Phillip Nova高级投资分析师林知霖先生

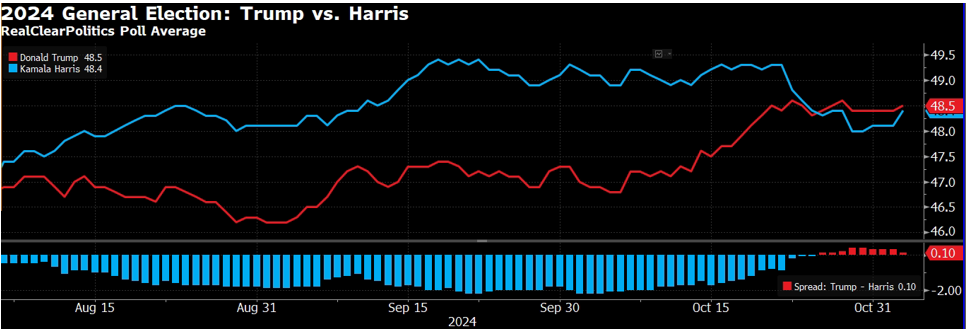

在这场看似掷硬币的选举中,唐纳德·特朗普和卡玛拉·哈里斯正在各摇摆州展开激烈角逐,在竞选活动的最后几天向选民进行最后的宣传,但民调显示,双方尚未分出胜负。最新民调显示,两人的得票率均在49%左右。另一项民调显示,哈里斯在爱荷华州以47%对44%领先。

值得注意的是,选举结果可能无法在选举之夜最终确定,因为包括华盛顿特区在内的一些州直到投票结束才开始计票,而且有些州的计票速度会比其他州更快。2020年大选结果在选举结束后四天公布;而2016年,希拉里·克林顿在大选后的第二天早上就向唐纳德·特朗普认输了。选举结果延迟公布可能会加剧各类资产的波动性。

此外,紧随选举日之后的是 11 月 8 日新加坡时间凌晨 3 点举行的 11 月联邦公开市场委员会 (FOMC) 会议,预计美联储将在会上降息 25 个基点。

见解:

- 选举前波动性往往会上升

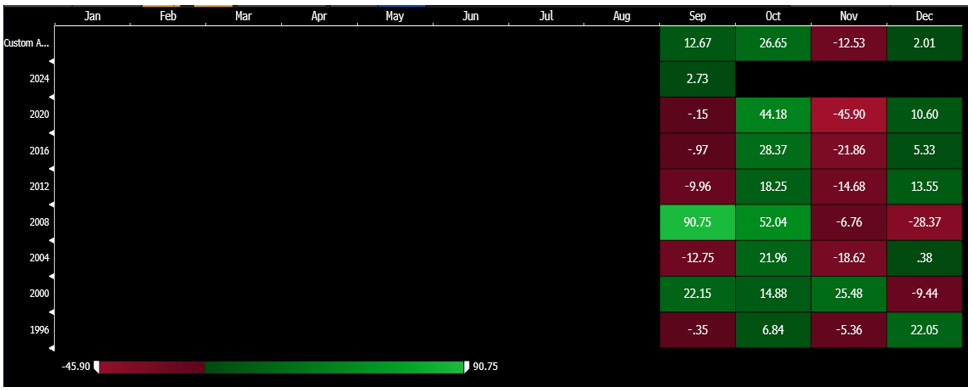

最可预测的结果将是波动性加剧。在过去七次选举中,VIX通常在选举前一个月(10月)上涨约26.65%,然后在选举后波动性减弱,11月平均下跌约-12.53%,如下图季节性图表所示。

- 选举对标普500指数的影响

回顾 1992 年以来标准普尔 500 指数的表现(如下所示),我们发现,在选举前一个月,标准普尔 500 指数平均下跌 2.45%,而在选举后的 11 月和 12 月,标准普尔 500 指数分别勉强上涨 0.35% 和 0.83%。

总体而言,标准普尔 500 指数 选举年平均收益为 1.15% 自 1992 年以来,选举年对美国股市来说通常都表现良好,自 1992 年以来,标准普尔 500 指数几乎在每个选举年都上涨,只有 2000 年和 2008 年例外,这两年受到经济衰退的影响。

