What is Forex?

Derived from the term Foreign Exchange, Forex (or FX) is the process of converting one currency into another. The forex market is a global marketplace for exchanging national currencies and it operates 24 hours a day for 5 days a week, excluding public holidays. The forex market is the largest and most liquid asset market in the world.

Who trades Forex?

Forex is traded for various reasons – from commerce, global trade, to tourism. Market participants use forex to conduct cross border trades, imports & exports, hedge against currency, diversify portfolio, etc. Aside from financial transactions, most of the forex trading volume comes from speculation! Speculators buy and sell currency pairs to take advantage of short term price movements of currency pairs.

What are Lots?

Forex is traded on a standard unit size called lots. There are 3 lot sizes:

- Standard: 100,000

- Mini: 10,000

- Micro: 1,000

How to Read Currency Pairs?

Currency pairs are usually quoted in 6 letters. First 3 letters represent the base currency while the last 3 letters stand for the quote currency:

Based on the example above:

When you long a currency pair, you are buying EUR (base currency) and simultaneously selling USD (quote currency).

When you short a currency pair, you are selling EUR (base currency) and buying USD (quote currency).

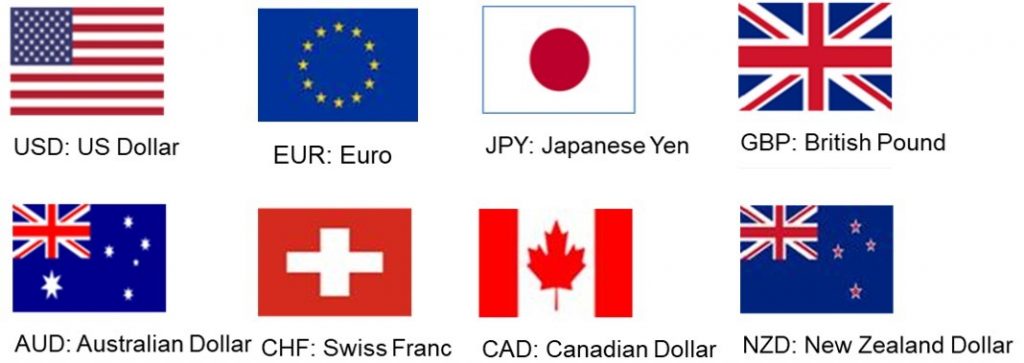

Which are the Most Traded Currencies?

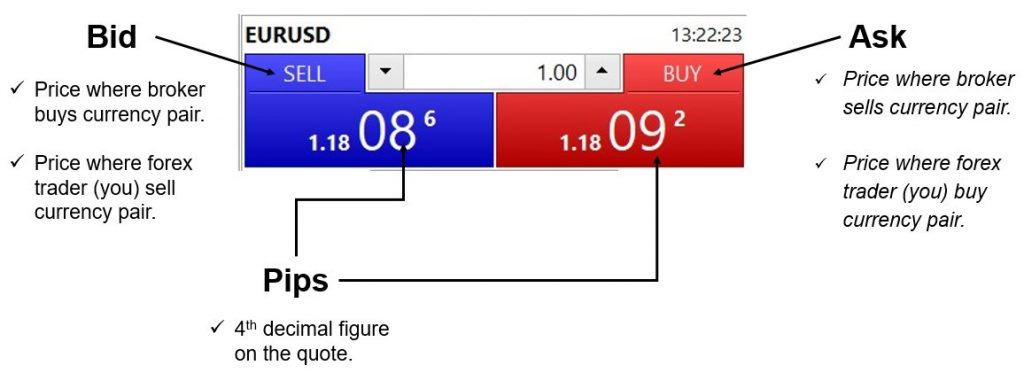

How to Read Quotes?

What are Spreads?

A spread is the difference between the ask price and the bid price in forex trading.

Spread = Ask Price (Buy) – Bid price (Sell)

= 1.18092 – 1.18086

= 0.6 pips

Spreads are one of the costs involved in forex trading. The lower the spreads, the better. Major pairs can be traded at tight spreads from as low as 0.6 pips on Phillip MetaTrader 5!

What are Major and Minor Currency Pairs?

Major pairs are currency pairs that are the combination of the US dollar and the 7 most traded national currencies.

Minor pairs are crosses between the most traded currencies, without the US dollar.

