By Eric Lee, Sales Director, Phillip Nova

Malaysia is witnessing a robust resurgence in tourism, marked by a 32.5% increase in tourist arrivals in the first quarter of 2024. This uptick is largely driven by strategic initiatives such as the extension of visa-free travel for Chinese tourists until 2025, a critical move given China’s significant contribution to Malaysia’s tourism sector.

The positive trend in tourist arrivals is expected to bring substantial benefits to Malaysia’s aviation and tourism sectors. Enhanced flight connectivity, strategic marketing campaigns, and the improvement of tourism infrastructure are central to sustaining this growth. The increase in tourist numbers translates into higher demand for flights, accommodations, and related services, thus boosting the overall economy.

Capital A Bhd, the parent company of AirAsia, is particularly well-positioned to capitalise on this tourism boom. As one of Asia’s leading low-cost carriers, AirAsia is set to benefit from the increased passenger traffic resulting from the surge in tourist arrivals. The airline’s extensive network and competitive pricing make it a preferred choice for both international and domestic travellers.

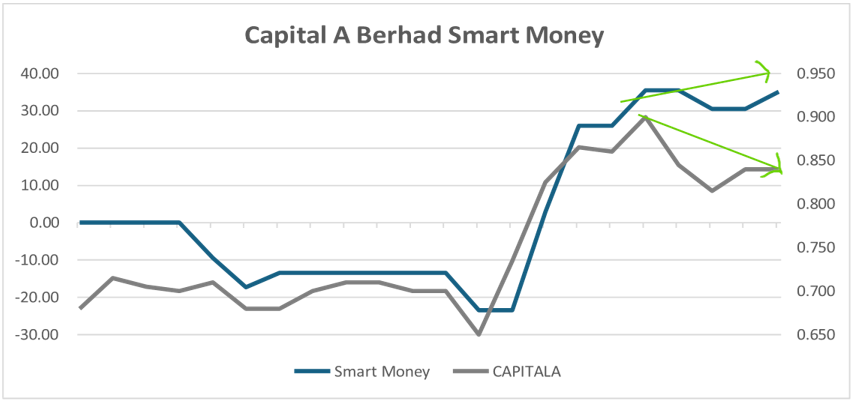

The chart above compares weekly share price of Capital A to Malaysia’s Tourist Arrivals number. As can been seen, this economic metric is a major factor to the performance of its share price. Currently, tourist arrivals number had already risen back to pre-Covid level, but this is not yet been reflected onto its share price yet. With the prospect of higher tourist arrivals, especially from China, the company may stand to benefit from this trend.

Key factors contributing to Capital A Bhd’s potential growth include:

- Increased Passenger Numbers: With more tourists flying to Malaysia, AirAsia is likely to see a significant rise in passenger volumes. This directly boosts the airline’s revenue and market share.

- Strategic Market Positioning: AirAsia’s strong presence in key Asian markets, particularly China, positions it advantageously to tap into the influx of Chinese tourists.

- Expansion Plans: Capital A Bhd’s plans to enhance flight connectivity and customer experience align well with the expected growth in tourism. These initiatives are likely to attract more travelers, further boosting the company’s earnings.

- Operational Efficiency: AirAsia’s focus on maintaining operational efficiency and cost-effectiveness ensures that it can offer competitive pricing while maintaining profitability.

