EURUSD

Bias: Bullish

We look to Buy at 1.0954 with target prices of 1.1195 and 1.1225, and a stop price of 1.0842

Confidence: 20%

Technical Analysis

- Short term indicators have turned positive

- This is positive for sentiment and the uptrend has potential to return

- Dip buying offers good risk/reward

- Further upside is expected although we prefer to buy into dips close to the 1.0950 level

GBPUSD

Bias: Bearish

We look to Sell at 1.3290 with target prices of 1.3090 and 1.3000, and a stop price of 1.3360

Confidence: 60%

Technical Analysis

- We are trading at overbought extremes

- A Doji style candle has been posted from the high

- This is negative for sentiment and the downtrend has potential to return

- We look to sell rallies

USDJPY

Bias: Bearish

We look to Sell at 116.45 with target prices of 115.52 and 115.25, and a stop price of 116.82

Confidence: 20%

Technical Analysis

- Prices have continued the bullish move higher and resulted in 3 consecutive positive days

- This has resulted in signals for sentiment being at overbought extremes and we look for a move to the downside

- A move higher faces tough resistance and we remain cautious on upside potential

- Preferred trade is to sell into rallies

GOLD

Bias: Bearish

We look to Sell at 2008 with target prices of 1940 and 1920, and a stop price of 2041

Confidence: 20%

Technical Analysis

- Although we remain bullish overall, a correction is possible with plenty of room to move lower without impacting the trend higher

- A bearish Head and Shoulders is forming

- Further downside is expected and we prefer to set shorts in early trade

- Although the anticipated move lower is corrective, it does offer ample risk/reward today

- Preferred trade is to sell into rallies

GER40

Bias: Bearish

We look to Sell at 14078 with target prices of 13802 and 13702, and a stop price of 14191

Confidence: 60%

Technical Analysis

- Daily signals are bearish

- Bespoke resistance is located at 14100

- Trading close to the psychological 14000 level

- We look for a temporary move higher

- Early optimism is likely to lead to gains although extended attempts higher are expected to fail

- 20 1day EMA is at 14000

AUDUSD

Bias: Bullish

We look to Buy at 0.7254 with target prices of 0.7398 and 0.7425, and a stop price of 0.7198

Confidence: 60%

Technical Analysis

- Buying pressure from 0.7250 resulted in prices rejecting the dip

- This is positive for sentiment and the uptrend has potential to return

- Our bias remains bullish and further upside is expected to target resistance at 0.7400

- Dip buying offers good risk/reward

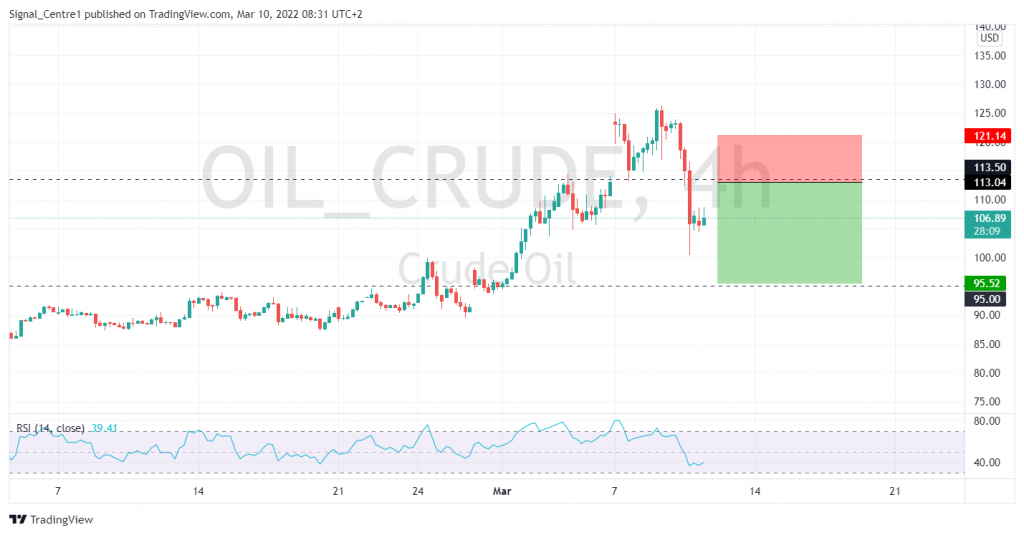

WTI

Bias: Bearish

We look to Sell at 113.04 with target prices of 95.52 and 95.00, and a stop price of 121.14

Confidence: 20%

Technical Analysis

- Although we remain bullish overall, a correction is possible with plenty of room to move lower without impacting the trend higher

- A lower correction is expected

- Preferred trade is to sell into rallies

- Further downside is expected