By Ong Xun Xiang, ETF Business Lead, Lion Global Investors

Why invest in Singapore now?

Headed into 2023, markets were rattled over global recessionary concerns. During the Federal Open Market Committee (FOMC) meeting in June 2023, Chairman Powell did not raise interest rates for the first time in over a year before signaling the possibility of 2 additional rate hikes in 2023. We believe that this is less hawkish than at first glance given that Chairman Powell acknowledged the fact that the underlying conditions to bring inflation back to target are being put in place, and that the decision would appear to be highly data-dependent on realized core inflation. Lower downside risk from reduced banking sector stress would also increase the possibility of a soft landing in the US with Singapore benefitting from a better global outlook.

Going forward, we should be nearer to the end of US interest rate hikes and interest costs have started stabilising. While global recessionary concerns could weigh on global equity market performance in the near term, we believe Singapore equities present an interesting entry point due to its defensive characteristics and attractive valuations.

Greater volatility is expected to unfold in the coming months. Against the volatile macro backdrop, investors should stay defensive and diversified, while taking into consideration their risk appetite and time horizon.

The Lion-OCBC Securities Singapore Low Carbon ETF provides easy access to 50 leading Singapore companies with lower carbon footprint. It is suitable for investors who wish to stay defensive and diversified, while also supporting a lower carbon Singapore economy.

Introduction

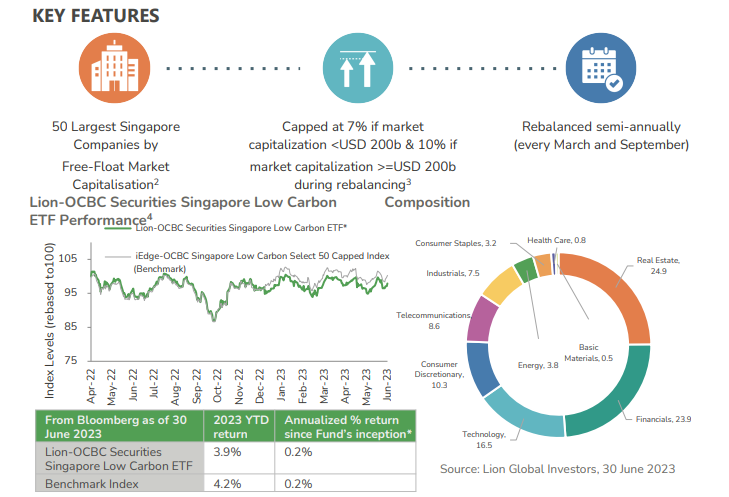

- The Lion-OCBC Securities Singapore Low Carbon ETF was listed on the Singapore stock market on 28 April 2022.

- This ETF is Singapore’s first low carbon ETF and pays semi-annual distributions1.

- It is a 21st century and greener version of the Straits Times Index (STI), being Singapore centric and with a stronger focus on low carbon.

- The ETF is passively managed to fully replicate the iEdge-OCBC Singapore Low Carbon Select 50 Capped Index.

Key Facts

- Dual trading currencies: SGD and USD

- Total Assets Under Management (AUM): SGD 58.3 million as of 30 June 2023

- Management fee: 0.40% p.a.

- Bloomberg tickers: ESGSG SP (SGD counter), ESGUS SP (USD counter)

* Returns are based on NAV-NAV basis in SGD and assuming all dividends are reinvested net of all charges payable upon

reinvestment. The Lion-OCBC Securities Singapore Low Carbon ETF was listed on 28 April 2022. Opinions and estimates

constitute our judgment and along with other portfolio data, are subject to change without notice. Past performance, as well as

any prediction, projection, or forecast are not necessarily indicative of future or likely performance

1 Semi-annual distributions are paid at the discretion of the Fund Manager. Distributions are not guaranteed and may fluctuate.

Past distributions are not necessarily indicative of future payments. Distribution payouts and its frequency might be changed at

the Manager’s discretion and can be made out of income, capital or both. Any payment of distributions by the fund may result

in an immediate reduction of the net asset value per share/unit. Please refer to LGI website for more information on the income

disclosures.

