EURUSD

Bias: Bullish

We look to Buy at 1.1055 with target prices of 1.1295 and 1.1325, and a stop price of 1.0953

Confidence: 20%

Technical Analysis

- The trend of lower intraday highs has also been broken

- This is positive for sentiment and the uptrend has potential to return

- Previous resistance at 1.1050 now becomes support

- Dip buying offers good risk/reward

GBPUSD

Bias: Bearish

We look to Sell at 1.3200 with target prices of 1.2900 and 1.2800, and a stop price of 1.3320

Confidence: 60%

Technical Analysis

- Although the bulls are in control, the stalling positive momentum indicates a turnaround is possible

- A Doji style candle has been posted from the high

- This is negative for sentiment and the downtrend has potential to return

- Preferred trade is to sell into rallies

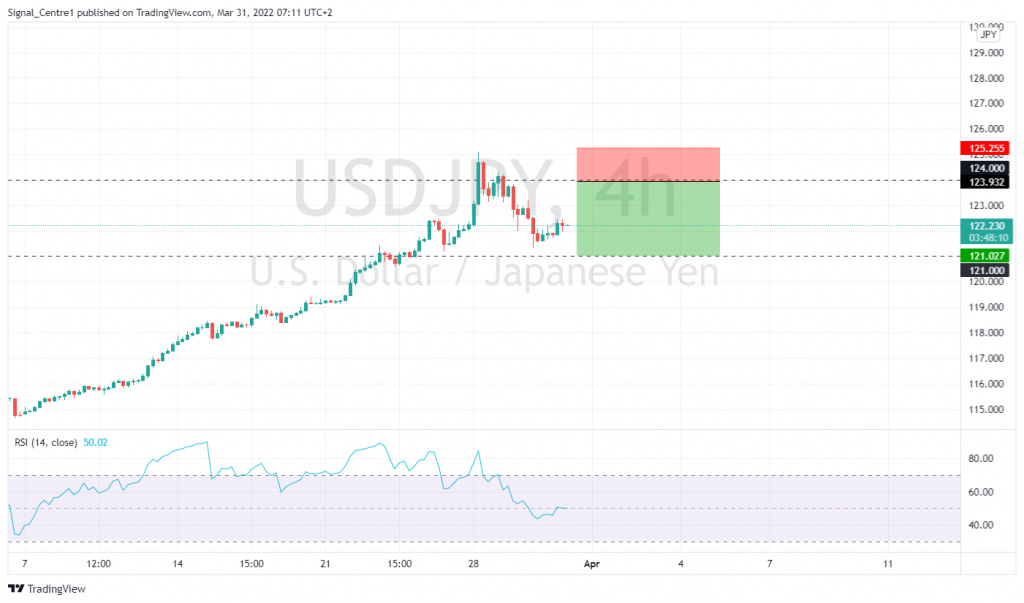

USDJPY

Bias: Bearish

We look to Sell at 123.93 with target prices of 121.02 and 120.80, and a stop price of 125.25

Confidence: 20%

Technical Analysis

- Following yesterday’s bearish candle, the overall trend lower looks set to continue today

- There is scope for mild buying at the open but gains should be limited

- Rallies should be capped by yesterday’s high

- Preferred trade is to sell into rallies

- Although the anticipated move lower is corrective, it does offer ample risk/reward today

GOLD

Bias: Bearish

We look to Sell at 1937 with target prices of 1880 and 1860, and a stop price of 1962

Confidence: 40%

Technical Analysis

- Our outlook is bearish

- The trend of lower highs is located at 1940

- We look to sell rallies

- Further downside is expected

GER40

Bias: Bullish

We look to Buy at 14474 with target prices of 14674 and 14714, and a stop price of 14394

Confidence: 40%

Technical Analysis

- Short term bias is bullish

- There is no clear indication that the upward move is coming to an end

- 50 4hour EMA is at 14460

- We look to buy dips

AUDUSD

Bias: Bullish

We look to Buy at 0.7410 with target prices of 0.7535 and 0.7555, and a stop price of 0.7365

Confidence: 60%

Technical Analysis

- Daily signals for sentiment are at overbought extremes

- The current move lower is expected to continue

- The bias is still for higher levels and we look for any dips to be limited

- We therefore, prefer to fade into the dip with a tight stop in anticipation of a move back higher

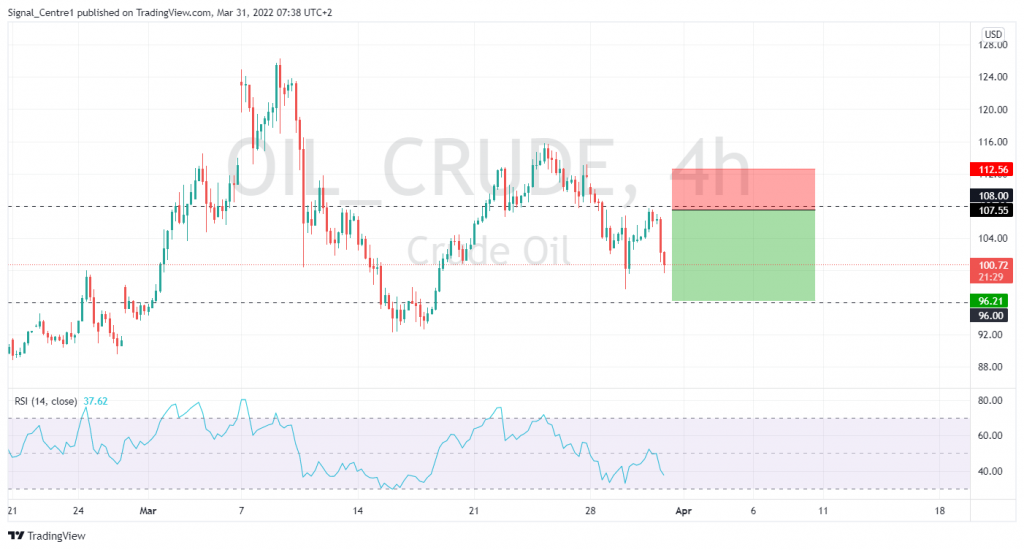

WTI

Bias: Bearish

We look to Sell at 107.55 with target prices of 96.21 and 92.00, and a stop price of 112.56

Confidence: 20%

Technical Analysis

- TThe trend of lower highs is located at 108.00

- This is negative for sentiment and the downtrend has potential to return

- There is scope for mild buying at the open but gains should be limited

- We look to sell rallies

Trading ideas at a glance.

Download the Acuity Signal Center plugin.

The Acuity Signal Centre combines experienced, human-led analysis with powerful AI technology to conduct deep analyses of the markets whilst drawing on professional trading expertise to deliver transparent trade ideas that support novice and advanced traders alike.

- Clear Calls to Action

Each trade idea consists of clear target levels, confidence ratings, and continuous updates

- Transparent Strategies

Every trade idea is generated by a team of expert analysts and is accompanied by the strategies behind them

- Performance Monitoring

The performance of every signal is monitored and translated into the confidence rating of each new signal