By Eric Lee, Account Manager, Phillip Futures

Source: Phillip Nova

After correcting 46% from its peak in Feb 2021, Lion-OCBC Sec HSTech ETF is showing some signs of price stabilisation when it hit a double bottom late in August and early October and with MACD diverging from price, often an indication of weakening trend and subsequent trend reversal. We can see it breaking above the down-trendline (in purple). Traders looking to buy HSTech ETF can consider the following signals:

- The 1st signal I was looking for was triggered when prices broke above the intraday resistance of $1.09

- The 2nd signal, which we now have, as prices had retreated from its initial breakout and Williams %R indicator is showing that it is currently oversold in the short-term.

- For traders who want to wait for price momentum as an indicator, they can wait for price to break out and trade above the short-term resistance of $1.14

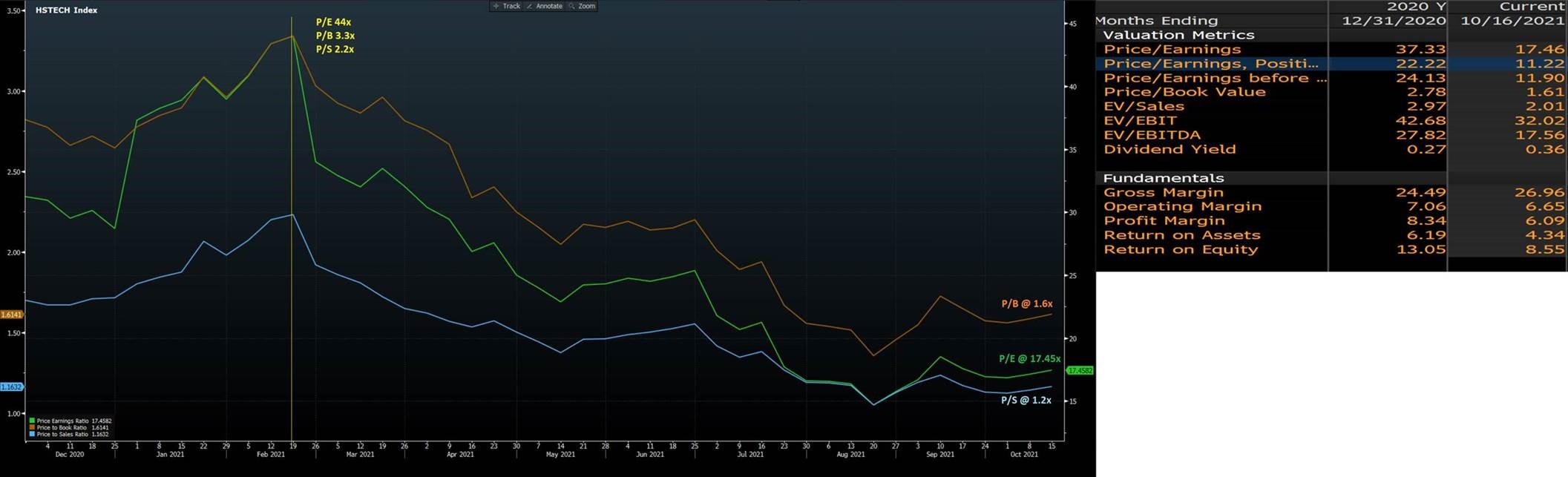

Source: Bloomberg

HSTech Index is currently trading at an attractive valuation with P/E @ 17.5x, P/B @ 1.6x and P/S @ 1.2x. This is a much attractive level compared to its valuation back in February this year. Comparatively, at the height of the Great Financial Crisis back in 2009, Nasdaq 100 (stock index that tracks the top 100 U.S. technology stocks), was trading at a valuation of P/E 17x, P/B 2.7x and P/S 1.6x. In hindsight, those who bought Nasdaq 100 ETF back in 2009 and held it till now, would have their investment compounding at 23% p.a. At this rate, a $10k investment would have multiplied by 15x to $150k.

China’s economy had its set of issues, including the various policies targeting companies in the technology sector. I believe back in 2009, many would have said the same regarding the U.S. economy as well. Who would have foreseen Nasdaq rising 1500% within 13 years? Thus, investors have to be comfortable with the potential risk v.s reward when investing in Chinese stocks.

