By Pranay Yadav, Portfolio Analyst, Mint Finance

Japan’s lost decades are behind us. Many long-term factors are driving resurgence in Japanese equities. Economic growth is accelerating – driven by strong domestic consumption. Radical market reforms have made Japan attractive for domestic and global investors. As a result, the benchmark Nikkei 225 set a new all-time-high after four decades.

However, the rally is facing challenges. Tightening monetary policy, trade uncertainties, and waning impact of corporate efficiency reforms pose near-term headwinds that could push the benchmark into a correction, followed by a period of consolidation.

BOJ’s rates hikes

The Bank of Japan (BoJ) plays a crucial role in the performance of Japanese equities. Since 2016, the BoJ instituted negative rates to support economic growth which boosted equity markets.

Chart 1: From 2015 to 2025, loose monetary policy boosted the Nikkei 225, but equities have stagnated since rates began rising

Source: TradingView

However, in March 2024, the BoJ hiked rates for the first time after two decades. Subsequently, rates were lifted twice, up to 0.5%, the highest since 2008. Crucially, it intends to raise rates further as part of a broader return to neutral policy rate – one that’s neither too restrictive nor too accommodative.

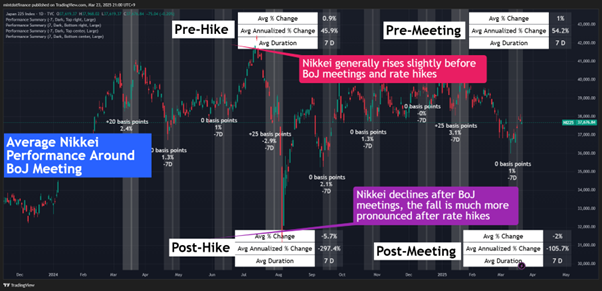

Chart 2: The Nikkei 225 tends to rise slightly before BoJ meetings but falls sharply afterward, especially following rate hike (2024 to Present)

Source: TradingView

The BoJ is expected to hike rates by 50 basis points by end of March 2026 according to a Reuters poll. Two-thirds expect the next rate hike in Q3, likely in July this year. Traditionally the wage hikes in spring serve as a critical indicator for the BOJ, influencing its decision to continue raising interest rates as part of its shift towards a more neutral monetary policy. This year, many economists expect the wage hikes to match or exceed 5.1% as seen in 2024. With yen’s slide halting, the BoJ will have more room to manoeuvre. Consequently, a rate hike seems likely forming additional headwinds to Japanese equities.

Fading impact of Corporate Reforms

Nikkei’s ascent is also thanks in part to TSE’s corporate reforms. For years, Japanese equities were seen as “value trap,” dissuading investors.

In 2023, to unlock the value trap, the TSE embarked on a campaign to enhance capital efficiency among listed Japanese firms to attract wider investment. New listing rules “urge” firms to deploy their capital better – either through shareholder returns or CAPEX.