因此,除非经济背景发生突然变化,否则我们仍对大选后的美国股市持乐观态度。

特朗普胜利:

- 特朗普提议将企业税率从21%降至15%。

- 全面征收10%-20%关税,并对中国制造的商品征收60%关税。可能产生通胀影响。

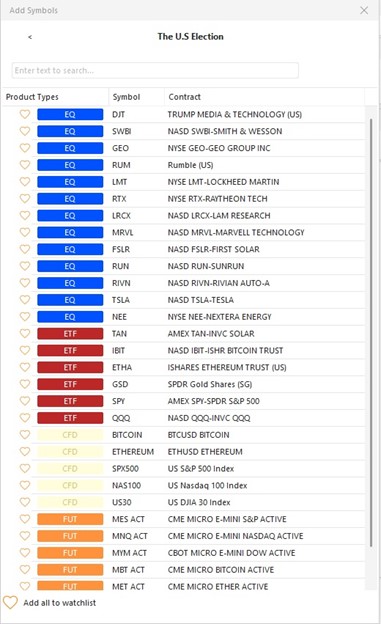

- 受益人: 监管放松下的金融股(美国银行、高盛)、石油和能源公司(贝克休斯、埃克森美孚、康菲石油)、国防公司(洛克希德·马丁、诺斯罗普·格鲁曼)、监狱(Geo Group)和枪械制造商(史密斯威森)、加密货币股(Coinbase、Marathon Digital、Riot Platforms)。特朗普媒体与科技集团

- 在中国业务高度活跃的公司 如果贸易紧张局势升级,这些公司可能会面临压力。其中包括高通、Marvell、塞拉尼斯等材料公司,以及奥的斯等工业公司。

哈里斯胜利:

- 哈里斯提议将企业税率提高至 28%,同时对高收入者征收更高的税率。

- 竞选信息表明,哈里斯也将对中国采取强硬立场,尽管程度不如特朗普

- 受益人: 可再生能源生产商(如 First Solar、Sunrun)、电动汽车制造商(如特斯拉、Rivian 和 Lucid)以及电动汽车充电网络运营商(如 ChargePoint Holdings、Beam Global、Blink Charging Co)。房屋建筑商(如 DR Horton、Lennar、KB Home),大麻(如 Tilray Brands、Canopy Growth)

富时中国A50期货:

在刺激政策的不确定性和经济不稳定的背景下,富时中国 A50 期货似乎处于盘整状态。

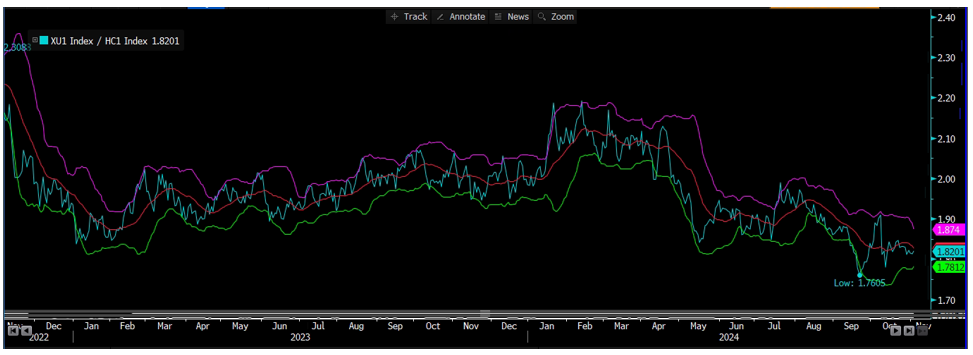

与小型H股指数期货相比,我们观察到过去两年的相关性较高,约为0.83。然而,由于A股的大部分收入来自国内市场,A50通常被认为对地缘政治紧张局势的敏感度较低。

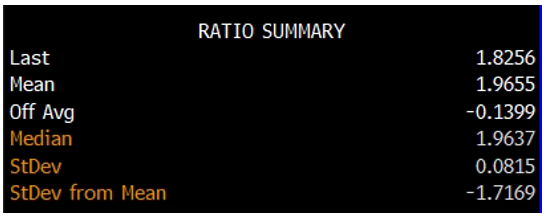

通过观察富时中国 A50 期货与小型 H 股指数期货之间的比率,我们能够辨别出基于布林带的均值回归模式,如上所示。

因此,我们认为选举季的波动性为该比率提供了一个机会,使其暂时进入超买或超卖区域,然后再回归均值。该比率目前低于均值-1.7个标准差。

期货剧本:

