Singapore markets will be closed on polling day, Saturday, 3 May 2025. This allows investors the weekend to digest election results ahead of the market reopening on Monday, potentially reducing volatility from knee-jerk reactions.

Crucially, bank stocks tend to respond not just to the Singapore election outcome, but also to:

- Global macro risk (impacts credit card spend, loan growth, etc)

- Interest rate trajectory (impacts Net Interest Margins (NIMs) and loan appetite)

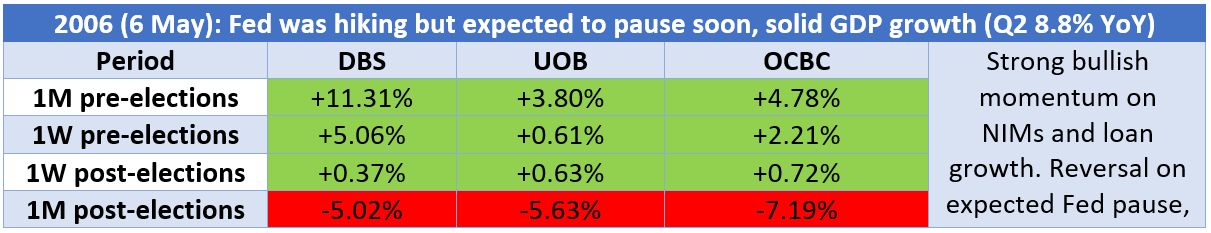

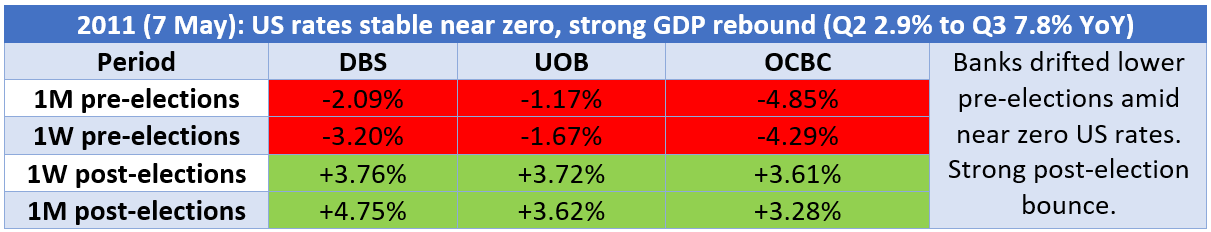

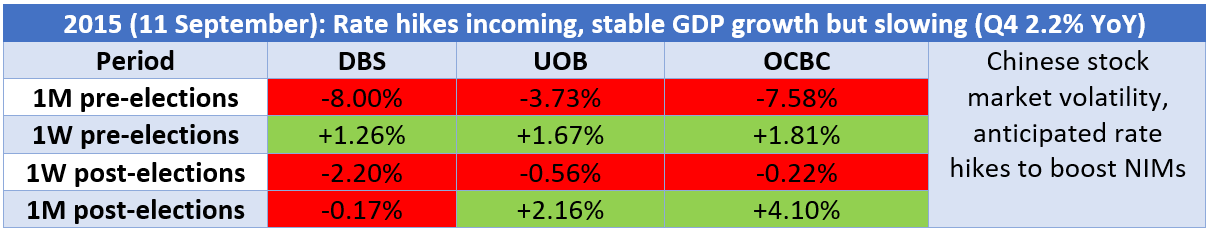

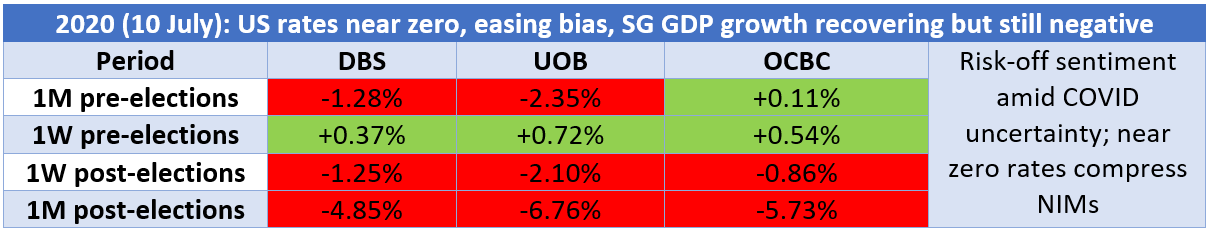

Based on our historical analysis of the price action of Singapore’s big 3 local banks (DBS, UOB, OCBC) in the build-up and aftermath of the past 4 elections (2006, 2011, 2015, 2020), we observe the following:

Takeaways for 2006: Massive pre-election surge on higher rates, rally reversed post-elections as investors anticipated Fed pause amid profit taking activity.

