By Eric Lee, Sales Director, Phillip Nova

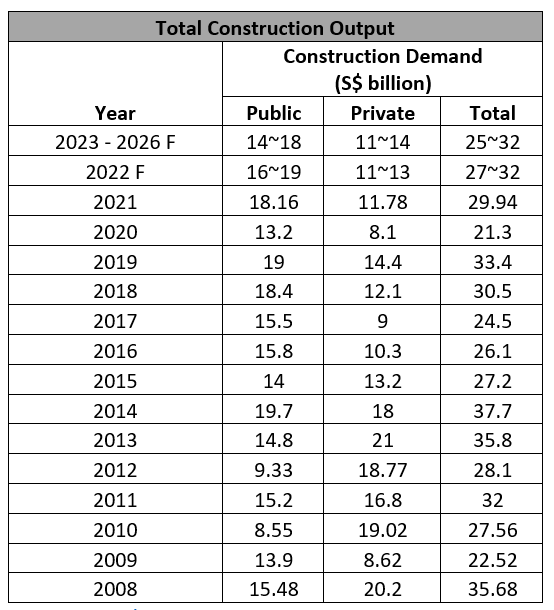

At the beginning of every year, the Building and Construction Authority (BCA) will announce the projection for the total construction demand in Singapore for the coming year and report on the preliminary actual construction demand for the previous year.

Source: www.bca.gov.sg

Above is the tabulated result since 2008. For most years, BCA’s forecast had mostly landed within its forecasted range. You may also refer to the link below for its projection for 2022 and 2023-2026.

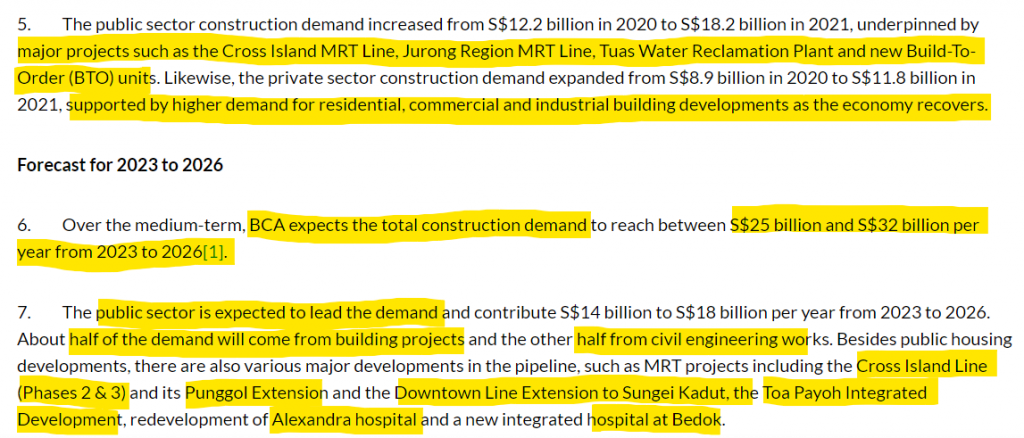

Above was extracted from BCA’s announcement on 26 Jan 2022, which helps to summarise their forecast on the construction demand from 2022 till 2026, highlighting that the major bulk of the demand will come from the public sector and the major projects involved. COVID-19 had applied the brakes to the construction scene due to the shortage of labour, shortage in the supply of materials as well a reduced productivity due to the various social distancing measures.

With the nation moving to the endemic phase of living with the virus and with the gradual opening of borders, part of the labour shortage will be resolved. With the labour shortage being addressed, I feel that construction activities may ramp up to make up for the lost ground in the last 2 years due to the pandemic.

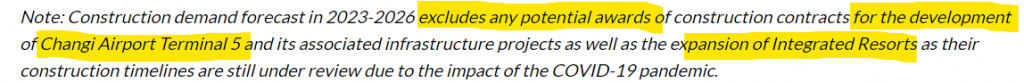

Interestingly, at the end note of the announcement, BCA highlighted that the forecasted numbers do not include Changi Airport Terminal 5 development and the expansion of the 2 Integrated Resorts; Marina Bay Sands (MBS) and Resorts World Sentosa (RWS). You can find the details to these 3 major projects below. These projects had been put on hold for the past 2 years as they were more directly impacted by the drop in visitor numbers to Singapore. Changi Airport Terminal 5 was budgeted at $10 billion and initial expected date of completion is 2030. MBS and RWS were budgeted at $4.5bil each and initial date of completion is 2026.

