EURUSD

Bias: Bearish

We look to Sell at 1.1293 with target prices of 1.1153 and 1.1125, and a stop price of 1.1358

Confidence: 60%

Technical Analysis

- Following yesterday’s bearish candle, the overall trend lower looks set to continue today

- Neckline resistance 1.1300

- A mild correction has been posted from yesterdays low, this is seen as a retest of the breakout level

- Further downside is expected although we prefer to sell into rallies close to the 1.1300 level

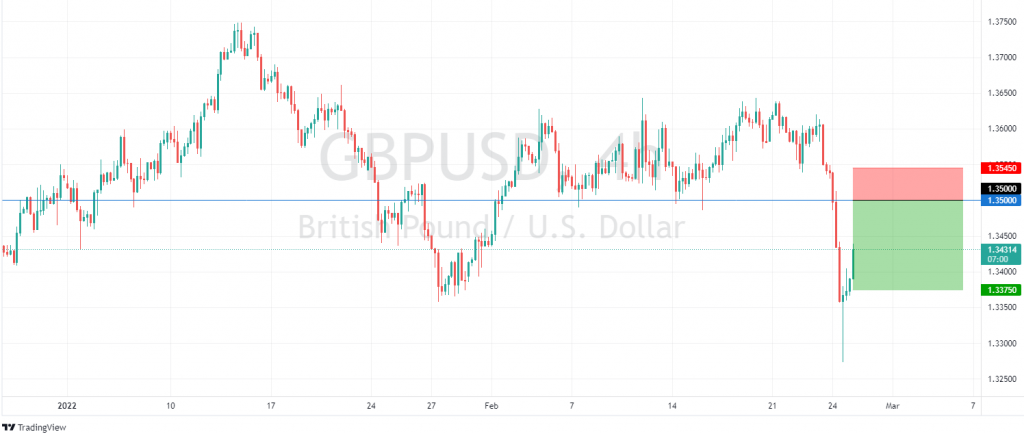

GBPUSD

Bias: Bearish

We look to Sell at 1.3500 with target prices of 1.3375 and 1.3300, and a stop price of 1.3545

Confidence: 40%

Technical Analysis

- Buying pressure from 1.3273 resulted in prices rejecting the dip

- The current move higher is expected to continue

- The bias is still for lower levels and we look for any gains to be limited

- Preferred trade is to sell into rallies

USDJPY

Bias: Bearish

We look to Sell at 115.45 with target prices of 114.51 and 114.25, and a stop price of 115.87

Confidence: 20%

Technical Analysis

- A bearish Head and Shoulders is forming

- This is negative for sentiment and the downtrend has potential to return

- Further downside is expected

- We look to sell rallies

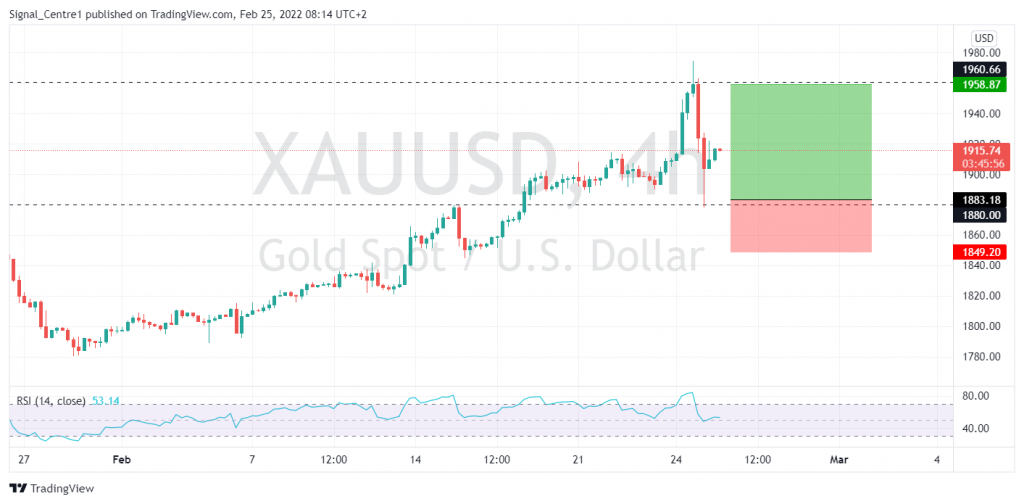

GOLD

Bias: Bullish

We look to Buy at 1883 with target prices of 1958 and 1980, and a stop price of 1849

Confidence: 100%

Technical Analysis

- The primary trend remains bullish

- Although we remain bullish overall, a correction is possible with plenty of room to move lower without impacting the trend higher

- Dip buying offers good risk/reward

- Further upside is expected although we prefer to buy into dips close to the 1880 level

GER40

Bias: Bearish

We look to Sell a break of 14197 with target prices of 13951 and 13901, and a stop price of 14294

Confidence: 40%

Technical Analysis

- Daily signals are bearish

- There is no clear indication that the downward move is coming to an end

- Previous support at 14300 now becomes resistance

- A break of the recent low at 14220 should result in a further move lower

AUDUSD

Bias: Bearish

We look to Sell at 0.7246 with target prices of 0.7127 and 0.7100, and a stop price of 0.7299

Confidence: 60%

Technical Analysis

- Following yesterday’s bearish candle, the overall trend lower looks set to continue today

- We look for a temporary move higher

- Rallies should be capped by yesterday’s high

- Preferred trade is to sell into rallies

WTI

Bias: Bearish

We look to Sell at 97.79 with target prices of 90.10 and 89.50, and a stop price of 101.26

Confidence: 20%

Technical Analysis

- The primary trend remains bullish

- Although we remain bullish overall, a correction is possible with plenty of room to move lower without impacting the trend higher

- A lower correction is expected

- Selling spikes offers good risk/reward

- Although the anticipated move lower is corrective, it does offer ample risk/reward today