Takeaways for 2011: Broad selloff before the vote, followed by a sharp post-election bounce with the best 1M returns. Rates were near zero but strong GDP momentum and macro recovery drove gains.

Takeaways for 2015: Deep selloff one month before elections driven by China-led volatility and cautious loan guidance. Hawkish Fed expectations gave banks a short-term lift, but a weak macro backdrop limited overall upside.

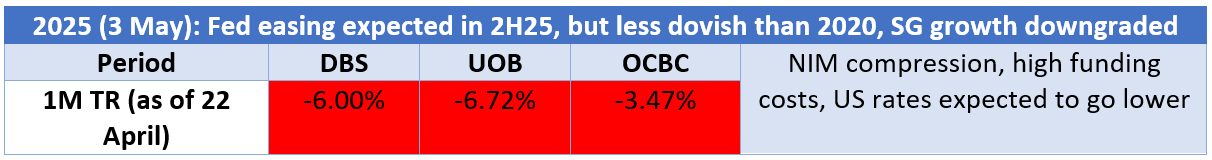

Takeaways for 2020: Modest pre-election bounce, followed by a broad selloff as near-zero US rates compressed margins and macro weakness from COVID weighed on sentiment.

What do we see so far in 2025?

Bank performance around Singapore’s elections appears to be driven less by politics and more by the Fed’s interest rate trajectory and macro risk.

- A relief rally 1 week prior to the election is common (3 out of 4), we attribute this to a short-term bounce on renewed election clarity

- 1-month prior to the elections, banks’ performance was weak if macro is shaky (2015, 2011) but strong if in a rate hike cycle (2006)

- 1-week post-election, performance was typically flat or weak unless macro was improving (2011 was the outlier)

- 1-month post-elections, performance was mixed but sustained upside only occurred in 2011 due to GDP rebound

Outlook for Post-Election

We expect a short-term bounce post-election, driven by political clarity and positioning relief.

However, medium- to long-term headwinds remain.

The Monetary Authority of Singapore (MAS) recently eased its monetary policy amid global trade risks.

- The slope of the S$NEER was reduced, while its width and centre was maintained

- The 2025 GDP forecast was cut to 0%-2% from 1%-3%, citing US tariffs and trade risks

- The MAS and MTI both warned of “downside risks” from market volatility and trade outlook

- MAS cut its core inflation forecast to 0.5%-1.5%, down from 1%-2%

- Q1 GDP Growth Rate was +3.8%, below consensus of 4.3% and prior reading of 5.0%

The current policy mix — a dovish MAS stance combined with deteriorating global conditions (GDP downgrades, rising trade risks) — is likely to exert pressure on bank margins, weigh on loan demand, and drag on earnings in the coming quarters.

Potential Catalysts ahead:

- DBS reports on 8 May

- UOB on 7 May

- OCBC on 9 May

These earnings announcements may offer near-term trading catalysts, but sustained outperformance likely depends on macro surprises to the upside — which remains elusive.

Nevertheless, similar to US peers, SG banks could still outperform consensus expectations through stronger non-interest income (NOII) — especially from trading and treasury divisions, which tend to benefit from increased market volatility. This segment may help cushion the impact of narrowing NIMs in the quarters ahead.

下一步是什么?

Markets respond to clarity — and GE2025 could offer plenty. Stay nimble and tuned in as the Singapore index could move in anticipation of post-election policies.

Trade the Volatility with Phillip Nova 2.0

Take advantage of election-driven market opportunities in Singapore, trade the SGX MSCI Singapore Index Futures (SGP) at S$1.38*.

Or take a view on the Singapore market via Singapore stocks and the STI ETFs on the Phillip Nova 2.0. Click here to open an account now!

在 Phillip Nova 交易股票、ETF、外汇和期货

Phillip Nova 的交易特点

- 访问 20 多个全球交易所

从 20 多个全球交易所的 200 多个全球期货中捕捉机会

- 全球股票的交易机会

新加坡、中国、香港、马来西亚和美国市场的 11,000 多只股票和 ETF。

- 超过 90 项技术指标

使用 Phillip Nova 平台上的 90 多种技术指标,查看实时图表并轻松进行交易

- 在 Phillip Nova 上交易多种资产

您可以在 Phillip Nova 的单一账本上交易股票、ETF、外汇和期货