By Eric Lee, Sales Director, Phillip Nova

Since it re-tested the high of $120 early June, Crude Oil had fallen to a recent low of $86 on 16 Aug. This had helped in easing inflation pressure as can be seen with the U.S. inflation rate falling from a high of 9.1% to 8.5%.

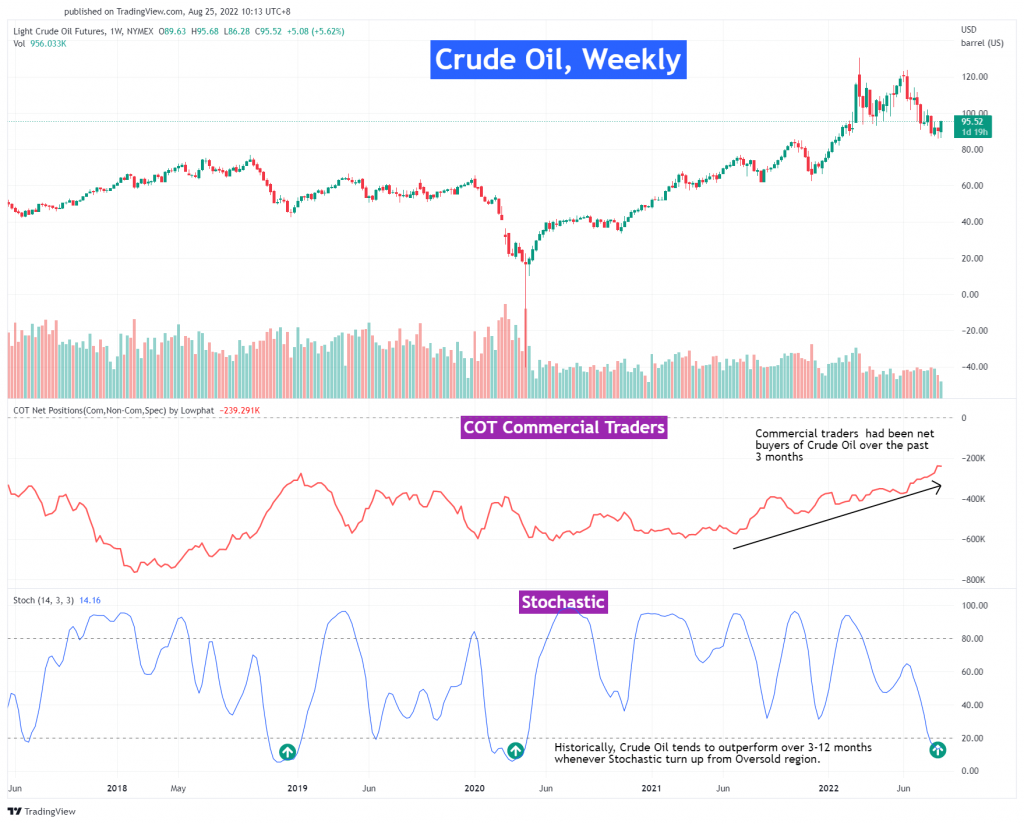

From the Crude Oil weekly chart, we can see that despite the falling oil price, Commercial Traders had been net-buying Crude Oil over the past 3 months. As the Commercial Traders are a group of physical oil hedgers, their actions often signify real supply and demand of the underlying product. Since 2017, current COT Commercial Index is the most bullish it has ever been.

Weekly Stochastic is also a good indicator to spot short-to-mid-term overbought or oversold conditions of Crude Oil prices. Currently, it is trading at an Oversold level and we can look out for it to cross back above 20 as indication of buying momentum coming back to the asset.

On the daily chart, Crude Oil is currently hovering around the 250-days Moving Average, which had often acted as a mid-to-long-term support for the price chart. KST, which had recently crossover upwards, is also an indicator we can use to spot potential signal on the start of a new uptrend. This is especially so if the price is coming up from near the 250-days Moving Average support.

Technical analysis wise, $85 is the near-term support and the next support at $75. Resistance is not so obvious at the moment due to the choppiness of its price actions over the past 6 months. Usually, a whole number like $100 can be taken as a psychological resistance.

Where to trade/invest in Crude Oil?

At Phillip Nova, we have the platforms and products available for you to trade Crude Oil:

- Nymex Crude Oil futures available on Phillip Nova trading platform

- Crude Oil CFD available on Phillip MT5 trading platform

Value-Added Service

Periodically, I will be sending out market analysis like this to my clients, as well as alerting them when the trading strategies I used indicated potential entry and exit signals. Click on the button at the bottom if you would like to arrange for a One-to-One Coaching session to learn more about trading futures & forex, and how you may benefit from the services I provide.

Eric Lee is a Sales Director with Phillip Nova. With expertise in Futures, Forex, Stocks, and Unit Trust, Eric makes an all-rounded advisor. Make informed trading decisions without spending time combing through endless information as Eric readily provides clients with trade alerts and insights via WhatsApp. Over his years of experience, Eric developed systematic strategies in trading and investing. Book a complimentary coaching session below to leverage on his expertise as he imparts his knowledge to enhance your trading journey.

- Free Phillip Nova Demo Account

- Free Phillip MT5 Demo Account

- Trade Forex and Receive Up To US$864

*T&Cs apply, contact Eric below for more information.