By Danish Lim, Investment Analyst, Phillip Nova

- Much of the surge in Japanese equities have been powered by currency-sensitive exporters like Toyota, which have benefitted from a weaker yen.

- We note that the weaker currency has resulted in higher imported inflation and negatively impacted consumption. The correlation between a weaker yen and stronger stock prices started turning flat once the yen depreciated past ¥155/$

- The next leg of this rally could be driven by domestic demand-oriented stocks; provided yen depreciation eases and wage growth is able to keep up with inflation.

- Delayed BOJ rate hikes and delayed FOMC rate cuts should eventually translate into an easing of yen depreciation pressure- supporting a Yen rebound and enabling Japanese equities, particularly domestic demand-linked stocks, to outperform in 2H 2024.

- We see current weakness as an entry opportunity. Our technical setup has a risk-reward ratio of 2.03x.

Our View:

The SGX Nikkei 225 Index Futures contract slumped in April (-5.03%) and was nearly flat in May (-0.05%) as the rise in 10-year JGB yields following the BOJ’s March and May meetings weighed on semiconductor/real estate names and other growth stocks.

The contract also dipped following the BOJ’s June meeting as the central bank announced it will reduce JGB purchases but postponed details such as scale and the pace of reduction until July. This uncertainty over monetary policy alongside political instability in Europe resulted in the Nikkei VIX (seen below) surging by almost 13% on 17 June.

Source: Bloomberg, Nikkei VIX, 17 June

Equities were also dragged by weakness in Toyota as the world’s largest automaker found itself embroiled in a safety scandal and had to halt some shipments.

Yen Depreciation:

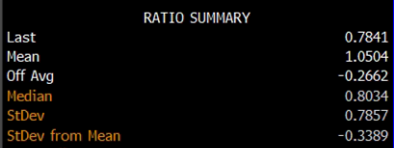

We believe that domestic demand-oriented stock laggards, having been dragged down by prolonged yen weakness, could be the next key driver of Japan’s historic market rally. In terms of P/E ratio, a Ratio Analysis of the Nikkei 225 Domestic Exposure Index to the Nikkei 225 Global Exposure Index shows that the current ratio (0.78) is well below the 5-year average (1.05). Mean reversion indicates potential upside for domestic demand-linked stocks.

Source: Bloomberg, 18 June, Mean Reversion indicates potential upside for domestic-exposure stocks

Despite rising yields, due to interest rate differentials and carry trades, the Yen continued to depreciate against the Dollar. Although a depreciating currency previously helped the Nikkei 225 climb to new record highs, it has also resulted in higher imported inflation, weighing on consumption-related companies including retailers, pharmaceuticals, and private railways.

This came as several business leaders expressed concerns about the yen’s extended weakness. A survey conducted by Teikoku Databank on May 17 reported that about 64% of firms surveyed said the recent depreciation of the yen has eroded their profits, while just 7.7% saw a positive impact.

Koji Shibata, President of ANA Holdings, said that a more “comfortable” level would be 125 to the Dollar. Rival Japan Airlines President Mitsuko Tottori said an exchange rate of around 130 to the dollar would be better for the airline.

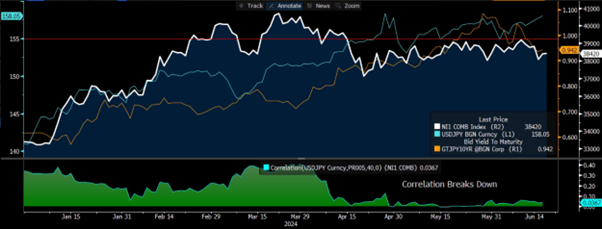

In our opinion, yen depreciation, once a key growth driver, now exerts downward pressure on the stock market through higher imported inflation. We note that the correlation between a weaker yen and stronger stock prices started turning flat once the yen depreciated past ¥155/$ (seen below).

Source: Bloomberg, 18 June, Nikkei 225 Futures (SGX), and USDJPY (Light Blue), and JGB 10Yr Yields (Orange)

Key to our outlook also depends on whether wage growth is able to keep up with inflation, helping households reverse decades of deflation mentality and consumption patterns.

Taking into account the recent soft US CPI data, we expect delayed BOJ rate hikes and delayed FOMC rate cuts to translate into an easing of yen depreciation pressure- supporting a Yen rebound and enabling Japanese equities, particularly domestic demand-linked stocks, to outperform in 2H 2024 and drive the next leg of the rally.

In the meantime, we see any near-term weakness or pullback as an entry opportunity. Corporate governance reforms should provide support for Japanese equities over the medium to long term.

Expressing Our View:

We favor the hypothetical trade setup below in order to express our view:

Long SGX Nikkei 225 Index Futures:

The daily chart shows the contract recently consolidating around the 38,000 – 39,500 level.

With a Trend-based Fibonacci Extension drawn from the October 2023 low, we prefer to take entry at around 38,430, as we view current weakness as an entry opportunity. The 14-day RSI indicates that the contract is currently not at overbought levels.

We set our target level at the 0.50% extension level around 42,035. Stop loss is set below the key support level at 36,650. This setup delivers a reward: risk ratio of 2.03x.

- Entry Level: 38,430

- Target Level: 42,050

- Stop Loss Level: 36,650

- Profit at Target: 3620 x ¥500= ¥1,810,000

- Loss at Stop: 1780 x ¥500= ¥890,000

- Reward: Risk Ratio: 2.03x

Trade Now & Fly to Japan Promotion

Win tickets to Japan when you trade SGX Nikkei 225 Index Futures, at only 50 cents, with Phillip Nova. Click here to learn more now.

Trade Stocks, ETFs, Forex & Futures on Phillip Nova

Features of trading on Phillip Nova

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, China, Hong Kong, Malaysia and US markets.

- Over 90 Technical Indicators

View live charts and trade with ease with over 90 technical indicators available in the Phillip Nova platform

- Trade Multiple Assets on Phillip Nova

You can trade Stocks, ETFs, Forex and Futures on a single ledger with Phillip Nova