By Eric Lee, Sales Director, Phillip Nova

UOL Group Ltd is beginning to draw renewed investor interest—and rightly so. Recent developments suggest a compelling case to revisit this underappreciated Singapore-listed property and hospitality conglomerate. With valuation metrics nearing historical lows, resilient fundamentals, and clear signs of institutional accumulation, UOL may be well positioned for an upside re-rating.

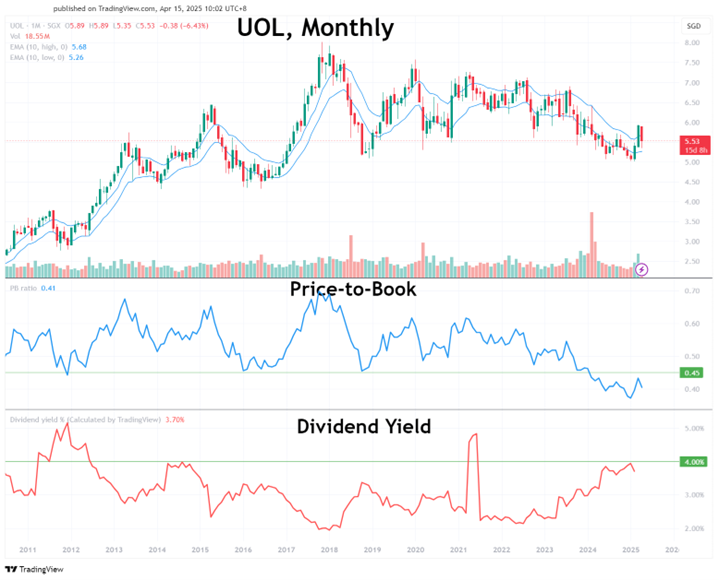

UOL is currently trading at a Price-to-Book (P/B) ratio of just 0.41x—well below its 10-year historical average and close to two standard deviations below the mean—a level typically associated with long-term accumulation opportunities. Compared to peers like CapitaLand Investment (0.6x) and City Developments (0.5x), UOL appears significantly undervalued.

Its dividend yield of 3.7% is also attractive, especially in a rate environment where income-generating assets are back in favour. Historically, UOL’s dividend yield rarely stays above 3.5% for extended periods, reinforcing current levels as a potential entry point.

Recent launches—such as PARKTOWN Residences (87% sold at launch), Watten House (88%), and Pinetree Hill (81%)—signal robust demand despite market cooling measures. High occupancy in Singapore offices (94%) and retail (99.6%), along with strong hotel RevPAR gains, further reinforces the quality of its recurring income streams. (Source: The Strait Times )

UOL offers a unique mix of deep value, resilient income, strong pipeline visibility, and financial strength. With volume analysis showing possible accumulation on its daily chart, investors may want to use the recent price correction as an opportunity to consider adding the stock to their long-term portfolio.

Trade Smarter with Phillip Nova

Access the contract directly on the Phillip Nova trading platform—your one-stop hub for trading Stocks, ETFs, DLCs, Structured Warrants, Forex, and Futures. Powered by TradingView, our platform delivers seamless charting across desktop, tablet, or mobile. With over 100+ technical indicators, live price charts, and an advanced Market Depth Trading Tool, you’ll have everything you need to make confident, informed trades. Try it risk-free today here.

Get Started Now

- Click here to open an account now

- Try a free Phillip Nova 2.0 Demo Account

- Try a free Phillip MT5 Demo Account

- Sign up for a free coaching session with Eric Lee here.

Upcoming Seminar By Eric Lee

Want more insights from Eric Lee? Do not miss his upcoming webinar on Tuesday, 29 April 2025 on Smart Money Concept: Navigate the Singapore Stock Market Like A Pro. In this strategy webinar, Eric will share how we can leverage Smart Money Concepts to navigate the Singapore stock market. Don’t miss his insights, register here.

Value-Added Service from Eric Lee

My clients benefited from my services including investment advisories in unit trust and stocks, investment insights based on my personal knowledge and experiences while navigating the markets for the past 20 years.

Periodically, I will be send out market analysis to my clients, as well as alerting them of support and resistance levels for the technical indicators which I am utilising on a chart. Click on the button at the bottom if you would like to arrange for a One-to-One Coaching session to learn more about trading futures, forex, stocks and more, and how you can benefit from the services I provide.

Eric Lee is a Sales Director with Phillip Nova. With expertise in Futures, Forex, Stocks, and Unit Trust, Eric makes an all-rounded advisor. Make informed trading decisions without spending time combing through endless information as Eric readily provides clients with trade alerts and insights via WhatsApp. Over his years of experience, Eric developed systematic strategies in trading and investing. Book a complimentary coaching session below to leverage on his expertise as he imparts his knowledge to enhance your trading journey.

- Open an account now

- Free Phillip Nova Demo Account

- Free Phillip MT5 Demo Account

*T&Cs apply, contact Eric below for more information.