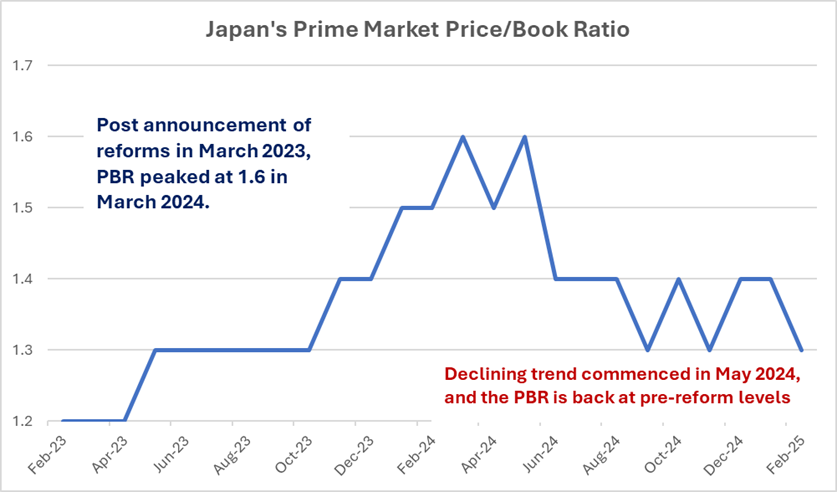

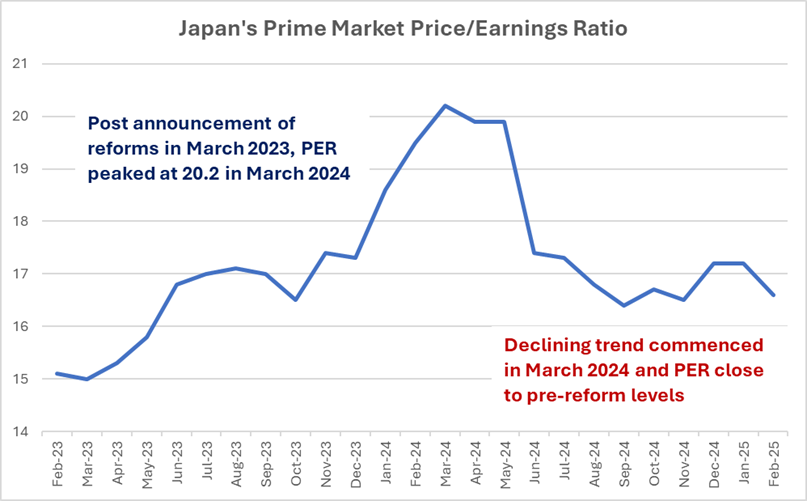

These reforms were effective in the near-term, boosting key valuation metrics such as P/B and P/E ratios. However, the improvements from these reforms are starting to slow.

Chart 3: Japan’s Prime Market weighted average Price-to-Book ratio has fallen back to pre-reform levels over the past year (2023 to Present)

Source: Japan Exchange Group

Average P/B and P/E ratios of the prime market firms listed on the TSE is back to pre-reform levels. The large short-term bump from these policies have faded, no longer providing an immediate tailwind.

Chart 4: Japan’s Prime Market weighted average Price-to-Earnings ratio has fallen back to pre-reform levels over the past year (2023 to Present)

Source: Japan Exchange Group

Tariff Risks Haunt Markets

Perhaps the largest near-term risk facing the Nikkei 225 is the potential for trade disruptions.

Chart 5: Nikkei 225 daily returns show a sharp drop on the day tariffs were announced

Source: TradingView

Trump has announced a steep 25% tariff on imported cars, set to take effect on April 2, a dramatic 10-fold increase from the current 2.5%. Additionally, he has raised the steel and aluminium tariffs to 25%, with no exemptions or exceptions—a significant blow to Japan, one of America’s key trade and security allies. Despite Japan’s trade minister Yoji Muto lobbying for relief in Washington, the U.S. has yet to offer any concessions.

US remains Japan’s largest export market, accounting for ¥21 trillion ($140. 6 billion) in trade, with automobiles making up nearly 28% of that figure. The impending tariff spike is expected to dent Japanese exports, slash domestic production, and squeeze profit margins.

Trade tariffs, especially those impacting some of the largest companies in the Nikkei 225 present a significant risk for investors.

Additionally, the tariffs are likely to lead to a shrinking trade surplus for Japan which may weaken the yen and further exacerbate inflationary pressures, prompting the BoJ to hike rates.