Exotic pairs consist of currencies from emerging markets.

| Major Currency Pairs | Minor Currency Pairs | Exotic Currency Pairs |

| • EURUSD • USDJPY • GBPUSD • USDCHF • AUDUSD • USDCAD • NZDUSD | • EURGBP • EURJPY • AUDCHF • AUDCAD • GBPAUD • GBPJPY | • USDHKD • NZDSGD • USDZAR • USDTHB • USDSGD |

Which Currency Pairs Should I Start With?

It is optimal for beginners to start trading forex with major currency pairs for the following reasons:

- High traded volume

- High liquidity

- Spreads for major pairs tend to be narrower compared to exotic pairs

- There is always someone to buy or sell at any given time

- Ample economic events and analysis for traders to take advantage of price movements

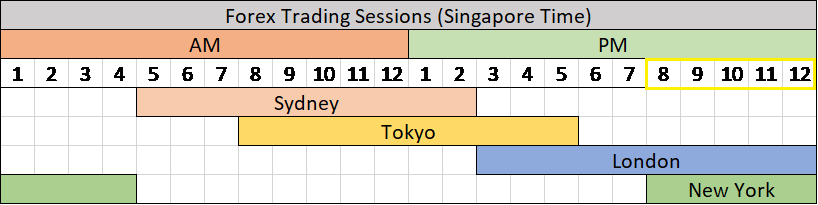

What are the Different Forex Trading Sessions?

A trading day in the Forex market starts with the Sydney session which begins at 5am SGT, followed by Tokyo, London, and then the New York session ends the day before the Sydney session opens again.

The most popular time to trade forex is during the overlap between the London and New York sessions (8pm – 11.59pm SGT), as this is when the markets for the most traded currency pair – EURUSD – is open.

Why Trade Forex?

- Opportunity in Volatility

For 24 hours a day, 5 days a week, the forex market never runs short on price stimulating events that stir volatility. The higher the volatility in the market, the more trading opportunities are generated for forex traders. - Leverage

FX is a leveraged product, this allows traders to open a large position with a small amount of capital. With a margin of 5%, you can leverage your capital by 20x. This means that you can initiate a trade 20x the amount of your capital. - Bi-Directional

Allows you the flexibility to trade in both directions (long and short) to take advantage of the ups and downs of the market. - High Liquidity

Given the sheer size of the market, you can buy/sell at any time at favourable prices and liquidity.

How Much Do I Need to Start Trading Forex?

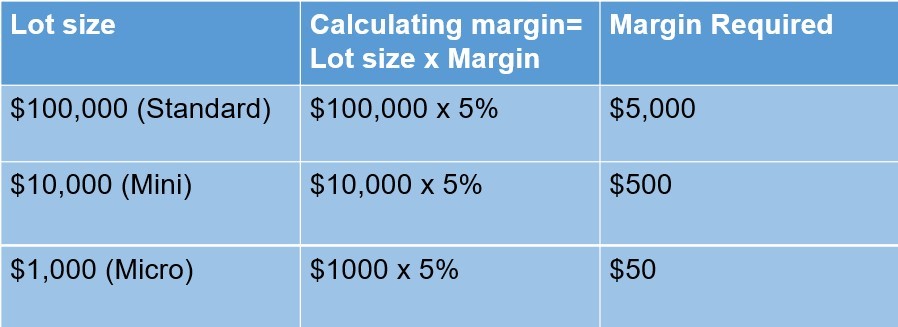

As forex is traded on a 5% margin, the capital required to initiate a trade is only 5% of the position size. The computation of capital required is elaborated in the table below.

What are the Costs Involved to Trade Forex?

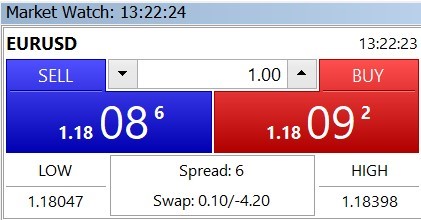

Aside from the spreads mentioned earlier, swap is the other cost t. while trading forex. Swap is the cost incurred for holding a position from one day to the next, factoring in your financing/borrowing charges. Swap rates vary and can be found on the Phillip MetaTrader 5 (MT5) trading platform.

Trade Forex on Phillip MetaTrader 5 (MT5).

Trade Forex at zero commission on Phillip MetaTrader 5, a dynamic platform that offers low spreads. Integrated with Acuity’s Signal Centre and Trading Central Indicators, and available on mobile and desktop app, you will never miss a trading opportunity with Phillip MT5.

Download Trading Central’s Market Buzz for updates on more topics.

What’s more? Phillip MT5 is now supported on Mac OS! To install, simply download the file below and complete a simple installation process.