Pre-elections analysis courtesy of Eurex

With the German elections coming up on 23 Feb 2025, we will deep dive into the actions taken by the German government and review its potential impact on Europe’s political stability and economic landscape.

德国

1.1 Political system

Germany is a federal parliamentary republic consisting five “constitutional bodies”, their

responsiblities include but not limited to:

- Bundestag and Bundesrat: Responsible for legislation (legislative)

- Federal Constitutional Court: Supreme court decisions (judicial)

- Federal President: Head of state, representing 16 states1. Represents Federal Republic of Germany both at home and abroad, proposes Chancellor, appoints/dismisses Chancellor, dissolves the Bundestag2.

- Federal Cabinet: Consists of the Chancellor and Federal Ministers

- Chancellor: Has the right to form the Cabinet, choose ministers, make proposal binding

with the Federal Government and determines general guidelines of government policies. - Federal ministers: Conduct their affairs autonomously following the Chancellor’s

guidelines.

- Chancellor: Has the right to form the Cabinet, choose ministers, make proposal binding

Election

- President is elected every 5 years by Federal Convention.

- Federal election is held every 4 years. Electoral law combined principles of majority voting and proportional representation, which each voter has two votes:

- Individual constituency candidate out of 299 constituencies

- Party-list in a particular state (Land)

- State election is held every 5 years.

1.2 Major Political Parties and their relationship with the Chancellor

| BSW (Leftist to far-left) |

Left Party (Leftist) |

Social Democratic Party of Germany (SPD) (Centre-left) | Alliance 90/The Greens (Greens) (Centre-left) |

Free Democratic Party (FDP) (Centre-right) |

Christian Democratic Union (CDU) (Centre-right) |

Alternative for Germany (AfD) (Far-right) |

People in leadership positions

- President of Germany: Frank-Walter Steinmeier (Feb 12 2017 – Present)

- Previous President of Germany: Joachim Gauck (Mar 18 2012 – Mar 18 2017)

- Current Chancellor: Olaf Scholz (Dec 8 2021 – Present)

- Previous Chancellor: Angel Merkel (Nov 22 2005 – Dec 8 2021)

Federal Cabinet – “Traffic Light Coalition”

- Three-way coalition in Scholz’s cabinet since German Federal Election in Dec 2021

- Composed by Social Democratic Party (SPD; 206/736 seats), Allliances 90/The Greens (Greens; 118/736 seats) and Free Democratic Party (FDP; 91/736 seats)

- Coalition agreement: Pursue climate protection with innovative economic growth

- Cabinet consists of Chancellor Scholz and 16 federal ministers (as of Nov 7 2024)

Disagreements within the coalition

With SPD and Greens as centre-left and FDP as centre-right, disagreements developed within the coalition since 2022, especially making budgeting decisions amid economic crisis in 2024.

FDP advocated for reducing budget on climate protection, while SPD and Greens proposed to raise public debt for economic expansion. Both the Greens and FDP released their proposals without consultation from the alliance members, which destabilized the coalition.

On Nov 7 2024, the coalition collapsed after Christian Lindner from FDP was dismissed by Chancellor Scholz, with his party members leaving the cabinet/declaring independence:

- FDP (4) → Independent (2)

- Christian Lindner (Finance; dismissed on Nov 7 2024)

- Marco Buschmann (Justice; resigned on Nov 7 2024)

- Volker Wissing (Digital and Transport; independent + Justice since Nov 7 2024)

- Bettina Stark-Watzinger (Education and Research; resigned)

|

Old |

SPD (7) | Greens (5) | FDP (4) |

| (新推出) | SPD (8) | Greens (6) | Independent (2) |

1.3 Economic Situation

- Germany faces several structural problems that led to stagnation, including high labour and energy costs, tax burdens, geopolitical uncertainties, excessive bureaucracy and decline in domestic and foreign demands.

- International Money Fund (IMF) ranked Germany as 39th in growth among 41 advanced economies.

- Main economic activities encounter significant challenges:

- Automobile industry: Main exports reduced due to China’s competition. Volkswagen (VW), the largest German manufacturer, has considered closing its factories in its home country for the first time in its 87-year history.

