of UOL, though its Book Value per share grew by 8.3% since 2009, its rate of growth had slowed down to 3.5% the recent 5 years. To be conservative, lets take the lower rate of 3.5%. Assuming UOL’s price trades at $6.15, which is at 0.5x P/B and subsequently, its P/B expanded back to upper range of 0.8x over the next 18 months, that will set its share price $10.35 then.

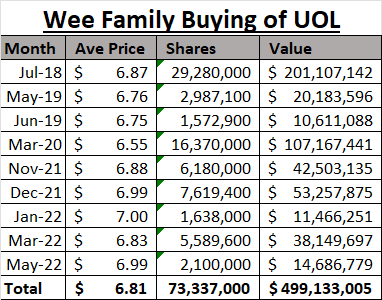

As per SGX disclosure, Dr Wee Cho Yaw and his family has the controlling stake over UOL. Since 2018, the Wee Family had been actively buying up the UOL shares from the market. Over the past 5 years, they had spent close to $500 million buying the shares at an average price of $6.81, which represented almost 10% of its market capitalisation of $5.5 billion.

How to trade UOL?

UOL is available for trading on the Phillip MT5 trading platform

Value-Added Service

Periodically, I will be sending out market analysis like this to my clients, as well as alerting them of support and resistance levels for the technical indicators which I am utilising on a chart. Click on the button at the bottom if you would like to arrange for a One-to-One Coaching session to learn more about trading futures, forex stocks and more and how you can benefit from the services I provide.

Eric Lee is a Sales Director with Phillip Nova. With expertise in Futures, Forex, Stocks, and Unit Trust, Eric makes an all-rounded advisor. Make informed trading decisions without spending time combing through endless information as Eric readily provides clients with trade alerts and insights via WhatsApp. Over his years of experience, Eric developed systematic strategies in trading and investing. Book a complimentary coaching session below to leverage on his expertise as he imparts his knowledge to enhance your trading journey.

- Free Phillip MT5 Demo Account

- Free Phillip Nova Demo Account

- Trade Forex and Receive Up To US$864

*T&Cs apply, contact Eric below for more information.