As such, we may have another $2bil per year added to the construction demand over the next few years, from BCA’s projections shown above.

Links for reference:

– Airport Technology website

– The Straits Times website

– www.asgam.com website

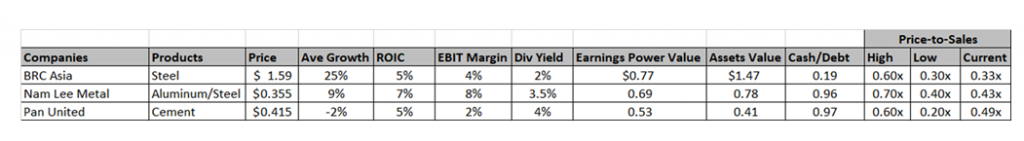

Below please find the list of 3 building material companies worth looking into and some of their financial statistics.

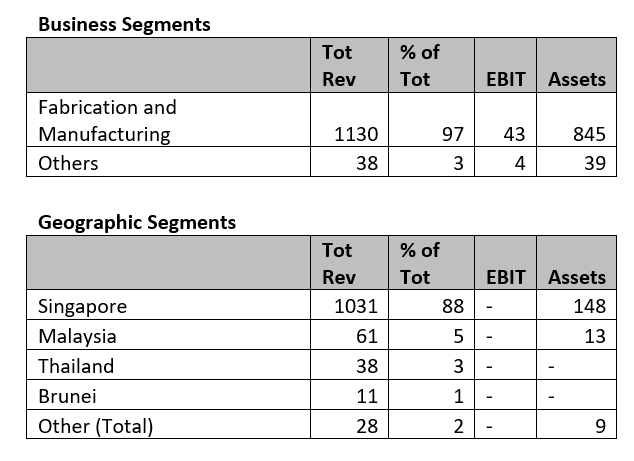

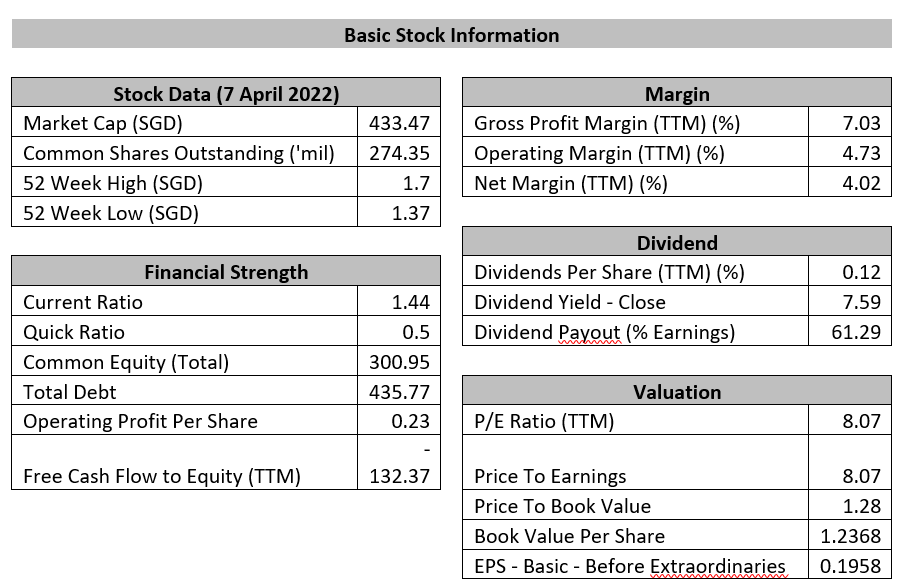

BRC Asia Limited:

Business Summary:

BRC Asia Ltd. engages in the prefabrication of steel reinforcement for use in concrete and trading of steel reinforcing bars. It operates mainly through the Fabrication and Manufacturing segment. The Fabrication and Manufacturing business includes the prefabrication of steel reinforcement for use in concrete, trading of steel reinforcing bars, and manufacturing and sale of wire mesh fences. The Others segment relates to property development and interest in associated business of airport management, hotel and resort, and property development. The company was founded on December 14, 1938 and is headquartered in Singapore.