- Energy-intensive business: Suffered from energy crisis from Russian-Ukraine crisis

- 4Q24 GDP growth: -0.2%

- CPI 2024 YoY: +2.5%

- Probability of Recession: 52.5% (from Bloomberg ECFC)

2.4 Important Timeline

- Sep 1 and 22 2024 Traffic Light Coalition lost their main stakes in 3 state elections

- Thuringia (Sep 1): SPD had their worst result since post-war period (6/88 seats)

- Saxony (Sep 1): Greens lost 8 seats compared with 2019 state election

- Brandenburg (Sep 22): Greens and FDP lost all their seats

- In all three states, far-right Alternative for Germany (AfD) and left-wing BSW led in the elections.

- Oct 23 2024 Robert Habeck proposed debt-backed investment boost

- Nov 1 2024 Christian Lindner issued a new economic policy paper

- Nov 7 2024 Scholz dismissed FDP Finance Minister Christian Lindner; Traffic Light Coalition collapsed

- Dec 16 2024 Scholz lost a vote of confidence and requested Steinmeier to dissolve the Bundestag

- Feb 23 2025 Snap Federal Election

1.5 Impact on Eurex Derivatives

1)Equity Index

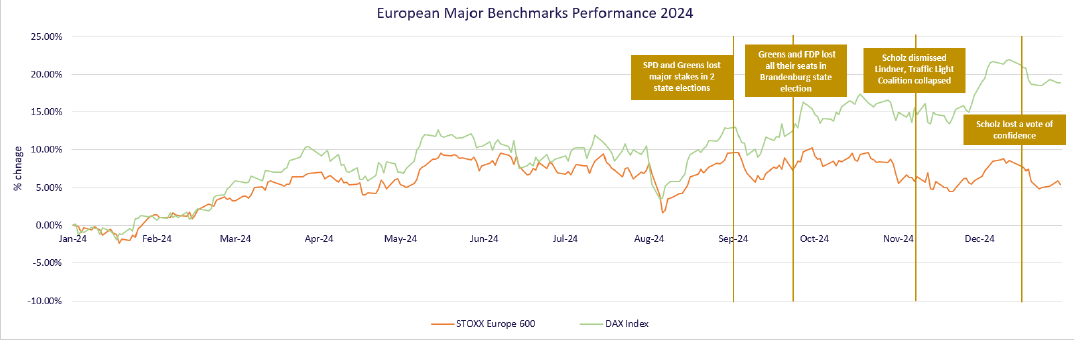

Despite economic and political concerns in France and Germany, STOXX Europe 600 rose 5.97% in 2024 with FIG sectors as the top winners (Banks +26.0%, Insurance +18.2%), driven by high capital ratios and stronger earnings from lower lending costs8. Auto&Parts was the biggest laggard (-12.17%), with slower EV development in EU, higher energy prices and weak economic growth. Data released in Sep 2024 shows that EU car registeration dropped 18.3% YoY compared with Aug 20239.

Both STOXX Europe 600 and DAX Index slid on the day that Scholz lost a vote of confidence.

a) Benchmark Annual % Change:

- STOXX Europe 600 (+5.97%)

- DAX Index (+18.85%)