我们认为,无论哈里斯还是前总统特朗普赢得大选,股市都能在年底前表现良好。基本面稳健,历史趋势也有利于大选后的股市。

然而,特朗普胜选也可能导致短期市场波动,因为额外关税将带来通胀影响,债务和赤字支出也将增加。另一方面,哈里斯胜选可能会因增税和额外监管措施而给市场带来压力。

如前所述,我们认为短期内波动性可能会加剧。这种波动性可能导致短期波动,从而为均值回归交易提供诱人的机会。

- 做多CME E-迷你标普500期货

我们倾向于做多 CME E-迷你标普500期货 根据美国股市在大选后上涨的历史趋势。

- 做多富时中国A50期货(CN),做空迷你H股指数期货(MCH)

我们倾向于做多 富时中国A50期货 并短路 小型H股指数期货我们认为,A50指数对美国大选波动的反应较小,因为在岸A股受中美贸易紧张局势的影响较小。因此,如果大选后波动加剧,我们预计小型H股指数期货的价格走势将大于A50指数,这将在短期内影响价差比率。

如果该比率低于平均值 2 个标准差,我们倾向于做多 CN 并做空 MCH,反之亦然。

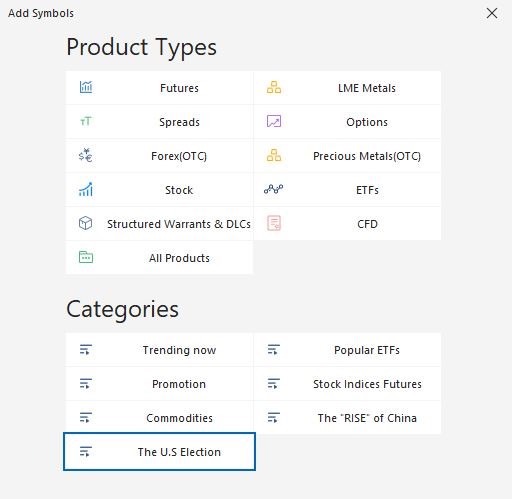

利用 Phillip Nova 2.0 为选举带来的机遇做好准备

我们已为您完成繁重的工作。凭借我们全新的“美国大选”类别,Phillip Nova 2.0 提供了一份精心挑选的产品列表,涵盖可能受大选影响的不同资产类别。无论您对能源、金融、科技还是可再生能源行业感兴趣,此功能都能帮助您发现与潜在政治结果相符的交易机会。要访问新的精选类别,请前往您的关注列表>+添加>点击“美国大选”类别。

Phillip Nova 2.0 为您提供了各种工具,让您能够领先于选举驱动的市场变化,轻松做出明智的交易决策。

立即交易美国股票、ETF、期货和期权

立即在 Phillip Nova 2.0 上交易美国股票、ETF、期货和期权!点击 立即开户。 立即开设账户。试用演示版 立即开户。.

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals, and Stocks with Phillip Nova 2.0

Features of trading on Phillip Nova 2.0

- 访问 20 多个全球交易所

从 20 多个全球交易所的 200 多个全球期货中捕捉机会

- 全球股票的交易机会

Over 11,000 Stocks and ETFs across Singapore, US, China, Hong Kong, Malaysia and Japan markets.

- Charting Powered by TradingView

View live charts and gain access to over 100 technical indicators

- True Multi-Asset Trading

Trade CFDs, ETFs, Forex, Futures, Options, Precious Metals and Stocks on a single ledger on Phillip Nova 2.0