By Eric Lee, Sales Director, Phillip Nova

In my last article Exploring the Opportunities of Investing in the European Markets Through Eurex Micro-Dax Futures, I mentioned about the importance of understanding the component stocks in a stock index as that will help those of us trading the index. You can click on the link above to reference back to the article, which I had highlighted the 10 stocks with the highest weightage fpr the German stock index, Dax.

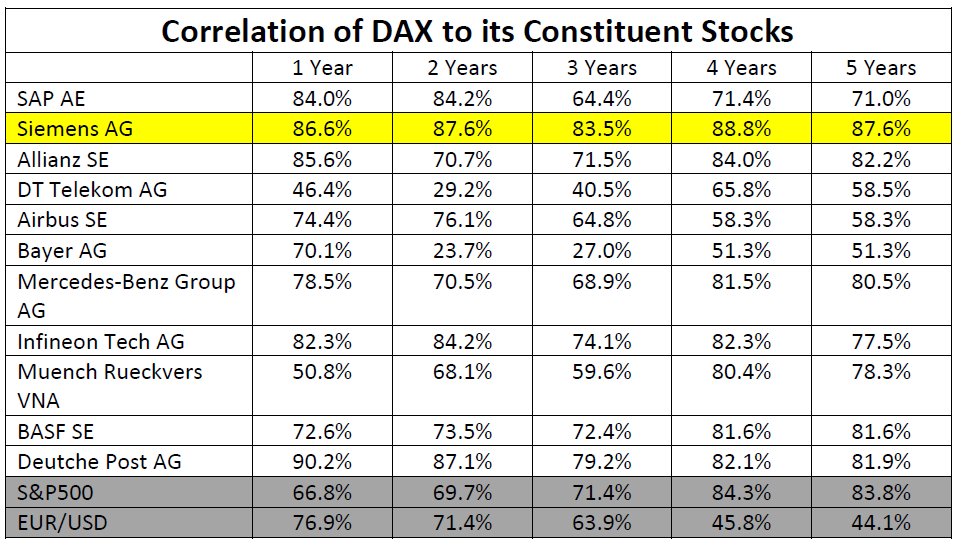

In this article, I would like to dig deeper and to look at the correlation these stocks have with the Dax. Below is the table showing the Top 10 Dax component stocks ranked by their weightage to the index and their correlation to the index over a period of 1 to 5 years. I’ve also included the correlations to the S&P500 and the EUR/USD pair for reference. One way traders look for trading ideas is via intermarket analysis. As such, it is good to pay attention to other markets, especially those with a strong correlation to the index we are trading with.

I’ve highlighted Siemens AG in yellow on the correlation table, and we can see that it has the highest and most consistent correlation with the Dax index among the top 10 component stocks. I did not show it on the table but when I look at the 10 years correlation, Siemens AG continued to have a high 80+% correlation to the index.

