Pre-elections analysis courtesy of Eurex

With Germany heading to the polls on Sunday, 23 February 2025, all eyes are on how the DAX Futures might react. Will market volatility create new trading opportunities? ![]()

![]() Read on to learn more!

Read on to learn more!

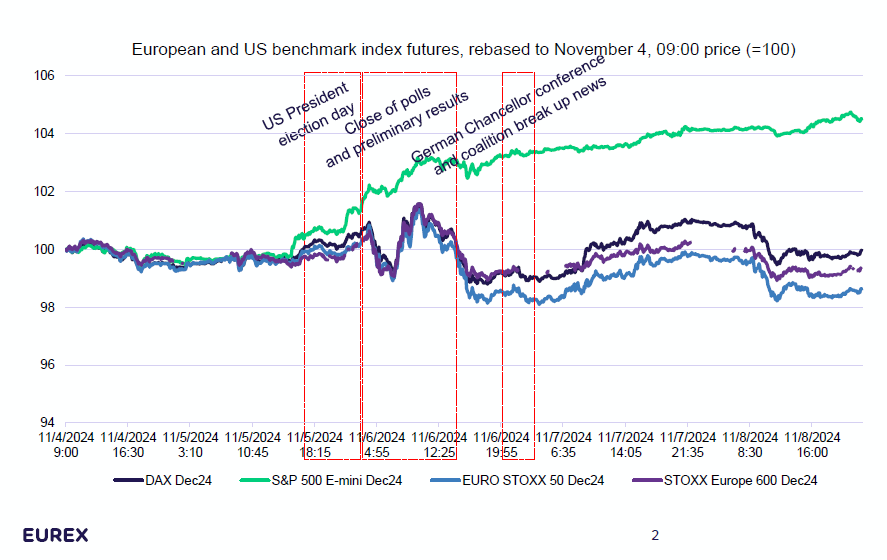

European and US benchmark index futures and their sensitivity to political news

- European and US benchmark index futures are highly correlated, moving in the same direction in regular times.

- We also see that US presidential election caused more volatility to DAX than internal news on parliamentary coalition break-up in Germany

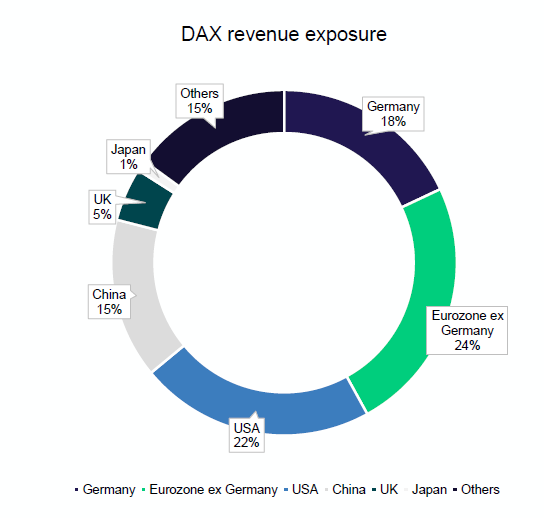

- This can be explained by the structure of DAX companies that generate only 18% of the sales inside Germany

DAX as a global export powerhouse

- As stated in Deutsche Bank report1 published in 2023, DAX companies mostly generate sales outside Germany and show higher correlation to

global GDP (0.41) than to Germany’s GDP (0.33) - As Germany GDP stagnated (-0.2%) in Q4 2024, DAX continues to rally as index is more exposed to the political discussion around tariffs than to the national election cycle

- DAX is floating at 21,770 as of January 31, showing 8% Ytd growth (vs ~3% in S&P500). The DAX’s current valuation of around 16 times earnings presents an attractive alternative to the S&P 500’s multiple of 25

- This valuation gap provides potential opportunities for investors seeking exposure to global growth at more reasonable prices

- The lower technology weighting has proven beneficial during recent AI related market volatility

- These factors make the DAX an interesting proposition for those looking to diversify their index trading exposure and could serve as a catalyst for rotation from US equity dominance in global asset allocation observed last years

