By Eric Lee, Sales Director, Phillip Nova

Every week, various U.S. based market participants report their futures and options positions to the Commodity Futures Trading Commission (CFTC). This information is published every Friday in the Commitment of Traders (COT) report, which can be a valuable resource for retail traders seeking to understand market trends, especially in the commodities market like gold.

The futures market is largely dominated by institutional players, often referred to as “big whales.” By closely monitoring what these institutions are trading, retail traders can gain insights into underlying market trends, potentially improving their trading strategies.

In today’s article, we delve into the activities of a specific group of traders known as commercial traders. But who exactly are these commercial traders? This group comprises producers, merchants, processors, and end-users—essentially companies that need to buy, sell, or stockpile commodities as part of their business operations. These companies often hedge against price fluctuations in their inventories or increase their holdings when they believe the market is mispricing the commodity based on their business outlook.

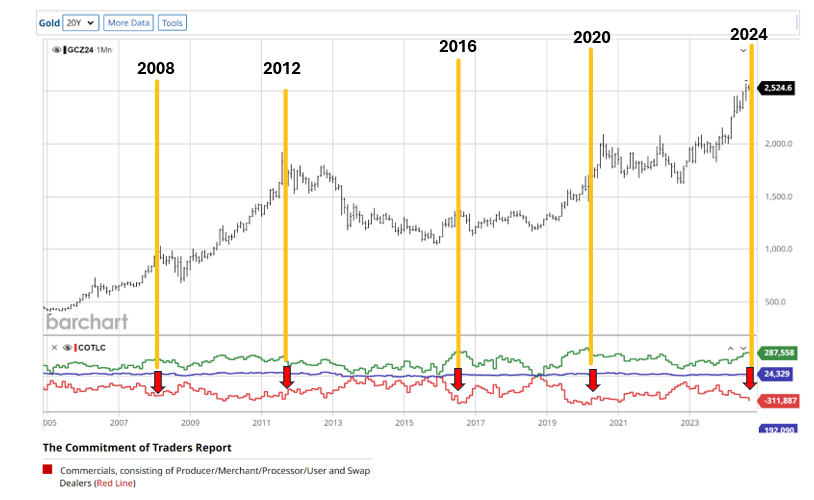

When commercial traders hold long or short positions that deviate significantly from historical norms, they can tip the supply-demand balance, leading to trend reversals in prices. As shown in the COT chart from barchart.com, commercial traders are represented by the red color. Over the past 20 years, whenever this red line dropped to an extreme low, it was typically followed by a peak in gold prices and a subsequent downtrend.

Another noteworthy observation from the chart is a four-year peak-to-peak cycle in gold prices. Previous peaks occurred in 2008, 2012, 2016, and 2020. Based on this cyclical pattern and the fact that commercial traders are currently holding net-short positions in gold similar to those held in 2020, there is a possibility that gold prices could peak in the coming weeks.

Since October 2023, COMEX Gold has been trending higher, making a series of higher highs and higher lows. Traders considering shorting gold may want to wait for signals from the daily chart, such as the formation of lower lows or a break below the trendline or support level.

Both COMEX Gold Futures and Spot Gold (XAU/USD) are available for trading on Phillip Nova 2.0. If you prefer to trade Spot Gold at zero commission, you may trade the XAU/USD contract on our Phillip MetaTrader 5 platform instead.

Try a Phillip Nova 2.0 or Phillip MT5 demo now

Upcoming Webinar By Eric Lee

For more insights from Eric Lee, do not miss his upcoming webinar on Tuesday, 24 September 2024 on Navigating the Yen Carry Trade: How the Yen’s Rise is Shaping the Future of the Nikkei 225. In this strategy webinar, Eric will share how the raising of the rates for the Japanese Yen will impact the stock market and subsequently the Nikkei 225 index. Don’t miss his insights, register here.

Value-Added Service from Eric Lee

My clients benefited from my services including investment advisories in unit trust and stocks, investment insights based on my personal knowledge and experiences while navigating the markets for the past 20 years.

Periodically, I will be send out market analysis to my clients, as well as alerting them of support and resistance levels for the technical indicators which I am utilising on a chart. Click on the button at the bottom if you would like to arrange for a One-to-One Coaching session to learn more about trading futures, forex, stocks and more, and how you can benefit from the services I provide.

Eric Lee is a Sales Director with Phillip Nova. With expertise in Futures, Forex, Stocks, and Unit Trust, Eric makes an all-rounded advisor. Make informed trading decisions without spending time combing through endless information as Eric readily provides clients with trade alerts and insights via WhatsApp. Over his years of experience, Eric developed systematic strategies in trading and investing. Book a complimentary coaching session below to leverage on his expertise as he imparts his knowledge to enhance your trading journey.

- Open an account now

- Free Phillip Nova Demo Account

- Free Phillip MT5 Demo Account

*T&Cs apply, contact Eric below for more information.