2 Based on the underlying Index Securities of the iEdge-OCBC Singapore Low Carbon Select 50 Capped Index.

3 Weightage of individual stocks within the index will be reviewed and rebalanced semi-annually by the index provider

(Singapore Exchange Limited). The weights of each Index Security might fluctuate above 7% and 10% respectively due to

market movements in between the rebalancing period

4 Source: Bloomberg, Lion Global Investors, Singapore Exchange Limited, 30 June 2023

How does this ETF compare with other Singapore-Focused ETFs

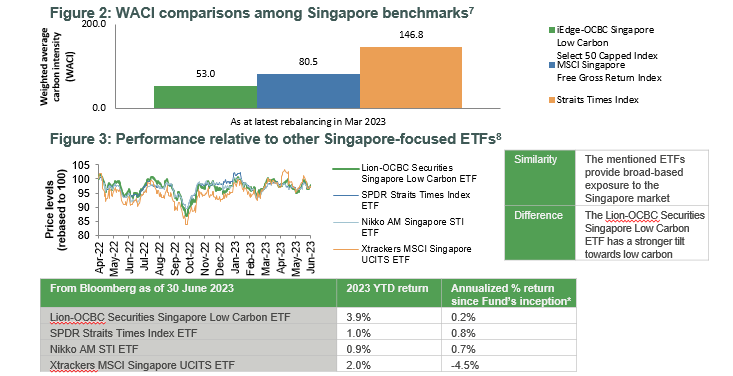

The Lion-OCBC Securities Singapore Low Carbon ETF tracks the iEdge-OCBC Singapore Low Carbon Select 50 Capped Index (“the Index”), which aims to track performance of the top 50 companies by free-float market capitalisation that are representative of Singapore’s real and financial economy, with a focus on index decarbonisation through reduction of the Index’s Weighted Average Carbon Intensity (WACI). As shown in Figure 2, the Index has a much lower WACI compared with other Singapore benchmarks.

Between 28 April 2022 (ETF’s listing date) and 30 June 2023, the Lion-OCBC Securities Singapore Low Carbon ETF demonstrated comparable performance5 (Figure 3) with other Singapore-focused ETFs such as the SPDR STI ETF and Nikko AM Singapore STI ETF, while cumulatively outperforming6 the Xtrackers MSCI Singapore UCITS ETF as of 30 June 2023.

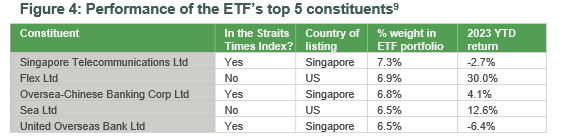

Between 1 January 2023 and 30 June 2023, the ETF’s inclusion of US-listed constituents such as Sea Ltd and Flex Ltd helped boost its performance compared to Singapore-focused ETFs such as the SPDR STI ETF and Nikko AM Singapore STI ETF (Figure 4). Through greater geographical and sector diversification, the Lion-OCBC Securities Singapore Low Carbon ETF offers investors comparable performance but with a much lower carbon footprint. Do good. For your portfolio and our planet.

5, 6 Source: Bloomberg, as of 30 June 2023.

7 Source: SGX Index Edge, as of 30 June 2023.

8 Source: Bloomberg, as of 30 June 2023.

* Returns are based on NAV-NAV basis in SGD and assuming all dividends are reinvested net of all charges payable upon reinvestment. The Lion-OCBC Securities Singapore Low Carbon ETF was listed on 28 April 2022. Past performance, as well as any prediction, projection, or forecast are not necessarily indicative of future or likely performance. Opinions and estimates constitute our judgment and along with other portfolio data, are subject to change without notice. Each ETF currently adopts a direct replication strategy in tracking their respective indices. The SPDR Straits Times Index ETF and Nikko AM Singapore STI ETF track the Straits Times Index while the Xtrackers MSCI Singapore UCITS ETF tracks the MSCI Singapore Investable Market Total Return Net Index.

