By Danish Lim, Investment Analyst, Phillip Nova

Japan’s equity markets have seen a world-beating rally thanks to a variety of structural factors such as a weak Yen, improved corporate profits, reallocation away from China, exit from decades-long deflation, and exposure to Semiconductors. However, corporate governance is often overlooked as a key catalyst.

Historically lagging behind Developed Market Peers in Capital Efficiency

The ROE of Japanese companies has remained lower than that of their US peers for decades, as seen above.

At the same time, Japan garnered a reputation as a “value trap” for investors- where stocks perceived to be undervalued will continue to remain cheap. Japan had an unusually high number of stocks that traded below book value, meaning a P/B ratio below 1.0x, implying that markets are valuing the company less than the book value of their assets.

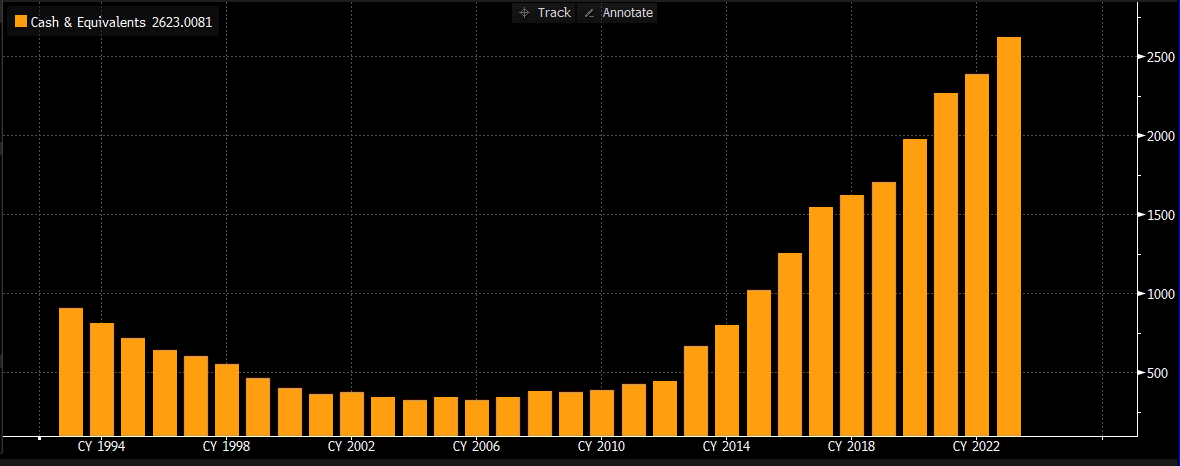

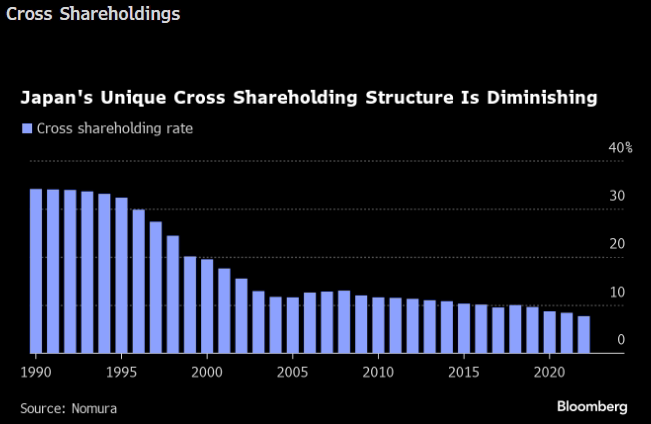

Foreign investors and activists frequently criticize negative corporate practices in Japan such as cross-shareholdings or “Keiretsu”, takeover defence measures such as poison pills, and an unusually large cash hoard for eroding shareholder returns.

As seen above, Japanese companies have a historical tendency to hoard cash rather than invest for growth, which weighed on corporate valuations. Investors tend to be critical of large cash stockpiles as it represents lost opportunities for growth; although it does provide downside protection during times of crisis.

Corporate Governance Reforms to Boost Shareholder Returns

To address the issue of low ROE and low P/B ratio in Japanese companies, the Tokyo Stock Exchange (TSE) and the government has proactively attempted to boost capital efficiency and increase shareholders’ returns.

Starting off with “Abenomics” under former PM Shinzo Abe, the introduction of the Stewardship Code in 2014 and the Corporate Governance Code in 2015 were the first of several chapters of corporate governance reforms that had a fundamental impact on the Japanese stock market.