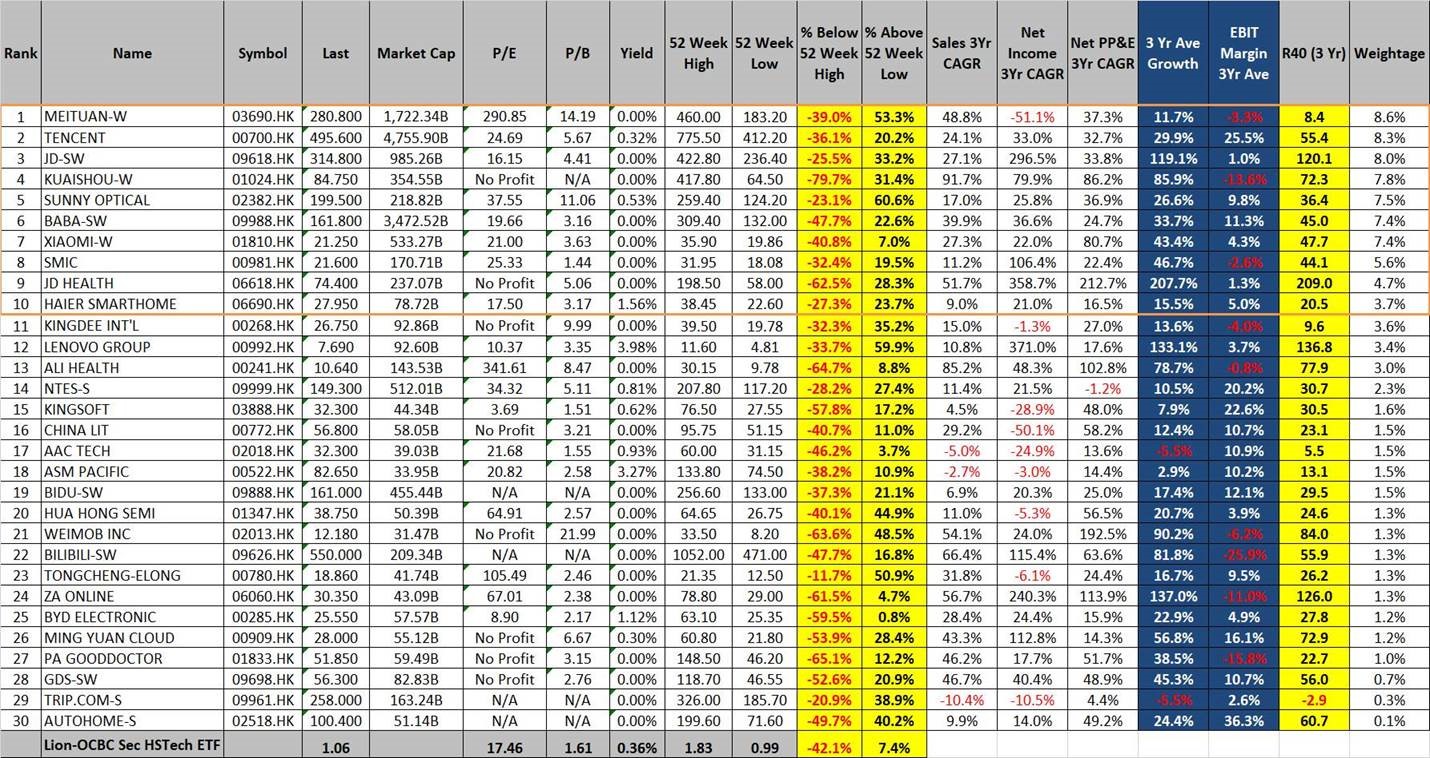

Source: Bloomberg, Koyfin

Lastly, I’ve compiled the breakdown of some financial data for the 30 stocks that make up the Hang Seng Tech ETF. We only need to pay attention to the top 10 stocks that I had drawn up within the orange box as they collectively represent 70% of the index. We can also include the next 3 stocks (Kingdee, Lenovo and Ali Health) as this group of Top 13 stocks represent 80% of the index. Overtime, due to their business performances, some of these stocks will move into and out of the Top 10 list as well.

Among the Top 10 stocks, with the exception of Meituan and Haier Smarthome, all the rest had met the Rule of 40 (R40) criteria. Rule of 40 is a screening tool we can use to rank the performance of the companies. Basically, we add the average growth rate of the company with its profit margin and companies with this number above 40 is deemed to be better than those with a smaller number. This is not a be-all-and-end-all as it is important that we look at the other quantitative and qualitive factors of these companies. Younger companies still in the high growth stage, generally have a higher growth rate but low or negative profit margins. Mature or established companies will see their growth rate slowed down as they had already captured a larger pie of the market but will usually have a higher profit margin by then and are able to retain some of it as profit for distribution for its shareholders or to increase their profile through acquisition or re-investing to build their business.

In conclusion, Chinese stocks may be undergoing some pressure economically and politically at the moment, but if we consider their growth potential and the valuation they are trading at, this may be an opportunity to participate in the China story.

Eric Lee is an Account Manager with Phillip Futures. With expertise in Futures, Forex, Stocks, and Unit Trust, Eric makes an all-rounded advisor. Make informed trading decisions without spending time combing through endless information as Eric readily provides clients with trade alerts and insights via WhatsApp. Over his years of experience, Eric developed systematic strategies in trading and investing. Book a complimentary coaching session below to leverage on his expertise as he imparts his knowledge to enhance your trading journey.