作者:Phillip Nova 销售总监 Eric Lee

Imagine trying to boost a car’s speed by pressing the gas pedal, but the brakes are firmly on too. That’s kind of what had been happening in China’s stock market until last Tuesday, 24日 September 2024.

Rate Cuts: The Gas Pedal

A bit of exciting news hit the market recently—China is slashing interest rates and cutting the banks’ reserve ratio to try to inject some life into its economy. In simpler terms, they’re making it easier and cheaper for businesses and people to borrow money. Historically, this move would have sent the stock market flying. But since 2021, these moves hadn’t work so well. Why? Because of one major roadblock: the real estate sector.

China’s real estate market has been wobbling like a teetering Jenga tower. One of the biggest culprits? Evergrande, a colossal real estate developer, defaulted on its debt, causing a ripple effect throughout the economy. The stock market, especially the China A50, has become more closely tied to property prices than ever before. So, until the real estate sector gets its act together, those rate cuts might not have the same punch.

New Policies: More Pedal, But Brakes Still On

Wait, there’s more! On 24日 September, China introduced a laundry list of policies to further boost its economy. Here are the key points:

- Reduced reserve requirements for banks

- Cut mortgage interest rates

- Lowered down-payments for second home buyers

- Encouraged state-owned firms to buy unsold flats

Their goal? Kickstart the economy, and more importantly, jumpstart the stock market. But will these moves be enough to overcome the drag of the real estate market?

Copper: The Market’s Secret Weapon

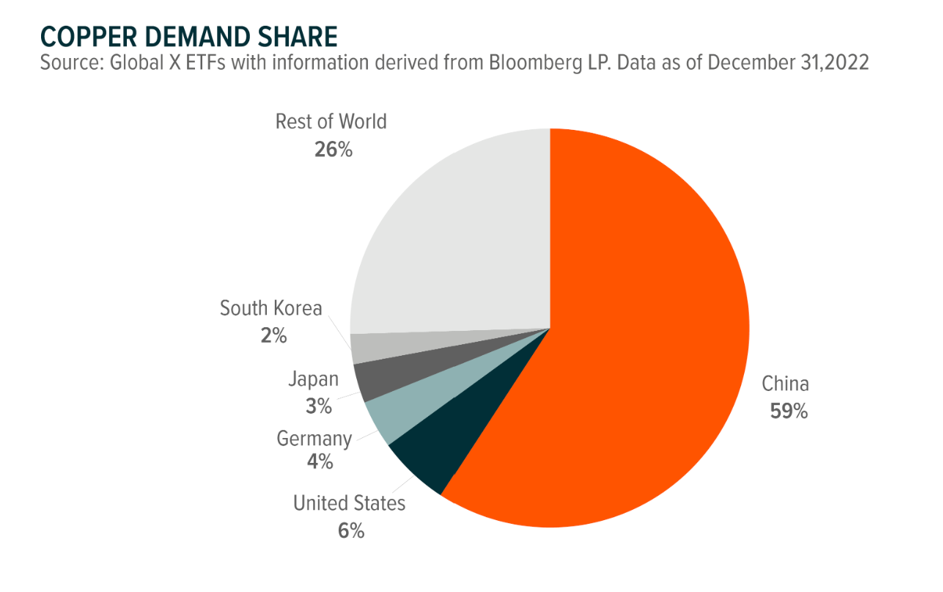

Now, if you want to go deeper than interest rates and bank policies, here’s a suggestion: keep an eye on copper. Yes, copper. It’s more than just a metal for wiring—it’s the lifeblood of construction and manufacturing. Guess what? China alone consumes 60% of the world’s copper. That’s right, 60%! No copper, no buildings, and no bustling economy.

Because of this, copper prices are often used by the investing community as a proxy for China’s economic health. If copper prices are rising, it’s a sign that China’s industrial activity is picking up—and that’s usually a good sign for the stock market too.