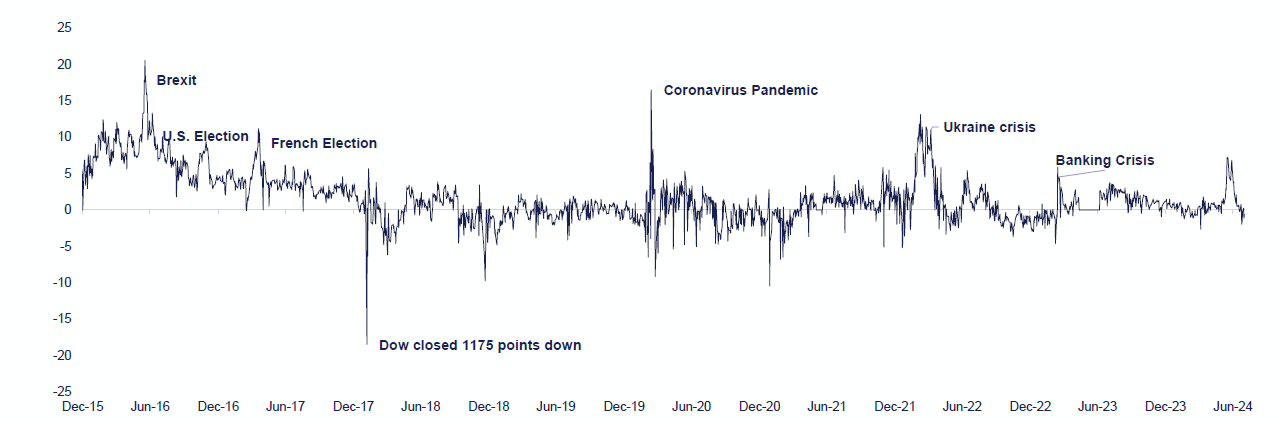

Volatility derivatives: VSTOXX® vs. VIX®

VSTOXX®/VIX® spread has historically been mean-reverting, but relationship can break down during times of Euro or US specific events.

Between 2016 and 2024, the spread has averaged 1.66 points (VSTOXX® over the VIX). Given that VSTOXX ® gauges volatility of EURO STOXX 50 and EURO STOXX 50 consists only 28% of companies based in Germany, clients might want to opt for DAX ® derivatives family as a hedge for political events in Germany.

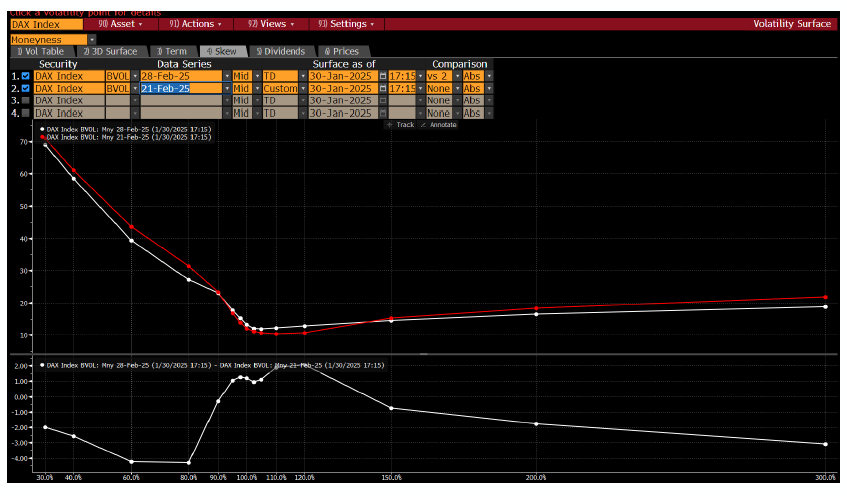

Volatility surface for DAX options

Given that parliamentary elections are planned for Feb 23, we observe the typical volatility smile for DAX Options expiring on Feb 21 (red line) and on Feb 28 expiry (white line). Worth to note that 28 Feb at-the-money and in-the-money options have higher IV than options expiring before the elections.