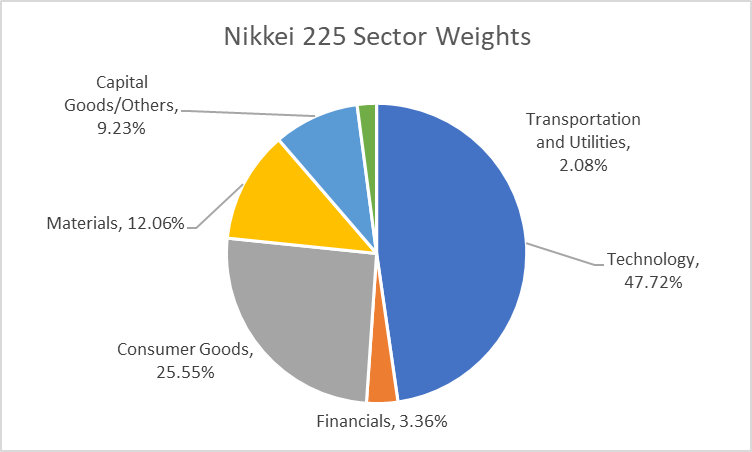

Nikkei 225 is Weighted Towards Exporters

The Nikkei 225 index is dominated by technology firms which makes up almost half of the index. This sector includes both Electronic Manufacturing firms and Software & Communications companies. Notable firms within this sector are Tokyo Electron (5.9%), Advantest (5.7%), Softbank Group (4.2%), and KDDI (2.5%).

Chart 6: Nikkei 225 sector weightings shows large weightage towards technology firms

Source: Nikkei; March 21, 2025

Other notable categories are Consumer Goods and Materials. Consumer Goods is dominated by Fast Retailing, the single largest component of the index with a weight of 10.7%. The index is impacted substantially by trade given its heavy tilt towards manufacturing. Rising input costs from imports and reduced demand for exports can both stifle performance

Chart 7: Nikkei 225 Sector wise 1Y performance.

Source: TradingView

Over the past year, Finance has been one of the strongest sectors in the index. Contrastingly, Producer Manufacturing, which has a high weightage in the index, has been among the underperforming sectors. This trend is likely to continue, with trade disruptions and a slowing AI rally posing headwinds to major index components.

CME Group Nikkei 225 Futures

CME Group’s suite of Nikkei 225 futures provide a range of instruments to express views on Japan’s benchmark equity index. Futures are available in two different contract sizes – Standard and Micro. More information on these can be found at the Nikkei 225 Futures page.

Particularly, the newly launched Micro Nikkei 225 contract presents interesting possibilities for both trading & hedging exposure. Due to the smaller size, the contract requires lower margin, boosting capital efficiency for traders. For risk managers, it allows for precise hedging, reducing unwanted residual exposures.

A crucial use case of these futures is the expanded trading hours in the week. Investors can trade CME Group’s Nikkei futures 23 hours a day, 5 days a week, significantly longer than the underlying cash market. This allows futures to be an effective overnight hedging tool.

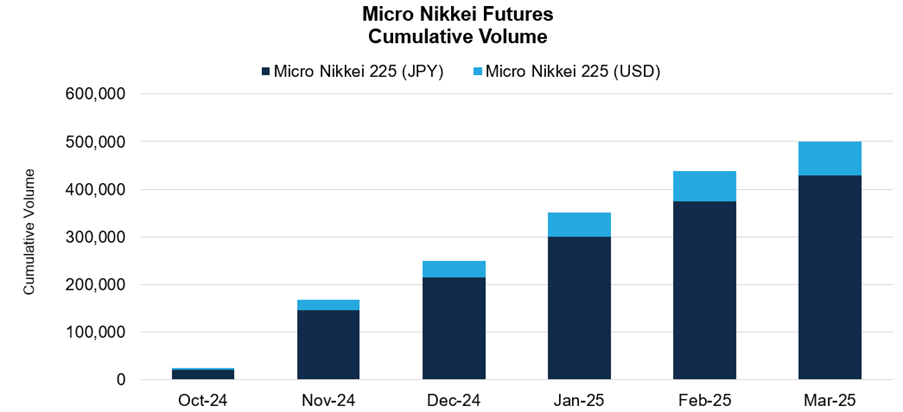

Chart 8: CME Micro Nikkei futures cumulative volume growth

Source: CME Group; Oct 2024- Mar 2025

The Micro Nikkei futures are available both as a yen-denominated, and USD-denominated product. Both provide for compelling use-cases to hedge FX volatility.