Recent Developments

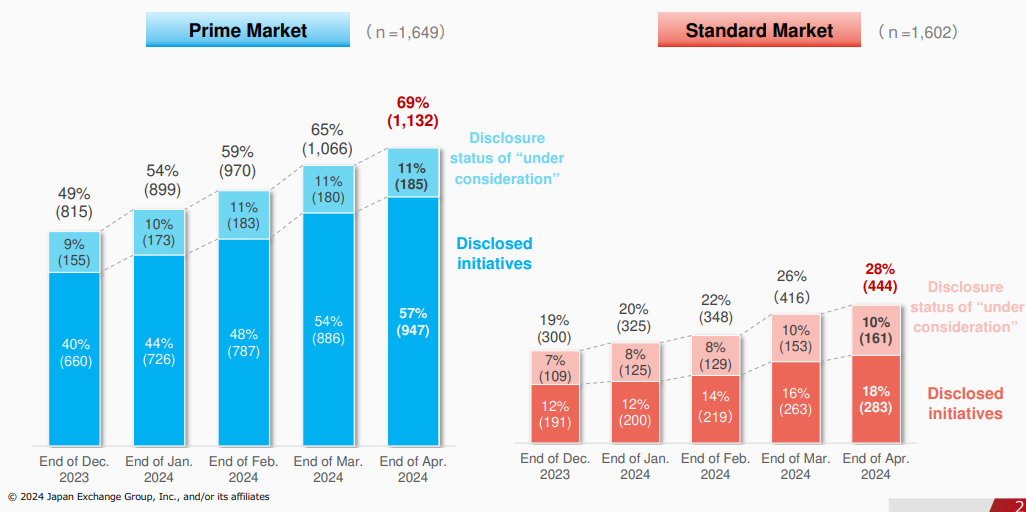

As seen above, the Tokyo Stock Exchange (TSE) publishes a monthly list of companies that have voluntarily disclosed their plans to increase capital efficiency. Companies in the list are likely to be evaluated more favourably by investors.

A key goal of the list is to shift the mindset of Japanese corporates to one that is more conscious of the cost of capital, as well as profitability based on cash flows and the balance sheet, rather than just the bottom line on the income statement.

Although companies are not legally obligated to disclose their plans, the list was designed to “name and shame” companies with a P/B ratio below 1.0, indirectly forcing them to take action to improve investors’ evaluation of the business’s growth potential and boost shareholder returns.

Such plans could include share buybacks, increasing dividends, investing more for growth, improving board independence, and lower resistance to activist demands.

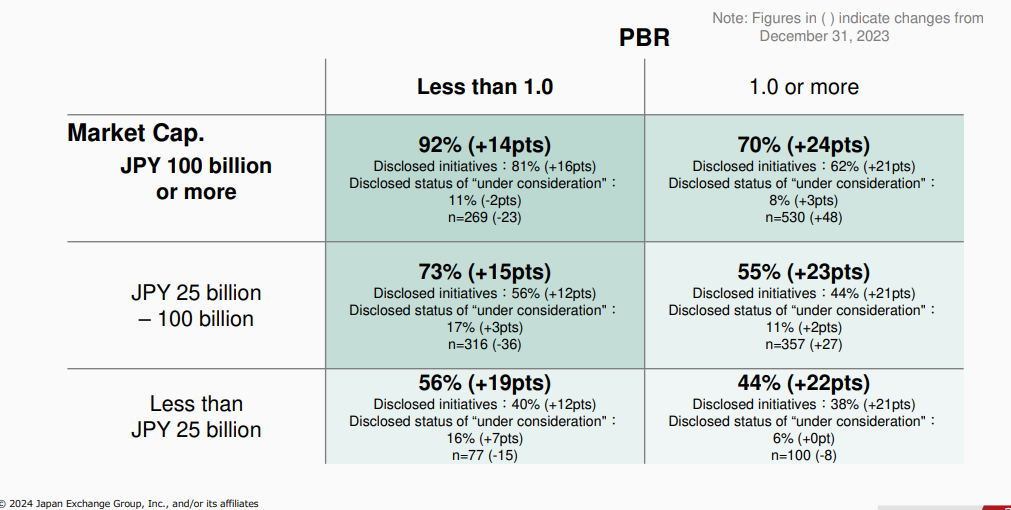

As seen above, as of 30 April 2024, 69% of Prime Market listed companies and 28% of Standard Market listed companies have disclosed their plans – an increase 20% in the prime market and 9% in the standard market since the end of December 2023.

Data from Japan Exchange Group indicates that disclosure is more prevalent among companies with large market cap and a P/B ratio below 1.0x.

