The USDJPY had been a one-way bet since the start of 2021 as the USD skyrocketed on rapid Fed rate hikes while BOJ maintained negative interest rates to stimulate its deflationary economy. On the 3rd of January 2021, we saw the USDJPY open at 103.3 and subsequently soar to a peak of 160.94 on 3rd July 2024, marking a whopping 55.8% depreciation in the Japanese yen within a span of 3.5 years.

Upon hitting the 38-year high of 160.94 in early July, the USDJPY had retraced sharply to below 145 and erased almost all of its gains in 2024 (at the time of writing on 5 August). The strengthening of the USDJPY is a result of an imminent reversal of the monetary policies for the US Federal Reserve (Fed) and Bank of Japan (BOJ). The stark monetary policy divergence between the Fed and the BOJ had been a major bullish factor for the USDJPY, and as the BOJ recently lifted its interest rates for the second time, and as the US reports softer jobs data, market expectations on an imminent Fed rate cut in September weighed on the USDJPY.

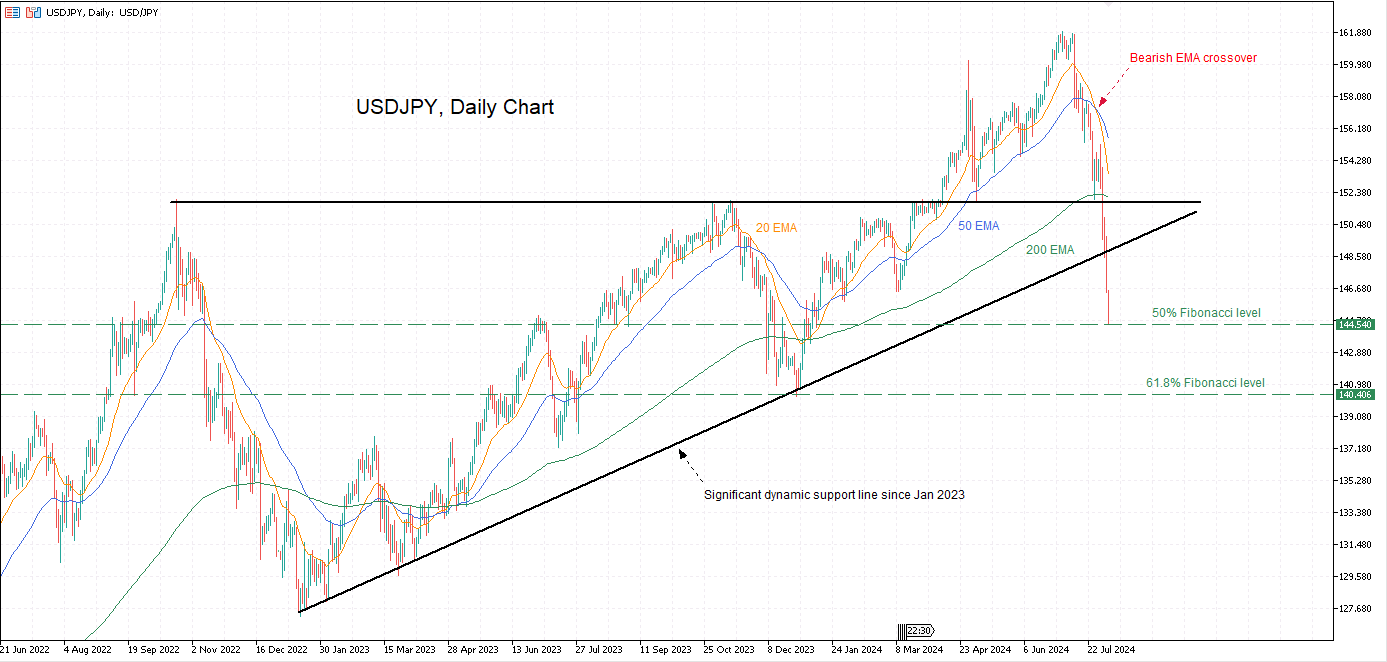

Technically speaking, the USDJPY broke down from multiple support zones with the most recent one being a significant upward sloping support line that was established and tested on multiple occasions since January 2023. By applying the Fibonacci retracement tool between the January 2023 trough and the July 2024 peak, we see that the USDJPY is currently testing the 50% retracement level around 144.5. This is common retracement level where prices may find support. A reversal here might suggest a moderate pullback but still within the bullish trend.

In the event the USDJPY breaks below this level, the next downside target is the 61.8% retracement zone around 140.4, which coincides with a previous swing low. The 61.8% zone is a crucial Fibonacci level, a break below this level can be a strong signal that the bullish trend may be weakening or ending.

Trade Forex on Phillip MetaTrader 5 (MT5).

Trade Forex at zero commission on Phillip MetaTrader 5, a dynamic platform that offers low spreads. Integrated with Acuity’s Signal Centre and Trading Central Indicators, and available on mobile and desktop app, you will never miss a trading opportunity with Phillip MT5.

Download Trading Central’s Market Buzz for updates on more topics.

What’s more? Phillip MT5 is now supported on Mac OS! To install, simply download the file below and complete a simple installation process.