EURUSD

Bias: Bearish

We look to Sell at 1.1093 with target prices of 1.0967 and 1.0950, and a stop price of 1.1150

Confidence: 80%

Technical Analysis

- Previous resistance located at 1.1100

- We look for a temporary move higher

- Resistance could prove difficult to breakdown

- Preferred trade is to sell into rallies

GBPUSD

Bias: Bearish

We look to Sell at 1.3335 with target prices of 1.3170 and 1.3000, and a stop price of 1.3395

Confidence: 80%

Technical Analysis

- Buying pressure from 1.3157 resulted in prices rejecting the dip

- Trading within a Bullish Channel formation

- Our expectation now is for this swing higher to continue towards the top of the trend channel, to complete a correction before sellers return

- Preferred trade is to sell into rallies

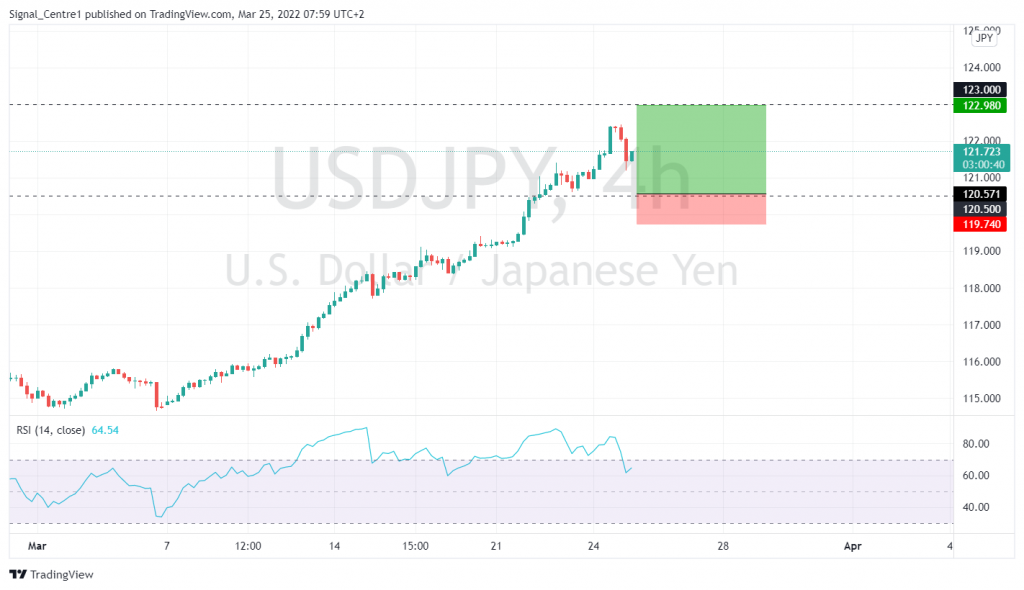

USDJPY

Bias: Bullish

We look to Buy at 120.57 with target prices of 122.98 and 123.25, and a stop price of 119.74

Confidence: 100%

Technical Analysis

- The medium term bias remains bullish

- We can see no technical reason for a change of trend

- Dip buying offers good risk/reward

- Further upside is expected

GOLD

Bias: Bearish

We look to Sell at 1967 with target prices of 1901 and 1875, and a stop price of 1995

Confidence: 40%

Technical Analysis

- Following yesterday’s bullish candle, the overall trend higher looks set to reverse today

- Bespoke resistance is located at 1970

- Resistance could prove difficult to breakdown

- Selling spikes offers good risk/reward

GER40

Bias: Bearish

We look to Sell a break of 14178 with target prices of 13931 and 13841, and a stop price of 14276

Confidence: 60%

Technical Analysis

- Daily signals are bearish

- A break of yesterdays low would confirm bearish momentum

- 50 4hour EMA is at 14230

- The bearish engulfing candle on the daily chart is negative for sentiment

AUDUSD

Bias: Bearish

We look to Sell at 0.7555 with target prices of 0.7315 and 0.7260, and a stop price of 0.7640

Confidence: 60%

Technical Analysis

- Although the bulls are in control, the stalling positive momentum indicates a turnaround is possible

- Daily signals for sentiment are at overbought extremes

- This is negative for short term sentiment and we look to set shorts at good risk/reward levels for a further correction lower

- Previous resistance located at 0.7555

- Preferred trade is to sell into rallies

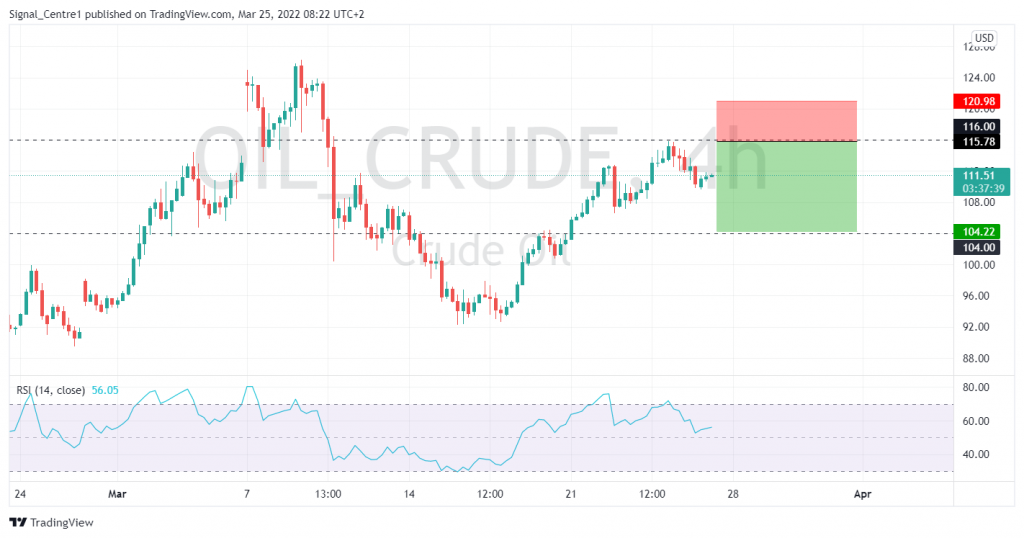

WTI

Bias: Bearish

We look to Sell at 115.78 with target prices of 104.22 and 102.50, and a stop price of 120.98

Confidence: 40%

Technical Analysis

- Following yesterday’s bearish candle, the overall trend lower looks set to continue today

- There is scope for mild buying at the open but gains should be limited

- Resistance is located at 116.00 and should cap gains to this area

- Preferred trade is to sell into rallies

Trading ideas at a glance.

Download the Acuity Signal Center plugin.

The Acuity Signal Centre combines experienced, human-led analysis with powerful AI technology to conduct deep analyses of the markets whilst drawing on professional trading expertise to deliver transparent trade ideas that support novice and advanced traders alike.

- Clear Calls to Action

Each trade idea consists of clear target levels, confidence ratings, and continuous updates

- Transparent Strategies

Every trade idea is generated by a team of expert analysts and is accompanied by the strategies behind them

- Performance Monitoring

The performance of every signal is monitored and translated into the confidence rating of each new signal