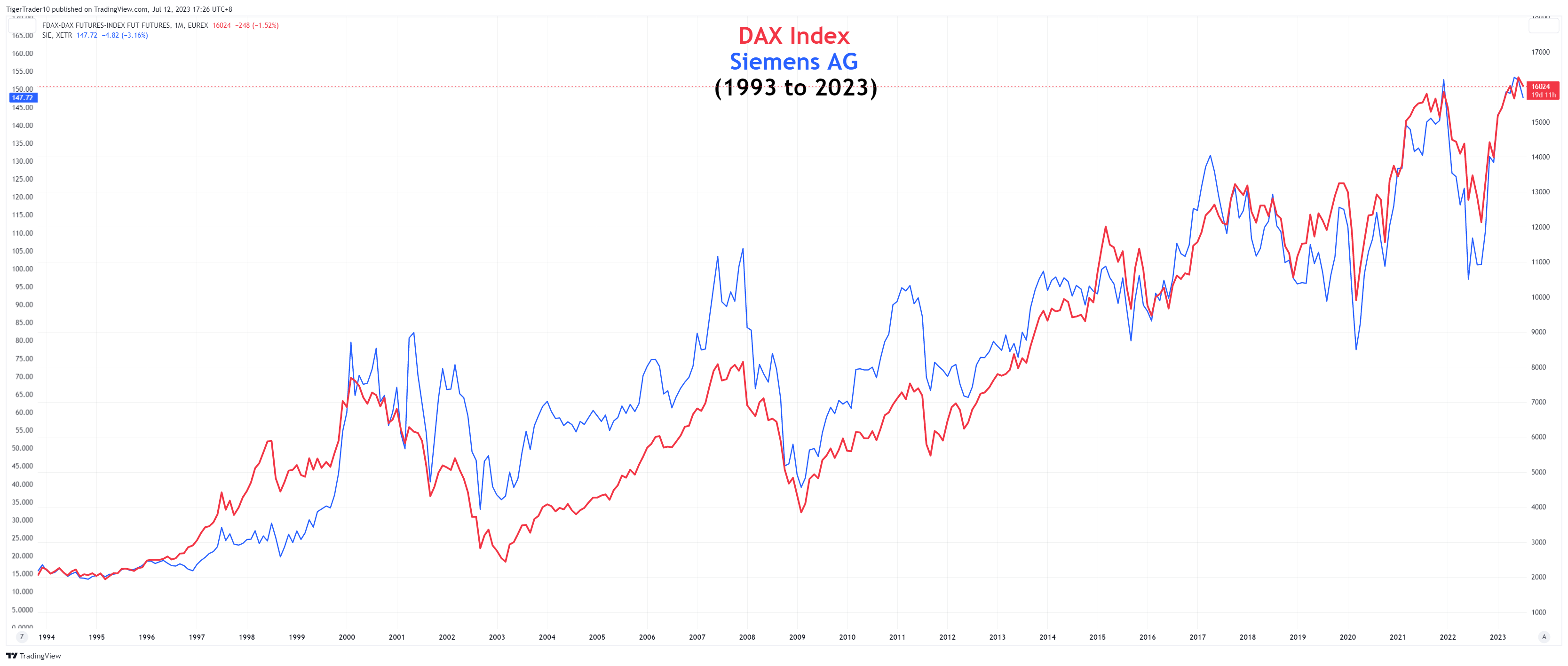

Chart below is a visual reference to this relationship between DAX Index and Siemens AG over the past 30 years. This is good news for traders who want to perform fundamental analysis on the Dax index. Unlike individual stocks, it is not easy to get the fundamental data on a stock index. In this case, traders can analyse the valuations of Siemens AG and use it as a proxy to understand if Dax is Overweight or Underweight based on it.

On Tuesday, 25 July 2023 at 7pm, I will be conducting a free webinar about Mastering Micro DAX Futures, and I will be sharing about how we can use Siemens’ valuations to look out for possible buy and sell setups for the Dax futures. Register for the webinar here.

For a limited time until Thursday, 31 August 2023, Phillip Nova is offering a zero-commission promotion for trading Micro-Dax futures. This presents a great opportunity for traders interested in Dax futures.

Trade Micro-DAX® Futures and Micro-EURO STOXX 50® at 0 Commission*

Value-Added Service from Eric Lee

My clients benefited from my services including investment advisories in unit trust and stocks, investment insights based on my personal knowledge and experiences while navigating the markets for the past 20 years.

Periodically, I will be send out market analysis to my clients, as well as alerting them of support and resistance levels for the technical indicators which I am utilising on a chart. Click on the button at the bottom if you would like to arrange for a One-to-One Coaching session to learn more about trading futures, forex, stocks and more, and how you can benefit from the services I provide.

Eric Lee is a Sales Director with Phillip Nova. With expertise in Futures, Forex, Stocks, and Unit Trust, Eric makes an all-rounded advisor. Make informed trading decisions without spending time combing through endless information as Eric readily provides clients with trade alerts and insights via WhatsApp. Over his years of experience, Eric developed systematic strategies in trading and investing. Book a complimentary coaching session below to leverage on his expertise as he imparts his knowledge to enhance your trading journey.

- Open an account now

- Free Phillip Nova Demo Account

- Free Phillip MT5 Demo Account

*T&Cs apply, contact Eric below for more information.