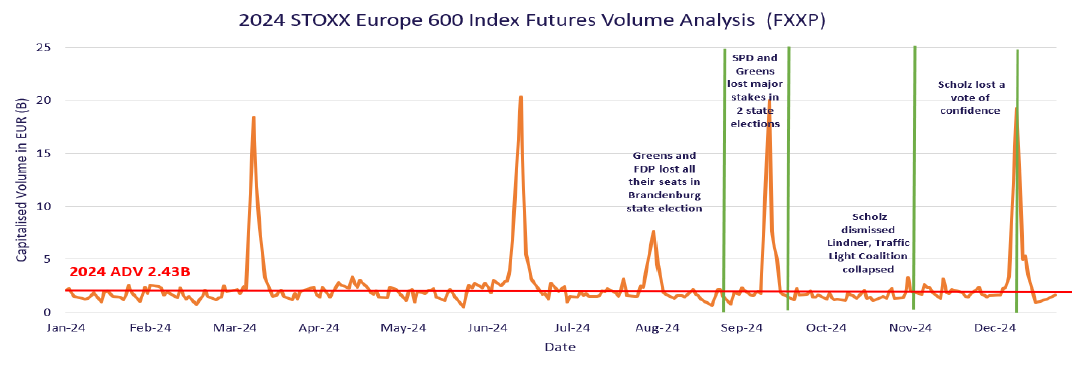

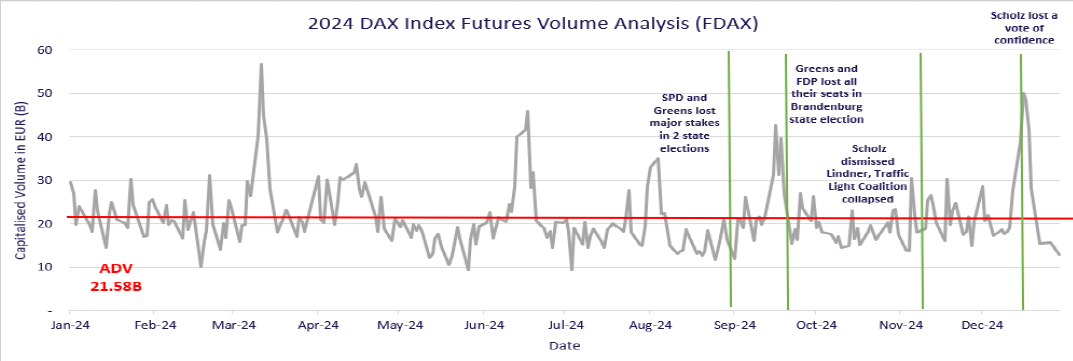

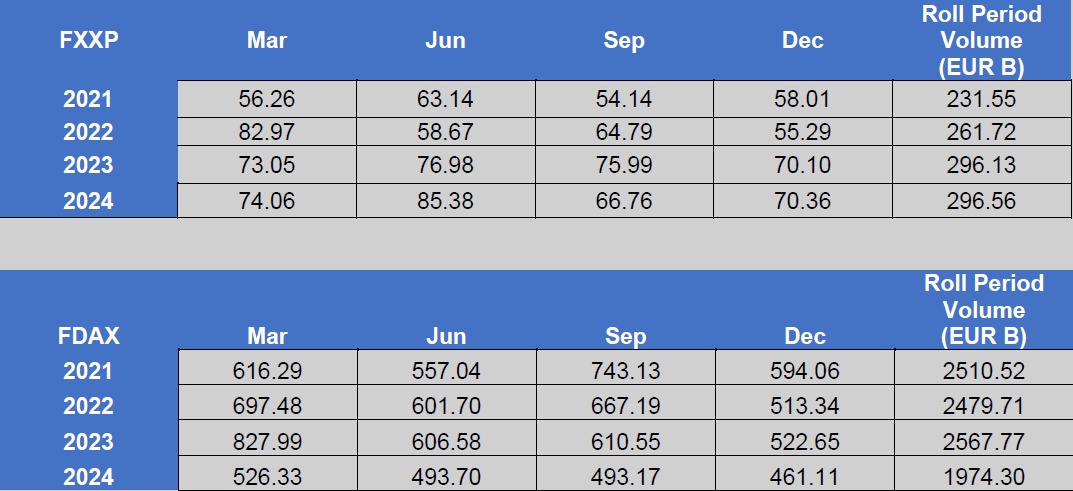

b) 2024 Eurex Product Volume (EUR) – STOXX Europe 600 Index Futures (FXXP) and DAX Index Futures (FDAX)

c) Eurex Product Volume (EUR, 2021 – 2024 Roll Period)10 – STOXX Europe 600 Index Futures (FXXP) and DAX Index Futures (FDAX)

Compared with FI products, Eurex EQI trading volume was seen to be more independent with political activities.

2) Volatility

2024 has been a volatile year for European markets. With political turmoil in France and Germany, economic contraction and intensified geopolitical tensions between Israel and Palestine, Iraq and Lebanon, and Russian-Ukraine War.