9 Source: Bloomberg, as of 30 June 2023.

Disclaimer

Lion Global Investors This advertisement or publication has not been reviewed by the Monetary Authority of Singapore. It is for information only, and is not a recommendation, offer or solicitation to deal in any capital markets products or investments and does not have regard to your specific investment objectives, financial situation or particular needs. You should read the prospectus and Product Highlights Sheet for the Lion-OCBC Securities Singapore Low Carbon ETF (“ETF”), which is available and may be obtained from Lion Global Investors Limited or any of the appointed Participating Dealers (“PDs”), before deciding whether to purchase units in the ETF. Investments are subject to investment risks including the possible loss of the principal amount invested. The performance of the ETF, the value of its units and any accruing income are not guaranteed and may rise or fall. Past performance, payout yields and payments and any prediction, projection, or forecast are not indicative of the future performance, payout yields and payments of the ETF. Any extraordinary performance may be due to exceptional circumstances which may not be sustainable. The ETF’s net asset value may have higher volatility as a result of its narrower investment focus on a limited geographical market, when compared to funds investing in global or wider regional markets. You should independently assess any information, opinion or estimates, graphs, charts, formulae or devices provided and seek professional advice on them. Any information, opinions, estimates, graphs, charts, formulae or devices provided are subject to change without notice and are not to be relied on as advice. The ETF may invest in financial derivative instruments for hedging or for efficient portfolio management. The units of the ETF are listed and traded on the Singapore Exchange (“SGX”), and may be traded at prices different from its net asset value, suspended from trading, or delisted. Such listing does not guarantee a liquid market for the units. You cannot purchase or redeem units in the ETF directly with the manager of the ETF, but you may, subject to specific conditions, do so on the SGX or through the PDs. Any dividend distributions, which may be either out of income and/or capital, are not guaranteed and subject to the Manager’s discretion. Any such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value of the ETF. © Lion Global Investors Limited (UEN/ Registration No. 198601745D). All rights reserved. LGI is a Singapore incorporated company and is not related to any corporation or trading entity that is domiciled in Europe or the United States (other than entities owned by its holding companies).

Singapore Exchange Limited The units in the Lion-OCBC Securities Singapore Low Carbon ETF are not in any way sponsored, endorsed, sold or promoted by the Singapore Exchange Limited (“SGX”) and/or its affiliates and SGX and its affiliates make no warranty or representation whatsoever, expressly or impliedly, either as to the results to be obtained from the use of the iEdge-OCBC Singapore Low Carbon Select 50 Capped Index and/or the figure at which the iEdge-OCBC Singapore Low Carbon Select 50 Capped Index stands at any particular time on any particular day or otherwise. The iEdge-OCBC Singapore Low Carbon Select 50 Capped Index is administrated, calculated and published by SGX. SGX shall not be liable (whether in negligence or otherwise) to any person for any error in the Lion-OCBC Securities Singapore Low Carbon ETF and the iEdge-OCBC Singapore Low Carbon Select 50 Capped Index and shall not be under any obligation to advise any person of any error therein. OCBC is a registered trade mark of Oversea-Chinese Banking Corporation Limited and is used under licence. Save for the foregoing, all intellectual property rights in the iEdge-OCBC Singapore Low Carbon Select 50 Capped Index vest in SGX. The iEdge-OCBC Singapore Low Carbon Select 50 Capped Index is used by Lion Global Investors Limited under licence.

Trade Stocks, ETFs, Forex & Futures on Phillip Nova

Features of trading on Phillip Nova

- Gain Access to Over 20 Global Exchanges

Capture opportunities from over 200 global futures from over 20 global exchanges

- Trade Opportunities in Global Stocks

Over 11,000 Stocks and ETFs across Singapore, China, Hong Kong, Malaysia and US markets.

- Over 90 Technical Indicators

View live charts and trade with ease with over 90 technical indicators available in the Phillip Nova platform

- Trade Multiple Assets on Phillip Nova

You can trade Stocks, ETFs, Forex and Futures on a single ledger with Phillip Nova