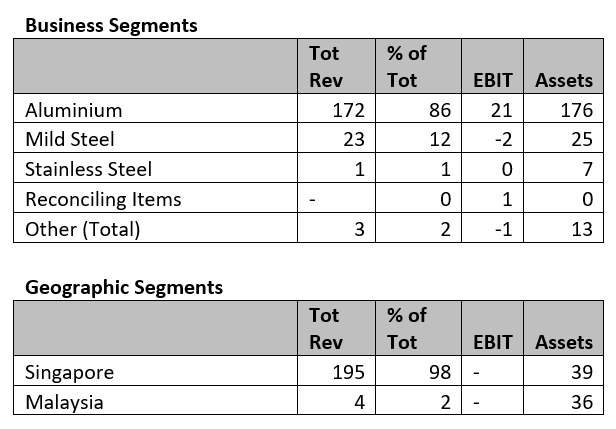

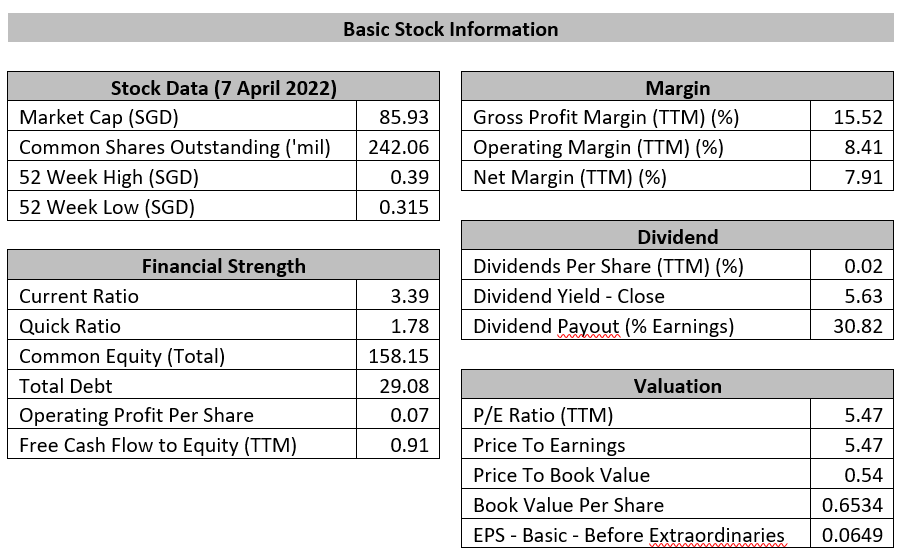

Nam Lee Pressed Metal Industries Limited

Business Summary:

Nam Lee Pressed Metal Industries Ltd. engages in the design, fabrication, and installation of steel and aluminium products. It operates in the following segments: Aluminium, Mild Steel, Stainless Steel, and Others. The Aluminium segment covers aluminium-made products used for the building construction and industrial sectors. The Mild Steel segment refers to products for door frames and gates for building construction projects. The Stainless-Steel segment pertains to manufacturing of stainless steel products, such as drying racks and hoppers. The Others segment include glasswork and shower screens. The company was founded by Koon Chin Yong, Kin Sen Yong, and Poon Miew Yong on March 10, 1975 and is headquartered in Singapore.

