作者:Phillip Nova 销售总监 Eric Lee

Every week, various U.S. based market participants report their futures and options positions to the Commodity Futures Trading Commission (CFTC). This information is published every Friday in the Commitment of Traders (COT) report, which can be a valuable resource for retail traders seeking to understand market trends, especially in the commodities market like gold.

The futures market is largely dominated by institutional players, often referred to as “big whales.” By closely monitoring what these institutions are trading, retail traders can gain insights into underlying market trends, potentially improving their trading strategies.

In today’s article, we delve into the activities of a specific group of traders known as commercial traders. But who exactly are these commercial traders? This group comprises producers, merchants, processors, and end-users—essentially companies that need to buy, sell, or stockpile commodities as part of their business operations. These companies often hedge against price fluctuations in their inventories or increase their holdings when they believe the market is mispricing the commodity based on their business outlook.

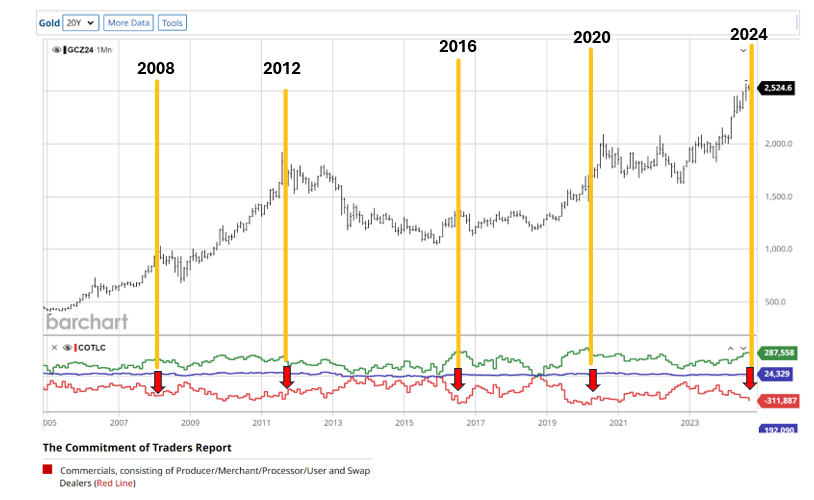

When commercial traders hold long or short positions that deviate significantly from historical norms, they can tip the supply-demand balance, leading to trend reversals in prices. As shown in the COT chart from barchart.com, commercial traders are represented by the red color. Over the past 20 years, whenever this red line dropped to an extreme low, it was typically followed by a peak in gold prices and a subsequent downtrend.

Another noteworthy observation from the chart is a four-year peak-to-peak cycle in gold prices. Previous peaks occurred in 2008, 2012, 2016, and 2020. Based on this cyclical pattern and the fact that commercial traders are currently holding net-short positions in gold similar to those held in 2020, there is a possibility that gold prices could peak in the coming weeks.

Since October 2023, COMEX Gold has been trending higher, making a series of higher highs and higher lows. Traders considering shorting gold may want to wait for signals from the daily chart, such as the formation of lower lows or a break below the trendline or support level.

Both COMEX Gold Futures and Spot Gold (XAU/USD) are available for trading on Phillip Nova 2.0. If you prefer to trade Spot Gold at zero commission, you may trade the XAU/USD contract on our Phillip MetaTrader 5 platform instead.

Try a Phillip Nova 2.0 or Phillip MT5 demo now

Eric Lee 即将举办的网络研讨会

For more insights from Eric Lee, do not miss his upcoming webinar on Tuesday, 24 September 2024 在 Navigating the Yen Carry Trade: How the Yen’s Rise is Shaping the Future of the Nikkei 225. In this strategy webinar, Eric will share how the raising of the rates for the Japanese Yen will impact the stock market and subsequently the Nikkei 225 index. Don’t miss his insights, register 此处.

Eric Lee 的增值服务

我的客户受益于我的服务,包括单位信托和股票的投资咨询、基于我过去 20 年在市场中的个人知识和经验的投资见解。

我会定期向我的客户发送市场分析,并提醒他们我在图表上使用的技术指标的支撑位和阻力位。如果您想安排一对一辅导课程,以了解有关期货、外汇、股票等交易的更多信息,以及如何从我提供的服务中受益,请点击底部的按钮。

Eric Lee 是 Phillip Nova 的销售总监。凭借在期货、外汇、股票和单位信托方面的专业知识,Eric 是一位全方位的顾问。无需花时间梳理无穷无尽的信息,即可做出明智的交易决策,因为 Eric 可以通过 WhatsApp 随时为客户提供交易警报和见解。凭借多年的经验,Eric 在交易和投资方面制定了系统化的策略。预订下面的免费辅导课程,以利用他的专业知识,因为他传授他的知识来改善您的交易之旅。

- 立即开户

- 免费 Phillip Nova 模拟账户

- 免费 Phillip MT5 模拟账户

*适用条款和条件,请联系下方的 Eric 了解更多信息。