By Danish Lim, Investment Analyst for Phillip Nova

Traditionally, the Utility sector has been viewed as a defensive sector, as companies in the sector typically provide essential and regulated services and amenities to the public- such as energy, water, electricity, and waste management.

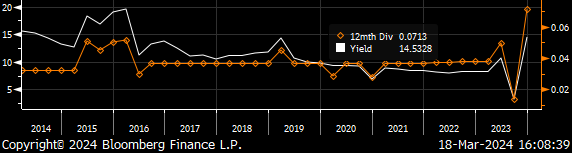

However, the sector is also regarded as a “bond proxy” due to its sensitivity to interest rates. Utility stocks typically generate bond-like cash flows, whose net present value decline when interest rates rise. At the same time, newly issued bonds in a rising rate environment also become more attractive.

For example, using the S&P 500 Utilities sector as a proxy, our regression analysis shows that the sector has a winsorized (excludes outliers) negative correlation of -0.185 to the US 10-Year Treasury Yield over the past 10 years.

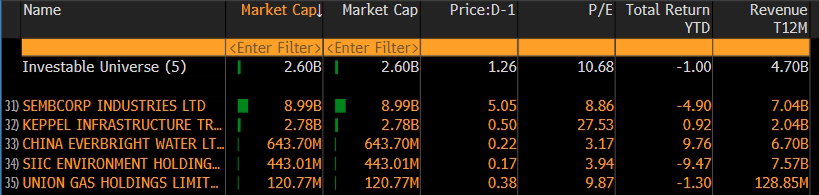

Looking at our customised equity basket of SGX-listed utility stocks with market cap above 100M:

In terms of market cap, Sembcorp Industries and Keppel Infrastructure Trust are by far the largest companies by market cap. Total return YTD is at -1.00%, with SIIC Environment, Union Gas, and Sembcorp Industries in the red. The basket posted a -5.0% return over the past month which we attribute to investors re-assessing the timing of the Fed’s first rate cut.

Sector Drivers:

From a macro perspective, this could be a good entry opportunity given that interest rates are likely to have peaked. Central banks are likely to start cutting interest rates this year, although the timing and size of such cuts remain uncertain.

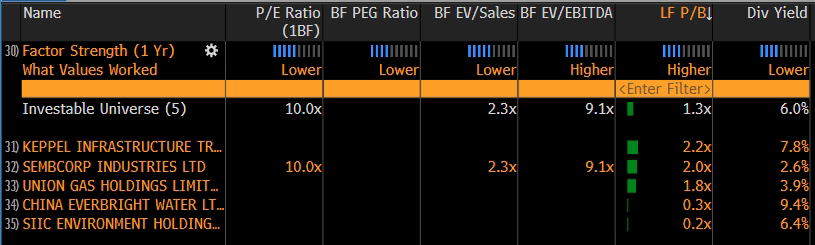

Looking at valuations, we focus on the Price/Book ratio due to the asset-heavy nature of the utilities sector.

Keppel Infrastructure, Sembcorp Industries, and Union Gas appear to be trading at premiums to book value. The mean P/B ratio is 1.3x.

Keppel Infrastructure Trust (SGX: A7RU)

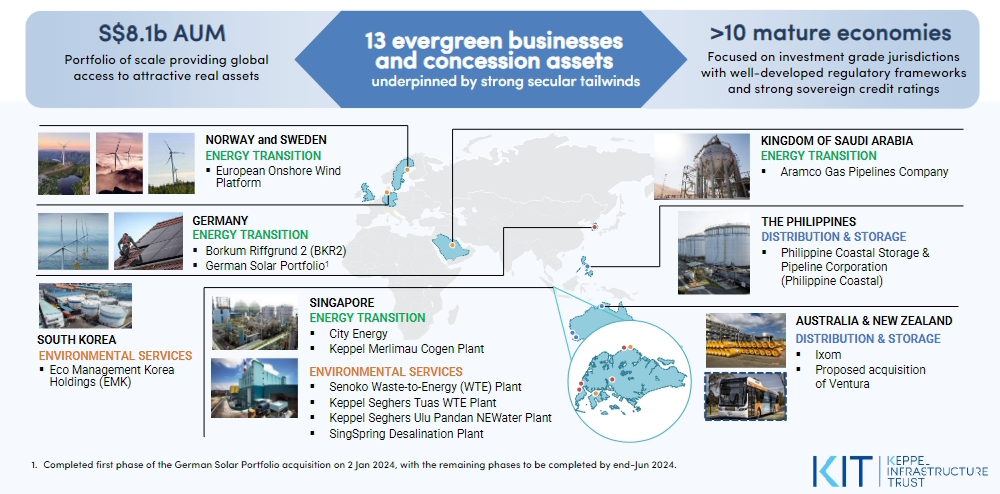

KIT is a business trust that invests in a large and diversified portfolio of infrastructure and infrastructure-like businesses across the globe.

It has 3 main business segments including Distribution & Storage, Energy Transition, and Environmental Services.

It’s Singapore assets include the Keppel Seghers Ulu Pandan NEWater Plant, and SingSpring Desalination Plant. The company is capable of processing up to 19% of desalinated water and 36% of NEWater supply in Singapore.

FY 2023 EBITDA hit a record $447.6m, up by 11.3% YoY. The stock posted total Returns of ~7% in 2023, surpassing the STI’s 4% return.

Keppel Infrastructure was able to limit its interest rate risk, with approximately 83% of debt fixed and hedged.

Long-term prospects:

A key growth driver in the long-run would be KIT’s expanding renewables portfolio, which currently makes up around 19% of AUM as of 2 Jan 2024- putting the company on track to hit its 25% AUM target.

Key developments include the recent acquisition of a 45% stake in a German solar portfolio in Jan 2024, marking the company’s 1st solar portfolio investment.

KIT also entered into the transportation infrastructure sector with the acquisition of a 98.6% interest in Ventura Motors, the largest bus operator in Victoria, Melbourne. The acquisition is expected to increase FY 2023 proforma DPU by 3.4%.

Dividend Yield of 7.84% is higher than most S-REIT peers. FY 2023 Distributable Income grew by 42.4% YoY to $316m. FY 2023 DPU was at a record high 6.19 cents, up by 62%, thanks to a special distribution of 2.33 cents.

Closing comments:

Overall, the Utilities sector could benefit from peak interest rates and the potential shift in monetary policy from global central banks. The stable cash flows of Utilities could become more attractive as bond yields start to decline. In addition, the defensive nature of the sector could provide investors with a cushion should the global economy arrive at a “hard landing”.

We favour companies with a strong track record of consistent distributions, and strong renewables exposure.

Trade Stocks, ETFs, Forex & Futures on Phillip Nova

Features of trading on Phillip Nova

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, China, Hong Kong, Malaysia and US markets.

- Over 90 Technical Indicators

View live charts and trade with ease with over 90 technical indicators available in the Phillip Nova platform

- Trade Multiple Assets on Phillip Nova

You can trade Stocks, ETFs, Forex and Futures on a single ledger with Phillip Nova