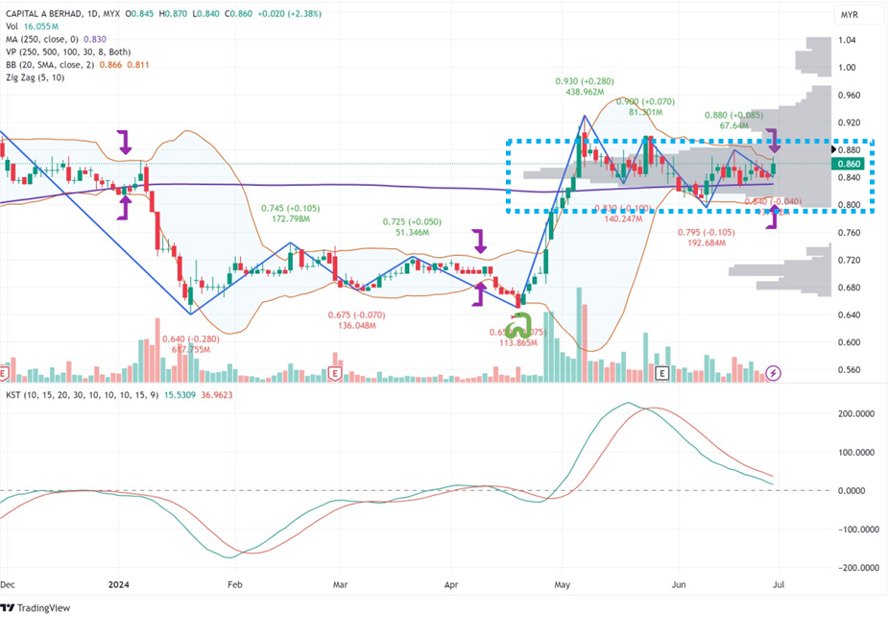

The stock looks poised for a Bollinger “Squeeze” breakout after 2 months of consolidation. Volume analysis suggest accumulation within range of $0.80-$0.88 and Smart Money chart indicated that institution had been buying since late April.

Traders can use the resistance of $0.88 as signal to buy in should price breaks above, and especially close above $0.88 with higher-than-average volume. Support of $0.79 can be set as cut-loss level if upward momentum fails and price breaks down below support.

In conclusion, Malaysia’s impressive growth in tourist arrivals presents a golden opportunity for Capital A Bhd. The company’s strategic positioning, coupled with the expected rise in passenger volumes, makes it a promising investment for those looking to capitalize on the booming tourism industry.

Phillip Nova 2.0 Trading Platform

Phillip Nova trading platform is a powerful, intuitive platform that enables effective trading of Stocks, ETF, DLCs, Structured Warrants, Forex & Futures from your desktop browser, tablet or mobile phone. Equipped with over 100 technical indicators, live charts and a Market Depth Trading Tool, Phillip Nova is your ideal trading companion.

Capital A Bhd (ticker code – 5099) is available on our Phillip Nova trading platform. It’s the perfect account that a global investor needs to capitalize on opportunities available in the international markets.

Upcoming Webinar By Eric Lee

For more insights from Eric Lee, do not miss his upcoming webinar on Tuesday, 30 July 2024 on Institutional Insights: Strategies to Master the Malaysian Stock Market. In this strategy webinar, Eric will discuss the patterns and movements of capital, offering actionable insights that can help you identify and leverage market trends. Don’t miss his insights, register here.

Value-Added Service from Eric Lee

My clients benefited from my services including investment advisories in unit trust and stocks, investment insights based on my personal knowledge and experiences while navigating the markets for the past 20 years.

Periodically, I will be send out market analysis to my clients, as well as alerting them of support and resistance levels for the technical indicators which I am utilising on a chart. Click on the button at the bottom if you would like to arrange for a One-to-One Coaching session to learn more about trading futures, forex, stocks and more, and how you can benefit from the services I provide.

Eric Lee is a Sales Director with Phillip Nova. With expertise in Futures, Forex, Stocks, and Unit Trust, Eric makes an all-rounded advisor. Make informed trading decisions without spending time combing through endless information as Eric readily provides clients with trade alerts and insights via WhatsApp. Over his years of experience, Eric developed systematic strategies in trading and investing. Book a complimentary coaching session below to leverage on his expertise as he imparts his knowledge to enhance your trading journey.

- Open an account now

- Free Phillip Nova Demo Account

- Free Phillip MT5 Demo Account

*T&Cs apply, contact Eric below for more information.