By Eric Lee, Sales Director, Phillip Nova

The United Kingdom (UK) has faced challenges since the Brexit vote in 2020, adding stress to the already weakened Pound. Typically, the country’s economy, including its real GDP, is a major factor in determining the strength of its currency. Goldman Sachs predicts a contraction of 1.2% in the UK’s real GDP in 2023, which is similar to the 1.3% contraction forecasted for Russia by the bank. The main reason for the contraction in the UK is due to a sharp decline in household living standards, causing higher inflation and interest rates, which has significantly reduced household purchasing power. As a result, the year-on-year GDP growth rate has continued to decline since June 2021.

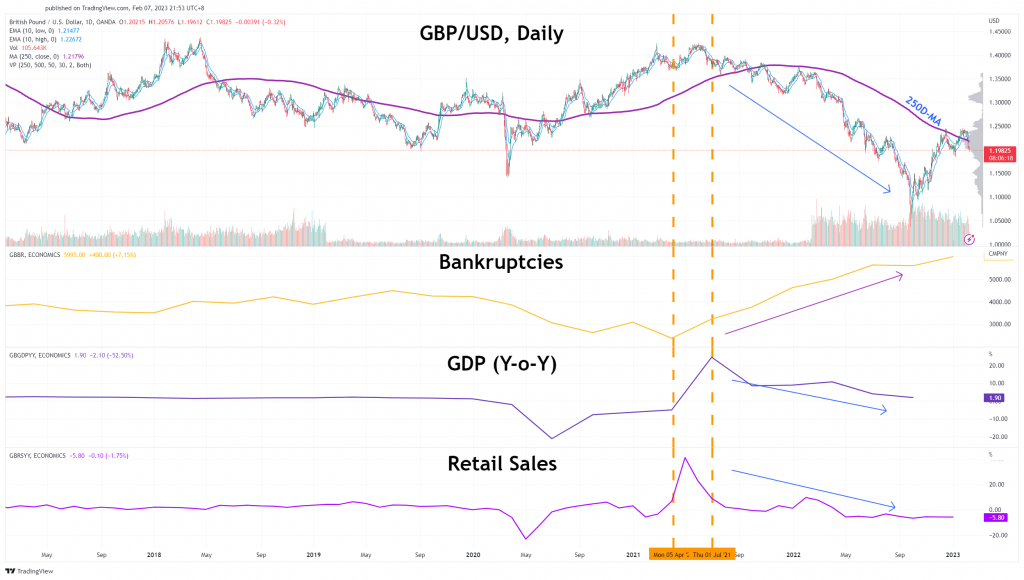

The number of company insolvencies in England and Wales has increased since April 2021 and has reached its highest level since 2009 in Q2 2022. In August 2022, over 10% of UK businesses reported a moderate to severe risk of insolvency, with energy prices being a major concern for 22% of businesses. The construction, manufacturing, accommodation, food service, wholesale and retail trade industries together accounted for over half of the business insolvencies in H1 2022 in England and Wales.

Retail sales in Britain experienced a record fall in December, with a 5.8% decline in sales volume compared to the previous year. This was due to the cost of living squeeze and the postal strike, which impacted online sales. Despite this, major retailers, including Tesco, Sainsbury’s, and Marks & Spencer, reported better-than-expected Christmas trading updates. The Bank of England is expected to raise interest rates for the 10th consecutive time in February, but retailers and consumers hope the situation will improve in H2 2023.

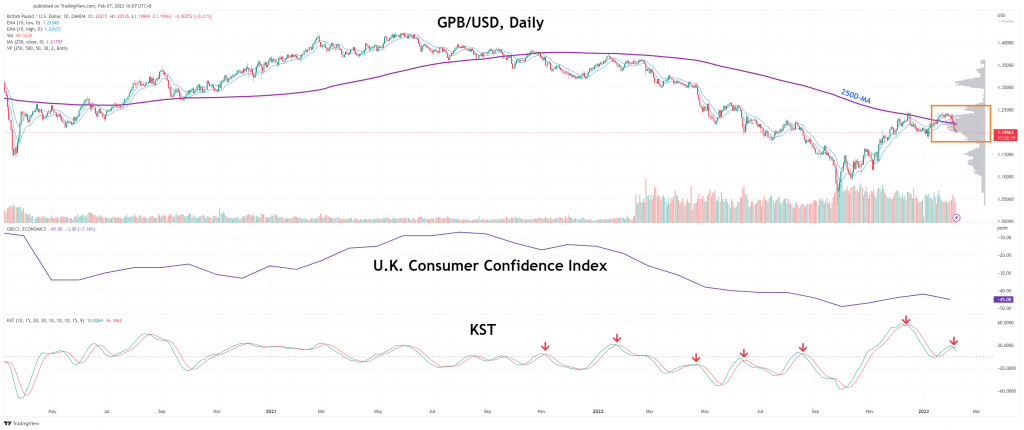

The chart below plots the GBP/USD currency pair along with economic data, including bankruptcies, GDP growth rate, and retail sales. We can see that the currency pair trends in the same direction as GDP growth rate and retail sales, but inversely to bankruptcies. To simplify, traders can use the U.K. Consumer Confidence Index, which factors in economic data such as employment rates, income levels, and interest rates, as a proxy for all economic indicators.

The U.K. Consumer Confidence Index is a crucial barometer for currency traders looking to trade the GBP/USD pair, especially with the turmoil in the United Kingdom since Brexit. The index has been trending downwards since July 2021, and recent data suggests a continued downtrend. Traders can use technical analysis tools, such as KST crossover downward and the 250-day Moving Average, to make informed decisions when entering the market. If the GBP/USD falls below the support of 1.18, its downtrend may resume, potentially leading to a retest of its parity against the USD.

GBPUSD is available for trading on the Phillip MT5 trading platform

Value-Added Service from Eric Lee

Periodically, I will be sending out market analysis like this to my clients, as well as alerting them of support and resistance levels for the technical indicators which I am utilising on a chart. Click on the button at the bottom if you would like to arrange for a One-to-One Coaching session to learn more about trading futures, forex, stocks and more, and how you can benefit from the services I provide.

Eric Lee is a Sales Director with Phillip Nova. With expertise in Futures, Forex, Stocks, and Unit Trust, Eric makes an all-rounded advisor. Make informed trading decisions without spending time combing through endless information as Eric readily provides clients with trade alerts and insights via WhatsApp. Over his years of experience, Eric developed systematic strategies in trading and investing. Book a complimentary coaching session below to leverage on his expertise as he imparts his knowledge to enhance your trading journey.

- Free Phillip MT5 Demo Account

- Free Phillip Nova Demo Account

- Open an account now

*T&Cs apply, contact Eric below for more information.