Weekly report courtesy of Eurex

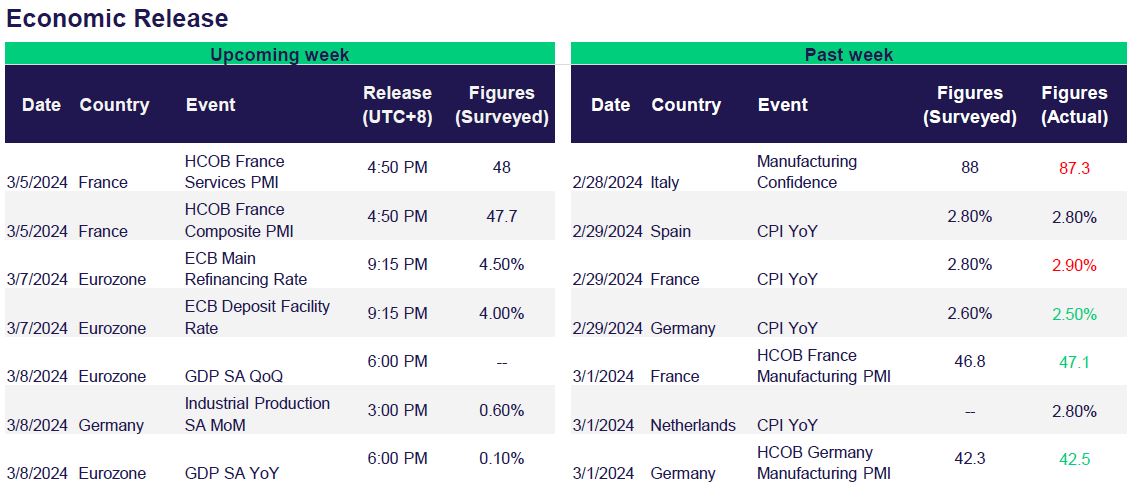

The major economic releases of this week include holding a meeting this week to discuss interest rate rates with June being the expected time of rate cuts.

Market News

– On Thursday (29th February), Germany published its inflation report for February which saw rates falling to 2.7%, while

Eurozone inflation eased to 2.6% in February according to data released by EU on Friday (1st March). The fall in inflation was

expected by economist and will be a strong stand for European Central Bank to cut their interest rates later this year.

Although a large part of the falling inflation was due to the cheaper energy prices, Chief Economist Joerg Kraemer suggested

that without considering volatile food and energy prices, inflation hardly seem to be falling at all. (Source 1,2)

– ECB was not convinced and felt that inflation rate was declining slower than underlying price pressure and is very reluctant to

reduce interest rates. They will meet this week to determine how early they can start to cut interest rates. Although many

rate-setters are still worried of the rapid wage growth which was hiking prices in labor-intensive service sectors. (Source 1,2)

– On Friday (1st March), Goldman Sachs pushed back their forecast for ECB rates cut from April to June. They are being more

bearish and are anticipating five 25-basis-point cuts instead of the initial six. This could be possibly due to crucial core figures

which have missed expectations and forecast such as fuel prices and inflation rates. (Source)

Company News

– On Monday (26th February), Microsoft announced that they will be investing 15 million euro for a partnership with French start

up Mistral AI as they plan to expand its footprint in the fast-evolving artificial intelligence industry beyond OpenAI and unlock

new commercial opportunities. Under the deal, Mistral’s large language models will be available on Microsoft’s Azure cloud

computing platform, while its ChatGPT style multilingual conversational assistant “Le Chat” will be rolled out. Microsoft

President further state that ‘’ it is one of the most important days in terms of Microsoft’s technology support for Europe.

(Source)

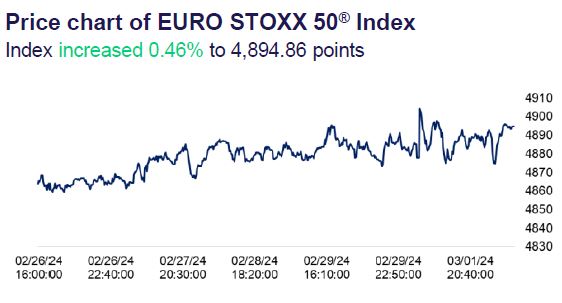

– As Europe’s benchmark index hit a new record high on Friday (1st March) propelled by rate-sensitive stocks, the shares of

Daimler Truck hit a fresh all-time high, surging 18.1%, after posting record full-year profit, and announcing increasing of

dividends to return cash to investors. Additionally, the company posted better-than-expected pretax earnings for 2023 (+39%

YoY), beating analysts’ expectations”. (Source)

For more insights on the Dax and Euro Stoxx 50, don’t miss our upcoming webinar on Thursday, 28 March 2024 on Precision Engineered Trading Performance: German DAX and EURO STOXX 50 Futures. Click here to register now.

Trade Stocks, ETFs, Forex & Futures on Phillip Nova

Features of trading on Phillip Nova

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, China, Hong Kong, Malaysia and US markets.

- Over 90 Technical Indicators

View live charts and trade with ease with over 90 technical indicators available in the Phillip Nova platform

- Trade Multiple Assets on Phillip Nova

You can trade Stocks, ETFs, Forex and Futures on a single ledger with Phillip Nova