Impact of Corporate Governance Reforms

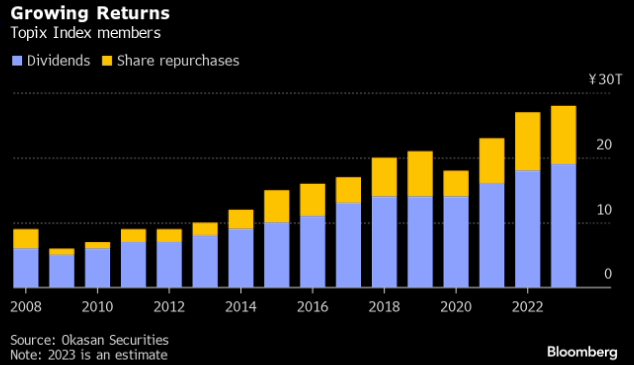

As seen above, dividends and share repurchases have steadily increased as means of redeploying the large stockpiles of cash held by corporates. Data from Okasan Securities indicate that dividends more than doubled from 8T yen in 2013 to 19T yen in March 2023; while share buybacks saw a fivefold increase from a decade ago.

We have also seen an unwinding of cross shareholdings or “Keiretsu”, which is a practice where Japanese firms have cross-company holdings with their business partners to maintain business alliances. These holdings are rarely ever traded. Activists are encouraging firms to sell these holdings and use the proceeds to invest for growth.

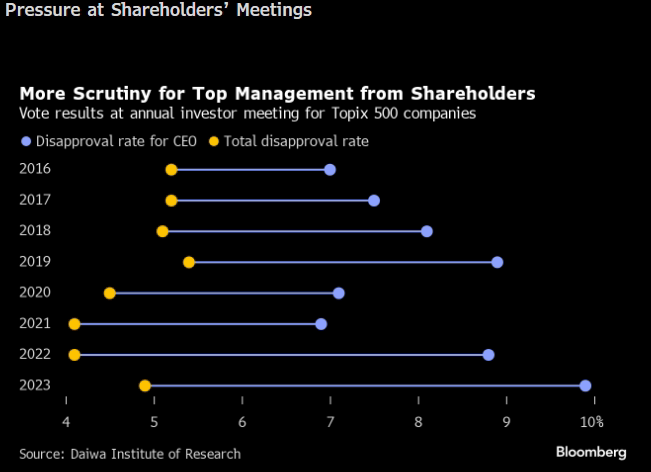

Opposition to CEO appointments are also on the rise. For example, Akio Toyoda, chairman of Toyota Motors, was reappointed last year with 84.57% of shareholder votes, the lowest since 2010, and down from 96% a year earlier.

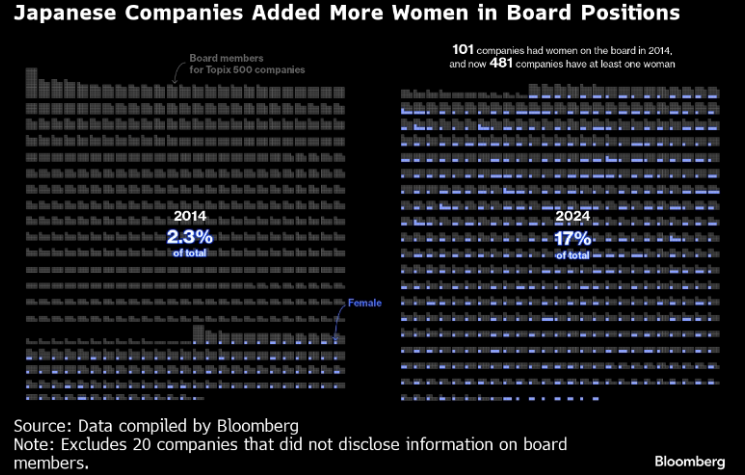

Pressure from investors has also resulted in greater board diversity – with Women now holding more board seats in Japan compared to just a decade ago.

Conclusion

Corporate governance reforms are expected to drive shareholder returns in the long-run. Companies with P/B ratio below 1.0x could see a re-rating to 1.0x P/B or higher. As more companies re-rate higher, this could lead to further upside for the major Japanese stock indices such as the Nikkei 225 and the TOPIX.

For more information on corporate governance in Japan, please click here.

Trade Now & Fly to Japan Promotion

Win tickets to Japan when you trade SGX Nikkei 225 Index Futures, at only 50 cents, with Phillip Nova. Click here to learn more now.

Trade Stocks, ETFs, Forex & Futures on Phillip Nova

Features of trading on Phillip Nova

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, China, Hong Kong, Malaysia and US markets.

- Over 90 Technical Indicators

View live charts and trade with ease with over 90 technical indicators available in the Phillip Nova platform

- Trade Multiple Assets on Phillip Nova

You can trade Stocks, ETFs, Forex and Futures on a single ledger with Phillip Nova