By Eric Lee, Sales Director, Phillip Nova

Comex Gold futures have been hovering close to the 250-day moving average since mid-February. Volume analysis over the past four years shows that there is strong support at $1850, followed by $1675. $1850 is also where its 250-day moving average is at currently. This support level may indicate a potential buying opportunity for traders.

Recent news of the collapses of Silvergate Bank and Silicon Valley Bank (SVB) have caused market fear of a contagion effect. Silvergate Bank was a California-based bank that focused on serving clients in the cryptocurrency industry. However, the bank collapsed on March 8, 2023, due to its exposure to the failing cryptocurrency exchange FTX. The collapse of FTX caused panic among Silvergate’s customers, and many rushed to withdraw their funds, leading to a bank run. The sudden bank run and capital shortage left Silicon Valley Bank facing an uncertain future. On March 10, 2023, FDIC placed SVB into receivership. This meant that the bank was shut down by California’s banking regulators, and FDIC effectively took control of the bank.

The fear of a contagion effect may prompt traders to look for safe-haven assets such as gold. MACD bullish crossover together with Gold price breaking the resistance of $1850 indicated a possible upward momentum to continue. Resistance of $200 can be where Gold price is heading next, and $1850 becomes the near support should the upward momentum continue the following week.

When performing market cycle analysis, it was noted that Gold has a seasonal tendency for bullish bias between the mid-March to mid-April period. This seasonality may be a potential buying opportunity for traders.

In addition to the recent news of the bank collapses, several other factors may impact the price of gold. Even though inflation had fallen from its high in June 2022, it is still hovering at a relatively high level, adding challenges to central bankers all over the world as they adjust their monetary policies to fight off inflation and at the same time keeping the economy from slipping into recession. Geopolitical tensions like the on-going Russia-Ukraine war and on and off spats between the world’s largest economies (U.S.A. and China) can impact investor sentiment and market volatility as well.

Commodities can be notoriously volatile, and gold is no exception. Market speculation and unexpected events can lead to sudden price swings, making it important for traders to manage their risk appropriately.

Based on intermarket analysis, USD/CNY has a 65% probability of leading Gold by 8 months. From the chart above, candlestick bars are the daily data of Comex Gold. Green line is the price of USD/CNY pushed forward by 8 months. From its projection, if this correlation remains the same over the next 3 months, this implies that there’s a 65% chance that Gold will rise over the next 3 months.

In conclusion, the recent collapses of Silvergate Bank and Silicon Valley Bank have led to a fear of a contagion effect, prompting traders to consider safe-haven assets like gold. Technical analysis and market cycle analysis indicate that there may be a buying opportunity for Comex Gold futures, and historical trends suggest that gold may continue to appreciate in value over the short-to-mid-term.

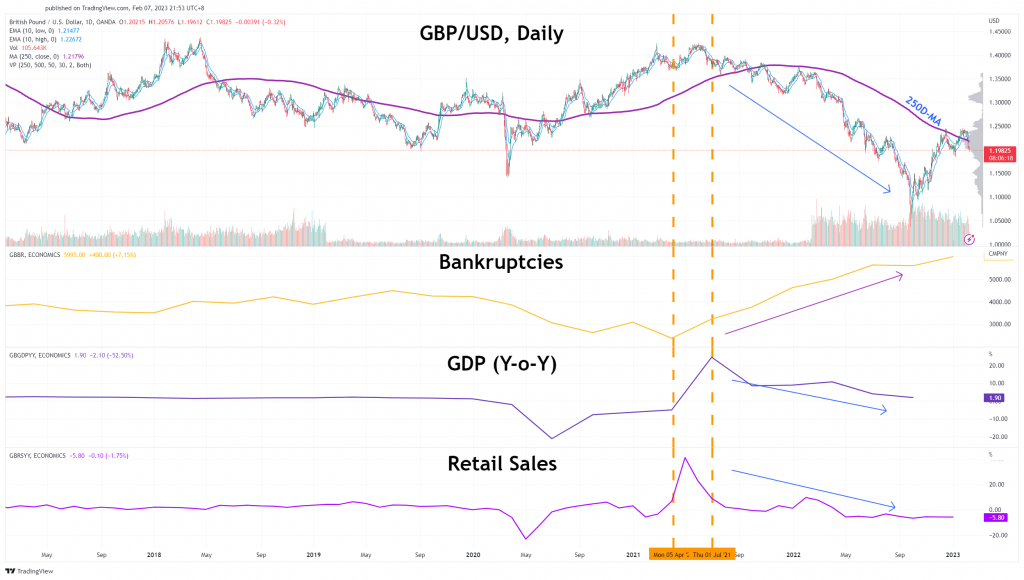

GBPUSD is available for trading on the Phillip MT5 trading platform

Value-Added Service from Eric Lee

Periodically, I will be sending out market analysis like this to my clients, as well as alerting them of support and resistance levels for the technical indicators which I am utilising on a chart. Click on the button at the bottom if you would like to arrange for a One-to-One Coaching session to learn more about trading futures, forex, stocks and more, and how you can benefit from the services I provide.

Eric Lee is a Sales Director with Phillip Nova. With expertise in Futures, Forex, Stocks, and Unit Trust, Eric makes an all-rounded advisor. Make informed trading decisions without spending time combing through endless information as Eric readily provides clients with trade alerts and insights via WhatsApp. Over his years of experience, Eric developed systematic strategies in trading and investing. Book a complimentary coaching session below to leverage on his expertise as he imparts his knowledge to enhance your trading journey.

- Free Phillip MT5 Demo Account

- Free Phillip Nova Demo Account

- Open an account now

*T&Cs apply, contact Eric below for more information.