A Technical Approach: Copper and China A50

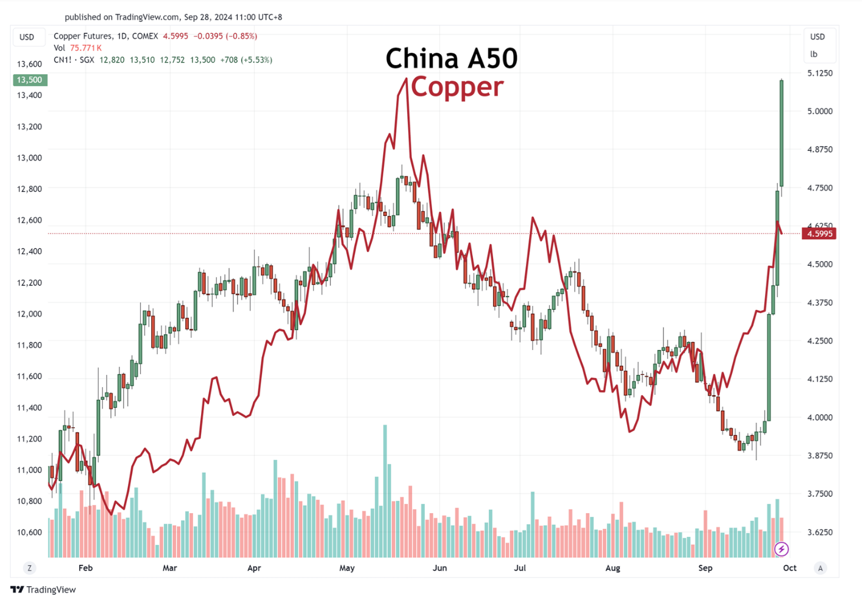

Let’s go one step further and look at how we can use copper to get an edge in the stock market. By overlaying the price of Comex Copper Futures with the SGX FTSE China A50 Index Futures, traders can apply technical analysis—like spotting trends or price divergences. When copper breaks a resistance level or shows a trend reversal, it might be time to consider a trade in the China A50.

Think of copper as the coffee fuelling the construction workers. No copper? No buildings, no economic growth. And that’s why traders keep a close eye on it—because it’s a real-time indicator of what might happen in the Chinese stock market.

结论:

China’s economy is like a complex puzzle, with many moving pieces. If you want to stay ahead, don’t just focus on government policy. Keep an eye on the real estate sector and the price of copper—these are the clues that can help you anticipate what’s next for the stock/futures market. Will China’s new policies be enough to revive its struggling market? Time (and copper prices) will tell!

Both COMEX Copper Futures and SGX FTSE China A50 Index Futures are available for trading on Phillip Nova 2.0.

Try a Phillip Nova 2.0 or Phillip MT5 demo now

Eric Lee 即将举办的网络研讨会

Want more insights from Eric Lee, do not miss his upcoming webinar on Tuesday, 29 October 2024 在 Institutional Insights: Mastering Singapore Stocks with Smart Money Strategies. In this strategy webinar, Eric will share how we can make use of the information of institutional fund flow to navigate the Singapore stock market. Don’t miss his insights, register 此处.

Eric Lee 的增值服务

我的客户受益于我的服务,包括单位信托和股票的投资咨询、基于我过去 20 年在市场中的个人知识和经验的投资见解。

Periodically, I will be send out market analysis to my clients, as well as alerting them of support and resistance levels for the technical indicators which I am utilising on a chart. Click on the button at the bottom if you would like to arrange for a One-to-One Coaching session to learn more about trading futures, forex, stocks and more, and how you can benefit from the services I provide.

Eric Lee 是 Phillip Nova 的销售总监。凭借在期货、外汇、股票和单位信托方面的专业知识,Eric 是一位全方位的顾问。无需花时间梳理无穷无尽的信息,即可做出明智的交易决策,因为 Eric 可以通过 WhatsApp 随时为客户提供交易警报和见解。凭借多年的经验,Eric 在交易和投资方面制定了系统化的策略。预订下面的免费辅导课程,以利用他的专业知识,因为他传授他的知识来改善您的交易之旅。

- 立即开户

- 免费 Phillip Nova 模拟账户

- 免费 Phillip MT5 模拟账户

*适用条款和条件,请联系下方的 Eric 了解更多信息。