Investors can use the USD-denominated contract to negate any risk from movements in the yen, and trade directly using USD.

Conversely, the yen-denominated contract can be deployed strategically to benefit from a strengthening yen.

Technical Signal Near-Term Bearishness

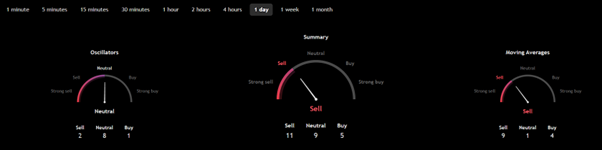

Technical summary of Nikkei 225 index shows a bearish outlook on the 1D chart timeframe. This suggests potential downside in the near-term.

Chart 9: Nikkei 225 technical indicator signals short-term bearish outlook

Source: TradingView (1-day timeframe)

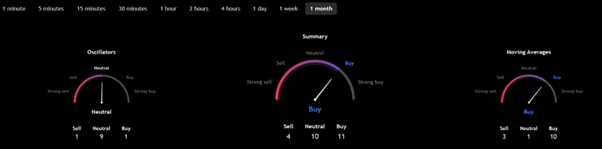

In the longer-term (1-month timeframe) Nikkei 225 technical indicators show a bullish signal

Chart 10: Nikkei 225 long-term technical indicator signals bullish outlook

Source: TradingView (1-month timeframe)

Looking at specific technical indicators, the rebound following the tariff related decline seems to be fading with MACD and RSI, signaling a weakening trend. With Nikkei 225 trading below a key support/resistance level, strong momentum may be required to pass this level. At present, that momentum is lacking.

Chart 11: Nikkei 225 RSI, Bollinger Bands, and MACD signal emerging bearish trend

Source: TradingView

Hypothetical Trade Setup

While Nikkei 225 has multiple long-term drivers that support secular growth, near-term risks are palpable. Tariff uncertainty, BoJ policy, and fading impact of the TSE market reforms support a short-term bearish view on the Nikkei 225.

Investors can express this view by deploying a short position on Micro Nikkei (JPY) denominated futures expiring on June 13 (MNIM25). The following hypothetical trade setup provides a reward to risk ratio of 1.8x. The same view can be expressed using CME Group’s standard Nikkei (JPY) denominated contract which would scale the below P&L by 10x.

Crucially, this position’s P&L is denominated in yen. The yen appreciation due to BoJ policy will further boost the USD value of this P&L, enhancing overall returns.

Chart 12: Shorting Micro Nikkei (JPY) futures expiring in June (hypothetical trade setup)

Source: TradingView

- Entry: 37,650

- Target: 36,300

- Stop Loss: 38,400

- Profit at Target: JPY 67,500 = ((37,650-36,300) x JPY 50), which is around ~USD 450

- Loss at Stop: JPY 37,500= ((37,650-38,400) x JPY 50), which is around ~USD 250

- Reward to Risk: 1.8x

Trade Nikkei 225 Futures from 10 Cents/Lot*

Trade Nikkei 225 Futures from just 10 cents/lot. Learn more here and access this low-cost opportunity to start trading CME Micro Nikkei 225 with ease.

The author’s views are independent and do not represent that of Phillip Nova. For applicable terms and conditions and a full risk disclaimer, please refer to www.phillipnova.com.sg. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Trade Stocks, ETFs, Forex & Futures on Phillip Nova

Features of trading on Phillip Nova

Capture opportunities from over 200 global futures from over 20 global exchanges

Over 11,000 Stocks and ETFs across Singapore, China, Hong Kong, Malaysia and US markets.

View live charts and trade with ease with over 90 technical indicators available in the Phillip Nova platform

You can trade Stocks, ETFs, Forex and Futures on a single ledger with Phillip Nova