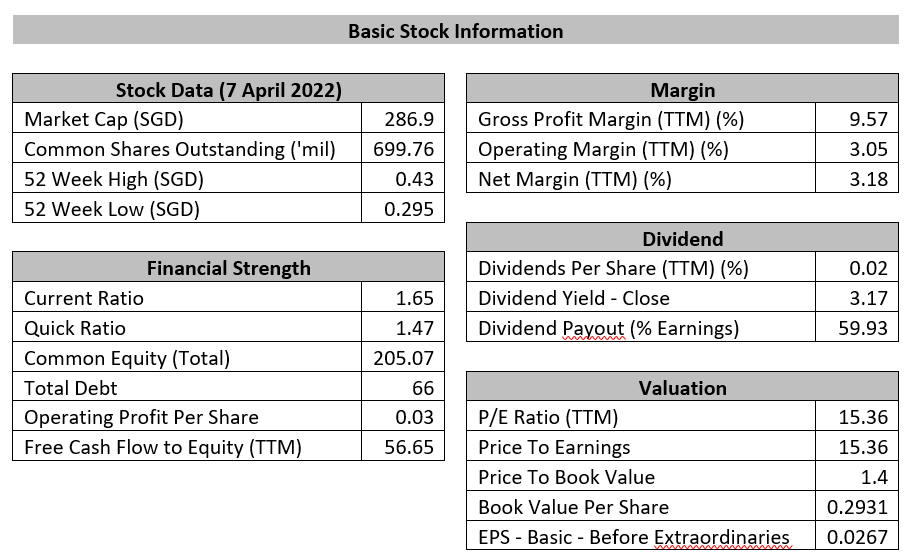

Pan-United Corporation Ltd

Business Summary:

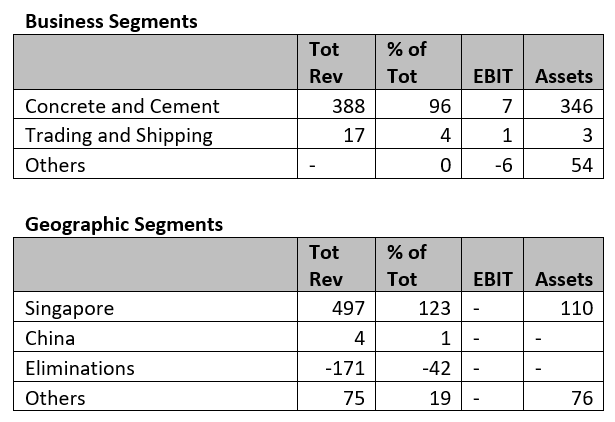

Pan-United Corp. Ltd. is an investment holding company. The firm engages in the production of cement products and provision of logistics services. It operates through the following segments: Concrete and Cement, Trading and Shipping and Others. The Concrete and Cement segment supplies mainly cement, granite, ready-mix concrete and refined petroleum products to the construction and marine industries of Singapore, Vietnam, Malaysia and Indonesia. The Trading and Shipping segment consists of coal trading, bulk shipping and agency operations. The Others segment relates to companies which are mainly investment holding in nature. The company was founded by Ng Kar Cheong in 1958 and is headquartered in Singapore.

I had short-listed these 3 as they had demonstrated some level of growth in its revenue and earnings. BRC Asia and Nam Lee is trading near the lower end of its Price-to-Sales valuation. Pan-United is slightly above average but not at the higher end of its historical range. In relation to its Earnings Power Value and Asset Value, BRC Asia is trading at a higher valuation than Nam Lee Metals and Pan-United, which is explainable by its higher growth rate than the other 2 as well.

Trading Idea

The attached chart above showed the Monthly Chart of BRC Asia with its financial data. BRC Asia had experienced strong growth over the past 4 years with its revenue growing at a compounded annualised rate of 39%. Management had rewarded its shareholders handsomely by paying out 75% of its Net Income as dividends, thus achieving a Dividend Yield of 7.5% in FY2021.

Even though its result is phenomenal, its share price didn’t move as much as its valuation suffered a multiple compression, in part due to its over-valuation swing in 2017. As can be seen on the monthly chart, its Price-to-Sales ratio is currently trading at a very attractive level of 0.33x. In fact, since 2016, whenever it fell below P/S of 0.30x, its share price often trended upward.

On its Daily Chart, its share price looks to be supported by 250-day Moving Average and we have a MACD crossover, indicating possible upward momentum. Short-term traders can use the 250-day Moving Average as support level and cut-loss if price close below it. Currently, its 250-days Moving Average is supporting at $1.45 level. Its next resistance levels are at $1.70 and $1.80.

Eric Lee is a Sales Director with Phillip Nova. With expertise in Futures, Forex, Stocks, and Unit Trust, Eric makes an all-rounded advisor. Make informed trading decisions without spending time combing through endless information as Eric readily provides clients with trade alerts and insights via WhatsApp. Over his years of experience, Eric developed systematic strategies in trading and investing. Book a complimentary coaching session below to leverage on his expertise as he imparts his knowledge to enhance your trading journey.