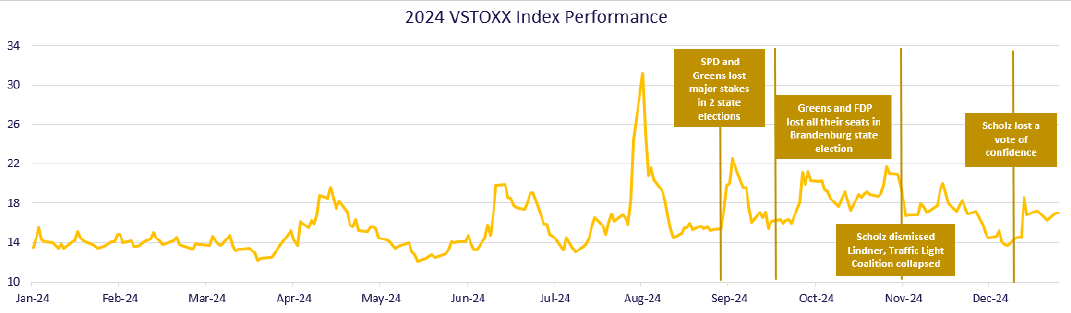

a) Benchmark Annual % Change: VSTOXX Index (+25.3%)

Volatility spiked up after Scholz lost a vote of confidence.

