EURUSD

Bias: Bullish

We look to Buy at 1.0852 with target prices of 1.0998 and 1.1025, and a stop price of 1.0789

Confidence: 40%

Technical Analysis

- Previous support located at 1.0850

- Posted a Double Bottom formation

- A higher correction is expected

- We look to buy dips

GBPUSD

Bias: Bullish

We look to Buy at 1.2990 with target prices of 1.3130 and 1.3160, and a stop price of 1.2940

Confidence: 20%

Technical Analysis

- There is no sign that this bearish momentum is faltering but the pair has stalled close to a previous swing low of 1.2999

- Daily signals for sentiment are at oversold extremes

- This is positive for short term sentiment and we look to set longs at good risk/reward levels for a further correction higher

- Although the anticipated move higher is corrective, it does offer ample risk/reward today

- Preferred trade is to buy on dips

USDJPY

Bias: Bullish

We look to Buy at 124.17 with target prices of 126.98 and 127.25, and a stop price of 122.95

Confidence: 80%

Technical Analysis

- Following yesterday’s bullish candle, the overall trend higher looks set to continue today

- The continuation higher in prices through resistance has been impressive with strong momentum and shows no signs of slowing

- Previous resistance at 124.00 now becomes support

- Preferred trade is to buy on dips

GOLD

Bias: Bearish

We look to Buy at 1941 with target prices of 1979 and 1998, and a stop price of 1924

Confidence: 60%

Technical Analysis

- Buying pressure from 1940 resulted in prices rejecting the dip

- A sequence of intraday higher highs and lows has been posted

- Further upside is expected

- Dip buying offers good risk/reward

GER40

Bias: Bearish

We look to Sell at 14228 with target prices of 14027 and 13967, and a stop price of 14303

Confidence: 80%

Technical Analysis

- Our short term bias remains negative

- Intraday rallies continue to attract sellers and there is no clear indication that this sequence for trading is coming to an end

- 20 1day EMA is at 14250

- 50 4hour EMA is at 14260

- We look for a temporary move higher

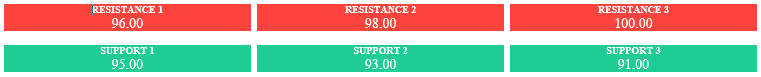

WTI

Bias: Bearish

We look to Sell at 99.98 with target prices of 93.55 and 90.00, and a stop price of 102.98

Confidence: 60%

Technical Analysis

- The sequence for trading is lower lows and highs

- Trades with a bearish descending triangle formation

- We are assessed to be in a corrective mode higher

- We therefore, prefer to fade into the rally with a tight stop in anticipation of a move back lower

Trading ideas at a glance.

Download the Acuity Signal Center plugin.

The Acuity Signal Centre combines experienced, human-led analysis with powerful AI technology to conduct deep analyses of the markets whilst drawing on professional trading expertise to deliver transparent trade ideas that support novice and advanced traders alike.

- Clear Calls to Action

Each trade idea consists of clear target levels, confidence ratings, and continuous updates

- Transparent Strategies

Every trade idea is generated by a team of expert analysts and is accompanied by the strategies behind them

- Performance Monitoring

The performance of every signal is monitored and translated into the confidence rating of each new signal