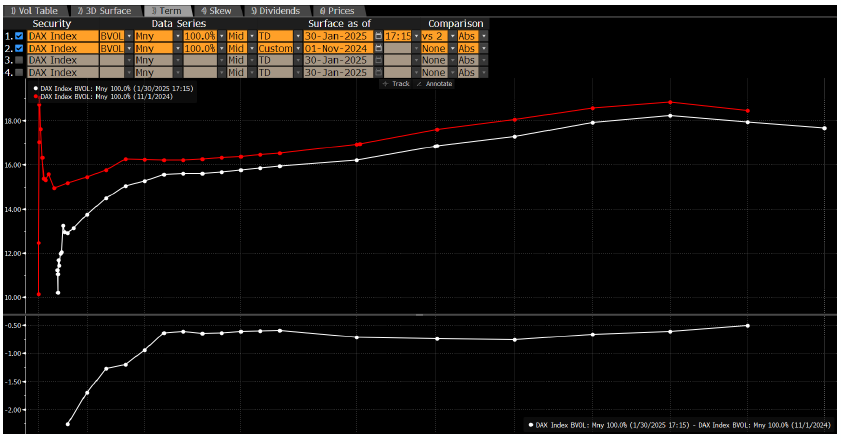

Term structure for DAX options

On the graph to the left we have term structures screened one week before US presidential elections (red line) and 3 weeks before Germany parliamentary elections (white line). We can see a hump clustered around front month contracts (dailies and weeklies) for both curves, although back in November the IV was higher across all terms.

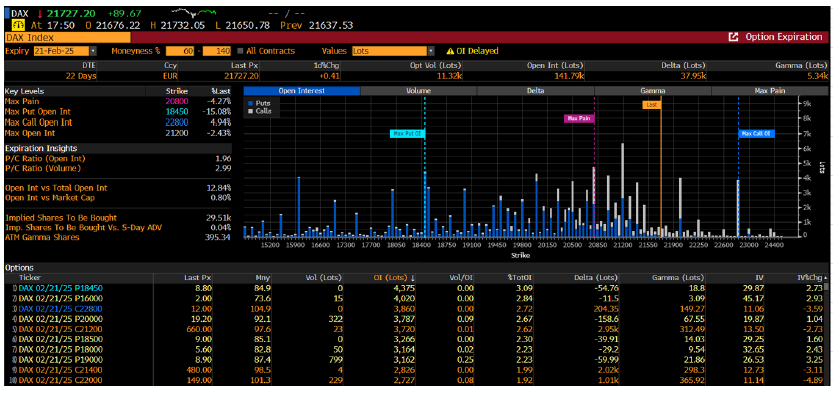

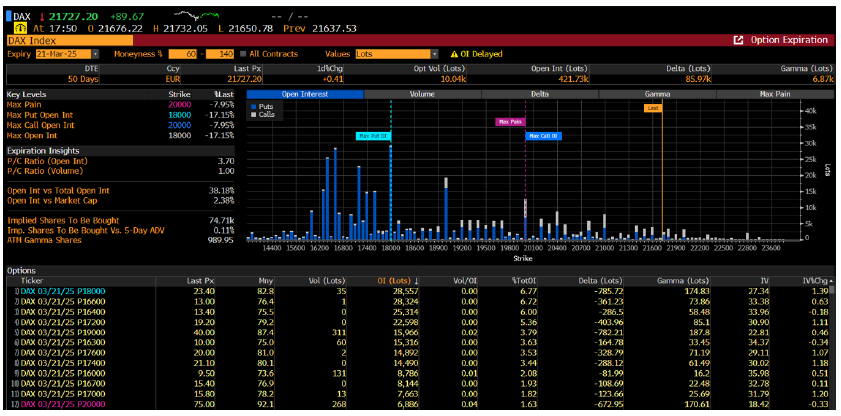

Open interest distribution for DAX options 21 Feb expiry

- 21 Feb expiry represents 12.84% of total open interest in DAX options. The most bullish position is 3,860 call options placed at 22,800 strike

- Put/call ratio is at 1.96

Open interest distribution for DAX options 21 Feb expiry

- 21 Feb expiry represents 12.84% of total open interest in DAX options. The most bullish position is 3,860 call options placed at 22,800 strike

- Put/call ratio is at 1.96

Take a view on the Micro DAX and the Micro EURO STOXX 50 Now!

Trade Micro-DAX® and Micro-EURO STOXX 50® Futures at EUR1.50*. Learn more here.

Trade Stocks, ETFs, Forex & Futures on Phillip Nova

Features of trading on Phillip Nova

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, China, Hong Kong, Malaysia and US markets.

- Over 90 Technical Indicators

View live charts and trade with ease with over 90 technical indicators available in the Phillip Nova platform

- Trade Multiple Assets on Phillip Nova

You can trade Stocks, ETFs, Forex and Futures on a single ledger with Phillip Nova