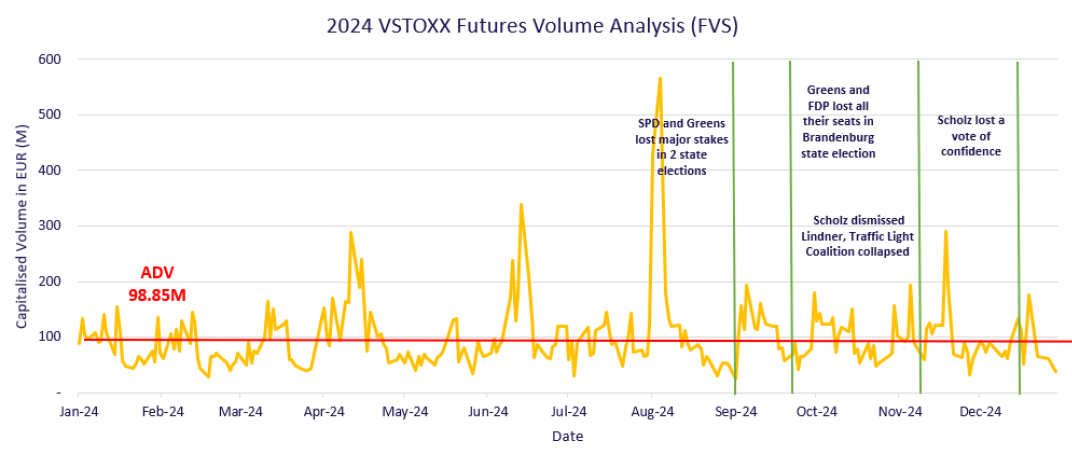

b) 2024 Eurex Product Volume – VSTOXX Futures

3) Rates

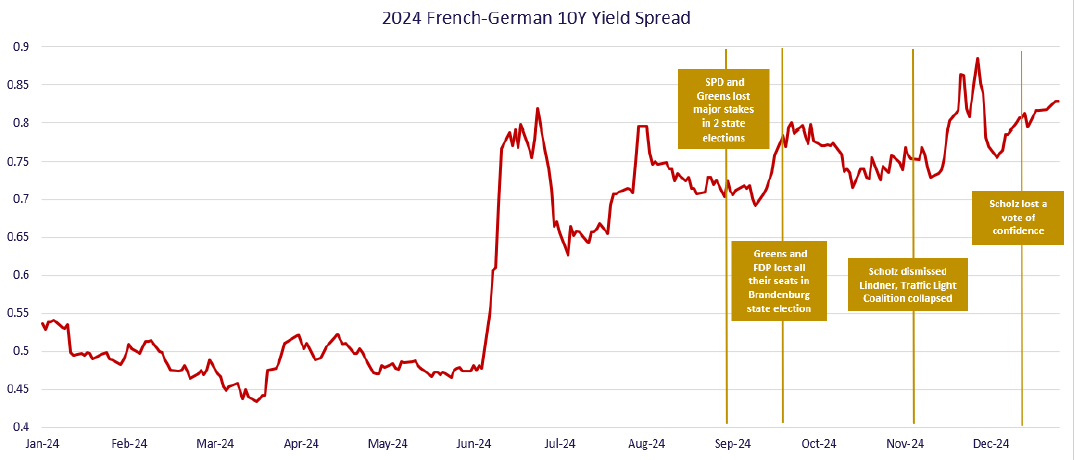

a) Benchmark Annual % Change – French-German 10Y Yield Spread (+56.2%)

Similarly, the 10Y treasury yield widened when Scholz lost the vote of confidence.

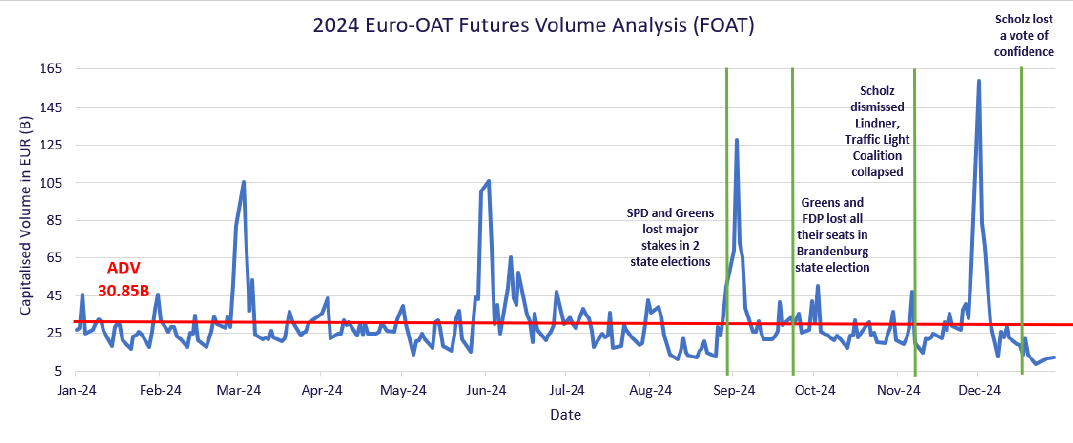

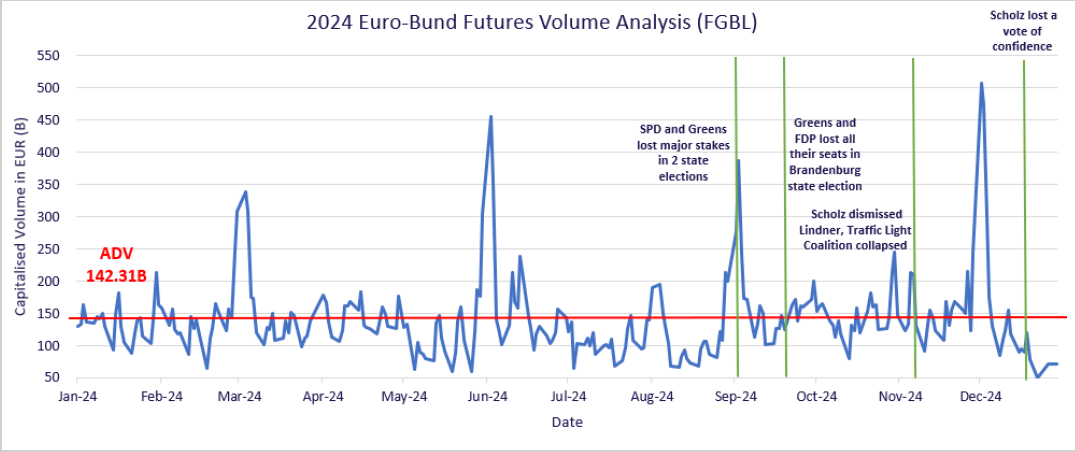

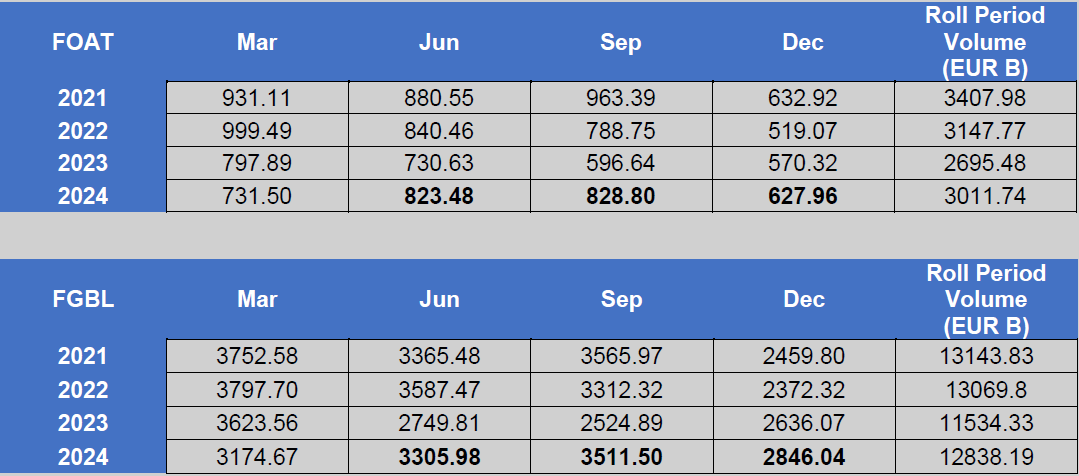

b) 2024 Eurex Product Volume – Euro-OAT and Euro-Bund Futures

c) Eurex Product Volume (EUR, 2021 – 2024 Roll Period)12 – Euro-OAT Futures (FOAT) and Euro-Bund Futures (FGBL)

Compared with 2023, FI Products have more significant growth in trading volume during June, September and December, where the major political events in Germany took place, such as coalition’s failure in state elections, collapse of coalition and Scholz’s loss of confidence vote.

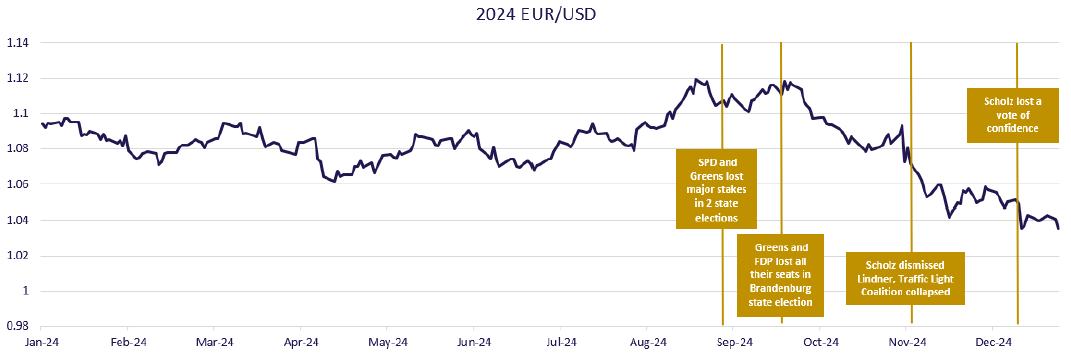

4)FX

In addition to the France’s collapse, collapse of Traffic Light Coalition and Scholz’s loss of confidence vote contributed to the slump in EUR/USD pair.

a) Benchmark Annual % Change – EURUSD Cross (-6.21%)

1.6 Future

- Snap Federal Election on Feb 23 2025

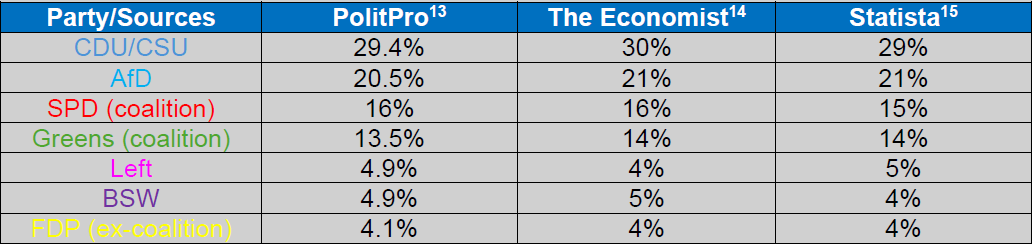

- Current poll

Recent polls show that the current coalition might not stay in the office. Established parties, including former coalition member FDP, risk falling below Bundestag’s 5% threshold to win seats and enter the parliament.

- Current poll

-

- Possible coalitions (ranked according to likelihood)

Two-party coalition: Despite far-right AfD has 96% of winning sufficient seats to join the coalition as the majority. Yet, with central-right CDU/CSU as the leading party, it might build up firewall against AfD. Based on the current poll, a coherent two-party coalition e.g. centre-right pairing CDU/CSU and FDP, or left-leaning SPD- Greens union are unlikely to become the majority.

- Possible coalitions (ranked according to likelihood)

- CDU/CSU (centre-right) + SPD (centre-left)

- Enabling “grand coalition”: arrangement favoured by Angela Merkel

- CDU/CSU (centre-right) + Greens (Centre-left)

Three-party coalition:

Around 9% chance three-party coalition will be formed again (CDU/CSU, SPD and BSW). Yet, it is less possible that BSW could get enough votes to secure at seat at the parliament.

- Expected Zero Real GDP Growth

Survey conducted by German Chamber of Industry and Commerce (DIHK), with responses from 25,000 companies, shows economic pessimism in 2025. DIHK lowered their forecast to at best “zero growth”, possibly the third consecutive year without real GDP growth. - Possible reevaluation on de-risking policies in China

In 2024, Greens emphasized the importance of de-risking from China by limiting exposure to Chinese goods and services. Yet, German businesses have been continuously increase their investment there as China’s largest trading partner among EU member states. The new cabinet could impact the future export and import policies towards China, gradually the Germany’s GDP growth in 202516.

1.7 Appendix

More info on the Federal Budget Discussion for 2025

During the budget discussion for 2025, members in the coalition expressed splitted view.

- Robert Habeck (Economics Affairs and Climate Action)

On Oct 23 2024, Habeck proposed a new debt-backed investment fund to encourage more business investment, including:

- Companies receiving 10% of their investments through tax deduction/reimbursement

- Financed by new debt17

Yet, Greens did not negotiate with SPD and FDP before release of the proposal, which triggered debates in the coalition. At the same time, the plan would be incompatible with Germany’s debt brake policy (debt limit), which limits the budget deficit to 0.35% of GDP.

- Christian Lindner (Finance)

On Nov 1 2024, Lindner Issued a 18-page new economic policy paper – “Economic transition for Germany – economic concepts for growth and intergenerational fairness”, including18:

- Delay emission reduction target, including climate friendly heating, and abandons ambitious national climate targets (Greenhouse gas neutrality by 2045) and pushes back climate target to EU’s 2050.

- Call for EU-wide corporate emission reporting regulations abolishment

- Dissolve Germany’s climate fund that supports financing in green transition projects

- Strongly oppose the suspending of debt brake regulations

- New tax cut

- Cut public spending

Similarly, the policy paper19 was released without consultation from the alliance members, which was seen as further destablizing the already weakened coalition. On Nov 7 2024, the coalition collapsed after Scholz requested Steinmeier to dismiss Lindner.

Take a view on the Micro DAX and the Micro EURO STOXX 50 Now!

以 1.50 欧元的价格交易 Micro-DAX® 和 Micro-EURO STOXX 50® 期货*。了解更多 立即开户。.

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals, and Stocks with Phillip Nova 2.0

Features of trading on Phillip Nova 2.0

- 访问 20 多个全球交易所

从 20 多个全球交易所的 200 多个全球期货中捕捉机会

- 全球股票的交易机会

Over 11,000 Stocks and ETFs across Singapore, US, China, Hong Kong, Malaysia and Japan markets.

- Charting Powered by TradingView

View live charts and gain access to over 100 technical indicators

- True Multi-Asset Trading

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals and Stocks on a single ledger on Phillip Nova 2.0